Almost a third of adults in the UK feel like they have to use credit cards, loans, or overdrafts to spend more than they can afford. New research shows that debt worries still affect those earning above the average salary.

Real wages are rising and inflation may be levelling off, but many Brits are still struggling to pay for their lifestyle without resorting to debt, new research by NerdWallet UK has found.

With stagnation in the UK economy, consumers may find it difficult to live comfortably within their means.

Surprisingly, the study reveals that those earning a higher salary don’t necessarily feel more financially secure. The data suggests higher earners may be at greatest risk of falling into larger debt because they feel under the most pressure to spend more than they earn.

Find out more about how people in the U.S. spend their money and get our advice on how to stay on top of things.

Debt is incredibly common in the UK, with the majority of adults holding some form of credit or loan. However not every single person is in debt. Here is an in-depth look at who has debt in the UK and the extent of household debt across the country.

Key Facts and Figures

-

Around 84% of UK adults had some form of credit or loan in the 12 months to May 2024. This means the vast majority of adults have debt of some kind.

-

The average total debt per UK household, including mortgages, was approximately £65,756 in October 2023.

-

Excluding mortgages, the average household debt was £15,000 in 2024.

-

Approximately 6,3 million households in the UK are in debt

-

The average debt per UK adult was £34,716 in 2023.

-

This is because young adults tend to have less debt—only about 20% of 18–24-year-olds had debt in 202024.

Types of Borrowing

There are several main categories of debt that UK consumers hold:

-

Mortgages – The biggest debt for most households. The average outstanding mortgage per household was £59,000 in 2024. Around 40% of households have a mortgage.

-

Credit Cards – Outstanding credit card debt totaled £68.9 billion in 2024. The average credit card debt per household was £2,600. Around 25% of households carry a credit card balance.

-

Personal Loans – Estimated at £240 billion in 2024. The average loan balance was £4,030 per household. 41% of UK adults have a personal loan.

-

Car Finance – Around £73. 5 billion in outstanding car finance debt in 2024. On average around £3,900 per household.

-

Student Loans – Total student loan debt is approximately £206 billion, averaging £45,000 per student.

Debt Levels by Age

Debt levels increase significantly with age, before falling again for older adults:

- 18-24 year olds – average debt of £13,000

- 25-34 year olds – average debt of £28,000

- 35-44 year olds – average debt of £37,000

- 45-54 year olds – highest average debt of £47,000

- 55-64 year olds – average debt of £31,000

- Over 65s – average debt of £17,000

Younger adults have lower debts because they are less likely to have mortgages. Middle-aged adults, on the other hand, have more mortgages and more earning potential. Over-65s’ debt goes down again as mortgages are paid off.

Who Doesn’t Have Debt?

While the majority do have some form of debt, there are still portions of the population that are debt-free:

- Around 50% of 18-24 year olds have no debt.

- 28% of over 65s have no debts at all.

- Just under 20% of the overall adult population have no debts.

So while the prevalence of debt is extremely high, it isn’t quite 100% of people. Debt-free individuals tend to be either young adults yet to take on large loans, or older groups who have paid off mortgages and other loans.

Regional Differences

The proportion of people in debt, and the average debt levels, varies considerably by region:

- London – Highest average debt at £65,000 per household. Around 45% have debt.

- South East – Average debt of £59,000 and 45% in debt.

- Northern Ireland – Lowest debt at £42,000 average and 35% in debt.

- Scotland – Average debt of £43,000 and 40% in debt.

- North West – Average debt of £44,000 and 38% in debt.

Households in London and the South East have higher incomes on average, allowing larger mortgages and contributing to higher debt levels.

Why Do So Many People Have Debt?

There are a number of key reasons why household debt is so prevalent:

-

Mortgages – The need to finance home purchases means mortgages are the biggest debt. Property prices have risen rapidly, meaning larger mortgages.

-

Low Interest Rates – Cheap borrowing has enabled people to take on higher debts. For example, average mortgage debt doubled between 1997 and 2024.

-

Consumerism – Easy access to credit and a culture of spending means consumers accumulate debts on items like cars, furniture, holidays.

-

Cost of Living – Stagnant wage growth means many rely on debt to cover basic living costs and bills.

-

Student Loans – Tuition fee rises have left students with far higher debts than previous generations.

Consequences of High Debt

While owing money is common, the risks of excessive debt should not be overlooked:

-

Debt interest payments represent a major monthly outgoing for indebted households. This leaves less money available for other spending.

-

Higher debt repayments make it harder to save money, e.g. for retirement or housing deposits.

-

Financial difficulties arise if debts become unaffordable, leading to events like bankruptcy.

-

Mental health can be impacted by debt worries, with many people feeling anxious or depressed about money.

-

UK consumer debt levels are considered by some to pose a risk to economic stability if debts later become unaffordable.

Do People Worry About Their Debts?

Despite the high levels of borrowing, surveys show mixed attitudes towards debt:

-

33% of UK adults feel overwhelmed by their level of debt according to 2024 research. This suggests a sizable minority have debt concerns.

-

But 50% claim to be comfortable with their debt level, and just 14% want to be debt-free. This hints many do not actively worry about debt.

-

25-34 year olds tend to be the most worried about debt, with higher stress levels. Older groups tend to be more comfortable.

So while debt itself may be widely accepted, a segment do have anxieties about their financial obligations. There is variation between different demographics.

Paying Off Debt

For those wanting to tackle debt:

-

Focus on higher interest debts first, e.g. credit cards. This minimizes total interest paid.

-

Take advantage of balance transfer offers to shift credit card balances to 0% interest deals.

-

Consider consolidating multiple debts into a lower interest loan.

-

Stick to a debt repayment budget and make more than the minimum payments.

-

Speak to free debt advisors if you are struggling with repayments.

With smart repayment tactics, reducing debts is possible over time for many.

While the notion that ‘everyone is in debt’ is an exaggeration, debt is certainly the norm for the vast majority of UK households, with over 80% having some form of credit. Mortgage borrowing accounts for the largest share, but consumer debt is also extremely prevalent. Debt levels have risen markedly from past generations, aided by easy credit access. However, high borrowing can have damaging financial and mental health impacts if it becomes excessive or unaffordable. Astute repayment strategies and budgeting are key to gradually reducing debts to more comfortable levels.

Factors that made it more likely someone will take on debt to fund their lifestyle

Adults between the ages of 25 and 44 are the most likely to fund their lifestyle using credit cards, overdrafts or personal loans, compared with other age groups. 9.6% of those aged 25-44 said they fund their lifestyle using debt ‘very often’, compared with an average of 4% across all age groups.

Men are more likely than women to experience pressure to spend beyond their means, either from their partner, family, friends or other places such as social media. 36% of men said that they feel pressure to exceed their own comfortable spending limits, compared with 29% of women.

Men are also more willing to take on debt to pay for their lifestyle, with 64% of men saying they find themselves in this situation ‘sometimes’, ‘somewhat often’ or ‘very often’, compared with 47% of women.

40% of Londoners sometimes, often or very often go into debt to pay for their lifestyle, compared to 19% of the general population.

Living in London makes it three times more likely that someone will take out a personal loan to pay for their lifestyle: 39% of Londoners said they’ve done this, compared with the national average of 13%.

Where are we spending the most?

We asked 2000 UK adults which spending categories are most important to them. The data reveals that for 52% of UK adults, essential outgoings like rent or mortgage payments are ‘very important’ or ‘somewhat important’. While fuel is ‘very important’ or ‘somewhat important’ to 46% of consumers. However, both of these categories were surpassed by broadband internet which is ‘very important’ or ‘somewhat important’ to 86% of UK adults surveyed, suggesting that with a rise in hybrid and home working, broadband is one of the most essential things that UK adults spend their money on.

After essential costs, self-care is an important spending category for many UK adults. Almost a third of Brits (30%) consider wellness activities, such as gym memberships, somewhat or very important. Even more UK adults prioritise spending on hair and beauty appointments, with 43% citing these as very or somewhat important to them.

Spending on non-essential treats such as takeaways, meals out and alcohol is a lower priority to UK adults, but remains important to many of those surveyed: 21% prioritise takeaways, 28% meals out and 27% alcohol.

Why Every Country Is in Debt? And Who Do They Owe?

FAQ

How much debt does a UK household have?

Most of a UK household’s debt is home loans—if they have a mortgage. The average UK mortgage debt per household is now £193,867, of households with a mortgage. Of non-mortgage lending, 15% of lending is in the form of credit card balances (£2,572 average), 53% is student loans (£9,056 average) and 32% are other personal loans (£5,545 average).

How much personal debt is there in the UK?

These figures highlight that personal debt in the UK is a growing concern for individual and households. On a per-household basis, the average debt, including mortgages, stood at £65,239. So, the average amount of debt for adults was £210,934,537% of their average yearly income in the UK.

What type of debt is most common in the UK?

Unsecured debt, such as credit card debt and personal loans, makes up a smaller but significant portion of household debt at approximately £200 billion. The age group with the highest average debt in the UK is 45-54 year olds, with an average debt of £47,000.

How much debt does the UK owe?

As of June 2023, the total amount of debt that people in Britain owe is £1,84 trillion. The lion’s share of the above amount, or £1. 62 trillion, is secured mortgage debt, while £213. 9 billion is unsecured consumer debt. Credit card debt accounts for more than a fourth of the unsecured consumer debt, or £66. 0 billion.

How much debt does the UK have without a mortgage?

Credit card balances make up 32% of non-mortgage loans, student loans make up 39%, and other personal loans make up 54%. Below, you can see how debt levels continue to rise for UK households—we’ve analysed debt levels including mortgages, and also debt levels without mortgages.

Is debt a problem in the UK?

Levels of average debt per adult continue to pose a major challenge to the Financial Wellbeing and Financial Resilience of many households across the UK, according to the February 2024 Money Statistics, produced by The Money Charity.

Is it rare to have no debt?

Debt-free people are a rare breed . . . especially in today’s world. Just about everyone has bought the lie that financial peace only happens when your FICO score is above average, you’ve got credit card points out the wazoo, and your mailbox is full of credit card applications.

Are 80% of Americans in debt?

80% of Americans are currently in debt. Here are two strategies that are commonly used to help pay off debt ⤵️ ⛰️ Avalanche Method This strategy focuses on debt with the highest interest rate first while paying the minimum on the rest of your debts.

Does the UK have any debt?

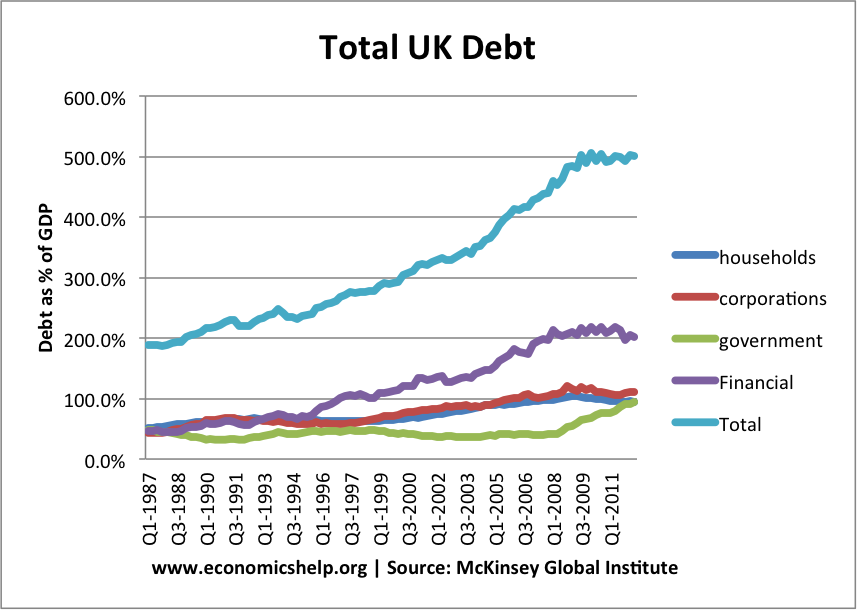

The total amount the government owes is called the national debt. It is currently about £2.8 trillion – or £2,800,000,000,000. That is roughly the same as the value of all the goods and services produced in the UK in a year, known as the gross domestic product, or GDP.

Who owns most of Britain’s debt?

The British government’s debt is owned by a wide variety of investors, most notably pension funds. These funds are on deposit, mainly in the form of Treasury bonds at the Bank of England. The pension funds, therefore, have an asset which has to be offset by a liability, or a debt, of the government.