In general, you cannot use a bank account to build credit. Thatâs because savings and checking account activity is not usually reported to credit bureaus, so it does not affect your credit scores. That said, some financial companies have introduced banking products with built-in features to help you build credit.

Bank accounts can help you manage your money and keep it safe, but banking activity isnt typically reported to credit bureaus. For that reason, it wont generally help you build credit.

There can be exceptions: Some fintech companies have created checking accounts and debit cards with features that help you get credit for your bank account activity. These are new to the scene, and they arent the norm. So, for the most part, banking activity wont impact your credit score.

Having a healthy balance or an emergency fund on hand can help protect your credit in a roundabout way by making sure that you don’t miss payments because of unexpected costs. In addition, savings may help you qualify for secured credit cards or loans, which can help you build credit.

Hey there folks! If you’re wondering, “Does having a bank account help your credit?” then you’ve come to the right spot. I’ve been down this road myself, thinking just having a checking or savings account would magically bump up my credit score. Spoiler alert it don’t work that way. Straight up having a bank account doesn’t directly help your credit score. But, before you close this tab, lemme tell ya—there’s more to the story. Stick with me, and I’ll break it down real simple, with some sneaky ways a bank account can still play a role in your credit game.

We’re gonna dive into why bank accounts don’t build credit, how they can still matter in a roundabout way, and most importantly, what you can do to actually boost that score Whether you’re starting from scratch or tryna fix a messy credit history, I’ve got your back with practical tips. Let’s get into it!

Why Don’t Bank Accounts Build Credit?

First, let’s talk about why having a bank account won’t help your credit score. Credit scores are based on how well you handle debt, not how much cash you have saved. Equifax and TransUnion, the big credit bureaus, don’t even look at how much money you have in your checking or savings account. They don’t know if you use that account to deposit your paycheck or pay your rent. It’s just not their thing.

Here’s what they do care about:

- Payment history: Are you paying bills on time? Late payments hurt big time.

- Credit usage: How much of your available credit are you using? Keep it low, like under 30% of your limit.

- Length of credit history: How long you’ve had credit accounts open.

- Types of credit: Having a mix, like credit cards and loans, can help.

- New credit inquiries: Too many hard pulls on your credit can ding ya.

Notice somethin’? Bank accounts ain’t on that list. These agencies don’t get information about your regular deposits, withdrawals, or even overdrafts. That means that having a big savings account or never having a check bounce won’t change your credit score. That’s too bad, right? That’s what I thought too when I first realized this.

But Wait—Can Bank Accounts Help Indirectly?

Now, hold up. Just ‘cause bank accounts don’t directly boost your credit doesn’t mean they’re useless in the credit game There are some slick ways they can set you up for success Let me lay out a few for ya

- Emergency Funds Save the Day: If you’ve got a healthy balance in your savings, it can stop ya from missing payments when life throws a curveball. Car breaks down? Medical bill outta nowhere? That cash can cover it, so your credit card or loan payments don’t slip. Missed payments tank your score, so this is a sneaky way to protect it.

- Qualifying for Secured Credit Products: Wanna build credit but got no history or a rough past? Secured credit cards or loans are your jam. These often need a deposit as collateral, and guess where that money can come from? Yup, your bank account. Having some savings can get you in the door to start building credit the right way.

- Showing Stability to Lenders: When you apply for a big loan—like for a house or car—lenders peek at your bank statements. They wanna see if you’ve got steady cash flow and assets. A solid bank account with regular deposits and no crazy overdrafts makes you look like a safe bet, even if it don’t touch your credit score directly.

- New Techy Options: Here’s a lil twist—some new financial apps and banking products are popping up that do tie your bank activity to credit building. They’re not super common yet, but they let you get some credit for keeping a positive balance or consistent transactions. It’s rare, but worth a peek if you’re curious.

So, while your bank account ain’t a direct ticket to a better credit score, it’s like a trusty sidekick. It helps you avoid pitfalls and can open doors to stuff that does build credit.

How Lenders View Your Bank Account

It’s kind of important to talk about how banks and lenders look at your accounts. People who want to give you a mortgage, car loan, or even a credit card don’t just look at your credit report. They want the full picture. That means you need to look at a few things on your bank statements:

| What Lenders Look At | Why It Matters |

|---|---|

| Account Balances | Shows if you’ve got cash to handle payments. |

| Transaction History | Are you consistent or all over the place? |

| Length of Account History | Long-standing accounts scream stability. |

| Overdrafts or Bounced Checks | Too many red flags say you might struggle. |

They’re not reporting this to credit bureaus, mind you. But if your bank account looks like a hot mess, they might say “nah” to your application, even with a decent credit score. On the flip side, a tidy account with some savings can make ‘em more likely to approve ya. It’s all about proving you can handle your money, ya know?

This was a big deal for me when I applied for my first big loan. I kept my checking account in good shape, which made me look trustworthy to the lender. Little things like that can go a long way.

So, How Do You Build Credit If Bank Accounts Don’t Help?

Alright, now that we’ve got the bank account myth outta the way, let’s talk real credit-building moves. If you’re itching to improve your score or start from zero, here’s what actually works. I’ve tried a couple of these myself, and trust me, they can make a difference if you stick with it.

1. Get a Credit Card and Use It Right

Credit cards are one of the easiest ways to build credit, but you gotta play it smart. Here’s the deal:

- Grab a secured credit card if your credit’s shaky or nonexistent. You put down a deposit (from that bank account, wink wink), and it acts as your credit limit.

- Use it for small purchases, like gas or groceries, and pay it off every single month. Don’t carry a balance if you can help it.

- Keep your usage low. If your limit is $500, don’t spend more than $150 or so. That’s called keeping your credit utilization down, and it’s a big deal for your score.

- Never, and I mean never, miss a payment. Even one late payment can haunt your score for years.

I started with a secured card back in the day, and just paying it on time every month got my score moving up. It’s slow, but it works.

2. Become an Authorized User

Got a friend or family member with a solid credit card history? Ask if they can add you as an authorized user on their card. You get a card in your name, and their good payment history can help your score. You don’t even gotta use it much—just being tied to their account can give ya a boost. Just make sure they’re responsible, ‘cause if they miss payments, it’ll hurt you too.

3. Take Out an Installment Loan

Loans like car loans, student loans, or even small personal loans get reported to credit bureaus. They’re different from credit cards ‘cause you pay a fixed amount each month for a set time. Paying on time builds your credit history. There’s also somethin’ called a credit-builder loan, designed just for folks tryna establish credit. You borrow a small amount, make payments, and it helps your score while you’re at it.

4. Pay Everything On Time

This ain’t just about credit cards or loans. If you’ve got bills that report to credit bureaus—like some utility or phone bills—pay ‘em on time. Late payments are the fastest way to trash your score. Set up auto-payments if you’re forgetful like I used to be. It’s a lifesaver.

5. Mix It Up

Credit scores like variety. Having both revolving credit (like credit cards) and installment credit (like loans) can give ya a lil edge. Don’t go overboard opening accounts, though—too many new ones can look risky to lenders.

Common Mistakes to Dodge When Building Credit

While we’re at it, lemme throw out some traps I’ve seen folks fall into (and yeah, I’ve stumbled into a couple myself). Avoid these if you wanna keep your credit journey smooth:

- Maxing out cards: Using up all your credit limit looks bad. Keep it low, like I said earlier.

- Missing payments: Even one slip-up can drop your score by a ton. Set reminders or automate it.

- Closing old accounts: If you’ve got an old credit card, don’t close it unless you got a real good reason. The length of your credit history matters.

- Applying for too much at once: Every time you apply for credit, it can ding your score a bit. Space it out.

- Ignoring your credit report: Check it now and then for errors. Wrong info can hurt ya, and fixing it is free.

I once applied for like three cards in a month, thinking more credit would help. Nope, my score took a hit. Learned that lesson the hard way.

How a Bank Account Still Fits Into Your Financial Big Picture

Even though bank accounts don’t build credit directly, they’re still a cornerstone of your money life. Think of ‘em as the foundation. Here’s why we at [Your Company Name] think you shouldn’t sleep on ‘em:

- Managing Cash Flow: You need a place to stash your paycheck, pay bills, and save for goals. Without a bank account, handling money gets messy quick.

- Avoiding Fees: Using cash or prepaid cards often comes with fees. A good checking account can save ya cash in the long run.

- Building Habits: Tracking your spending and saving through a bank account teaches discipline, which spills over into how you handle credit.

- Safety Net: Like I mentioned, an emergency fund in savings can keep you from racking up debt when stuff hits the fan.

So, yeah, keep that bank account in good shape. It’s not a credit booster, but it’s a tool that keeps your financial house in order.

What If You’re New to Credit Altogether?

If you’re just starting out or got no credit history, don’t sweat it. Bank accounts might not help directly, but they’re a stepping stone. Use that account to save up for a secured credit card deposit. Start small—maybe put aside $200 or $300. Then apply for that card and follow the tips I gave earlier. You can also look into credit-builder loans at local banks or credit unions. They’re made for newbies like you.

Another trick? See if you can get on someone’s credit card as an authorized user. It’s a quick way to get some credit history without much risk, as long as they’re reliable. I wish I’d known about this when I was younger—would’ve saved me some headaches.

Wrapping It Up: Bank Accounts Ain’t the Credit Hero, But They Matter

So, does having a bank account help your credit? Nah, not in the direct sense. Credit scores are all about how you manage borrowed money, not how much you’ve got saved or sitting in checking. But don’t underestimate your bank account—it’s got your back in other ways. It can protect your score by helping you avoid missed payments, get you into credit-building products, and show lenders you’ve got your act together.

If you’re serious about building credit, focus on getting a credit card or loan and using it responsibly. Pay on time, keep balances low, and mix up your credit types if you can. That’s the real path to a better score. Meanwhile, keep that bank account healthy. It’s your safety net and your starting point.

Got questions or wanna share how you’re working on your credit? Drop a comment below. I’m all ears, and I’d love to swap stories or tips. Let’s keep this money convo goin’!

How to Build Credit

Although the average bank account isnt part of your credit history, there are plenty of ways you can build good credit, whether you are recovering from a setback or starting from scratch. They include:

Do Bank Accounts Help You Build Credit?

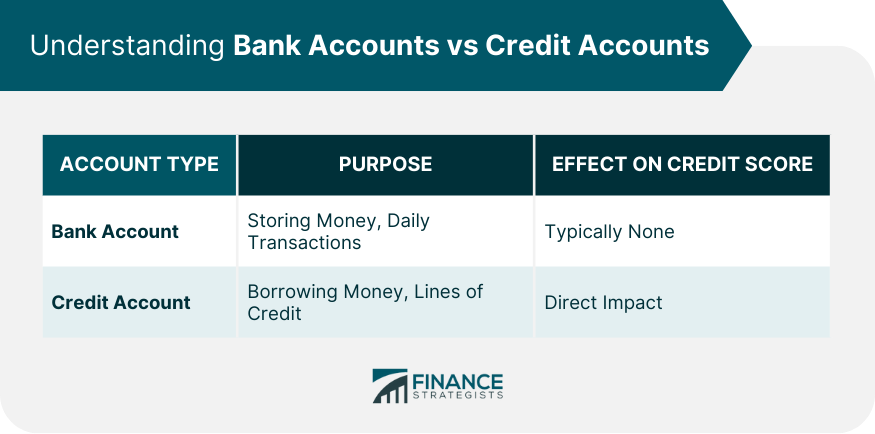

Checking, savings, CD, and money market accounts are examples of deposit accounts that are not reported as accounts to the credit bureaus. This means that bank accounts don’t usually help you build credit. Bank accounts typically are those that you use for transactions, like depositing paychecks and paying bills, as well as for saving money.

If you already have a bank account, it’s easier to get a loan because lenders can easily see how much money you make and how much you spend. If you borrow money from your bank, that account will likely be reported to the credit bureaus. That is true even if the loan account appears on your bank statement. It is still a credit account.

Types of accounts that are reported to credit bureaus include:

Does Bank Account Or Debit Card Activity Increase Your Credit Score? | Improve Your Credit Report?

FAQ

Does having a bank account help credit score?

Your checking account usually has no impact on your credit score. Normal day-to-day use of your checking account, such as making deposits, writing checks, withdrawing funds, or transferring money to other accounts, does not appear on your credit report. Your credit report only includes money you owe or have owed.

Does having a bank account help get a credit card?

Yes, having a checking account with them helps you get new cards. So does having a car loan with them. You become a preferred customer if you use more of their financial products.

Does having money in the bank increase credit score?

Use a bank account. Just make sure you have enough money in it to cover your bills. If you don’t, your credit score could go down instead of up. Using and managing an arranged overdraft carefully could also help to improve your credit score over time.

What raises your credit the fastest?

Ways to improve your creditKeep your credit utilization low. Keeping your credit utilization low is often one of the fastest ways to improve your credit score. Become an authorized user. Pay your bills on time. Check your credit report. Keep older accounts open. Don’t apply for too much new credit.