“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve kept this reputation for more than 40 years by making it easier for people to make financial decisions and giving them confidence in what to do next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. That way, you know that the information you’re reading, whether it’s an article or a review, is reliable. Bankrate logo.

Paying off a phone can help build your credit, but only if the phone was purchased on credit and the financing company reports your payment history to the credit bureaus. Simply paying your phone bill on time does not typically impact your credit scores. However taking out a loan or using a credit card specifically to buy your phone could help build your credit over time through on-time payments.

How Does Paying Off a Phone Build Credit?

There are a few ways that paying off a phone you bought on credit can help build your credit history and scores:

-

Taking out a loan for the phone means you’ll have a new account added to your credit report. As long as the lender reports your payment activity, this account will help build your credit history.

-

Making regular on-time payments shows lenders you’re reliable and helps improve your payment history, the biggest factor in your FICO® Score.

-

Paying off the loan slowly over time shows lenders that you can handle and honor your debts. This can help build your credit scores.

That being said, you usually need to get a loan or use a third-party lender to pay for the phone. Paying your phone bill on time every month won’t help your credit score because carriers don’t report this to credit bureaus.

Ways to Buy a Phone on Credit

You’ll need to use credit to pay for your new phone if you want to build credit when you pay it off. Here are some options to consider:

-

Credit cards: Many major credit card companies offer 0% intro APR deals that you can use to buy your phone without paying any interest. Just make sure you pay off the balance by the end of the period.

-

Retail store cards – Some electronics retailers offer store cards you can use to finance a phone purchase. They may offer 0% financing deals.

-

Phone company financing – Direct financing through phone makers like Apple often lets you pay off the phone over 12-24 months. They report payment activity to credit bureaus.

-

Personal loans – You may be able to qualify for a personal loan to purchase your phone, then pay it off in fixed monthly payments over 1-5 years typically.

-

Buy now, pay later – BNPL financing from companies like Affirm or Klarna lets you make smaller payments over 6-12 weeks. But it likely won’t help build credit.

When Does Paying Off a Phone Not Build Credit?

In some cases, paying off your phone won’t actually help improve your credit at all:

-

Wireless carrier financing – Carriers typically don’t report your monthly device payments to credit bureaus, so on-time payments don’t impact your credit.

-

Prepaid carrier plans – Prepaid phones with no contracts don’t require a credit check or financing, so they provide no credit benefits.

-

Debit/cash purchases – Paying cash or with a debit card provides no credit history benefits even if you pay the balance off quickly.

-

Authorized user accounts – If you’re just an authorized user on someone else’s phone plan, their payment activity doesn’t affect your credit history.

-

Buy now, pay later plans – Most BNPL providers don’t report payments to credit bureaus, so there’s no credit score impact.

-

Rental plans – With phone leasing or rent-to-own plans, you don’t actually own or pay off the phone in the end.

So you need to specifically finance the phone yourself using some form of credit. Simply paying your monthly phone bill on time or paying off someone else’s phone plan won’t directly help build your credit history.

Tips for Using Phone Payments to Build Credit

If you want to use phone payments to build or rebuild your credit, keep these tips in mind:

-

Check that the lender reports payment activity to at least one credit bureau. Accounts not on your credit reports don’t impact your scores.

-

Make sure you can afford the monthly payments comfortably based on your budget. Late or missed payments could actually hurt your credit score instead.

-

Consider starting with a secured credit card if you’re new to credit or have bad credit. This lets you build credit with less risk.

-

Apply for phone financing from a company that offers prequalification or soft credit checks first to avoid unnecessary hard inquiries.

-

Review all fees, interest rates, and terms before committing to any financing offers. Make sure you understand the total costs.

-

Pay off the phone balance in full each month if possible, or at least make the minimum payment on time every month.

-

Be cautious about financing expensive phones you can’t comfortably pay off over the repayment term. Too much debt could lower your credit scores.

The Bottom Line

Paying off a financed phone you purchase on credit can help build your credit, but only if the lender reports your payment history to the credit bureaus. Simply paying your monthly wireless bill on time does not directly impact your credit scores.

To build credit when buying a phone, you need to specifically use some form of credit – whether a credit card, store financing, or personal loan – that reports your payment activity. Consistently making on-time payments will demonstrate your creditworthiness and help improve your credit over time.

Report your payments to credit bureaus

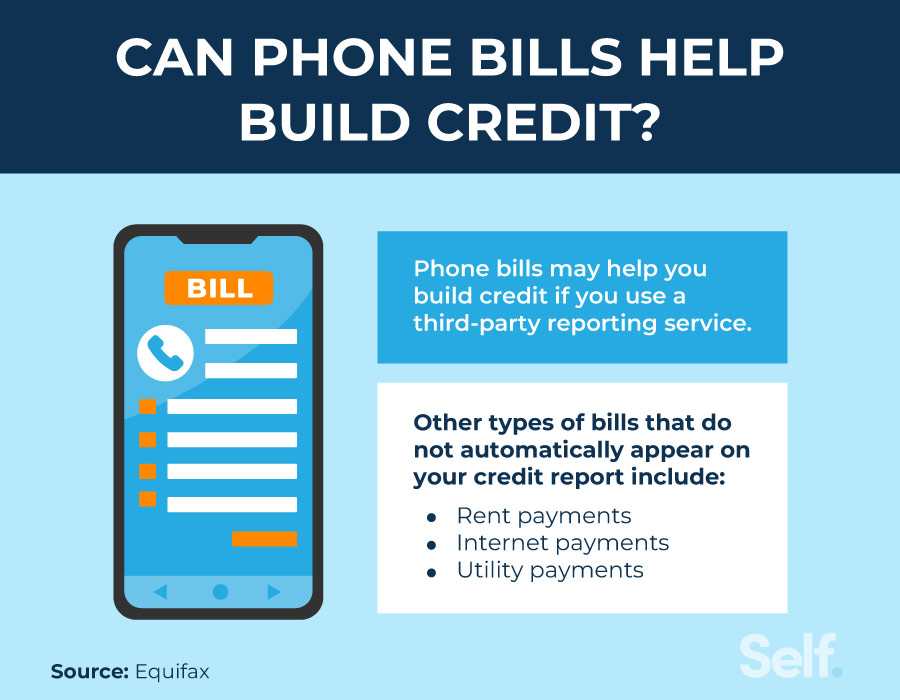

It’s not possible to directly self-report your cellphone payment history to the credit bureaus. However, you can authorize various third-party companies to track and report certain monthly bills that aren’t generally included in credit reports. That can include anything from your cellphone and internet services to your power bill and rent payment. Fees may apply.

Experian Boost, a free service the credit bureau offers, is another option. It allows you to add your cellphone account (and other regular payments) to your Experian credit report. Your on-time payments are factored into your credit score, but your late payments aren’t included.

Reporting your payments to the credit bureaus might be a good option if you have little credit history and are looking for alternative methods to build credit.

How to use your cellphone bill to build credit

While your on-time cellphone payments aren’t automatically included in your credit report, there are some strategies you can use to build credit with your cellphone. Your options include reporting your payments to the credit bureaus, paying your cellphone bill with a credit card or financing a new phone.

Does a Cell Phone build Credit (or get you DECLINED)?

FAQ

Does financing a phone build credit?

If you’re wondering whether financing a phone builds credit, the answer is that it depends. In some cases, financing a phone may help you build credit — but only if the financing company reports your payment activity to the credit bureaus. Further, you’ll need to consistently make on-time payments if you’d like to build your credit.

Can a cellphone Bill build credit?

It’s possible to use your cellphone bill to build credit, but it won’t happen automatically. Consider signing up for a service that will report your on-time phone payments to the credit bureaus, paying your phone bill with a credit card or financing your next cellphone. You can also take steps to build or repair credit without your cellphone bill.

Can monthly phone payments help build credit?

Regardless of whether you finance your phone, your monthly phone payments could help you build credit if you use Experian Boost ®ø. You can link your bank account to Experian Boost and add your monthly rent and utility bills, as well as some insurance and streaming service payments, to your credit report.

Does not paying your cell phone bill lower your credit score?

Not paying a cell phone bill can lower your credit score. It won’t help your credit score if you pay your cell phone bill on time, but lenders don’t like it when borrowers miss fees. If you don’t pay your cell phone bill, your cell phone company may notify the credit bureaus of a late payment.

Does a cellphone Bill affect your credit?

Typically, cellphone providers don’t report your payment activity to the credit bureaus. When you pay your phone bill, you’re paying for services rather than repaying money you borrowed. Unfortunately, it’s easier for your cellphone bill to negatively impact your credit. Your credit may take a short-term hit when you open the account.

Do cell phone financing companies report payments to credit bureaus?

It depends on which cell phone financing option you chose. Some financing providers report payment activity to the credit bureaus, while others don’t. For instance, wireless carriers most likely won’t report payments on cell phone financing, whereas phone manufactures and some electronic stores do.

Is paying off a phone good for credit?

Yes, paying off your contract phone and phone bill can positively impact your credit score. Here’s how: Payment History: Making on-time payments is one of the most significant factors in your credit score. Consistently paying your phone bill can help build a positive payment history.

Does paying a phone bill help build your credit?

Your cellphone bills can only improve the credit scores that are based on your credit reports with the cellphone accounts. Most tools don’t add your cellphone account to all three of your credit reports. Cellphone bills only affect certain credit scores. Most modern credit scoring models consider cellphone payments.

What raises your credit the fastest?

Ways to improve your creditKeep your credit utilization low. Keeping your credit utilization low is often one of the fastest ways to improve your credit score. Become an authorized user. Pay your bills on time. Check your credit report. Keep older accounts open. Don’t apply for too much new credit.

Do phone plans boost credit?

Since most cell phone companies don’t report to the credit bureaus, changes to your plan, like getting a better phone, won’t help your credit score.