âPre-qualificationâ and âpre-approvalâ are terms that can apply to credit cards and various types of loans, including mortgages and car loans. The specific differences between the terms may vary depending on the lender and the type of loan.

But for credit cards, both terms typically mean that an initial lender review suggests youâre likely to get approvedâthough pre-approval can be a more extensive assessment. Keep reading to learn more about what it might mean to be pre-qualified or pre-approved for credit card offers or loans.

When you get pre-approved for a mortgage or auto loan, it can feel like a big step forward in the lending process. After sending in paperwork and having your credit checked, you get a letter from the lender with estimated terms and loan amounts. This letter may make you feel like the hard part is over, but does getting pre-approved mean the lender will actually approve your loan application?

Unfortunately, pre-approval does not guarantee final loan approval. While being pre-approved is a promising sign, there are important differences between pre-approval and a final loan approval. Let’s break down what pre-approval means, why it doesn’t guarantee approval, and steps you can take to help ensure your loan application is ultimately approved.

What Does Pre-Approval Mean?

Pre-approval means a lender has thoroughly reviewed your credit, income, assets, and other information and conditionally approved you for a loan. Based on this review, the lender provides a pre-approval letter estimating loan terms you may qualify for.

The pre-approval process is fairly rigorous and goes beyond simply looking at a credit score. Exact requirements vary by lender, but pre-approval generally involves:

-

Submitting documents to verify income, assets, and employment. This may include W-2s, paystubs, tax returns, and bank statements.

-

Getting a hard credit check, which lets the lender look at your whole credit report This hard inquiry can temporarily lower your credit scores.

-

Providing information about the property you want to purchase, like the price and address.

-

Meeting the lender’s debt-to-income ratio and credit score requirements.

The lender will decide what loan terms you may be able to get after looking over all the paperwork and information you sent them. This pre-approval letter outlines details like:

-

The maximum loan amount they’re willing to lend.

-

Estimated interest rates based on your application and current market rates.

-

Loan programs it appears you would qualify for, such as conventional, FHA, or VA loans.

-

Next steps in the application process.

Pre-approval is like a lender’s promise to lend money, but with some conditions. The lender is telling you that they plan to approve your application as long as your financial situation stays the same.

Why Doesn’t Pre-Approval Guarantee Final Approval?

While being pre-approved is encouraging, keep in mind it does not guarantee the lender will ultimately approve your loan application. There are a few key reasons why:

1. Time Gap Between Pre-Approval and Final Application

Pre-approval letters are generally valid for 45-90 days. During this time, the lender will require you to submit updated documents if you formally apply for financing. Your financial profile could change during that period in ways that no longer meet the lender’s approval criteria.

For instance, you could take on new debts that hurt your debt-to-income ratio. Your credit score could also drop due to applying for other loans or credit cards. Failing to disclose debts or assets could also lead to denial later on.

2. Appraisal Contingencies

For home purchase loans, the property appraisal is a contingency for final approval. Even if you initially qualify based on your income and credit profile, the lender won’t approve financing unless the home appraises for at least the purchase price.

If the appraisal comes back low, it throws a wrench in the approval process. The lender may require you to provide a larger down payment to cover the gap between the appraised value and purchase price. If you can’t, they may deny the loan altogether.

3. Underwriting Review

During underwriting, a loan officer takes one final in-depth look at your application before issuing formal approval. They double check all documents, calculate your debt-to-income ratio and loan-to-value ratio, and verify employment. If they uncover any issues or inaccuracies, your loan could be denied.

While uncommon, lenders reserve the right to deny your application at underwriting even if previously pre-approved. Typically, this occurs if they find major discrepancies compared to your pre-approval documentation.

How to Improve Chances of Final Loan Approval

While pre-approval doesn’t guarantee loan approval, you’re generally in good shape if your lender pre-approves your application. Here are some tips to maintain your financial profile and help ensure ultimate approval:

-

Don’t take on new debts: Avoid applying for additional credit cards or loans to keep your debt-to-income ratio stable. Large purchases on existing cards can also inflate this ratio.

-

Monitor your credit: Review your credit reports from all three bureaus before applying to check for errors. Then keep an eye out for any new accounts or inquiries during the application process.

-

Stick to application facts: Clearly disclose all income, assets, debts, and property details upfront. Don’t exaggerate financial facts to try to get approved for more.

-

Act fast once pre-approved: Move forward with formally applying as soon as possible. Follow the lender’s timeline for submitting updated documents to prevent delays.

-

Be prepared to discuss changes: Notify your lender about any changes to your employment, income, debts, or credit right away. Explain impacts and have a backup plan if it could jeopardize approval.

The Bottom Line

Pre-approval provides conditionally positive feedback that you’re on the right track towards getting a mortgage loan or auto financing. It shows the lender is willing to move forward based on the financial documents and information you’ve provided so far.

However, a pre-approval letter is not the same as a final loan approval. Keep your financial profile consistent, complete the application accurately, and be in touch with your lender about any changes. This will provide you with the best shot at ultimately getting approved for the loan and terms outlined in your pre-approval letter.

Tips for getting pre-qualified or pre-approved for a credit card

Credit card issuers typically look into several factors related to credit history and income. Here are a few things you can do to help improve your credit and potentially receive more offers:

- Make on-time payments on your accounts.

- Maintain a low credit utilization ratio.

- Check your credit to get a better idea of how your money is doing.

- Have a diverse mix of credit.

Keep in mind that requirements can vary by issuer and card.

Why you might receive pre-qualification and pre-approval offers without applying

Credit card issuers typically set some basic initial eligibility criteria for a card. Then the issuer asks credit bureaus for a list of people who meet those criteria. From there, the issuer may send those people pre-qualified or pre-approved offers. Some pre-qualified or pre-approved offers might come to you in the mail, by phone or by email. If youâre interested in a new card, you can respond to these offers and apply to become a cardholder.

Does Pre-Approval Mean You Are Approved? – CountyOffice.org

FAQ

Does a pre-approval mean you can get a loan?

No. Being pre-approved for a loan doesn’t mean you are guaranteed to obtain a loan. Even though being pre-approved for a loan is a good sign that you can get it, it doesn’t mean the lender is ready to close the deal. It’s possible a further review of your finances will lead to a loan denial.

What does pre-approved mean on a credit card offer?

If a credit card offer says you’re “pre-qualified” or “pre-approved,” it means you’ve already met the basic requirements to get the card. But you still need to apply to get approved. With credit cards, pre-approved and pre-qualified may be more likely to be used interchangeably than with loans.

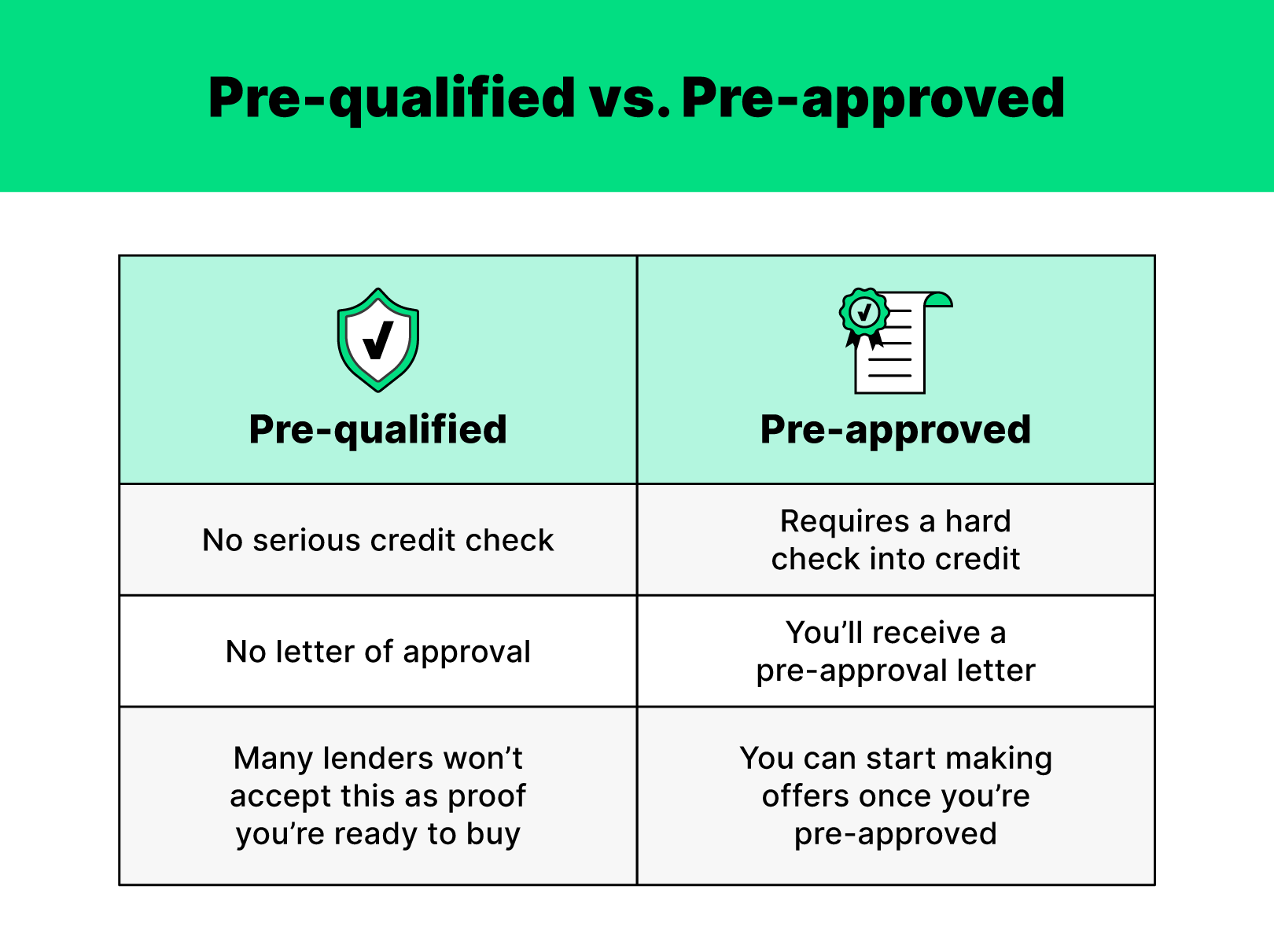

What is the difference between prequalified and preapproved?

The main difference between being prequalified and preapproved is that preapprovals hold more weight when trying to buy a home. This is because they are based on a more in-depth look at your finances, such as your most recent tax returns and a hard credit check.

What is preapproval & how does it work?

Preapproval is an estimate based on a more thorough review of your finances and is, therefore, more accurate than prequalification. If you’re wondering how to get preapproved, start by choosing a lender and applying. Your lender will run a hard credit check and ask to review your financial documents.

What is a preapproval letter?

The lender will provide a preapproval letter, which is a conditional loan offer that estimates how much it expects you’ll be qualified to borrow. Preapproval carries more weight with agents and sellers. Preapproval shows you’re ready to buy a home and can qualify for a loan that will allow you to do so.

Should I get a pre-approval before buying a home?

As such, consider getting a pre-approval before you start trying to negotiate with a home seller. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Can you be denied after pre-approval?

Can a pre-approved loan be rejected?

Is getting pre-approved a good thing?

Getting preapproved is a good first step toward getting a mortgage, but preapproval doesn’t mean you’ll get a mortgage.Dec 12, 2024

How long after pre-approval do you get approved?