Hey there! If you’re wondering, “Does the mortgage have to match the deed?” then you’ve come to the right place. I’m here to tell you the truth. We get this question a lot at Moshes Law, and trust me, it’s important for anyone buying a home or having problems with their property. That being said, the names on the mortgage and deed should match if possible, but they don’t have to. I’ll explain what that means, the risks, and how to deal with it. There are good reasons why they might not. Get a coffee, because we’re going to look into this homeownership puzzle in more detail!

What’s a Deed, and What’s a Mortgage? Let’s Clear the Fog

Before we get into the nitty-gritty, let’s make sure we’re on the same page about what these two things even are I’ve seen plenty of peeps mix ‘em up, and it’s no wonder—home buying is a maze!

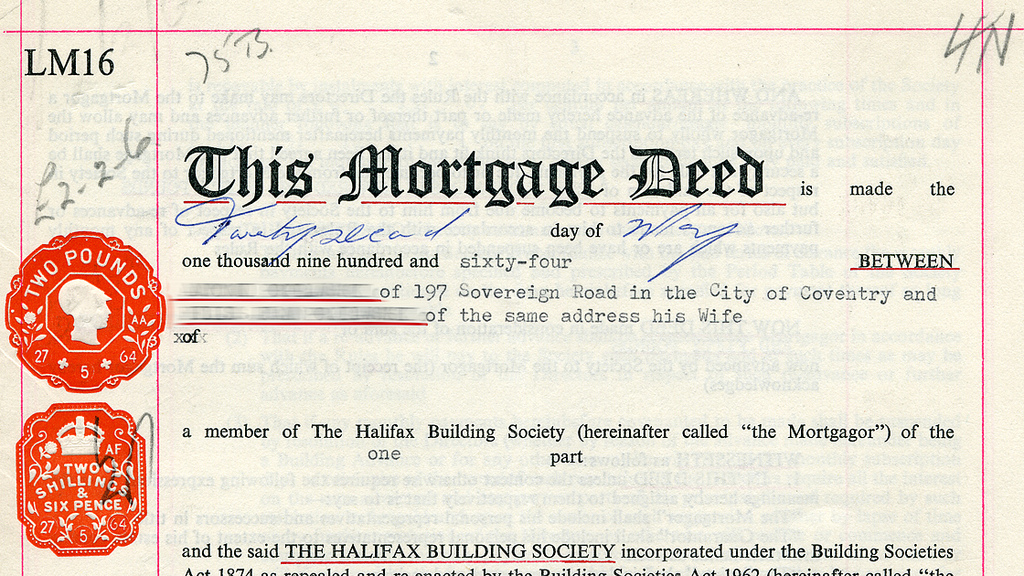

- Deed: This is the legal paper that says, “Yo, you own this house!” It’s proof of ownership, filed with your county’s office so everyone knows who’s the boss of that property. If your name’s on the deed, you’ve got a stake in the place.

- Mortgage: This ain’t about owning—it’s about owing. A mortgage is the loan you take out to buy the house, secured by the property itself. If you don’t pay up, the lender can swoop in and take the house (that’s foreclosure, and it sucks). Your name on the mortgage means you’re on the hook for payments.

Here’s a quick side-by-side to hammer it home:

| Aspect | Deed | Mortgage |

|---|---|---|

| What It Means | Proof you own the property | Loan you owe, tied to the house |

| Who’s Listed | Owners of the home | People responsible for paying |

| Legal Impact | Gives you rights to the property | Makes you liable for debt |

Got it? Cool. Now, the big question—do the names on these docs gotta be the same?

Do the Mortgage and Deed Have to Match? The Straight Answer

Here’s the deal in a perfect world the names on the deed and mortgage would match up like peanut butter and jelly. It keeps things clean—everyone who owns the house is also responsible for paying the loan. But life ain’t always perfect right? There are plenty of situations where they don’t match, and it’s not illegal or anything. It just gets… complicated.

Why might they not match? Well, I’ve seen this play out with buddies and clients over at Moshes Law heaps of times. Maybe one spouse has a trash credit score, so only the other’s name goes on the mortgage to snag a better interest rate. Or perhaps you’re helping a family member buy a place, so you’re on the mortgage as a co-signer but not on the deed. These mismatches happen for real, practical reasons, but they can open a can of worms if you’re not careful.

Common Scenarios Where Deed and Mortgage Don’t Match

Let’s paint some pictures here. These are the most common setups we run into, and I bet you’ll see yourself in at least one of ‘em.

- Two Owners on the Deed, One on the Mortgage: Think of a married couple. Both names are on the deed, so they both own the house. But only one’s on the mortgage ‘cause the other’s credit is shot, or maybe they’ve got no income history. The one on the mortgage is the only one legally tied to paying, but if they default, the house (which both own) is still at risk of foreclosure.

- One Owner on the Deed, Two on the Mortgage: This happens when someone’s just co-signing to help out. Say, a parent co-signs the mortgage for their kid, but only the kid’s name is on the deed. The parent’s on the hook for payments but doesn’t own a brick of that house. Risky biz, if ya ask me.

- Your Name’s on the Deed, Not the Mortgage: Congrats, you own part of the house! But you ain’t responsible for the loan payments. Sounds sweet, but if the person on the mortgage stops paying, the lender can still come after the property—your property. You could lose it even though you didn’t miss a payment.

- Your Name’s on the Mortgage, Not the Deed: Oof, this one’s a kicker. You’re obligated to pay the loan, but you don’t own the house. If the owner dies or something messy happens, you’ve got no claim to the place, even though you’ve been shelling out cash for it.

A friend of mine, let’s call him Mike, got stuck in that last situation. He helped his sister get a mortgage when he really was just helping her get started. Even though the deed was only in her name, she owned the house. When she left town, Mike was left to pay for it. He had to pay everything, but he had nothing to show for it. Brutal lesson, man.

Why Does It Matter if They Don’t Match? The Risks You Gotta Know

Alright, so they don’t have to match, but why should you care? ‘Cause when the deed and mortgage don’t line up, you’re playing with fire. Here’s the kinda trouble that can pop up:

- Foreclosure Risk: No matter who’s on the deed, if the mortgage payments ain’t made, the lender can foreclose on the property. So, even if you own the house but aren’t on the mortgage, you could lose it if the other party flakes out.

- Ownership Disputes: Let’s say you’re on the deed but not the mortgage, and the person on the mortgage passes away. If their name’s also on the deed, cool, you might inherit their share. But if it’s just their name, things get murky—could go to their estate or someone else, not you.

- Credit Hits: If you’re on the mortgage but not the deed, and payments get missed, your credit takes the hit. But you don’t even own the darn place! Talk about unfair.

- Divorce Drama: Oh boy, this one’s a mess. In places like New York, if you bought the house during marriage, it’s often considered joint property, even if only one name’s on the deed or mortgage. But if there’s a mismatch, figuring out who gets what—or who pays what—can turn into a courtroom circus.

- Tax Troubles: If you’re not on the mortgage, you might miss out on tax deductions for interest payments, even if you’re chipping in. That’s cash down the drain.

We’ve helped folks at Moshes Law who didn’t see these pitfalls coming. One couple came to us in a panic ‘cause only one was on the mortgage, both on the deed, and payments got missed. They nearly lost their home, even though one of ‘em wasn’t even supposed to pay! It’s a wake-up call—mismatches can bite ya hard.

Why Would You Want a Mismatch Anyway? The Pros (Yeah, There Are Some)

Now, I ain’t saying it’s all doom and gloom. There are reasons peeps choose to have different names on the deed and mortgage. Sometimes, it makes sense for your situation.

- Better Loan Terms: If one person’s got stellar credit and the other’s is in the gutter, putting just the good-credit person on the mortgage can get you a lower interest rate. Saves big bucks over time.

- Speedy Approval: Getting a mortgage approved for one person is often quicker than for two, especially if time’s tight and you’re racing to close on a house.

- Protecting Credit: If there’s a foreclosure, only the person on the mortgage takes the credit hit. The other owner’s score stays safe.

- Divorce Planning: If you’re splitting up, one spouse might buy a new place without dragging the other into it. Keeps things separate for a cleaner break.

But lemme be real with ya—even with these perks, you gotta weigh ‘em against the risks. It’s a gamble, and I’ve seen it go south more often than not.

How to Fix or Avoid a Mismatch: Practical Steps from Yours Truly

So, you’re in a spot where the deed and mortgage don’t match, or you’re thinking of setting it up that way. What can ya do to protect yourself? Here’s some straight-up advice from us at Moshes Law.

If You’re Already Mismatched:

- Refinance the Mortgage: Wanna add or remove someone from the mortgage? Most lenders won’t let ya just tweak it—you’ll need to refinance. That means getting a new loan with the right names on it, paying off the old one. It costs a chunk (like 2-5% of the loan amount), but it clears up the mess.

- Update the Deed: Adding someone to the deed? Look into a quitclaim deed to transfer ownership interest. But don’t DIY this—get a real estate lawyer to make sure it’s legit and filed right with the county.

- Talk to a Pro: Seriously, don’t wing it. A real estate attorney or trusted loan officer can look at your setup and tell ya the best move. Laws vary by state, and you don’t wanna miss a detail.

If You’re Setting Up a New Purchase:

- Think Twice About Mismatching: Unless there’s a darn good reason (like bad credit), try to keep names the same on both docs. It’s just safer.

- Get Everyone in the Room: On closing day, make sure all owners—even if they ain’t on the mortgage—are there. Some title companies insist on it for recording purposes.

- Plan for the Worst: Ask yourself, “What if the person on the mortgage can’t pay?” or “What if someone passes away?” Have a backup plan, maybe even a legal agreement between owners.

I remember helping a client who wanted to add their partner to the deed but not the mortgage. We walked ‘em through the quitclaim process, made sure everything was filed proper, and advised ‘em on what could happen if payments slipped. Saved ‘em a headache down the line, and they thanked us big time.

Special Situations: Divorce, Death, and Other Curveballs

Life throws some wild pitches, don’t it? Let’s tackle a couple extra scenarios where deed and mortgage mismatches get even trickier.

Divorce and Property Splits

If you’re getting a divorce and the mortgage is in your name only, what happens to the house? Well, it depends on when ya bought it. If it was before marriage, it might be yours alone. But if it was during, lots of states—like New York—call it shared property, no matter whose name is where. You and your ex gotta hash out who keeps the house or how to split equity. Often, one spouse refinances to take over the mortgage solo. No agreement? You’re both stuck liable for the debt, even if only one lives there. Yikes.

Death of a Spouse or Owner

If someone on the mortgage dies and you’re only on the deed and not the loan, the estate has to pay the bills or the lender may take back the house. It’s not always possible for banks to help the surviving spouse refinance in their own name. Also, if your name isn’t on the deed, you might not get the house; it could go to someone else according to the will or state law. Scary stuff.

Selling the House

Can ya sell if you’re on the deed but not the mortgage? Yup, you’ve got ownership rights to sell your share. But here’s the catch—the mortgage is still a lien on the property. It’s gotta be paid off or refinanced before the sale closes, or the deal’s dead in the water. Legal help can smooth this out.

Tips to Keep Your Head Above Water

I ain’t gonna leave ya hanging without some final nuggets of wisdom. Here’s how to stay outta trouble with deed and mortgage mismatches:

- Double-Check Docs: Before signing anything, read the deed and mortgage papers. Make sure you know who’s on what and why.

- Communicate: If you’re buying with someone else, talk openly about who’s responsible for payments and what happens if sh*t hits the fan.

- Save for a Rainy Day: If you’re on the deed but not the mortgage, have some cash stashed in case you gotta step in to save the house from foreclosure.

- Legal Backup: Keep a real estate lawyer or advisor on speed dial. Trust me, a quick consult can save ya thousands in losses or stress.

Wrapping Up: Knowledge Is Power, Fam

The mortgage doesn’t have to match the deed, but it’s safer if it does. Mismatches can happen for good reasons, like credit problems, bad timing, or personal issues like divorce, but they come with a lot of baggage. If things go wrong, you could lose your home, have a fight over who owns it, or get your credit lowered. We’ve seen it all here at Moshes Law, and we always tell people to give it some thought before they set up a mismatch. Do not worry if you are already in one; there are ways to fix it, such as refinancing or updating the deed.

Bottom line? Get clued up on your rights and risks. If your name’s on the deed, you own the place, but that don’t mean you’re free and clear if the mortgage ain’t paid. And if you’re on the mortgage without the deed, you’re carrying the debt without the reward. Either way, don’t go it alone. Chat with a pro to make sure you ain’t missing somethin’ crucial. Got questions or a sticky situation? Drop us a line—we’re here to help ya navigate this crazy homeownership game!

Can a married couple buy a house in only one person’s name?

Yes, a married couple can buy a house even if only one spouse’s name is on the mortgage and deed. However, in New York (a community property state), property obtained during the marriage is typically treated as owned by both spouses when dividing assets during divorce—even if only one name appears on the mortgage or deed.

Do Both Owners’ Names Need to be on a Mortgage?

No – you can have only one spouse on the mortgage but both on title. On the mortgage, both owners of the home do not have to be listed, even if they are married and on the deed. Keep in mind that the mortgage doesn’t say who owns the house, so not being on the mortgage won’t change the fact that you own the house.

In certain situations, having one spouse on the mortgage and both on the deed is ideal. This is often the case where one spouse has very poor credit, such that listing that spouse on the mortgage will result in a much higher interest rate than simply listing the other spouse alone. Listing only one spouse on the mortgage may save significant interest over the long term.

There are numerous other reasons to list only one spouse on a mortgage, including:

i. Income Requirements – If including both spouses would cause the couple to fail the income requirements, perhaps because he or she has not had an income in the past few years, that spouse may be best left off the loan application.

ii. Timing – It is often quicker to approve one spouse on a loan than both when time is of the essence.

iii. Limiting Credit Score Impact – If there is a foreclosure and only one spouse is listed on the mortgage, only his or her credit score will be affected.

iv. Pending Divorce – The spouses are pending divorce and one wishes to buy a home without the other.

It is not always as simple as just having one spouse apply for the mortgage, however. In reality, the loan officer will have to be okay with this arrangement knowing that both spouses are owners of the home. Learn more about who has legal rights to the home and title vs mortgage disparities.

Title vs. Deed: Don’t Get These Legal Concepts Confused!

FAQ

Does the deed have to match the mortgage?

Yes, someone can be on the title and not the mortgage. The two terms “deed” and “title” are often used synonymously.

What if the mortgage is in a different name than the deed?

You are not the property owner when your name on mortgage but not on deed. Your role on the mortgage is merely that of a co-signer. Because your name appears on the mortgage, you are responsible for making the payments on the loan, just like the property owner.

What happens if you are on the deed but not the mortgage?

If your name is on deed but not on mortgage, you are an owner of the home but not liable for the mortgage loan payments. If payments are defaulted on, the lender can still foreclose on the home, despite only one spouse being on the mortgage.

Do I own half the house if my name is on the deeds?

While warranty deeds are more common elsewhere, California’s community property laws provide that any property acquired during marriage is owned equally by both spouses, regardless of whose name is on the deed.