Credit scoring systems comb and analyze credit reports to evaluate how you manage credit. Their main concerns are your payment history, the amount of debt you have, how you use available credit, the length of your credit history, the types of credit you have, and any new credit you get.

Credit scoring systems such as the FICO® ScoreΠ8 and VantageScore® analyze credit report information to predict whether youll pay your debts as agreed. The software essentially uses advanced algorithms to comb your credit history for signs of good (and bad) credit management habits.

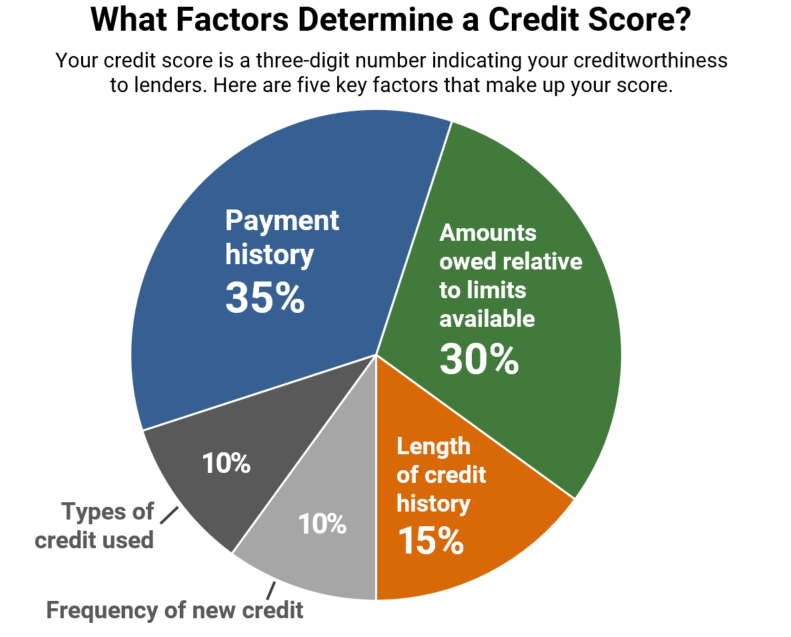

Credit scores are calculated in a way that is closely guarded trade secrets, but the factors they use and how they are weighted are known to everyone. The following factors and percentage weightings apply to the FICO® Score, which is used by 90% of top lenders.

VantageScore credit score factors differ somewhat, but adopting the habits described below will promote improvement on any credit score derived from credit report data.

The most important thing that determines your credit score is how well you’ve paid your bills in the past. It’s the only thing that goes into figuring out your FICO score. To keep your credit score high, you need to make sure you pay your bills on time every month for a long time.

What Exactly is Payment History?

Your payment history details your track record of paying loans and other debts as agreed. It shows whether you make payments on time, miss payments, or default on accounts completely.

Specifically payment history considers

- Your payment information on all credit accounts like credit cards, mortgages, student loans, and retail accounts

- How late any delinquent payments are currently or were in the past

- Amounts owed on delinquent accounts or collection items

- Number of past due payments

- Bankruptcies, lawsuits, wage attachments

- Time elapsed since each delinquency or public record

- Number of accounts paid as agreed currently

As you can see, your payment history shows how reliable you are at paying your debts over time.

Why Payment History Matters Most

Payment history is very important because it shows lenders the best way to guess how you’ll handle credit in the future. If you’ve always paid your bills on time in the past, they can assume you’ll keep doing that.

Multiple late payments or defaults, on the other hand, show that you are more likely to not pay back your debts as agreed. This directly affects how willing lenders are to give you new credit and what terms they offer.

Specifically, excellent payment history helps in these ways:

- Boosts credit scores, leading to better loan rates and terms

- Increases likelihood of loan and credit card approval

- Allows access to more credit products and higher limits

- Reduces security deposits required for utilities, rentals, etc.

Meanwhile, poor payment history hurts through:

- Lower credit scores increasing loan costs and reducing access to credit

- Higher denial rates for new loan and card applications

- Lower credit limits on accounts you do open

- Difficulty obtaining services that require credit checks

Clearly, payment history has an outsized influence on your finances both currently and into the future.

How Payment History Is Calculated in Credit Scores

As noted above, payment history determines 35% of your FICO credit score. The most weight is given to:

- Recency of delinquencies – More recent missed payments hurt more

- Severity of delinquencies – 30, 60, and 90+ days late are weighed differently

- Frequency of missed payments – The more often you pay late, the worse it is

One 30-day late payment can lower an excellent credit score by over 100 points. Scores tend to decrease more dramatically when high credit scores are involved.

On the other hand, a long history of on-time payments can help counterbalance minor lapses. For example, someone with ten years of perfect payments may only see a small drop from one 30-day late bill.

Bankruptcies, foreclosures, and debts in collection have severe negative impacts. They can drag scores down by 150-200 points and remain on reports for up to 10 years.

How Long Late Payments Affect Your Credit

Missed payments can stay on your credit report for up to seven years under the Fair Credit Reporting Act. However, as time passes, their impact on your scores gradually decreases.

For example, a 30-day late payment will hurt your credit score more severely one year after it’s reported than five years after. At the seven year mark, the late payment can no longer be reported at all.

This is why quickly correcting errors and re-establishing positive payment patterns is key. Doing so limits long-term score damage.

Tips for Improving Your Payment History

If you currently have late payments dragging your scores down, focus on these steps:

- Pay all accounts on time going forward – This positive pattern will slowly outweigh past lapses

- Get current on any missed payments – Bring late accounts up to date to stop further damage

- Contact creditors for assistance – See if they’ll waive late fees, adjust due dates, etc.

- Enroll in credit counseling – Get help creating a debt payoff plan if needed

- Consolidate debts – Simplify payments with a consolidation loan or program

- Dispute any errors – Ensure no inaccurate late payments appear on your reports

The bottom line is consistently making on-time payments now is vital. Slowly but surely this will improve your payment history percentage in credit scoring models.

Maintaining Good Payment History

Once you’ve corrected any past payment problems, the key is maintaining reliable payment patterns going forward. Strategies like setting payment reminders, paying more than minimums, and budgeting appropriately make that possible.

Here are some tips:

- Use autopay and calendar alerts to avoid missed due dates

- Pay more than minimums to avoid ballooning balances

- Review statements promptly to catch errors quickly

- Note payment due dates when activating new accounts

- Build emergency savings to deal with financial shocks

- Track expenses to create and follow a realistic budget

- Contact creditors at the first sign of trouble to discuss options

Making payments on time, all the time takes diligence. But it’s well worth the effort given the benefits for your finances.

The Takeaway

Your payment history has an outsized influence on your credit score compared to other factors. Missed payments can seriously damage your credit standing for years into the future.

That’s why maintaining a perfect payment record through careful money management is so crucial. If you’ve made some late payments in the past, focus on correcting the issue and re-establishing positive patterns.

Consistently meeting your obligations will gradually improve your payment history percentage in credit scoring calculations over time. So be diligent in paying all bills on time, every time. By doing so, you’ll see your credit scores slowly but surely start to increase.

Get your FICO® ScoreΠfor free

Sign up and get instant online access to your FICO® Score for free.

Checking your own credit wonât lower your credit scores.

View specific factors that are affecting your score and how to improve it.

ÎCredit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

Factors That Determine Credit Scores

Making debt payments on time every month benefits your credit scores more than any other single factorâand just one payment made 30 days late can do significant harm to your scores. An account sent to collections, a foreclosure or a bankruptcy can have even deeper, longer-lasting consequences. Payment history accounts for about 35% of your FICO® Score.

How Payment History Affects My Credit Score

FAQ

Does your payment history makes up the largest portion of your credit score?

You should pay your bills on time and keep an eye on your payment history as it’s the most important part of your score. Read next about amount of debt and how that factors into your FICO Scores too.

What makes up the largest portion of your credit score?

What is the biggest contributor to your credit score?

Payment history: The biggest factor in determining your credit score is payment history. Every time you pay a credit card bill, car payment, house payment, student loan payment, etc. , it gets added to your history. It’s important that all of your payments are paid before the due date listed on your statement.

Is 98% payment history bad?

Very little time is left to make late payments before your credit score starts to drop: 20100%%20%E2%80%93%20Great 99% – Good. 98% – Fair.