Quick Answer: Experian is a credit bureau that maintains your credit report. FICO® is a credit scoring model that uses the information in your credit report to calculate a credit score. Your Experian or FICO credit score might be different from the one you see elsewhere because of the credit scoring model being used to figure it out.

Credit scores are very important to our financial lives because they affect everything from whether we can get a loan to the interest rates we pay and even job opportunities in some fields. Your credit score is based on the information in your credit report. Equifax, Experian, and TransUnion are the three credit bureaus that keep your report.

If you’ve ever checked your credit score in one place – like your banking app – and compared it to your credit score on Experian – you may have wondered why the scores look different.

In this article we’ll explain why your scores look different (and why they’re all probably correct).

When it comes to your credit, your FICO score is one of the most important numbers you should know. This three-digit number gives lenders a quick snapshot of your creditworthiness

The higher your FICO score, the better chances you have of getting approved for new credit and securing the best terms. But with so many different credit scores out there, how do you know if the FICO score you get from Experian is accurate and trustworthy?

Below, we’ll explain what your FICO score is, where you can get it from Experian, and how accurate it is compared to scores from other sources.

What is a FICO Score?

The Fair Isaac Corporation made the FICO credit scoring model in 1989. FICO stands for “Fair Isaac Corporation.” A complicated mathematical formula is used by their credit score to look at the information in your credit report and come up with that three-digit number.

The FICO score range goes from 300 to 850. Lenders see you as less of a credit risk if the number is higher. Anything above 700 is generally considered good credit.

While the formula FICO uses is proprietary, we do know the main factors that impact your score and how heavily each one is weighted:

-

Payment history (35%): Have you paid past credit accounts on time? Late payments hurt your score.

-

Amounts owed (30%): This reflects your credit utilization. Your credit score can go down if you owe a lot of your available credit limits.

-

Length of credit history (15%): In general, the longer your credit history, the better.

-

Credit mix (10%): Having different types of credit can boost your score.

-

New credit inquiries (10%): Too many new credit applications in a short time can indicate higher risk.

FICO takes information from your credit reports at the three major credit bureaus – Experian, Equifax, and TransUnion – and uses it to calculate your score.

Since its launch over 30 years ago, FICO has become the industry standard scoring model used by most lenders. When you apply for credit, there’s a very strong chance the lender will pull your FICO score to help evaluate your application.

Why Your FICO Score Fluctuates Between Sources

Given how important your FICO score is, you’d think there would only be one true score. In reality, you don’t have just one FICO number – you potentially have many! Here are some of the reasons your score can vary:

1. Different versions of FICO models

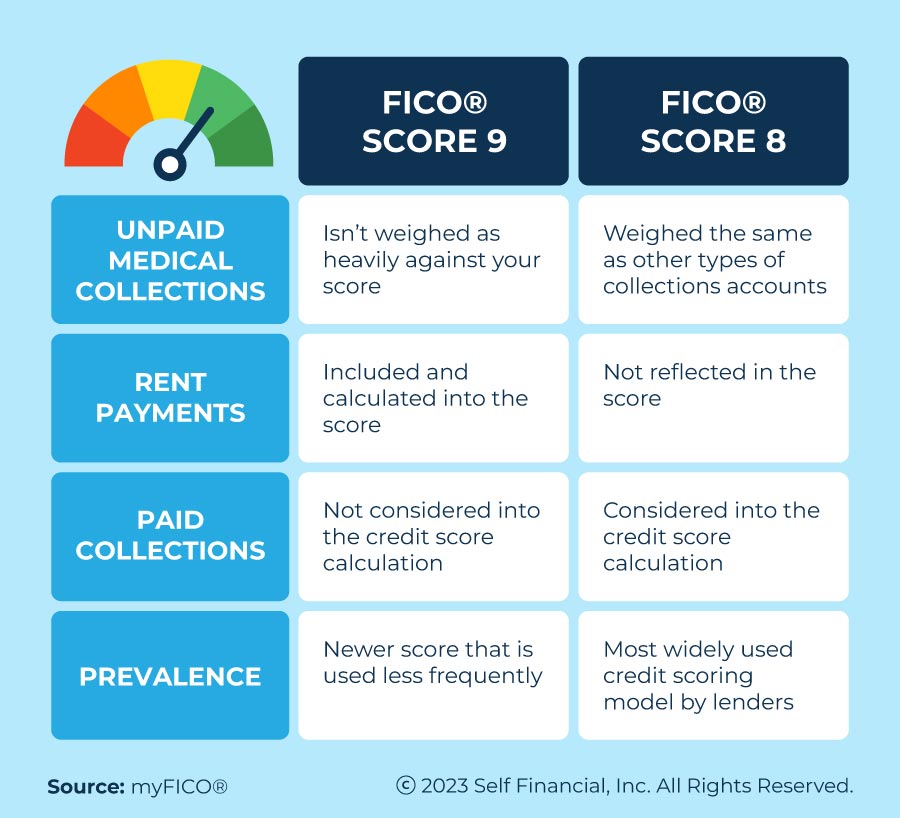

FICO regularly updates its credit scoring model. For example, there’s FICO Score 8, FICO Score 9, FICO Score 10, etc. Each version may weigh factors a little differently.

2. Specialized FICO models

In addition to the main base FICO models, there are industry-specific FICO scores tailored for auto lending, credit card lending, and mortgages. These versions emphasize factors relevant to those credit products.

3. Which credit bureau provided your data

FICO offers scoring models tailored to pull data from Experian, Equifax, and TransUnion separately. The information in your three reports may differ slightly.

4. When your credit data was last updated

Each credit bureau updates their information on different schedules. A score calculated today may use newer or older data than a score from last week.

5. The lender requested a different credit scoring model

While FICO is most common, lenders can choose to use VantageScore or even custom models tailored to their needs.

How Accurate is Experian’s FICO Score?

The FICO scores provided by Experian are highly accurate representations of your creditworthiness. There are a few reasons we can confidently say this:

1. Experian FICO scores use real credit data

The scores you get through Experian are calculated based on actual information from your Experian credit file. It’s not estimated or educational data.

2. Experian can provide your core FICO models

Experian offers access to your FICO Score 8, the standard model used by most lenders today. You can also get key industry-specific FICO versions like the Auto Score or Bankcard Score.

3. You get your full Experian credit report

Understanding what’s actually impacting your score is just as important as the score itself. Experian provides your full credit report alongside your FICO score so you can verify the data.

4. Experian refreshes your score frequently

Your Experian FICO score is updated every 14 days or less, keeping it current based on the latest credit information.

5. Experian has direct access to FICO scoring

As one of the 3 major credit bureaus providing data to FICO, Experian has a direct pipeline to accurate FICO scores tailored to your Experian credit report.

While your FICO score can fluctuate between sources, the score provided by Experian itself is an authoritative representation of your creditworthiness. It’s trusted by lenders and relied on by consumers to monitor their financial health.

When the Specific FICO Score Matters

While Experian provides a real FICO score, remember it may not always match the exact score a lender pulls. As we covered earlier, you have multiple FICO scores depending on the model version, credit bureau data, and scoring date used.

Here are two cases where it pays to check the specific FICO score a lender will use:

1. Applying for a mortgage

Most mortgage lenders use older FICO models, like FICO Score 2, 4, or 5. Checking your score through Experian will get you the most current FICO 8. So it may be wise to purchase your mortgage-specific scores beforehand.

2. If your score is near a threshold

For example, if your Experian FICO is 620 and a lender’s minimum is 630, being off by even 10 points could change their decision. Again, checking the exact scoring model they use could give you clearer expectations.

Outside of those situations, monitoring your Experian FICO Score 8 should give you an accurate view of your credit standing and alert you to meaningful changes.

5 Tips for Improving Your Experian FICO Score

Your Experian FICO score summarizes your creditworthiness – but it’s also in your control. Here are 5 proven ways to start improving your score:

-

Pay all bills on time. Payment history has the biggest impact. Set up autopay if it helps.

-

Keep balances low. High utilization hurts. Aim for 30% or less on revolving debt.

-

Be cautious applying for new credit. Too many new accounts can indicate risk. Space out applications.

-

Don’t close old accounts. Having longer credit history adds stability.

-

Check for errors on your credit reports. Dispute any inaccurate information that could be dragging down your score.

Healthy credit takes time, but staying diligent with these steps will put you on the path to increase your Experian FICO score.

The Bottom Line

While confusing at first glance, the fact you have multiple FICO scores from different sources doesn’t mean any are “wrong”. They each represent your creditworthiness using legitimate (albeit different) credit data and scoring models.

The key is being aware of which score a lender is likely to use when you apply for credit and verifying the factors influencing that particular score.

Overall, the FICO score provided by Experian itself offers an accurate look at your credit standing. Monitoring it along with your full Experian credit report will give you tremendous insight into your financial health.

Your Experian FICO score is a credit compass, guiding you toward responsible behaviors that keep your number steadily headed in the right direction. Use it to reach your credit goals and secure the loans and interest rates you deserve!

Hard Inquiries (10%)

Every time a credit check is performed when you applied for new credit hard inquiries (credit checks) have been made when you applied for new credit. Too many in a short time can suggest risk to lenders.

FICO combines all this data—pulled from your credit reports at the major bureaus (Experian, Equifax, and TransUnion)—and runs it through their scoring model to generate a number between 300 and 850. The higher the number, the lower the risk you pose to lenders.

Credit Utilization Ratio (30%)

This reflects how much debt you currently have compared to your available credit, also known as credit utilization. Using a large percentage of your available credit—even if you make payments on time—can lower your score. For best results, try to keep your utilization below 30%.

FICO Score vs Credit Score vs Credit Karma (Why Are My Credit Scores So Different?)

FAQ

Is Experian more accurate than FICO?

Is Experian Better Than FICO? No credit score is better than another. Some lenders prefer FICO, white others rely on VantageScore. Each model can provide lenders with different insights about a person’s financial habits.

How true is Experian credit score?

Experian is generally considered a reliable source for credit scores, but it’s not necessarily more accurate than Equifax or TransUnion. All three major credit bureaus (Equifax, Experian, and TransUnion) provide credit reports and scores based on the information they receive from creditors.

Which FICO score is most accurate?

Because different lenders and people use them for different reasons, there isn’t just one “most accurate” FICO score.

Why is my Experian Fico score higher than Credit Karma?

The primary reason for any discrepancy is that Credit Karma uses the VantageScore model, while most lenders use FICO scores. Apr 4, 2025.