So, you’re eager to pay off your mortgage early? That’s a great financial goal to set for yourself!

Not only is there huge freedom in being completely debt-free and living in a paid-for house, but it’s also a great way to build wealth—getting rid of your house payment leaves you with a ton of extra money each month to save for retirement. In fact, the average millionaire pays off their house in just 10. 2 years. 1.

But even though you’re dead set on ditching your mortgage ahead of schedule, you probably have one major question on your mind: How do I pay off my mortgage faster? That’s why we’re going to walk through exactly how to pay off your mortgage early so you can reach your goal and become a debt-free homeowner.

Paying off a $300k mortgage in just 5 years may seem like an impossible feat, but with strategic planning and discipline, it is achievable for some homeowners.

Why Pay Off a Mortgage Early?

There are several benefits to paying off your mortgage early:

-

You’ll save a significant amount in interest payments On a $300k mortgage, you could potentially save over $100k in interest by paying it off in 5 years instead of 30 years

-

You’ll build home equity faster. 100.0 percent of your home’s value will be equity once your mortgage is paid off.

-

You’ll own your home free and clear. This gives you financial flexibility and peace of mind.

-

Your monthly cash flow will improve without a mortgage payment. This gives you more money to save or invest.

However, paying off a mortgage early isn’t for everyone. Before you make extra mortgage payments, make sure you have an emergency fund, are saving enough for retirement, and don’t have any debt with a higher interest rate.

How Much Will I Need to Pay Each Month?

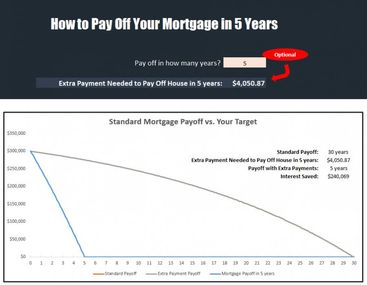

To pay off a $300k mortgage in 5 years, you’ll need to pay approximately $5,550 per month. This is calculated by taking the mortgage amount, dividing it by the number of months, and adding in the regular monthly payment.

For instance, a $300,000 mortgage with 5% interest over 30 years means that the monthly payment is about $1,610.

$300,000 mortgage divided by 60 months equals $5,000. Five thousand dollars times $1,610 a month equals $5,550 a month.

This is a significant increase from the normal payment. But it can be done by cutting expenses, increasing income, and making strategic sacrifices.

Steps to Pay Off a $300k Mortgage in 5 Years

Here is a step-by-step guide to paying off a $300k mortgage in 5 years:

-

Make a budget and cut discretionary spending

- Review expenses and cut back on dining out, entertainment, vacations, etc. Find an extra $500+ per month here if possible.

-

Increase your income

- Consider getting a side gig or asking for a raise at work. An extra $1,000 per month from a side hustle could make a big dent.

-

Make biweekly mortgage payments

- This results in 26 half payments per year rather than 12 monthly payments. Over 5 years, you’ll make 2-3 extra payments.

-

Pay half your annual bonus or tax refund toward the mortgage

- Any extra lump sums should be directed toward principal.

-

Downsize your home

- Consider selling your current home and downsizing to reduce the mortgage balance.

-

Refinance your mortgage

- See if you can refinance to a lower rate. This will allow more money to go toward principal.

-

Use windfalls wisely

- Put any money gifts, insurance payouts or legal settlements toward paying down principal.

-

Get an accountability partner

- Share your goal with a friend or family member. They can help you stay motivated and on track.

-

Celebrate small milestones

- Paying off $100k is an awesome achievement! Recognize your progress.

-

Visualize being mortgage free

- Keep your eye on the prize. In 5 years you’ll have financial freedom!

With extreme focus and discipline, paying off a $300k mortgage in 5 years is challenging but feasible. Follow the steps above to make steady progress each month. You’ll be mortgage free before you know it!

Refinance (or pretend you did).

Another way to pay off your mortgage early is to trade it in for a new loan with a lower interest rate or a shorter term (or both)—like a 15-year fixed-rate mortgage. Let’s see how this would affect our earlier example—a 30-year $240,000 mortgage with a 7% interest rate.

There is about $335,000 in interest that you will pay over the life of the 30-year mortgage if you keep it and make all of your payments on time. But if you switch to a 15-year mortgage with a lower rate of 6. 5%, you’ll save close to $200,000—and you’ll pay off your home in half the time!.

Sure, a 15-year mortgage will come with a bigger monthly payment. But if you can comfortably fit it within your monthly budget (meaning the payment is at or below 25% of your take-home pay), it’ll totally be worth it. Don’t forget that since you took out your mortgage, your income or cost of living will probably have gone up or down. If that’s the case, you’d be able to make the bigger payment without any problems.

If you want to refinance to a mortgage you can pay off fast, talk to an expert at Churchill Mortgage. Our team at Ramsey has worked with Churchill Mortgage for years, and their mortgage experts will show you the true cost—and savings—of each loan option. They’ll also coach you to make the best decision based on your budget and goals.

If you already have a low interest rate on a 30-year loan, don’t worry about refinancing. Go ahead and treat your 30-year mortgage like a 15-year mortgage by upping your monthly payment.

Downsizing your house may sound like a drastic step. But if you’re determined to pay off your mortgage faster, consider selling your larger home and using the profits to buy a smaller, less expensive house.

With the profits from selling your bigger house, you may be able to pay 100% cash for your new home. But even if you have to get a small mortgage, you’ll still pay less because you’ll have less debt.

Remember though: Your goal is to get rid of that new mortgage as quickly as possible. So use the smaller balance and lower payments you get from downsizing to accelerate paying off your home. This isn’t an excuse to pocket money in the short-term and delay your payoff.

If you think downsizing your home makes sense for your situation and you’re ready to get the process started, your first step should be hiring a top-notch real estate agent who can help you sell your current house and buy a new one.

You can find one in your area through our RamseyTrusted program, which matches you with pros our team has vetted to make sure they understand how important it is to buy a home you can afford. They won’t pressure you to consider homes that’ll bust your budget.

Make extra room in your budget.

You may have read that last section and thought, But I don’t have any extra money to put toward my house payments! Hang on—you can probably find more money in your budget each month than you realize.

Now, if you aren’t already making a budget every month, start there. Write down your income, list your expenses, subtract your expenses from your income to make sure you aren’t overspending, then track your spending during the month to make sure you’re staying on target.

If you are living on a budget—or once you make your first one—here are some adjustments you can make to free up money for paying off your house early.

- Lower your grocery budget. Unless you have a big family, groceries are probably one of the most expensive things you have to pay for. Here are some ways to save money: switch stores, look for sales, and buy food that is in season.

- Stop eating out so much. I have to say this is hard for me because I love going to restaurants. But it always costs more to eat out than to cook at home, and sometimes it costs a lot more. In the long run, cooking at home just two or three times a week can save you a lot of money.

- Do an insurance coverage checkup. An independent insurance agent who can compare rates from different companies might be able to get you better coverage for less money than you’re paying now. Getting in touch with a RamseyTrusted pro is a good way to start.

- Cancel some subscriptions. It’s very simple to sign up for more services than you actually need these days. Get rid of any streaming services that you don’t need and use the extra money to pay off your mortgage.

- Cut back on online shopping. I know, I know . With two-day shipping and one-click ordering, online stores like Amazon make shopping very easy. But all of those orders can add up quickly. We likely know we don’t need all the things in our digital cart if we’re being honest with ourselves. It’s too bad! Cutting back will let you make bigger mortgage payments every month.

How I Paid Off My Mortgage in 5 Years!

FAQ

How to pay off a $300,000 mortgage in 5 years?

There are some easy steps to follow to make your mortgage disappear in five years or so. Setting a Target Date. Making a Higher Down Payment. Choosing a Shorter Home Loan Term. Making Larger or More Frequent Payments. Spending Less on Other Things. Increasing Income.

Is it possible to pay off a mortgage in 5 years?

Paying off your mortgage in 5 to 7 years is possible with the right strategies and commitment. Making bi-weekly payments can significantly reduce your loan term. Refinancing to a shorter-term loan can accelerate payoff but may increase monthly payments.

What happens if I pay an extra $500 a month on my mortgage?

Paying an extra $500 a month on your mortgage will significantly reduce the total interest paid over the life of the loan and shorten the loan term. This is because the extra payment goes straight toward the principal balance, which lowers the amount used to figure out interest.

What is the average monthly payment for a $300000 mortgage?

Expect to pay about $1,798 to $2,201 per month for a $300,000 mortgage with a 30-year loan term, depending on your interest rate and other factors.