A debt spiral can be a significant obstacle to reaching your financial goals. If you have a lot of different kinds of debt, like credit cards, student loans, car loans, and mortgages, you may get stuck in a never-ending cycle of debt because the interest on your debts keeps going up.

Getting out of a debt spiral creates financial stability, but it can be challenging and take time. Here are some strategies you can implement to improve your financial situation and break the debt cycle.

Falling into the debt cycle can feel like you’re trapped in a vicious loop with no way out. As interest and fees accumulate, debt can snowball out of control, leaving you stuck making minimum payments that barely cover the rising interest charges. It may seem hopeless, but there are proven strategies you can use to break the debt cycle for good. This comprehensive guide will walk you through the steps to get out of the debt spiral so you can regain control of your finances.

Understanding the Debt Cycle

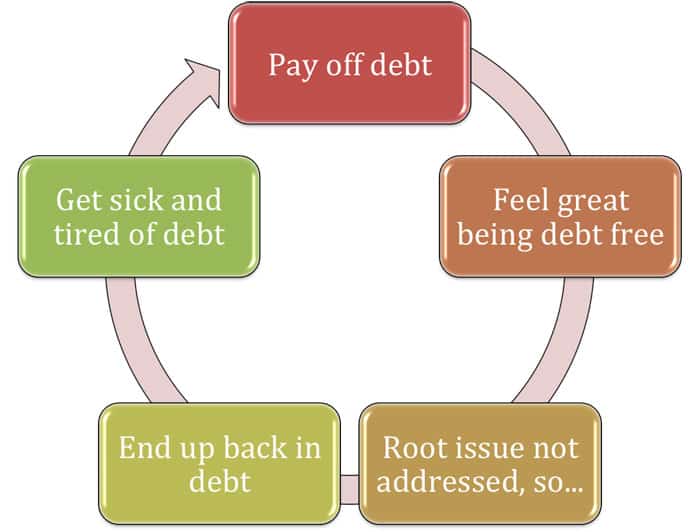

The debt cycle often starts innocently enough – you make a purchase on a credit card or take out a small loan. But over time, interest and fees start piling up. As the balance grows, you struggle to make even the minimum payments. So you take out another credit card or loan to cover expenses. Now you’re deeper in debt and paying more in interest. It’s an endless loop that keeps you trapped.

This cycle takes a mental toll too. Constant stress and anxiety over mounting debt can lead to feelings of despair. In this state, unhealthy coping mechanisms like emotional spending kick in, worsening the situation. Breaking this vicious cycle is key to financial freedom.

Effective Strategies to Break the Debt Spiral

Though daunting, with commitment and smart strategies, you can break the debt cycle. Here are some proven techniques:

Stop Borrowing Immediately

To break the debt loop, you must stop taking on new debt. Put away the credit cards and only buy what you can afford in cash. This prevents you from sinking deeper while paying off existing debts.

Make a Budget

A budget carves a clear path out of debt by tracking income, expenses, and allocations towards repayment. Be disciplined in sticking to it. Trim expenses where possible to free up more funds for debt repayment. Apps can help automate budgeting.

Pay More Than Minimums

Minimum payments only cover interest charges, not the principal balance. Paying extra directly reduces balances quicker. Even small increases make a difference over time.

Use the Debt Avalanche or Snowball Method

The debt avalanche method pays off the debts with the highest interest rates first, which saves money in interest over time. The debt snowball method helps you get motivated to pay off small debts first. Choose the one that resonates with you.

Build an Emergency Fund

Having 3-6 months’ worth of living expenses in an emergency fund prevents relying on credit when unexpected costs pop up, further worsening debt

Consider Balance Transfers or Consolidation Carefully

Balance transfers to a lower interest credit card or consolidating multiple debts through a consolidation loan can reduce costs. But, they also present risks like delayed repayment. Evaluate carefully before proceeding.

Seek Additional Income

Extra money can help you pay off your debt faster. You could work extra hours, do freelance work on the side, or turn a hobby into a business. The important thing is to be consistent.

Adopt Frugal Living Habits

Evaluate needs versus wants. Avoid unnecessary purchases and impulse shopping without a list. Pay attention to what you need and use any extra money to pay off your debts. Small lifestyle tweaks go far.

Celebrate Milestones

The debt repayment journey can be arduous. Celebrate each milestone to stay motivated. Visualize the freedom life without debt provides.

Seek Professional Help If Needed

Look for help from credit counseling services if you have big or unmanageable debts. They can help you negotiate with your creditors, give you advice, and come up with a way to pay back your debts.

With diligence and commitment, you can take back control of your finances. Arm yourself with the right strategies and mindset shifts to overcome obstacles along the way. The freedom and peace of mind achieved when you successfully exit the debt cycle makes the effort worthwhile. Stay focused on the end goal – you can do this!

Create a Debt Repayment Strategy

Once youve determined how much you can afford to pay toward debt repayment each month, youll want to plan a repayment method. There are several strategies you can use. Two popular ones are the debt snowball and the debt avalanche methods.

With the debt avalanche method, you aim to pay off your highest-interest debts first. After you make all your minimum payments, you put extra money toward the debt with the highest interest rate. This will result in the most financial savings by reducing the interest you pay. It can also help you pay down your debts faster.

With the debt snowball method, you instead allot your extra money toward the debt with the lowest balance after paying the minimums on your other debts. The debt snowball can provide motivation as you pay off your small debts quickly.

If you are deep in a debt spiral and cannot afford to keep up with payments, you can consider other options. You may want to consult a nonprofit debt counseling agency to help you develop a plan with creditors to repay your debt in regular payments with a debt management plan.

You can also use a debt relief company to help you negotiate a lower amount if you are severely behind on payments. Debt relief companies generally work with unsecured debt that is not backed by an asset.

Consider ways to make your debt less expensive, such as taking advantage of a 0% balance transfer credit card offer or getting a debt consolidation loan.

Do Debt Consolidation Loans Hurt Your Credit?

Applying for a new loan will require the lender to conduct a hard credit check, which can have a small and temporary negative impact on your credit score. If you use the loan responsibly to reduce your overall interest payment and reduce your total debt load, a debt consolidation loan can potentially help you improve your credit score.

Ray Dalio Breaks Down the Long Debt Cycle

FAQ

How to get out of the cycle of debt?

Here are two approaches to consider:Option 1: Target the account with the highest interest rate first. After you’ve paid the minimum payment to your other accounts, put as much extra as you can toward your highest-interest debt. Option 2: Pay down the account with the smallest balance first.

How to get out of the loan cycle?

Pay off the most expensive loans first. If you’re not consolidating your debt and paying it off one loan at a time, pay off your most expensive debt first. Once you have recognized the most expensive debt you need to plan a strategy to pay it off.

What is the 777 rule with debt collectors?

The 7-in-7 rule, also known as the 777 rule or 7×7 rule, is a guideline in debt collection that limits how often a debt collector can contact a person about a particular debt. Specifically, it means a collector cannot call a consumer more than seven times within a seven-day period about the same debt.

How long do debt cycles last?

The average long-term Big Debt Cycle has typically taken about 80 years, give or take 25 years (with the duration of that cycle also driven by a number of influences that we can monitor and use to come up with rough estimates of how long each one will last).