Depending on when you borrowed your Sallie Mae student loans, they may be a type of federal debt — and could be eligible for forgiveness programs.

Editorial disclosure: Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible. ”.

If you took out student loans from a private company like Sallie Mae, you probably won’t be able to get them forgiven. But the kind of Sallie Mae debt you have depends on when you borrowed money from them in the first place.

Find out if you can get your Sallie Mae student loans forgiven and what to do if you can’t.

Happy Monday, friend! If you look at your Sallie Mae student loans and wonder how you can get them forgiven, you’re not the only one. It can be hard to get around with student loans, but I’m here to help you find your way through this rough water. You can get your Sallie Mae loans forgiven if they were private or federal loans and if you paid them off on time. These days, most Sallie Mae loans are private. This makes it hard to forgive them, but it’s not always impossible. If yours are older, they may be federal, which gives you some great ways to get help. Stay with me, and I’ll break this down into manageable pieces so you can figure out what to do next.

First Things First: Are Your Sallie Mae Loans Private or Federal?

Before we dive into forgiveness we gotta know what kinda loans you’re dealin’ with. Sallie Mae a big player in the student loan game, changed its tune back in 2014. They split into two outfits—one handling private loans (still called Sallie Mae) and the other managing federal loans (called Navient). So, here’s the deal

- Post-2014 Loans: If you borrowed from Sallie Mae after 2014, you’ve likely got private loans. Bad news? These don’t qualify for federal forgiveness programs.

- Pre-2014 Loans: If you took out loans before 2014, they might’ve started as federal loans. If they got transferred to Navient (or later to Aidvantage), you could be eligible for federal relief programs.

How do ya check? It’s simple. You can’t miss the Federal Student Aid website; just type it into Google and go there. Sign in with your ID or email address and check out the “My Aid” page. If your loans show up there they’re federal. No one else can see them if Sallie Mae still has them. This is the first thing you need to do because it affects everything else.

Can Sallie Mae Private Loans Be Forgiven? The Hard Truth

Let’s not sugarcoat it—if your Sallie Mae loans are private forgiveness is a long shot. Unlike federal loans, private ones don’t get the fancy government-backed forgiveness plans. But, there are a couple of rare situations where Sallie Mae might wipe the slate clean

- Permanent Disability: If you’ve got a physical or mental disability that stops ya from working—permanently—you might qualify for a discharge. You’ll need a doc to back ya up with proof, fill out an application with Sallie Mae, and maybe go through a monitoring period to confirm it’s legit. If approved, poof, the balance is gone. Watch out, though—sometimes this counts as taxable income, so chat with a tax person.

- Death: I hate to be grim, but if the borrower passes away, Sallie Mae can discharge the remaining debt. Note: if there’s a cosigner, they might still be on the hook, so double-check the fine print.

Outside of these extreme cases, Sallie Mae ain’t gonna just forgive your debt ‘cause you’re strugglin’. But don’t lose hope yet—we’ve got other tricks up our sleeve later on.

Federal Loans from Sallie Mae: Your Forgiveness Options

You can get a lot of help if your old Sallie Mae loans turned out to be federal loans that were transferred to Navient or Aidvantage. Government loans have programs that can forgive some or all of your debt if you follow the rules. Here’s the lowdown on the big ones:

1. Public Service Loan Forgiveness (PSLF)

If you work for the government or a nonprofit, this could be your golden ticket. PSLF wipes out the rest of your direct federal loans after you’ve made 120 monthly payments (that’s 10 years) while working full-time for a qualifyin’ employer. Key points:

- Gotta work for federal, state, local, or tribal government, or a nonprofit.

- Must be full-time.

- Loans gotta be direct federal loans, and you should be on an income-driven repayment plan.

- Tip: Submit a PSLF form yearly to make sure your job qualifies.

Nurses, teachers, and other public health folks might qualify too. It’s a grind, but 10 years ain’t forever.

2. Teacher Loan Forgiveness (TLF)

If you’re a teacher, listen up! TLF can forgive up to $17,500 of your federal direct or FFEL loans if you’ve worked full-time at a school that qualifies for five years in a row (at least one after 1997–98). That most money could go to special education or high school math and science teachers. Other teachers could get less, but still worth it. There’s also:

- Perkins Loan Cancellation: For teaching at low-income schools or specific subjects.

- State-Sponsored Programs: Some states got extra forgiveness if you teach in high-need areas.

3. Other Federal Forgiveness Programs

There’s more where that came from. Check these out:

- Total and Permanent Disability (TPD): If you’re totally and permanently disabled by the government’s definition, you can apply to ditch direct loans, FFEL, or Perkins loans.

- Income-Driven Repayment Plans: Plans like Income-Based Repayment or Pay As You Earn forgive whatever’s left after 20 or 25 years of payments, dependin’ on the plan.

- Borrower Defense to Repayment: If your school misled ya about job prospects or credits, you might get forgiveness. Gotta apply with proof, though.

If any of these sound like you, don’t sleep on ‘em. Hit up your school’s financial aid office or the federal student aid site for the nitty-gritty.

What If My Sallie Mae Loans Ain’t Eligible for Forgiveness?

Alright, let’s say your loans are private with Sallie Mae, and forgiveness ain’t in the cards. Don’t throw in the towel just yet. There’s ways to make this debt less of a nightmare. We’ve been there, and here’s what I’d do if I was in your shoes:

1. Pause or Reduce Payments Temporarily

Sallie Mae, like many private lenders, lets ya hit pause on payments in certain situations. Goin’ back to school? In a residency program? Facin’ financial hardship? Give ‘em a call and ask about deferment or reduced payments. Be proactive—don’t wait ‘til you’ve missed a buncha payments. Heads up, though: interest usually keeps pilin’ up, so your balance might grow.

2. Look Into State-Based Assistance Programs

Some states got your back if you work in high-need jobs like teachin’, healthcare, dentistry, or law. These programs often pay off a chunk of your loans if ya commit to workin’ in underserved areas for a few years. Both federal and private loans might qualify, dependin’ on the state. Check your state’s Department of Education site or talk to your professional group to see what’s cookin’ in your area.

3. Ask Your Employer for a Hand

More and more companies are steppin’ up to help with student loans as a job perk. Some offer a flat monthly amount toward your debt or match your payments up to a cap. Ask your boss if they’ve got somethin’ like this—or heck, look for a gig at a company that does. It’s a sweet deal if ya can snag it.

4. Refinance for Better Terms

If forgiveness ain’t happenin’, refinancin’ might save ya some cash. This means takin’ out a new loan to pay off the old Sallie Mae one, hopefully with a lower interest rate or longer repayment term to shrink your monthly bill. Here’s how we’d tackle it:

- Shop Around: Prequalify with multiple lenders online to see what rates ya can get. It won’t ding your credit at this stage.

- Apply: Pick the best offer, gather docs like pay stubs or tax returns, and submit. Note: a hard credit check happens here, so your score might dip a smidge.

- Keep Payin’: Don’t stop payments on your current loan ‘til the new one’s finalized.

Pro tip: If your credit ain’t great, get a cosigner with solid finances to boost your chances of a better rate. Just know, if your loans are federal, refinancin’ turns ‘em private, and you lose federal perks like forgiveness or income-driven plans. Think hard before pullin’ that trigger.

5. Last Resort: Bankruptcy

If you’re drownin’ and nothin’ else works, bankruptcy might be an option—but it’s a tough road. You gotta file a special lawsuit called an adversary proceedin’ and prove the loans cause “undue hardship.” It’s rare to win, but not impossible. Talk to a lawyer if you’re at this point; don’t go it alone.

A Quick Cheat Sheet: Sallie Mae Loan Options at a Glance

Here’s a lil’ table to sum up where ya stand with Sallie Mae loans and forgiveness or relief options. Keep this handy while ya sort things out.

| Loan Type | Forgiveness Eligibility | Alternative Options |

|---|---|---|

| Private (Post-2014) | Only for death or permanent disability | Deferment, rate reduction, refinance, state/employer help, bankruptcy |

| Federal (Pre-2014, via Navient/Aidvantage) | PSLF, Teacher Forgiveness, TPD, Income-Driven Plans | Deferment, forbearance, refinance (loses federal benefits) |

Will Sallie Mae Loans Ever Be Forgiven in the Future?

I gotta be real with ya—broad forgiveness for private loans like Sallie Mae’s ain’t likely on the horizon. Most political talk and relief plans, like stuff from recent administrations, focus on federal loans managed by the Education Department. Private loans are kinda the wild west; they don’t get the same love. That said, keep an ear to the ground. Policies change, and who knows what might pop up. For now, focus on the options we got.

How to Get Started: Your Action Plan

Enough chit-chat—let’s get you movin’. Here’s a step-by-step plan to tackle your Sallie Mae loans and see if forgiveness or relief is possible:

- Check Your Loan Type: Log into the Federal Student Aid site and see if your loans are listed. If they’re with Sallie Mae directly, they’re private. If with Navient or Aidvantage, likely federal.

- Explore Forgiveness (If Federal): Look into PSLF, Teacher Forgiveness, or other federal programs if your loans qualify. Check eligibility and apply ASAP if ya fit the bill.

- Consider Alternatives (If Private): Contact Sallie Mae about pausin’ payments or lowerin’ rates. Research state programs or ask your employer for loan help.

- Think About Refinancin’: If payments are crushin’ ya, shop for a better rate to refinance private loans. Be cautious if they’re federal, though.

- Get Help if Needed: If this feels overwhelmin’, talk to a student loan advisor or lawyer for personalized advice. Sometimes a pro can spot options ya missed.

Why This Matters to Us

Look, at the end of the day, we know student loans can suck the life outta ya. I’ve seen folks stressin’ over this stuff, feelin’ trapped with no way out. That’s why I’m layin’ it all out here—‘cause you deserve to know your options, even if they ain’t perfect. Whether it’s snaggin’ forgiveness through a federal program or just makin’ payments more bearable, every lil’ step counts. We’re in your corner, rootin’ for ya to kick this debt to the curb.

Common Questions You Might Be Askin’

Let’s tackle some stuff ya might still be wonderin’ about, ‘cause I don’t wanna leave ya hangin’:

- Do I gotta pay back Sallie Mae loans no matter what? Yup, pretty much, unless you qualify for discharge due to disability or death. But there’s options like deferment to help manage if you’re strugglin’.

- Can military folks get Sallie Mae forgiveness? Sallie Mae itself don’t offer specific military forgiveness, but they got deferment or forbearance for active duty. If your loans are federal, check out PSLF or disability discharge programs.

- What if I just can’t afford it no more? Don’t ignore it—reach out to Sallie Mae for hardship options. Look into state or employer help, or refinance. Worst case, a lawyer can guide ya on bankruptcy.

Keepin’ the Faith

Dealin’ with Sallie Mae loans—or any student debt—can feel like climbin’ a mountain with no peak in sight. But here’s the thing: every payment, every strategy, every lil’ win gets ya closer to freedom. Maybe forgiveness ain’t in the cards right now, but managin’ this beast is doable with the right moves. Take it one step at a time, and don’t be shy about askin’ for help. We’ve got your back, and I’m bettin’ you’ve got the grit to see this through.

Got more questions or need a deeper dive on somethin’ specific? Drop a comment or shoot us a message. Let’s keep this convo goin’ ‘til you’re on solid ground. Stick with it, fam—you’re tougher than this debt!

Interest rates for student loan refinancing by credit score

When you look into refinancing your student loans, it’s important to know how your credit score might affect the rates you get. Generally, a higher credit score indicates lower risk to lenders and can help you secure lower interest rates. If your credit score is low, on the other hand, your rates may go up because lenders think you are more likely to not pay back your student loans.

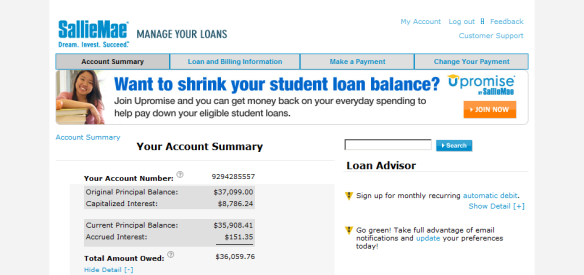

How to refinance your Sallie Mae student loans

If you have Sallie Mae loans that aren’t federal and can’t be forgiven, you might want to refinance them instead. Student loan refinancing involves taking out a new loan that repays your current loan — after that, youll begin making payments on your new loan.

Refinancing has many benefits, including potentially lowering your interest rate, changing your repayment term, and simplifying repayment if you have multiple loans that you combine into one.

Here are the general steps youll need to take to refinance your Sallie Mae loans:

- Prequalify with more than one lender: Look into lenders that offer student loan refinancing and compare rates by prequalifying on the websites of each lender. You can find out what rate you might be able to get this way without hurting your credit. Don’t just look at the interest rate; also look at the terms of the loan and any discounts the lender may offer.

- Fill out an application: Once you’ve found the best lender for you, fill out an application. In most cases, you’ll need to show proof, like recent tax returns or pay stubs. Remember that when you apply in person, the lender will do a hard credit check, which may temporarily lower your score.

- Keep making payments on your current loan: Keep making payments on your current loan until your loan application is approved and fully processed. You can start making payments on the new loan as soon as your new lender tells you that the old loan is paid off.

“If your finances arent strong enough to qualify for a lower interest rate, I recommend asking someone to cosign your application. A cosigner with good credit and stable income can improve your chances of getting a better rate.”

— Renee Fleck, Student Loans Editor, Credible