“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve kept this reputation for more than 40 years by making it easier for people to make financial decisions and giving them confidence in what to do next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. That way, you know that the information you’re reading, whether it’s an article or a review, is reliable. Bankrate logo.

Having old debt or closed accounts on your credit report can negatively impact your credit score Thankfully, you can write to the credit bureaus and request that they remove these items from your credit history In this comprehensive guide, I’ll explain everything you need to know about writing an effective letter to remove old debt or closed accounts from your credit report.

Why Remove Old Debt from Your Credit Report?

There are a few key reasons why you may want to have old debt or closed accounts removed from your credit report

-

Improve your credit score – Accounts that have been paid off, settled, or charged off will still show as negative items on your credit report and can drag down your credit score. Removing them can boost your score.

-

Inaccurate information – You may have old accounts or debt listings that are inaccurate or out of date. Disputing them can get errors fixed.

-

Less credit history – Shorter, cleaner credit history focused on active accounts looks better than a long history with many delinquent accounts.

-

Peace of mind – Eliminating reminders of past money struggles can give you a fresh start emotionally.

How to Remove Old Debt from Your Credit Report

Here are the key steps to follow:

1. Get Your Credit Reports

Step one is to get copies of your credit reports from Equifax, Experian, and TransUnion. This way, you can look over all the accounts that are listed. This lets you find any bad, wrong, or old information that you can dispute. You can get free reports annually at www. annualcreditreport. com.

2. Review and Make a List

Carefully review each credit report and make a list of any accounts you want removed. This includes:

- Old accounts that were paid off or settled years ago

- Accounts charged off by the creditor

- Any duplicate accounts

- Accounts that do not belong to you (identity theft)

- Inaccurate account statuses, dates, or balances

3. Draft Your Letter(s)

Now it’s time to draft your dispute letter(s). You’ll need to tailor a letter to each credit bureau, clearly identifying each item you dispute. Be sure to include:

- Your identifying information (name, address, SSN, etc.)

- The account name, number, and specific reason for your dispute

- A request to have the item removed or corrected

- Copies of any supporting documentation, like account statements

See the FTC sample dispute letter as a guide.

4. Send Your Letter(s) and Wait

Send each credit bureau a dispute letter by certified mail. Under the Fair Credit Reporting Act, credit bureaus must investigate within 30 days. You can also submit disputes online via the credit bureaus’ websites.

Make sure you keep copies of your dispute letters and any attachments. Once the investigation is over, the credit bureaus have to send you written results.

5. Follow Up if Needed

If the credit bureaus do not remove the disputed accounts after investigating, you may need to provide additional documentation and resend your letters. You can also submit a complaint with the CFPB or contact the original creditor about removing the account from your reports.

It may take more than one try to get wrong or questionable information removed from your credit report, so be persistent.

Tips for an Effective Credit Bureau Dispute Letter

When writing your letters asking for the person to move out, keep these things in mind to improve your chances of success:

-

Be specific – Clearly identify each account and the nature of your dispute. Vague letters are often disregarded.

-

Provide details – State the facts and explain in detail why each account is being disputed.

-

Ask for removal – Request that the account be deleted rather than just “investigated”.

-

Include documentation – Any proof, like account statements, strengthens your case for removal.

-

Send certified mail – This provides delivery confirmation so the bureaus can’t claim they didn’t receive your letter.

-

Customize for each bureau – Though similar, letters should be tailored and sent individually.

-

Be persistent – Keep records and follow up if the account is not removed after the first dispute.

Sample Letters to Credit Bureaus

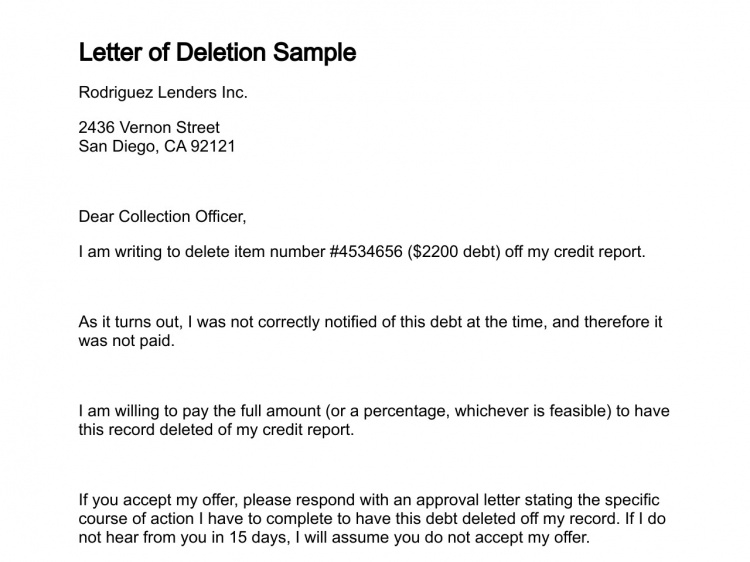

Here are a few sample dispute letters you can model yours after:

Request to Remove Paid Closed Account

Dear [Credit Bureau], The closed account [0000] listed on my credit report has been paid in full. As it no longer serves any purpose, I am requesting its removal to better reflect my financial responsibility. Please update my credit report at your earliest convenience.Thank you,[Your name]Dispute Inaccurate Balance or Status

Dear [Credit Bureau],I am writing to dispute the information reported for closed account [0000]. The status/balance listed is inaccurate. I have attached a copy of my account statement showing the correct status/balance. Please delete this closed account from my credit report immediately.Thank you,[Your name]Request to Remove Old Paid Account

Dear [Credit Bureau],The closed account [0000] is over 10 years old and was paid in full on [DATE]. I am requesting that this outdated account be removed from my credit history to maintain accurate information. Please investigate and delete this account from my credit file. Thank you,[Your name] Results to Expect from Removing Old Debt

If successful, having old paid, settled, or charged off accounts removed from your credit history can potentially:

-

Raise your credit score – Eliminating negative items can boost your score, sometimes significantly.

-

Improve credit history – Your report will show a cleaner history with only active accounts in good standing.

-

Increase chances of approval – You may have better luck getting approved for credit or loans with the negatives removed.

-

Promote financial health – Having debt removed can motivate you to continue positive financial habits.

Just be aware that completely removing all negative information is not guaranteed. But disputing items in error or that cannot be verified often does lead to removal, making it well worth the effort.

Can Removing Closed Accounts Hurt Your Credit?

A common question is whether removing old paid accounts can actually hurt your credit score. While it’s rare, here are a couple potential downsides:

-

Having an older paid account shows you managed credit responsibly over time. Removing it can lower your “average age of accounts” which has a minor impact on your score.

-

Eliminating accounts lowers your overall credit limit, which raises your credit utilization ratio if you carry balances. However, lowering utilization has a much greater positive impact.

Overall, the benefits of removing negative closed accounts significantly outweigh any minor drawbacks. Just focus on keeping active accounts in good standing going forward.

Take Control of Your Credit Report

Don’t let old debt or inaccurate information from your past bring down your credit score and financial opportunities. Be proactive by regularly reviewing your credit reports and disputing any derogatory or unverifiable accounts. With persistence, you can clean up your credit history and take control of your financial profile.

Dispute the error with the credit bureaus

Occasionally, debts may show up on your credit report past their expiration by mistake. If this happens, you can file a dispute by contacting each credit bureau that is still reporting the old debt. The credit bureaus can be contacted by phone, mail, or online.

Gather supporting documents such as receipts, letters and statements from your creditor. These documents will help the bureau verify when your account became delinquent. From there, they will open an investigation and contact your creditors to resolve the error.

The Fair Credit Reporting Act requires credit bureaus to correct or delete any information that can’t be verified or that is incorrect or incomplete, typically within 30 days. If the creditor can’t verify the debt, it has to come off your report. Lightbulb Icon Debt statute of limitations

Debt collectors can still pursue unpaid debts even if they have been removed from your credit report. Agreeing to repay the debt could restart the statute of limitations on your debt.

Confirm the debt should be removed

Start by requesting free copies of your credit reports from the three major credit bureaus — Equifax, Experian and TransUnion — at AnnualCreditReport.com to determine which credit reports have old debts on them. Each bureau records slightly different information, so old debt may appear on some reports and not others.

Once you know what debt is on your credit report, verify the age of your debt and search your financial records to determine whether you paid off the account and, if so, whether you paid the original creditor or a debt collector.

For delinquent debts, determine the date on which you first became delinquent. For example, if you missed your March 2022 payment and your bill eventually went into default, your delinquency date would be March 2022. No matter how many times a debt is sold (and resold), the date that counts for old debt is the date of delinquency with the original creditor.

DISPUTE LETTER to debt collector: here’s exactly what you should say in 2025

FAQ

How do I get an old debt removed from my credit report?

There are a few legal ways you can try to get it taken off your credit report in order to raise your credit score. Step 1: Ask for proof. Step 2: Dispute inaccurate collections. Step 3: Ask for a pay-for-delete agreement. Step 4: Write a goodwill letter to your creditor.

Is it true that after 7 years your credit is clear?

No, that’s not entirely accurate. Most bad things on your credit report, like late payments, charge-offs, and collections, usually go away after 7 years. But the debt itself might not go away.

What is a 609 letter for credit removal?

Section 609 of the Fair Credit Reporting Act (FCRA) says that you can use a 609 letter to ask credit bureaus for information about things that are on your credit report. It’s not a dispute letter itself, but it can help you identify inaccurate or unverifiable information that you can then dispute.

Can written off debt be removed from a credit report?

A debt that has been charged off is not forgiven or erased. You are still legally obligated to pay what you owe. Within a few months of a lender writing off a debt, the status of its account on your credit report will change to indicate it has been charged off.