If you’re looking to use the equity in your home through a home equity loan or HELOC, you probably want to get the money fast. You don’t want to wait around if you want to use the money for something else, like remodeling your home or paying for college.

In some cases, getting a home equity loan can happen quickly. We talked to Adam Carroll, a homeowner and the founder of National Financial Educators. He liked the idea of a HELOC because it would make it easy for him to get money for home improvement projects. “It was super easy,” he said. “It was easy to apply, and they did a drive-by appraisal to find out how much our house was worth.” ”.

However, it’s not true that everyone can get a home equity loan or HELOC as quickly as Adam did. The approval process can take anywhere from 2-6 weeks or even longer, depending on your situation. See below for factors that affect your timeline.

Bear in mind that every lenders process is slightly different; this is merely a general overview that applicants can expect.

Determine Eligibility The first step in the HELOC process is for you, on your own, to determine your HELOC eligibility.

You’ve come to the right place if you want to know “How long does it take to get an equity line of credit?” To get a Home Equity Line of Credit (HELOC), it usually takes between two and six weeks from start to finish. Sometimes it goes faster, and sometimes it takes longer. It depends on a lot of things, like your lender and how ready your paperwork is. We’re going to talk in depth about what this means for you, how the process works, and how to get things done faster if you need to.

At our lil’ corner of the internet, we’re all about keepin’ it real and helpin’ you navigate financial moves like this one. Whether you’re fixin’ up your crib, paying off some debt, or just need a cash cushion, a HELOC can be a sweet deal. But that timeline? It’s the big question, and I’ve got the answers. Let’s get into it!

What’s a Home Equity Line of Credit Anyway?

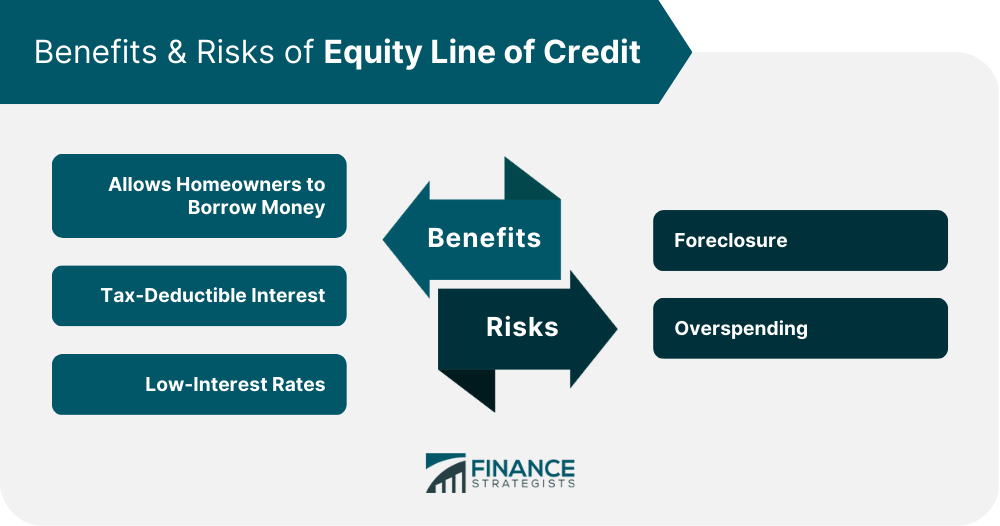

Before we geek out on timelines, let’s make sure we’re on the same page. A HELOC, or equity line of credit, is kinda like a credit card but backed by the value of your home. You borrow against the equity you’ve built up—basically, the difference between what your house is worth and what you still owe on your mortgage. It’s a flexible way to get cash, ‘cause you can draw from it as needed up to a certain limit, and you only pay interest on what you use.

It’s cool because the interest rates are usually lower than on personal loans or credit cards because your home is used as collateral. But keep in mind that it’s not free money. If you don’t pay it back, you could lose your house. Got it? Good. Let’s talk about how long it takes to get one of these.

The Big Question: How Long Does It Take to Get an Equity Line of Credit?

Alright, let’s cut to the chase. In general, it takes between 2 and 6 weeks to get a HELOC. That’s the time between when you apply and when the money is ready to go. But lemme tell ya, it ain’t set in stone. If they’re on top of their game, some people get it done in a couple weeks. Others may have to wait up to two months or more if the lender is busy or there are problems.

Here’s a quick peek at why it varies

- Lender Differences: Some banks or credit unions move fast; others got a backlog longer than a CVS receipt.

- Your Prep: If you’ve got all your docs ready to go, you’re zoomin’. If not, expect delays.

- Property Stuff: They gotta check your home’s value, and that can take time if a full appraisal’s needed.

- Underwriting: This is where they dig into your finances—credit score, income, debt—and it can drag if they’re picky.

I’ve seen peeps get frustrated ‘cause they thought it’d be quick like applyin’ for a credit card. Nah, this is a bigger deal, and lenders take their sweet time to make sure everything checks out. Let’s break down the steps so you know exactly where the clock’s tickin’.

Step-by-Step: The HELOC Process and Timeline

Let’s go through the steps to really understand why it takes two to six weeks. I’m breaking it up into clear pieces so you can see where the holdups might appear. Here’s how it generally goes down:

1. Gatherin’ Your Paperwork (About 1-2 Weeks)

First things first, you gotta round up a pile of documents. Lenders wanna know everything about you and your house before they hand over a dime. This part’s on you, and it can take a few days to a couple weeks if you’re not organized.

Here’s what you’ll likely need:

- Proof of identity (driver’s license or ID)

- Social Security card or number

- Pay stubs, tax returns, or W-2s to show your income

- Bank and investment statements

- Mortgage details and statements

- Info on your home—like when you bought it, for how much, and current taxes

- Insurance deets for your property

- Any liens or other debts tied to the house

Now, some of this you might have lyin’ around, but other stuff—like gettin’ a home appraisal if required—can slow ya down. An appraisal alone might take a week or two if they send someone out to inspect. Pro tip: start collectin’ this stuff now, even before you apply. It’ll save you a headache later.

2. Submittin’ Your Application (1-3 Days)

Once you’ve got your ducks in a row, fillin’ out the application is pretty quick. Most lenders let ya do it online, and it shouldn’t take more than a day or so. After you hit submit, they might reach out within a few business days to confirm details or ask for more info.

This part’s a breeze if your docs are ready. If they gotta chase you for missing stuff, though, add a few extra days. Be on it, fam—respond fast!

3. Underwriting: The Big Wait (Up to 30 Days)

Here’s where the real waitin’ game kicks in. Underwriting is when the lender checks if you’re good for the money. They look at your credit score, income, debts (like your debt-to-income ratio), and make sure your home’s equity backs up the loan amount.

This step can take anywhere from a couple weeks to a full month. Why so long? ‘Cause they’re diggin’ deep. They might pull your credit report, verify your income, and even double-check your home’s value. If the lender’s busy or if your financials are messy, it stretches out. I’ve heard of folks waitin’ longer during peak times like when interest rates drop and everyone’s applyin’.

4. Closing the Deal (About 5-7 Days)

Once underwriting gives the green light, you’re in the home stretch. Closing means signin’ a bunch of papers, often with a notary, and finalizin’ the loan. This usually takes less than a week. You’ll meet with the lender or do it digitally, sign off, and set up how the funds get to ya.

One quirky thing: there’s often a 3-day “cooling off” period after closin’ where you can back out if you get cold feet. After that, funds are usually ready within a few days. So, tack on another 4-7 days post-closing to actually touch the money.

Total Timeline Breakdown

Lemme throw this into a lil’ table to make it crystal clear:

| Step | Estimated Time |

|---|---|

| Gathering Documents | 1-2 weeks |

| Submitting Application | 1-3 days |

| Underwriting | Up to 30 days |

| Closing | 5-7 days |

| Cooling Off + Fund Release | 4-7 days post-closing |

Add it all up, and you’re lookin’ at roughly 2 to 6 weeks, sometimes stretchin’ to 7 or 8 if things get sticky. Some lenders, especially big credit unions, might even warn ya it could hit 60-75 days if they’re slammed. Yikes, right? But don’t fret—there’s ways to speed this up, and I’m gonna spill those next.

How to Speed Up Gettin’ Your Equity Line of Credit

Ain’t nobody got time to wait forever, especially if you need cash for a reno or to squash some high-interest debt. Good news: you can nudge the process along with a few smart moves. Here’s what I’d do if I were in your shoes:

- Shop Around for Faster Lenders: Not all lenders drag their feet. Some got quicker timelines, especially smaller banks or online ones. Compare a few and ask upfront about their processin’ times. Bonus points if they got low rates too, ‘cause HELOCs often have variable rates that can creep up.

- Skip the Full Appraisal if You Can: A full home appraisal can eat up weeks. Look for lenders who use an Automated Valuation Model (AVM). It’s a fancy way of sayin’ they use tech to estimate your home’s value instantly. Not all do this, especially for big loans, but it’s worth askin’.

- Don’t Apply with a Co-Borrower: If you’re applyin’ with a spouse or someone else, it adds more paperwork and underwritin’ time. If speed’s your jam, go solo if ya can.

- Get Your Docs Ready Beforehand: I can’t stress this enough—have everythin’ scanned and ready to upload. Pay stubs, tax returns, mortgage statements—don’t make ‘em wait on you. Uploadin’ online beats snail mail any day.

- Be Quick to Respond: If the lender emails or calls for more info, don’t sleep on it. The faster you reply or sign disclosures, the quicker they move.

I’ve seen buddies cut their wait time by half just by bein’ on top of their game. It’s all about not givin’ the lender a reason to stall. Play it smart, and you might be tappin’ into that equity sooner than ya think.

What If You Can’t Wait? Faster Alternatives to a HELOC

Now, let’s say 2-6 weeks is just too darn long. Maybe you got an emergency or a hot deal you can’t miss. A HELOC might not be the move, but there’s other ways to get cash quick. I’m gonna lay out a few options and how they stack up, ‘cause we gotta keep it real about what works for your sitch.

Personal Loans: Speedy but Pricey

Personal loans are way faster—some online lenders can approve and fund ya in 1-6 business days. No home collateral needed, so there’s no appraisal nonsense. Downside? Interest rates are higher, often around 8-10% or more compared to a HELOC’s lower variable rates. Plus, borrowin’ limits are smaller, usually toppin’ out at $100,000.

Good for: Smaller, urgent needs or if your credit’s solid enough for decent terms.

Credit Cards: Instant Access, High Cost

If you already got a credit card with a decent limit, you can tap into that right away. New cards might take up to 14 days to arrive after approval, which is still quicker than a HELOC. But watch out—rates average around 16-17%, and that’s a killer if you carry a balance.

Good for: Short-term needs or if you can pay off quick to dodge the interest.

Home Equity Loan: Similar Timeline, Different Vibe

Don’t mix this up with a HELOC. A home equity loan gives ya a lump sum upfront at a fixed rate, not a line of credit. Timeline’s about the same—2-6 weeks—’cause it’s still tied to your home’s value and needs underwritin’. Might not solve the speed issue, but the fixed rate could be safer if you’re worried about rates risin’.

Good for: One-time big expenses where ya want predictable payments.

Here’s a quick comparison to eyeball the differences:

| Option | Timeline | Interest Rate | Best For |

|---|---|---|---|

| HELOC | 2-6 weeks or longer | Low, variable | Flexible, ongoing needs |

| Personal Loan | 1-6 business days | Higher, fixed or variable | Quick cash, smaller amounts |

| Credit Card | Up to 14 days for new | Very high, variable | Immediate needs, short-term use |

| Home Equity Loan | 2-6 weeks | Moderate, often fixed | Big one-time expenses |

Bottom line: if speed’s your priority, personal loans win. If cost matters more and you can wait, stick with a HELOC. Weigh what’s drivin’ ya—time or savings.

Why Choose a HELOC Despite the Wait?

You might be thinkin’, “Why bother with a HELOC if it takes forever?” Fair question. I’ll tell ya why I think it’s worth it for a lotta folks. First off, the interest rates are usually much lower than other borrowin’ options since your home secures the loan. That can save you a bundle over time, especially for big projects like home renos or consolidatin’ debt.

Second, the flexibility is clutch. You draw what ya need, when ya need it, up to your limit. Only pay interest on what you use—not the whole amount. Compare that to a personal loan where you get a lump sum and start payin’ interest on all of it, whether you spent it or not.

Lastly, borrowin’ limits are often higher with a HELOC—anywhere from 60-85% of your home’s equity after subtractin’ your mortgage balance. That’s big bucks if your house has gone up in value. Sure, the wait ain’t ideal, but for long-term financial plays, it’s a solid bet.

Things to Watch Out For with a HELOC

I ain’t gonna sugarcoat it—there’s risks and traps to dodge. Since we’re talkin’ timelines, lemme throw in a few cautions so you’re not blindsided later:

- Variable Rates: Your interest rate can climb over time. What starts cheap could get pricier if market rates spike. Plan for that.

- Home as Collateral: Mess up on payments, and you’re riskin’ foreclosure. Don’t borrow more than you can handle.

- Hidden Fees: Some lenders hit ya with application fees, closin’ costs, or annual fees. Ask upfront so there’s no surprises.

- Delays Beyond Control: Even if you’re prepared, lender backlogs or title issues can slow things down. Build in buffer time.

I always tell folks to read the fine print and crunch the numbers. A HELOC’s powerful, but it ain’t a toy. Treat it with respect.

Boost Your Chances of Approval While Waitin’

While you’re in that 2-6 week window, why not up your odds of gettin’ approved with flyin’ colors? Lenders look at a few key things, and you can work on ‘em now. Check your credit score—higher scores snag better rates and faster approvals. If it’s shaky, pay down some debt or fix errors on your report.

Also, keep your income docs tight. Show steady earnings, ‘cause they wanna know you can repay. And don’t go rackin’ up new debt while applyin’—it messes with your debt-to-income ratio, and underwriters hate that.

I’ve had pals get denied ‘cause they applied while their finances were a hot mess. Tidy up now, and you’ll roll through smoother.

Wrappin’ It Up: Is a HELOC Right for You?

So, how long does it take to get an equity line of credit? As we’ve hashed out, plan on 2 to 6 weeks, maybe more if things get wonky. It’s not the fastest way to get cash, but the lower rates and flexibility make it a go-to for homeowners with equity to spare. If you’re itchin’ to speed things up, get your docs in order, shop for quick lenders, and consider skipin’ a full appraisal if possible.

If the wait’s a dealbreaker, look at personal loans or credit cards for quicker access—just know you’ll pay more in interest. At the end of the day, it’s about what fits your life. Need help decidin’? Drop a comment or shoot us a message. We’re here to chat through it and make sure you’re makin’ the best move for your wallet.

Remember, financial stuff like this ain’t a race—it’s a marathon. Take the time to do it right, and you’ll thank yourself later. Got any HELOC stories or hacks? Share ‘em below—I’m all ears!

Go Through the Underwriting Process

After you apply for the loan, an underwriter will look at your profile to see how it fits with their loan requirements.

It is usually the verification process that causes most delays to your home equity loan approval. Thats why you should aim to have all of your documents together from the beginning of the application process!.

Generally, the underwriting process for a HELOC can take anywhere from a few days to a few weeks, depending on the complexity of the application and the volume of applications being handled. If the underwriter asks for additional documents, the timeline will also be extended based on how quickly you are able to provide them.

Proof of Debt Payments

Lenders not only look at your credit history, but how much you owe to others. Lenders will add up the total monthly payment for your property alongside any other outstanding debt. This can include credit card bills, student loans, child support and even installment loans.

After adding up all of your debt, divide it by your gross monthly income, which includes your salary, investments, and any other income that applies. That means the more complicated your situation (i. e. you have lots of documentation to provide to your lender), the longer it may take them to determine a suitable amount of money to loan you.

Your lender may need these types of documents to determine how much equity you have on your home. This includes property tax assessments, your mortgage statements, and even a copy of the recorded deed on the property.

Once you have selected your lender and have your documents assembled, you will be prepared to complete the application.

If your credit score is high, you may be approved much more quickly than someone who has a fair to low credit score. In those cases, additional documentation may be needed to determine if you’re eligible for a loan or how much you can borrow.

Is it Hard to get a HELOC? – Minimum Requirements and How to Get Approved

FAQ

How fast can you get a home equity line of credit?

A Home Equity Line of Credit (HELOC) can typically be obtained in 2 to 6 weeks from application to funding. However, some online lenders are now offering HELOCs in as little as 5 days.

What is the monthly payment on a $100,000 home equity line of credit?

What is the monthly payment on a $100,000 home equity loan? At current rates, you would pay about $822 each month for a $100,000 home equity loan. Jun 3, 2025.

Can you get a HELOC immediately?

How Soon After Buying a House Can You Obtain a Home Equity Loan? # Technically you can take out a home equity loan, HELOC, or cash-out refinance as soon as you purchase a home. However, you don’t see very many people doing this because you won’t have much equity to draw from that early on.

What is the monthly payment on a $50,000 HELOC?

The interest rate and length of the loan can have a big effect on how much you pay each month on a $50,000 HELOC. Assuming a typical interest rate of around 9% and a 20-year repayment period, the monthly payment would be around $449. 86.