Getting a mortgage is probably one of the biggest financial decisions most people will ever make. It’s not easy to get a $400,000 mortgage, and people will have to make payments for many years. How long will it take me to pay this off? That’s a question that a lot of homeowners have.

The duration of a mortgage depends on several key factors

Mortgage Term

Mortgages are available in terms ranging from 10 to 30 years, with 30-year mortgages being the most common. A longer term means lower monthly payments, but more interest paid over the life of the loan. A shorter term has higher monthly payments, but less interest accrues resulting in paying the loan off faster.

For a $400k mortgage, here are approximate payoff times for different terms:

-

30 year mortgage—A $400,000 loan with a 30-year term would take 30 years to pay off. This is the longest duration option.

-

25 year mortgage – A 25 year term would pay off a $400k mortgage in 25 years,

-

a $400,000 loan would take twenty years to pay off with a 20-year term.

-

15 year mortgage – A 15 year term would pay off a $400k mortgage in 15 years.

-

10 year mortgage – The shortest term, a 10 year mortgage would pay off $400k in 10 years.

You can see that the payoff time is shorter when the term is shorter. But shorter terms mean higher monthly payments.

Interest Rate

The interest rate on a mortgage also greatly impacts payoff time. Lower interest rates mean less interest accrues, allowing more of the payment to go toward principal.

Here are approximate payoff times on a $400k mortgage at different interest rates:

-

3% Interest Rate – A $400k mortgage at 3% interest would take around 21 years to pay off.

-

4% Interest Rate – At 4%, payoff time increases to around 24 years.

-

5% Interest Rate – A 5% rate stretches out payoff time to about 26 years.

-

6% Interest Rate – Payoff time rises to around 29 years with a 6% rate.

-

7% Interest Rate – A $400k mortgage at 7% interest takes approximately 33 years to pay off.

Clearly, the lower the interest rate, the faster the payoff. Even a small rate change greatly impacts total interest costs.

Monthly Payment Amount

The monthly payment amount also determines payoff time. The more you pay each month, the faster the loan principal is paid down.

Here are payoff times based on monthly payment amount:

-

$2,000/month – At this payment, a $400k mortgage would take around 25 years to pay off.

-

$2,500/month – Increasing to $2,500/month reduces payoff time to around 20 years.

-

$3,000/month – With $3,000 monthly payments, payoff time drops to about 17 years.

-

$3,500/month – Payoff time falls to 14 years with monthly payments of $3,500.

-

$4,000/month – A monthly payment of $4,000 pays off a $400k mortgage in approximately 12 years.

Clearly, higher monthly payments accelerate payoff times substantially. But this requires having the cash flow to support higher payments.

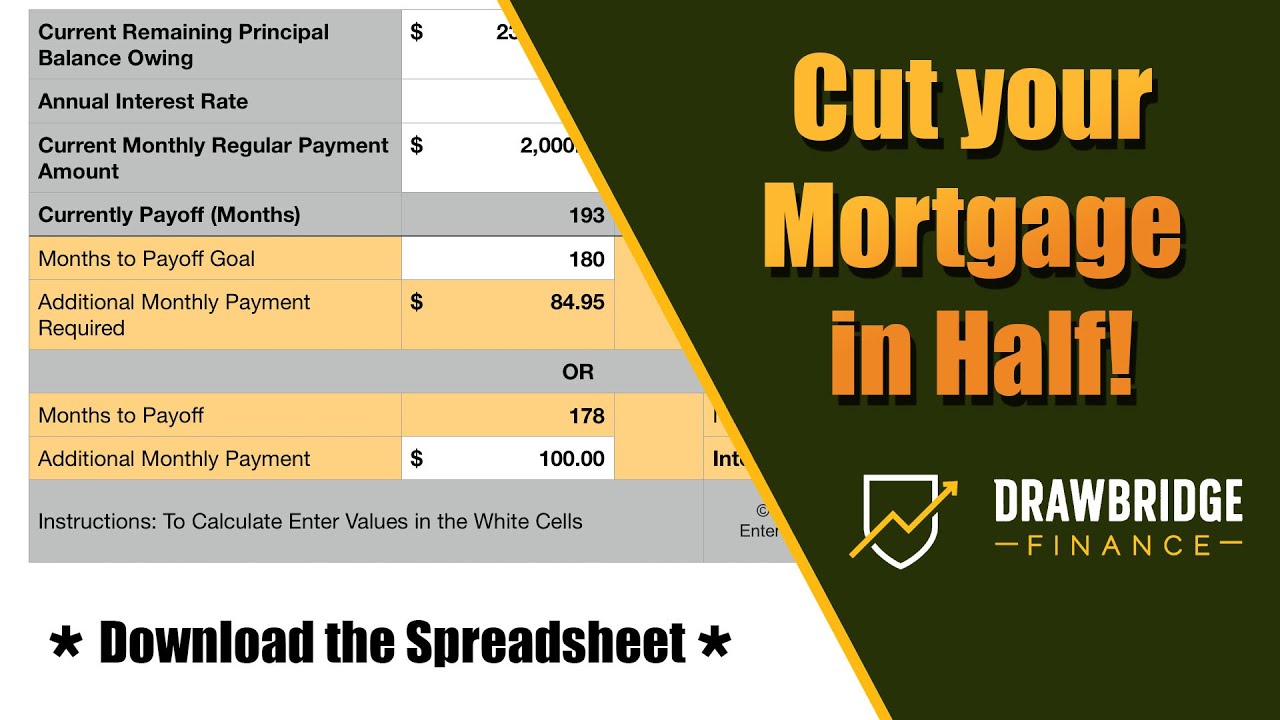

Making Extra Payments

Making extra principal payments is a strategy commonly used to pay off a mortgage faster. Even small extra monthly payments can shave years off a mortgage.

For example, on a $400k 30-year mortgage at 4% interest, making an extra $100 payment each month pays off the loan almost 6 years early, saving over $29,000 in interest. An extra $200 per month pays it off 10 years faster and saves $52,000.

Larger one-time extra payments have an even bigger impact. A single extra $5,000 payment could accelerate payoff time by about 18 months.

Biweekly Payments

Making biweekly (every two weeks) half mortgage payments instead of one monthly payment can also speed up payoff time. This results in the equivalent of 13 monthly payments per year rather than 12, reducing principal faster.

On a $400k mortgage, biweekly payments can pay off the loan about 7 years faster than conventional monthly payments, saving significant interest.

Refinancing

Refinancing involves getting a new mortgage loan to pay off your existing mortgage. This allows you to change the interest rate or term of the loan to reduce interest costs and accelerate payoff.

For example, refinancing a $400k 30-year mortgage to a 20-year term at a lower rate results in paying off the balance much faster while saving substantially on interest expenses.

When refinancing, closing costs and fees need to be considered to ensure it makes financial sense. But strategic refinancing can potentially shave years off a mortgage payoff timeline.

The Bottom Line

For a $400,000 mortgage, the payoff timeline can range anywhere from 10 years to over 30 years depending on the loan terms, interest rate, monthly payments, and supplemental payments made.

Factors like mortgage term, interest rate, payment amount, extra payments, biweekly payments, and refinancing all work together to determine how quickly you can become mortgage free. Evaluating these variables and developing a payoff strategy allows you to find the optimal timeline to pay off your $400k mortgage.

Planning to Pay Off Your Mortgage Early?

You can shorten the length of your loan and save money on interest by making extra payments on the principal every month, every year, or all at once. Use the “Extra payments” feature to find out how.

Explanations of Mortgage Payment Terms

Mortgage terminology can be confusing and overly complicated—but it doesn’t have to be! We’ve broken down some of the terms to help make them easier to understand.

How Much Income You Need for a 400k Home (Mortgage Broker Insider) #mortgage #realestate

FAQ

How long does it take to pay off a home loan?

The monthly or quarterly mortgage statement shows the amount of principal that has not been paid, the interest rate, and the amount of the monthly payment. The remaining term of the loan is 24 years and 4 months. By paying extra $500. 00 per month starting now, the loan will be paid off in 14 years and 4 months. It is 10 years earlier.

When will I pay off my mortgage?

Filters enable you to change the loan amount, duration, or loan type. When Will I Pay Off My Mortgage? If you only make your monthly mortgage payment, it will be easy to see when you will be able to own your home outright: when your loan term ends, which is usually after 30 years.

How to pay off a mortgage early?

Outlined below are a few strategies that can be employed to pay off the mortgage early. : Extra payments are additional payments in addition to the scheduled mortgage payments. Borrowers can make these payments on a one-time basis or over a specified period, such as monthly or annually.

Can you pay off a 30-year loan with 5% interest?

For example, a one-time additional payment of $1,000 towards a $200,000, 30-year loan at 5% interest can pay off the loan four months earlier, saving $3,420 in interest. For the same $200,000, 10-year, 5%-interest loan, extra monthly payments of $6,000 will pay off the loan four payments early, saving $2,796% in interest.

What happens if I pay off my mortgage in advance?

Understand the tax consequences. If you are eligible for the mortgage interest tax deduction on loans up to $750,000 (or up to $1,000,000 for loans originating on or before December 15, 2017), you lose that benefit if you pay off your mortgage in advance. Consequently, you will leave money on the table.

How can a borrower pay off a mortgage?

In such cases, borrowers can allocate a certain amount from each paycheck for the mortgage repayment. Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining.

What is the monthly payment on a 400k mortgage?

How to pay off a $400,000 mortgage fast?

- Make extra house payments. …

- Make extra room in your budget. …

- Refinance (or pretend you did). …

- Downsize. …

- Put extra income toward your mortgage.

How much would monthly payments be on a $400,000 mortgage?

With interest rates approximately at 4.6% as of early 2025, and considering a standard 25-year mortgage term, the average monthly repayment for a £400,000 mortgage is approximately £2,240. However, this is just an estimate as the monthly repayments on your mortgage will depend on a number of different factors.

What is the 2% rule for mortgage payoff?