Does AmEx have a 5/24 rule? No; in fact, the AmEx welcome bonus rules work differently than Chase.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

American Express has an impressive lineup of rewards credit cards with hefty welcome offers and useful perks. American Express doesn’t have a “5/24” rule like Chase does, but the company does limit your ability to get welcome offers based on your credit history. In theory, you can only get one welcome offer per credit card “per lifetime,” but in practice, it’s not always that easy. Here’s what you need to know about the “once per lifetime” rule.

The American Express lifetime rule is one of the most discussed topics among credit card rewards enthusiasts. This policy limits how often you can earn the welcome bonus on Amex cards so it’s crucial to understand before applying. In this comprehensive guide I’ll explain everything you need to know about the Amex lifetime rule, including how long it lasts and strategies to maximize your bonuses.

What is the Amex Lifetime Rule?

The Amex lifetime rule restricts you to only earning the welcome bonus on a card once per lifetime. This applies to all personal and business American Express cards.

For example, let’s say you earn the 60,000 point bonus on the Platinum Card from American Express Amex will mark your account so you can’t earn that bonus again if you apply for the same card later

The lifetime rule has been in effect since 2014. Before that, if it had been a few years, you could get bonuses on the same card over and over again.

How Long Does the Amex Lifetime Rule Last?

The Amex lifetime rule lasts indefinitely. There is no set amount of time that goes by before you can get the bonus again.

Credit card experts say that Amex doesn’t let you use their cards again even after 10 years. The restriction remains in place forever.

It’s possible to get bonuses twice on the same card, but it doesn’t happen often. It seems to only happen sometimes when you are being targeted for a deal. But in general, you can expect one bonus per card per lifetime.

Which Cards Are Affected?

The lifetime rule applies to all personal and business American Express cards. This includes popular rewards cards like:

- Platinum Card from American Express

- Gold Card from American Express

- Green Card from American Express

- Delta SkyMiles Cards

- Hilton Honors Cards

- Marriott Bonvoy Cards

And many other Amex cards. The policy also extends to older versions of these cards if they have been rebranded.

For example, you can only earn the bonus once on the Premier Rewards Gold Card (now the Amex Gold Card) per lifetime.

How to Check If You’re Eligible for an Amex Bonus

Because the lifetime limitation is indefinite, it can be tricky to remember if you’ve had a certain Amex card before. Thankfully, Amex built a bonus eligibility checker into the application process.

When you apply for an Amex card online, you will see a pop-up message if you are not eligible for the welcome bonus due to the lifetime rule. This gives you a chance to cancel the application if you were only doing it for the bonus.

You can also log into your Amex account and check for pre-approved offers with bonus language. These signal that Amex has deemed you eligible to earn the bonus.

Strategies for Maximizing Amex Bonuses

Since you only get one shot at the Amex bonus per card, you’ll want to make it count. Here are some strategies to ensure you earn the highest offers:

1. Check Historical Bonus Offers

Search online to see how high bonuses on your desired card have gone in the past. If the current offer isn’t close to the peak, you may want to wait for a better one.

2. Use CardMatch or Check for Pre-Approvals

CardMatch and the Amex site often provide targeted bonus offers that are higher than the public offer. Log in and see if you are pre-qualified for a better deal.

3. Consider Upgrade Offers

If you already have a lower-tier Amex card, check for upgrade offers which can provide a bonus for moving up to a premium card. Just be aware of the new lifetime restrictions on upgrades.

4. Evaluate the Perks

Don’t just chase the bonus. Make sure the card’s ongoing benefits and rewards make sense for your spending habits.

5. Spread Out Applications

Since you’ll want to space out Amex applications, take advantage of better bonuses from other issuers in between.

6. Plan Your Long-Term Strategy

Figure out which Amex cards align with your goals and apply for them strategically when bonuses are best. Think long-term about your ideal lineup.

The Amex Lifetime Rule Isn’t as Bad as 5/24

While the Amex lifetime policy is restrictive, it’s not as harsh as Chase’s 5/24 rule. With Amex, you can still be approved for a card again later without resetting the bonus clock.

Plus, you can earn bonuses on the business, personal, or different tiers of the same card. And Amex provides a heads up about your eligibility when you apply.

So while the lifetime rule requires more planning, it doesn’t totally stop you from enjoying Amex bonuses regularly.

The Bottom Line on the Amex Lifetime Rule

The Amex lifetime policy limits your welcome bonuses to just once per card, with no chance to reset it later. This unique restriction requires cardholders to be strategic about when they apply for Amex cards and bonuses.

Always check for pre-approved targeted offers before applying and wait for the highest historical bonuses. While the rule is restrictive, planning ahead and using upgrades and business cards can help maximize your earnings. Monitoring lifetime language and eligibility warnings prevents wasted applications.

Understanding the indefinite nature of the Amex lifetime rule is key to navigating bonuses judiciously. With some strategic planning, you can still enjoy a steady stream of valuable Amex welcome offers.

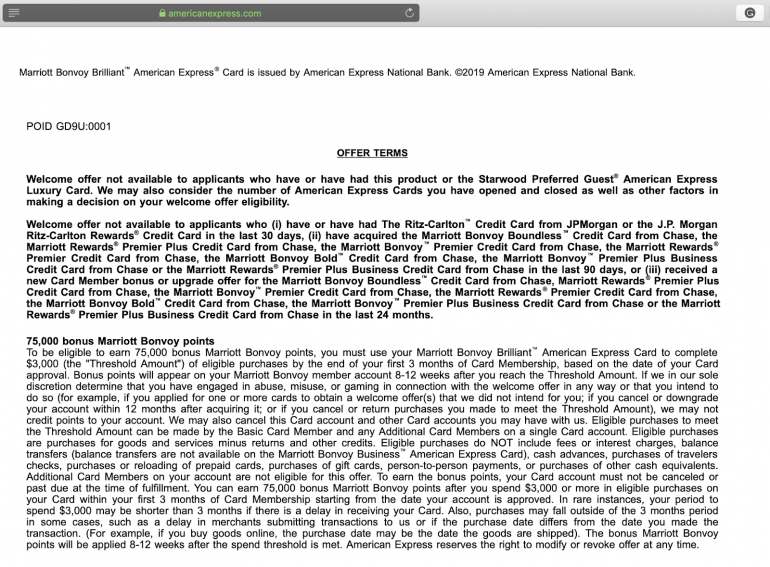

What are the workarounds?

Occasionally, you’ll find that the terms on certain offers do not contain once-per-lifetime language. For example, I used to have a Starwood Preferred Guest® Credit Card from American Express, which converted to the Marriott Bonvoy™ American Express® Card (no longer available for applications). Lately, I keep receiving offers to upgrade to the Marriott Bonvoy Brilliant™ American Express® Card. When I access the card terms, there is no language restricting my ability to earn the welcome bonus. That’s likely because AmEx wants to upsell me to this card, and removing the welcome bonus restriction is an incentive for me to apply for it.

Meanwhile, when I check the Marriott Bonvoy Brilliant™ American Express® Card product page on a private/incognito browser, the language restricting the ability to earn welcome bonuses to once per lifetime appears in bold letters. That tells me American Express is targeting me specifically to re-earn this welcome bonus while otherwise enforcing the once-per-lifetime rule.

Aside from this, the most foolproof workaround to the AmEx once-per-lifetime rule is to make sure you’re applying for an AmEx card with the highest welcome bonus possible to earn. Do a quick Google search for the card name and “highest offer.” You may come across articles that are a few years old, but they’ll give you an idea of how high a welcome bonus offer has historically been, which can help you decide how good the current offer is.

If you’re not in a rush to bank a new AmEx card welcome bonus offer, it might be worth it to hold off until a higher bonus comes around. After all, you’ll likely only qualify for it once, so waiting could be worthwhile.

What is AmEx’s once-per-lifetime rule?

American Express restricts each cards welcome bonus so that it can only be earned by one per person, per lifetime. In other words, if you apply for and earn the welcome bonus on the American Express® Gold Card, that’s it. You can’t earn that bonus again. You can still apply for the card again at some point down the line, but you won’t be eligible for earning another welcome bonus.

American Express Lifetime Language Rule What You Need to Know #creditcard

FAQ

How long do AMEX cards last?

One of the most significant restrictions when applying for Amex cards is the “once in a lifetime” rule, whereby you can typically only earn the bonus on a card once. This isn’t always as easy as it sounds, though, because most people think that this “clock” starts over seven years after you delete a card.

What is American Express ‘once in a lifetime’ rule?

American Express’s “once in a lifetime” rule is meant to get new customers to apply for cards, but it also means that they can’t cancel and reapply for the same card (or sometimes the same family of cards) to get another welcome bonus.

What is a ‘lifetime’ Amex card?

There are times when a “lifetime” only lasts a few years, you might not be able to get a card you’ve already had, but there may be ways to get around this. The good news is that Amex will let you know when you apply if you’re trying to get a card that doesn’t offer a welcome bonus.

Does Amex have a once-per-lifetime rule?

An expansion to the once-per-lifetime rule is being rolled out across some families of Amex credit cards. In simple terms, Amex will most likely disqualify you from receiving the welcome offer on lower-tier cards if you’ve previously held the higher-tier cards within the same card family.

Do AMEX cards reset after 7 years?

Anecdotally it would appear that this rule might not be quite as strict as it sounds on the surface. The most common belief is that Amex’s lifetime “clock” resets after seven years. That’s to say that you may be eligible for the bonus on a card again seven years after you’ve closed it: How can you figure out if you’ve had an Amex card before?

How long does an American Express credit card placement last?

American Express doesn’t specify an exact duration, but it’s generally understood within the credit card industry to mean several years, potentially extending to a decade or more. Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

What is the Amex lifetime rule?

As the name suggests, Amex’s once-per-lifetime rule only allows you to earn a welcome bonus once on a card. So if you apply for The Platinum Card® from American Express and earn the current 80,000-point bonus after spending $8,000 within six months, you won’t be eligible for another bonus on that card.

What triggers Amex pop-up jail?

Since they already suspect you’re abusing their welcome offers—hence why you’re in Amex pop-up jail—if they see you’re trying to apply for lots of their cards, they’re less likely to allow you to get the welcome offer. You won’t know if the pop-up has gone away if you don’t apply for a new card.

Does Amex have the 5/24 rule?

Does AmEx have a 5/24 rule? No; in fact, the AmEx welcome bonus rules work differently than Chase. Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

How many years does Amex expire?

Credit cards usually expire anywhere from three to five years after being issued, depending on the card issuer. The expiration date will appear on your credit card in month/year format.