Congress created the Federal Employees Retirement System (FERS) in 1986, and it became effective on January 1, 1987. Since that time, new Federal civilian employees who have retirement coverage are covered by FERS.

FERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). Two of the three parts of FERS (Social Security and the TSP) can go with you to your next job if you leave the Federal Government before retirement. The Basic Benefit and Social Security parts of FERS require you to pay your share each pay period. Your agency withholds the cost of the Basic Benefit and Social Security from your pay as payroll deductions. Your agency pays its part too. Then, after you retire, you receive annuity payments each month for the rest of your life.

The TSP part of FERS is an account that your agency automatically sets up for you. Each pay period your agency deposits into your account amount equal to 1% of the basic pay you earn for the pay period. You can also make your own contributions to your TSP account and your agency will also make an additional matching contribution up to 4%. These contributions are tax-deferred. The Thrift Savings Plan is administered by the Federal Retirement Thrift Investment Board.

The National Defense Authorization Act (NDAA) of 2009 changed the way unused sick leave is credited under the Federal Employee Retirement System (FERS).

The NDAA provides that FERS employees receive service credit toward the annuity computation based upon a percentage of the sick leave balance at retirement or death, which depends on the date the entitlement to the annuity began:

50 percent in the case of an annuity entitlement based on a separation from service from October 28, 2009 through December 31, 2013; and 100 percent in the case of an annuity entitlement based on a separation from service occurring on or after January 1, 2014.

CBP employees who are covered under FERS and elect to retire any day effective now through December 31, 2013 can expect to receive credit for half of their unused sick leave balance towards their retirement benefit. Employees who retire on or after January 1, 2014, can expect to receive service credit for their entire unused sick leave balance.

CBP employees covered under FERS may choose to voluntarily retire on any day of the month; however, they should keep in mind that their annuity will commence the first day of the following month. For example, if an employee chooses to retire anytime during the period of January 1 – 31, 2014, his/her annuity will commence on February 1, 2014. This employee could expect to receive his/her first interim annuity payment approximately 60 days from the date of retirement.

If you were on active duty in the military and received an honorable discharge, your military service is potentially creditable under FERS.

In 1957, military service became covered by Social Security. Because of this, you may be able to credit your active-duty military service in calculating your FERS benefit, but you must make a deposit covering active-duty military service after 1956. This deposit is called the Post-56 Military Deposit. Making the Post-56 Military Deposit allows you to get credit for your post-1956 active-duty military service under both Social Security and FERS.

Active-duty military service performed after 1956, known as Post-56 military service, is creditable under FERS only if you make a deposit.

The amount of the Post-56 military deposit under FERS is 3 percent of your military earnings, plus interest. Interest begins accruing October 1, 1989, or three years after your retirement coverage begins, whichever is later.

If you transferred to the Federal Employees Retirement System from the Civil Service Retirement System, your military service and deposit will be treated according to Civil Service Retirement System rules.

Are you considering a career with the federal government and wondering about retirement benefits? One of the most common questions people have is about pension eligibility – specifically, how many years of service you need to qualify Let’s break it down in simple terms so you can understand exactly what it takes to earn that federal retirement check

The Short Answer: 5 Years Minimum

The good news is that you only need 5 years of creditable federal service to become eligible for a pension under the Federal Employees Retirement System (FERS). This is what’s known as the “vesting period” – once you’ve worked these 5 years you’ve earned the right to receive some form of retirement benefit.

But wait – there’s more to the story! While 5 years qualifies you for a pension, when and how much you’ll receive depends on several other factors.

Understanding FERS: Your Three-Tiered Retirement System

If you’re a federal employee hired after 1987, you’re likely covered by FERS – a comprehensive retirement package consisting of three parts:

- FERS Basic Pension: The traditional pension component

- Social Security Benefits: Just like other American workers

- Thrift Savings Plan (TSP): Similar to a 401(k) plan

The FERS Basic Pension is a defined benefit plan which means you’ll receive a guaranteed monthly payment for life after retirement. The amount is based on your years of service retirement age, and highest 3-year average salary (known as your “High-3”).

Retirement Eligibility: When Can You Actually Retire?

Here’s where things get a bit more complex. While you’re vested after 5 years, you can’t necessarily retire and start collecting immediately. FERS has different retirement categories:

Immediate Retirement

You can retire with immediate benefits if you meet one of these combinations:

- Age 62 with 5 years of service

- Age 60 with 20 years of service

- Your Minimum Retirement Age (MRA) with 30 years of service

- Your MRA with at least 10 years of service (but with a reduced benefit)

What’s Your MRA?

Your Minimum Retirement Age depends on your birth year:

| If you were born | Your MRA is |

|---|---|

| Before 1948 | 55 |

| In 1948 | 55 and 2 months |

| In 1949 | 55 and 4 months |

| In 1950 | 55 and 6 months |

| In 1951 | 55 and 8 months |

| In 1952 | 55 and 10 months |

| In 1953-1964 | 56 |

| In 1965 | 56 and 2 months |

| In 1966 | 56 and 4 months |

| In 1967 | 56 and 6 months |

| In 1968 | 56 and 8 months |

| In 1969 | 56 and 10 months |

| In 1970 and after | 57 |

Deferred Retirement

If you leave federal service before meeting the age requirements but have at least 5 years of service, you can receive deferred retirement benefits when you reach:

- Age 62 with 5 years of service

- Age 60 with 20 years of service

- Your MRA with 30 years of service

- Your MRA with at least 10 years (with reduced benefits)

Early Retirement Options

Sometimes you can retire earlier than the standard rules allow. Early retirement is available in cases of:

- Involuntary separation (like during a reduction in force)

- Voluntary separation during major reorganizations

To qualify for early retirement, you need:

- Age 50 with 20 years of service, OR

- Any age with 25 years of service

How Is Your FERS Pension Calculated?

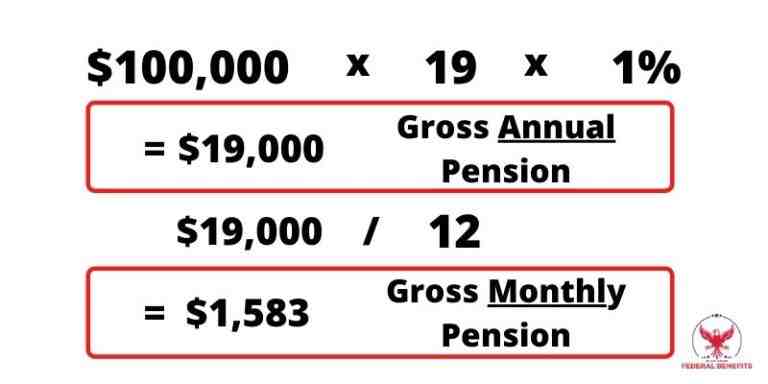

The formula for calculating your basic FERS annuity is pretty straightforward:

-

If you retire before age 62, OR at age 62 or older with less than 20 years of service:

1% × High-3 Salary × Years of Service -

If you retire at age 62 or older with 20+ years of service:

1.1% × High-3 Salary × Years of Service

Let me give you an example: If you worked for 30 years and your highest 3-year average salary was $100,000, your annual pension would be:

- Under age 62: $100,000 × 30% = $30,000 per year

- Age 62 or older: $100,000 × 33% = $33,000 per year

Special Provisions for Law Enforcement and Firefighters

If you’re in law enforcement or a firefighter, you get a better deal! Your pension is calculated differently:

- 1.7% of your high-3 average salary for each year up to 20 years

- PLUS 1% for each year beyond 20 years

These positions also have different retirement eligibility rules:

- Can retire at age 50 with 20 years of covered service

- Can retire at any age with 25 years of covered service

Plus, they face mandatory retirement at age 57 with 20 years of service.

Disability Retirement

If you become disabled while working for the federal government, you might qualify for disability retirement benefits with as little as 18 months of service. Special requirements apply – your disability must prevent you from doing your job efficiently, be expected to last at least a year, and your agency must be unable to accommodate your condition.

What Counts as Creditable Service?

Not all federal service automatically counts toward your pension. Generally, creditable service includes:

- Federal service where FERS retirement deductions were taken from your pay

- Unused sick leave (for computation purposes only)

- Some federal service performed before 1989 without retirement deductions (if you make a deposit)

- Military service (with deposit payment)

The FERS Supplement: An Extra Benefit

If you retire before age 62 (when you become eligible for Social Security), you might receive a FERS Annuity Supplement. This provides additional income approximating the Social Security benefit you earned during your federal service. It continues until age 62, regardless of whether you claim Social Security then.

The TSP Component: Don’t Forget It!

While the FERS pension requires 5 years to vest, don’t overlook the importance of the TSP! The government matches your contributions:

- Automatic 1% contribution (even if you contribute nothing)

- Dollar-for-dollar match on the next 3% you contribute

- 50-cents-on-the-dollar match for the next 2%

This means if you contribute 5%, the government adds another 5% – that’s FREE MONEY, people! And unlike the pension, you’re immediately vested in your own contributions and earnings, plus any matching contributions.

Health Benefits in Retirement

Wanna keep your health insurance after retirement? You’ll need:

- An immediate annuity starting within 30 days of leaving

- Health insurance coverage for 5 consecutive years immediately before retirement

This is super important to plan for – don’t overlook it!

My Take on Federal Retirement Planning

I’ve talked with many federal employees over the years, and I always tell them the same thing: while 5 years gets you vested, aim for at least 20-30 years if possible. The difference in benefits is HUGE!

For example, with only 5 years of service at age 62 and a final salary of $70,000, your annual pension would be just $3,500 (5% of your salary). That’s hardly enough to live on! But with 30 years of service, that jumps to $23,100 (33% of salary) – much more substantial.

What Should You Do Right Now?

Whether you’re just starting your federal career or have been serving for years, here are my tips:

- Start contributing to TSP immediately – at least 5% to get the full match

- Review your service history – make sure all eligible service is counted

- Consider buying back military time if applicable

- Understand your insurance options – health, life, dental, vision

- Keep beneficiary forms updated

- Attend retirement training seminars offered by your agency

Bottom Line

So there ya have it – you need just 5 years of federal service to be eligible for a pension, but the sweet spot is 20-30 years for a comfortable retirement. The FERS system is actually pretty generous compared to what most private employers offer these days, with the three-tier approach giving you multiple income streams in retirement.

Remember that retirement planning is super personal, and what works for your colleague might not be right for you. If you’re serious about maximizing your benefits, consider talking with a financial advisor who specializes in federal benefits.

Have you started planning for your federal retirement yet? It’s never too early to start!

What is Deposit Service?

Deposit Service is a period of Federal civilian employment during which no retirement contributions were withheld from your pay. It is also called “Non-Deduction Service.

If your work history includes non-permanent service under an appointment excluded from retirement coverage you have “Deposit Service.” Examples are:

- Temporary Appointments (limited to one year or less)

- Intermittent Appointments

- When Actually Employed (WAE) and Seasonal Appointments

The basic FERS deposit rule is simple: “no deposit, no credit.” The FERS deposit may be made as follows:

- FERS deposits are only allowed for Deposit Service performed before January 1, 1989.

- You are not allowed to make a deposit for FERS Deposit Service on or after January 1, 1989. The service does not count towards eligibility of service or retirement computation.

If you transferred to FERS from the Civil Service Retirement System (CSRS) or CSRS Offset, you should contact the Retirement and Benefits Advisory Services branch for more information regarding your transfer. Special rules apply to determine if your service prior to becoming FERS will follow the FERS rules or the CSRS rules.

The FERS deposit rate is 1.3 percent of the salary you earned during the period of deposit service, plus interest.

Deposit Service which is creditable under the special retirement provisions will cost 0.5 percent more. Special retirement provisions cover FERS law enforcement officers, firefighters, CBPOs, and air traffic controllers.

When the service was performed determines the amount of interest. Interest is charged each year there is an unpaid deposit balance (compounded annually).

- 4 percent interest before January 1, 1948.

- 3 percent interest from January 1, 1948 to December 31, 1984.

- Variable interest rates apply after December 31, 1984. Variable interest rates can be found at: OPM.

- You should request the “Application to Make Service Credit Payments for Civilian Service,” SF-3108, from the Indianapolis Hiring Center (IHC) or you may download the form from the you may download the form from the Office of Personnel Management (OPM) Website..

- Complete the front of the form and submit it to IHC at the address below.

- IHC will complete the remainder of the form and mail it to OPM.

- OPM computes the amount of the deposit (including interest) and will provide you payment instructions and an official bill.

- You can pay the deposit in full or in installments of at least $50.

- Payments must be made directly to OPM. You cannot pay the deposit through payroll deductions, but you can arrange for electronic transfer of finds from your bank account to OPM.

- OPM will send an updated statement every time a payment is made.

- Deposits may be made before or after retirement, but must be completed before the final adjudication of a retirement claim. Generally the installment payments must be at least $50.

NOTE: When you submit your retirement application and you are within six months of retiring, OPM will send you a letter informing you of the opportunity to make the deposit before final processing of your retirement application. Mailing Address: U.S. Customs and Border Protection Attn: Indianapolis Hiring Center 8899 E. 56th St. Indianapolis, IN 46249 For more information, please contact HRM Customer Response Interactive Services at (317) 715-3000.

Significant changes have been made to the Federal Employee Retirement System (FERS). A new system of coverage, known as the Federal Employee Retirement System – Revised Annuity Employees (FERS-RAE), has been established under Public Law 112-96, Section 5001, of the “Middle Class Tax Relief and Job Creation Act of 2012.” This new system of coverage, FERS-RAE, generally applies to those who are first hired in a Federal appointment on or after January 1, 2013, and who would previously have been covered by FERS.

The new FERS-RAE coverage increases the amount of employee retirement contributions. FERS-RAE employees will pay an additional 2.3 percent of their salary into the retirement system. The increase raises retirement contributions from .08 to 3.1 percent for regular employees, and from 1.3 to 3.6 percent for special category employees (Law Enforcement/Customs and Border Protection Officers). This increased employee contribution does not increase or decrease your retirement annuity.

U.S. Customs and Border Protection employees who are subject to the Civil Service Retirement System (CSRS), the Civil Service Retirement System-Offset, or Federal Insurance Contribution Act-only coverage and who have an opportunity to elect to transfer to FERS, will be subject to FERS, not FERS-RAE, if they elect to transfer to FERS.

What is Redeposit Service?

If you leave Federal service for more than 30 days, you may request and receive a refund of the retirement contributions you have paid into the FERS retirement system. When you receive this refund the period of service represented by the refund is now called Redeposit Service.

A FERS employee who receives a refund of FERS (only) retirement contributions may not make a redeposit. A FERS employee who receives a refund of Civil Service Retirement System (CSRS), CSRS Interim, or CSRS Offset retirement contributions may make a redeposit, but only under certain conditions.

- If you applied for the refund of CSRS, CSRS Interim, or CSRS Offset contributions prior to automatic coverage or transfer to FERS, you may make a redeposit.

- An employee who transfers to FERS with eligibility for a CSRS annuity component may make a redeposit for CSRS service that is included in the CSRS annuity component.

- If you do not have a CSRS annuity component, you may make a redeposit for SRS/CSRS Offset service only if you applied for the refund of contributions before you transferred or became covered by FERS. FERS redeposit rules apply.

The basic FERS redeposit rule is simple: “no redeposit, no credit.” If you do not pay the redeposit, you will not receive any credit for your service towards retirement eligibility or annuity computation. Remember, FERS retirement contributions cannot be redeposited; CSRS, CSRS Interim, or CSRS Offset retirement contributions that are now creditable under FERS may be redeposited if you applied for the refund before you transferred or became covered by FERS.

You will have a CSRS annuity component if you elected to transfer to FERS and you had at least five years of creditable civilian service under CSRS and/or FICA (Social Security) prior to electing FERS.

The amount of the redeposit equals the amount of the refund received, plus accrued interest beginning the date the refund was paid.

The amount due is 1.3 percent of basic pay earned during the period of service plus interest.

FERS Redeposit Service is subject to interest, based on when the service was performed. Interest accrues annually on the outstanding balance, compounded annually, as follows:

- 4 percent interest before January 1, 1948.

- 3 percent interest from January 1, 1948 through December 31, 1984.

- Variable interest rates apply after December 31, 1984 (see variable interest rates at OPM).

FERS Redeposit Service is subject to interest, based on when the service was performed. Interest accrues annually on the outstanding balance, compounded annually, as follows:

- You should request the SF-3108, “Application to Make Service Credit Payments for Civilian Service,” from the Indianapolis Hiring Center (IHC) or download the form from the Office of Personnel Management (OPM) Website

- Complete the front of the form and submit it to IHC at the address below.

- IHC will complete the remainder of the form and mail it to OPM.

- OPM computes the amount of the deposit (including interest) and will provide you payment instructions and an official bill.

- You can pay the redeposit in full or in installments of at least $50.

- Payments must be made directly to OPM. You cannot pay the deposit through payroll deductions, but you can arrange for electronic fund transfer from your bank account to OPM.

- OPM will send an updated statement every time a payment is made.

- Redeposits may be made before or after retirement, but must be completed before the final adjudication of a retirement claim. If the redeposit is not paid in full before the retirement claim is finalized, OPM will send you a refund of the incomplete redeposit.

NOTE: When you submit your retirement application and you are within six months of retiring, OPM will send you a letter informing you of the opportunity to make the deposit before final processing of your retirement application. Mailing Address: U.S. Customs and Border Protection Attn: Indianapolis Hiring Center 8899 E. 56th St. Indianapolis, IN 46249

For more information, please contact HRM Customer Response Interactive Services at (317) 715-3000.

A Government Pension – What You Should Know

FAQ

How long do federal employees have to work to get a pension?

This is a common question among federal employees, and the answer depends on the specific retirement system you are enrolled in. For those covered by the Federal Employees Retirement System (FERS), the answer is at least 5 years. However, the number of years you work significantly impacts the amount of your pension. Navigating the FERS Landscape

How long do you have to serve for a federal pension?

Both FERS and CSRS require 5 years of creditable civilian service for vesting. If an employee separates from service before vesting, they are generally only entitled to a refund of their retirement contributions. Beyond service length, age plays a significant role in federal pension eligibility.

Can you get a federal pension if you work 5 years?

You must work at least 5 years with the Federal Government before you are eligible for a FERS Federal Pension, and for every year you work, you will be eligible for at least 1% of your High-3 Average Salary History. Can you get a federal pension after 10 years?

How many years do you have to work for the federal government?

How many years do you have to work for the federal government to get a pension? You must work at least 5 years with the Federal Government before you are eligible for a FERS Federal Pension, and for every year you work, you will be eligible for at least 1% of your High-3 Average Salary History.

Do you qualify for a pension if you work full time?

Remember, if you’re 62 years old and have worked full-time for five years, you may qualify for a pension and additional benefits. Workshops are an excellent resource to clarify your benefits and help you plan effectively for retirement.

When can a federal employee retire?

Normally, an employee is eligible to retire from federal service when the employee has at least 30 years of service and is at least age 55 under the Civil Service Retirement System or 56 and four months in 2022 (note: this age is rising by two months a year until it will reach 57) under the Federal Employees Retirement

How much is a federal pension after 20 years?

Can I retire at 57 with 20 years of federal service?

You are able to retire at age 50 with 20 years of service or at any age if you have 25 years of service. However, the 20 or 25 years have to be special provision years. If you don’t have enough special provision-specific time then you’d fall under the traditional FERS retirement rules.

Do all federal employees get a pension?

What is the average pension of a federal employee?