The Earned Income Tax Credit is designed to help low-to-moderate-income taxpayers get a tax break. Which workers qualify depends on factors like income and investment earnings, filing status, citizenship, and more. Check out this breakdown of the Earned Income Credit to see if you might be able to get it and how much you could get.

Hello, friend! If you want to get some extra money when you file your taxes, you need to know about the Earned Income Tax Credit, or EITC. This little gem will change everything for people who work hard but don’t make a lot of money. In 2021, it helped a lot of people get more money, and I’m going to tell you how much you could have gotten if you were eligible. So you can see what’s going on, whether you filed late or are just interested, let’s break this down in simple terms.

Let’s get right to the good stuff: how much credit you could have gotten in 2021. Once we talk about who can get it, what “earned income” means, and how to make sure you don’t miss out, Stay with me, because this could lead to a nice refund boost!

How Much EITC Could You Get in 2021? The Numbers That Matter

Alright, let’s cut to the chase The amount of Earned Income Tax Credit you could get in 2021 depends on a few things how many kids or dependents you got, your income, and whether you’re filing solo or with a spouse Here’s the breakdown of the maximum credits you could’ve claimed

- No qualifying children: Up to $1,502

- 1 qualifying child: Up to $3,618

- 2 qualifying children: Up to $5,980

- 3 or more qualifying children: Up to $6,728

Now, hold up—that’s the max amount. You don’t automatically get that just ‘cause you got kids. Your income’s gotta be below certain limits, and that’s where it gets a bit tricky. Check this table for the income caps in 2021 based on your filing status:

| Number of Children | Single, Head of Household, or Widowed (Max Income) | Married Filing Jointly (Max Income) |

|---|---|---|

| 0 | $21,430 | $27,380 |

| 1 | $42,158 | $48,108 |

| 2 | $47,915 | $53,865 |

| 3 or more | $51,464 | $57,414 |

Your AGI might have been less than these amounts if it meant you could get some or all of that credit. But, and this is a big but, you’re out of luck if you had investment income over $10,000 in the form of interest or dividends. No EITC for you. Harsh I know, but them’s the rules.

Why’s This Credit Such a Big Deal?

Lemme tell ya, the EITC ain’t just some small change. You can get your money back, so even if you didn’t owe any taxes, Uncle Sam could still help you out. In 2021, this was like a small windfall for a lot of people, especially families with a few kids. Friends of mine have used it to pay their bills, fix up their cars, or just take a deep breath. Trust me, it’s worth the trouble to find out if you qualify.

Do You Qualify for the 2021 EITC? Let’s Check

Now that you know the dollar amounts, let’s see if you woulda qualified back in 2021. There’s a few boxes you gotta tick, and I’m gonna lay ‘em out plain and simple. If you’re not sure, don’t sweat it—there’s ways to double-check.

Basic Rules to Qualify

Here’s the rundown of who can claim this credit:

- You gotta have earned income. That’s money from a job, freelance gigs, or even some disability benefits before retirement age. Stuff like unemployment or Social Security don’t count.

- Your income’s gotta be low enough. Look at that table above—if you’re over the limit for your family size and filing status, the credit starts shrinking or disappears.

- You need a valid Social Security Number. That’s for you, your spouse if you got one, and any kids you’re claiming. No SSN, no dice.

- Investment income can’t be too high. Like I said, over $10,000 in 2021 from stuff like stocks or rentals, and you’re disqualified.

- Gotta be a U.S. citizen or resident. Plus, you gotta live in the States for more than half the year.

- Age stuff for no-kid filers. If you ain’t got dependents, you needed to be at least 25 but under 65 in 2021 to claim it.

What About Kids or Dependents?

If you’re claiming the bigger credits with kids, they gotta be “qualifying children.” That means:

- They’re related to you—could be your kid, stepkid, foster child, or even a sibling or niece if you’re taking care of ‘em.

- They’re under 19 at the end of 2021, or under 24 if they’re a full-time student. If they’re permanently disabled, age don’t matter.

- They lived with you in the U.S. for more than half the year.

I got a pal who took care of his younger cousin after some family drama. Didn’t adopt ‘em or nothing, but since the kid lived with him most of 2021, he could claim ‘em for EITC. Made a huge difference in his refund!

Filing Status Weirdness

One thing to watch: If you’re married, you usually can’t file separately and get this credit. There was a special rule in 2021 thanks to some new laws, so if you did file separate, you might still qualify—but it’s got extra hoops. Most folks are better off filing jointly if they’re hitched.

What Counts as Earned Income? Don’t Mess This Up

This part trips people up all the time, so listen close. Earned income is the money you make from working—not just any cash coming in. Here’s what counts for EITC:

- Wages and salaries from a regular job (the stuff on your W-2).

- Tips, if you reported ‘em.

- Gig work—like driving for rideshares, delivering food, or selling crafts online.

- Self-employment income if you run your own biz or hustle on the side.

- Some disability benefits, if you got ‘em before retirement age.

- Union strike benefits, if you were on strike.

- Even nontaxable combat pay can count, but it’s tricky—it might raise or lower your credit, so you gotta crunch the numbers.

Here’s what don’t count, so don’t mix ‘em in:

- Unemployment checks.

- Child support or alimony.

- Pensions or retirement payouts.

- Social Security benefits.

- Interest or dividends from savings or stocks.

I made the mistake once of thinking some side cash from a buddy didn’t need reporting. Nah, if it’s work, report it—could boost your EITC!

How Your Income Affects the Credit Amount

Okay, so you know the max credits, but most folks don’t get the full amount. Why? ‘Cause the EITC phases in and out based on how much you earn. It’s like a bell curve—starts low, peaks, then drops off if you make too much.

- Phase-in: If you earn very little, your credit starts small and grows as your income rises.

- Max credit: You hit the sweet spot where you get the full amount (like that $6,728 for 3+ kids) if your income is in the right range.

- Phase-out: Once you pass a certain income (check that table), the credit shrinks until it’s gone.

For 2021, if you’re single with one kid, the phase-out started around $19,520 and ended at $42,158. That means if you earned, say, $30,000, you’d get less than the max $3,618. It’s a sliding scale, and honestly, it’s a pain to calculate by hand. That’s why I always tell folks to use a tax tool or chat with someone who knows their stuff.

How to Claim Your EITC for 2021

If you think you qualified in 2021 and didn’t claim it, or you’re filing late, don’t worry—you can still get that money! Here’s how we do it:

- File a tax return. Even if you didn’t owe taxes, you gotta file to get the refundable credit.

- Add Schedule EIC if you got kids. This form lists your qualifying children. Skip it if you got no dependents.

- Double-check your numbers. Make sure your income, SSN, and all that jazz is correct. Mistakes can delay your refund big time.

- File for free if you can. There’s programs like VITA (Volunteer Income Tax Assistance) where certified folks help you file at no cost. Saved my bacon one year when I was broke as heck.

If you already filed for 2021 but forgot the EITC, you can amend your return. It’s a bit of a hassle, but that extra cash is worth it, right?

Common Mistakes That’ll Cost Ya

I’ve seen too many peeps miss out on this credit ‘cause of dumb slip-ups. Don’t be that guy. Watch out for these:

- Not reporting all income. Yeah, I know, reporting gig work sucks, but if you skip it, you might miss EITC.

- Claiming kids who don’t qualify. They gotta live with you over half the year—don’t fudge it.

- Filing status mix-ups. Married filing separately usually don’t work for EITC, ‘cept in rare cases for 2021.

- Missing the investment income cap. Over $10,000 from stocks or whatever, and you’re out. Double-check!

Did the EITC Change After 2021? A Quick Peek

Just so you ain’t caught off guard, the EITC amounts and rules shift a bit each year. In 2022, for instance, the max credit with no kids dropped way down to $560, compared to $1,502 in 2021. Weird, huh? Income limits also creep up a lil’ most years ‘cause of inflation or whatever. Point is, if you’re lookin’ at other years, don’t assume 2021 numbers still apply. Always check the latest deets for the year you’re filing.

Why You Shouldn’t Skip This Credit

Look, I get it—taxes are a headache. Forms, numbers, rules… ugh. But the EITC is legit one of the best ways to get some cash back if you’re working hard and not rolling in it. In 2021, some states even had their own version of this credit on top of the federal one, so you mighta got double the boost. I’m just sayin’, don’t leave money on the table. I had a rough year back in the day, and a credit like this woulda been a lifesaver if I’d known about it sooner.

Extra Tips to Maximize Your Refund

Wanna make sure you’re getting every penny you deserve? Here’s a few tricks I picked up over the years:

- Use tax software or a pro. They can spot if you qualify for EITC and other credits you might miss.

- Check for state credits. Some places got their own EITC—could be extra hundreds in your pocket.

- Keep records handy. Pay stubs, W-2s, proof of where your kids live—have it ready in case the tax folks ask.

- File on time (or amend quick). If you’re late for 2021, don’t drag your feet too long—there’s deadlines to claim refunds.

What If You’re Still Confused?

If all this still feels like a jumbled mess, don’t stress. Taxes ain’t easy for nobody. There’s tools online—like qualification assistants—that can walk you through if you qualify for 2021’s EITC. Or hit up a local tax help center. Heck, I’ve sat down with a volunteer before and they broke it down so simple I felt like a dummy for not gettin’ it sooner.

Wrapping It Up: Claim That Cash!

So, how much Earned Income Credit could you get in 2021? Anywhere from $1,502 with no kids to a sweet $6,728 if you got three or more dependents, as long as your income was under the caps. It’s a real boost for working folks who need it most, and I’m rooting for ya to claim every dime. Remember, you gotta file a return, make sure you qualify, and watch them income limits. If you missed it back then, it ain’t too late to amend and get your refund.

Got questions or a weird situation? Drop a comment below—I’m all ears! Let’s make sure you ain’t missing out on what’s yours. And hey, share this with a buddy who might need the help. We’re all in this tax game together, ya know? Keep hustlin’, and let’s get that money back where it belongs—in your pocket!

Special rules for tax years 2020 and 2021

The Consolidated Appropriations Act (CAA) was signed into law on December 27, 2020, as a way to help people who were hurt by the pandemic. For tax year 2020, the CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit (ACTC) as well as the Earned Income Credit (EIC). For 2021, you are allowed to use your 2019 or 2021 earned income based on whichever one gives you the highest credit.

How much can I earn and still qualify?

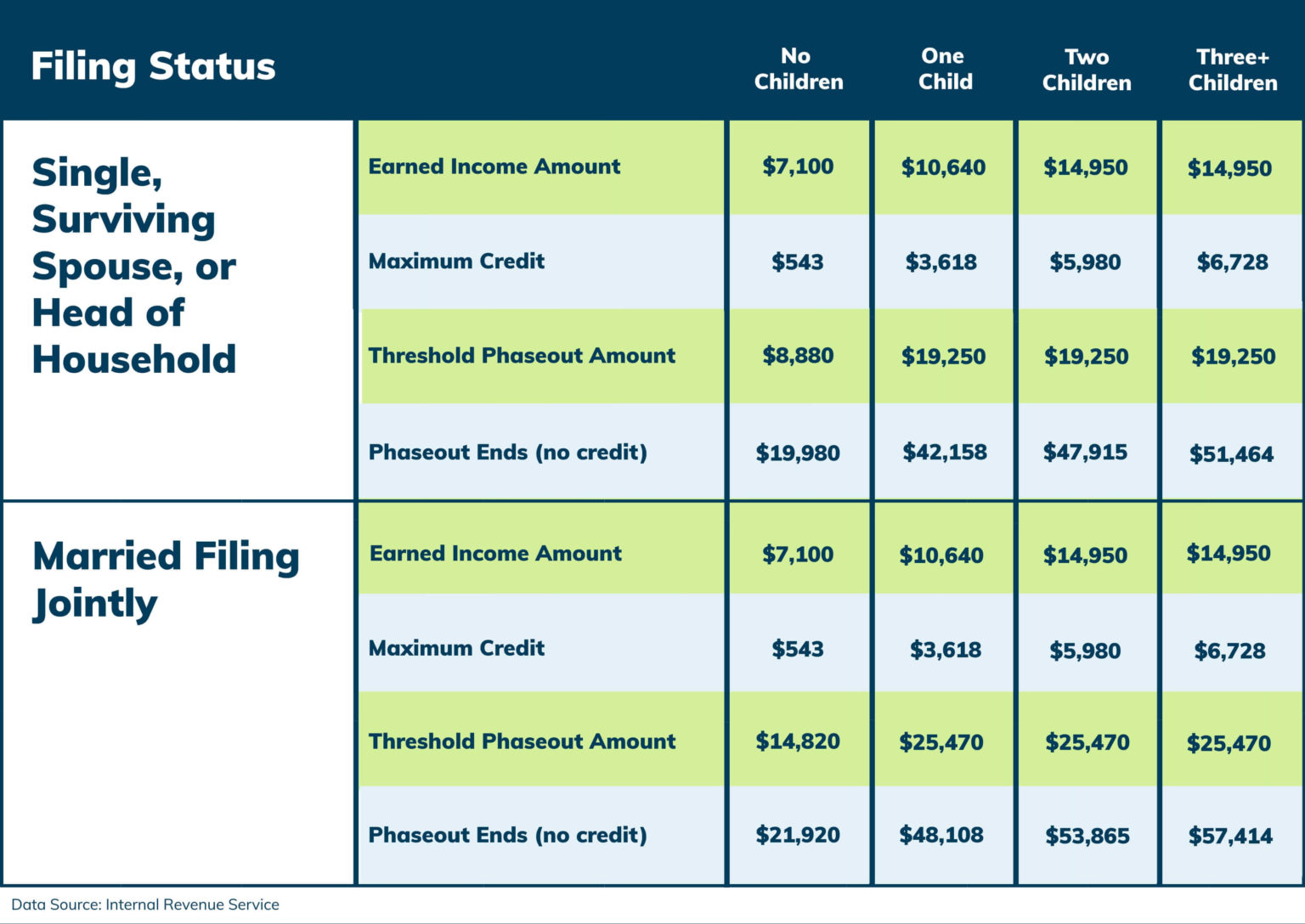

This credit is targeted at households with modest incomes, so if you earn “too much” you may not qualify. Just how much can you earn and still qualify? It depends on how many qualifying children you have (well define this in a moment). Those with the lowest income qualify for the biggest credits. Those with incomes above the phase-out threshold qualify for lower credits until they reach the point where the credit is eliminated completely. The rules have been liberalized to result in higher credits for many households, especially those with three or more qualifying children.

The following table shows the 2024 income limits for receiving credits and the maximum 2024 credit amounts.

| If you have: | Your earned income (and adjusted gross income) has to be less than these amounts to receive any credit: | Your maximum credit will be: |

|---|---|---|

| No qualifying children | $18,591 ($25,511 if married and filing a joint return) | $632 |

| 1 qualifying child | $49,084 ($56,004 if married and filing a joint return) | $4,213 |

| 2 or more qualifying children | $55,768 ($62,688 if married and filing a joint return) | $6,960 |

| 3 or more qualifying children | $59,899 ($66,819 if married and filing a joint return) | $7,830 |

The following table shows the 2023 income limits for receiving credits and the maximum 2023 credit amounts.

| If you have: | Your earned income (and adjusted gross income) has to be less than these amounts to receive any credit: | Your maximum credit will be: |

|---|---|---|

| No qualifying children | $17,640 ($24,210 if married and filing a joint return) | $600 |

| 1 qualifying child | $46,560 ($53,120 if married and filing a joint return) | $3,995 |

| 2 or more qualifying children | $52,918 ($59,478 if married and filing a joint return) | $6,604 |

| 3 or more qualifying children | $56,838 ($63,398 if married and filing a joint return) | $7,430 |

Earned Income Tax Credit (EITC) Explained

FAQ

How much EIC do I qualify for in 2021?

| Number of qualifying children | California maximum income | CalEITC (up to) |

|---|---|---|

| None | $30,000 | $255 |

| 1 | $30,000 | $1,698 |

| 2 | $30,000 | $2,809 |

| 3 or more | $30,000 | $3,160 |

How do I calculate my Earned Income Credit?

If your adjusted gross income is greater than your earned income your Earned Income Credit is calculated with your adjusted gross income and compared to the amount you would have received with your earned income. The lower of these two calculated amounts is your Earned Income Credit.

How much will I get back with an Earned Income Tax Credit?

As a working family or person making up to $31,950 a year, you may be able to get a California Earned Income Tax Credit (CalEITC) of up to $3,644. You must fill out the 2024 FTB 3514 form, which is called the California Earned Income Tax Credit, and send it in. If you file electronically, follow the tips that come with your software.

What would disqualify you from Earned Income Credit?

In general, disqualifying income is investment income such as taxable and tax-exempt interest, dividends, child’s interest and dividend income reported on the return, child’s tax-exempt interest reported on Form 8814, line 1b, net rental and royalty income, net capital gain income, other portfolio income, and net .