Hey there friend! If you’re sittin’ there wonderin’, “How much extra should I pay on my car payment?” you’ve come to the right spot. I’ve been down that road, stressin’ over car loans and dreamin’ of the day I’d be debt-free. Lemme tell ya payin’ a lil’ extra on your car payment can work wonders—savin’ you money on interest and gettin’ that loan off your back sooner. But how much is the sweet spot? Don’t worry, I’m gonna break it down real simple, with some handy tips and examples to get you rollin’.

Right away, the short answer is to pay as much extra as your budget will allow without affecting your other bills. If you can, start with $50 to $100 a month. Little extras can cut months off your loan and save you a lot of money on interest. Don’t leave me yet, though—I’m going to teach you all the good stuff we need to know to figure out what works for you.

Why Pay Extra on Your Car Payment? The Big Win

Is it worth it to pay more? Let’s talk about that before we get to the “how much.” You don’t just pay for the car when you get a loan; you also pay interest on the money you borrowed. Over the years, that interest can add up to a lot of money, especially if the loan term is long. Here’s the deal .

- Cuts Down Interest Costs: Extra payments go straight to the principal (the actual amount you borrowed), not the interest. Less principal means less interest piling up over time.

- Shortens Your Loan Term: Payin’ more now means you finish payin’ off the car way sooner. Imagine bein’ done in 3 years instead of 5!

- Financial Freedom, Baby: The sooner you’re outta debt, the more cash you got for other dreams—vacations, savin’ up, or just not stressin’ every month.

I remember when I first started throwin’ extra at my car loan, it felt like a weight liftin’ off. Even if it’s just a few bucks, it’s a step closer to ownin’ that ride outright

Car Loan Basics: What You’re Workin’ With

Let’s make sure we all understand how car loans work. Don’t worry if this is new to you—I’ll keep it simple. This is what happens when you borrow money to buy a car:

- Loan Amount (Principal): This is the chunk of cash you borrowed to buy the car. Say, $30,000 for a sweet ride.

- Interest Rate (APR): This is the percentage you pay on top of the principal each year. Could be 5%, 6.7%, or higher if your credit ain’t stellar.

- Loan Term: How long you got to pay it back—usually 24 to 84 months (2 to 7 years). Longer terms mean smaller monthly payments but more interest overall.

- Monthly Payment: Part of this goes to interest, part to principal. Early on, more goes to interest, which sucks, but it flips over time.

When you pay extra, that money skips the interest nonsense and chips away at the principal. That’s the magic trick! But decidin’ how much extra to pay depends on your loan details and your wallet.

How Much Extra Should I Pay? Findin’ Your Number

Now, the big question: how much extra should you pay on your car payment? There ain’t a one-size-fits-all answer, but I got a game plan to figure it out. Let’s break it into steps so it don’t feel like a dang kerfuffle.

Step 1: Check Your Budget, Homie

First things first, look at your monthly cash flow. You can’t pay extra if you’re scrapin’ by. Ask yourself:

- How much do I got left after bills, groceries, and a lil’ fun money?

- Can I cut back on somethin’ small—like eatin’ out less—to free up $50 or $100?

- Am I savin’ for emergencies? (Don’t skip this—life throws curveballs!)

It’s good to have at least $50, $100, or even $200 extra every month. If not, even $25 helps. The key is consistency—payin’ extra every month adds up.

Step 2: Look at Your Loan Details

Next, dig into your loan deets. You need to know:

- Your current balance (how much you still owe).

- Your interest rate (higher rates mean more savings if you pay extra).

- How many months you got left on the term.

Got a high interest rate like 7% or more? Payin’ extra is gonna save you a ton ‘cause interest eats up more of your payment. Lower rate, like 3%? Still worth it, but the savings ain’t as dramatic.

Step 3: Start Small and See the Impact

If you’re not sure where to start, try tossin’ an extra $50 or $100 at your payment. Lemme show ya how this plays out with a real example. Say you got a $35,000 loan at 6.7% interest for 60 months (5 years), and you’ve got 48 months left. Here’s what happens with different extra amounts each month:

| Extra Payment Per Month | Months Shaved Off Term | Total Interest Saved |

|---|---|---|

| $0 | 0 | $0 |

| $50 | 3 | $322.72 |

| $100 | 6 | $598.03 |

| $150 | 9 | $834.93 |

| $200 | 11 | $1,042.08 |

See that? Even $50 a month knocks off 3 months and saves over 300 bucks! Bump it to $200, and you’re done almost a year early, savin’ over a grand. That’s real money back in your pocket!

Step 4: Consider Bigger Moves

If you got a windfall—like a tax refund or a bonus—think about a one-time extra payment. Or, switch to bi-weekly payments instead of monthly. Payin’ half your monthly amount every two weeks means you sneak in an extra payment each year, ‘cause there’s 26 bi-weekly payments versus 12 monthly ones. Check this out for the same $35,000 loan:

- Monthly Payment with $300 extra: Total interest paid around $2,605, paid off in about 38 months.

- Bi-weekly Payment with extra built in: Total interest drops to around $1,710, and you’re done in 36 months, savin’ nearly $900!

That’s the power of frequency, y’all. It’s like trickin’ your loan into disappearin’ faster.

Step 5: Use a Calculator to Play Around

I’m a big fan of messin’ around with numbers to see what works. There’s plenty of free tools out there where you punch in your loan amount, rate, term, and extra payment to see the results. You can experiment with:

- Small extras ($25-$100) to stay comfy.

- Bigger extras ($200+) if you’re hustlin’ hard.

- One-time payments versus regular extras.

These tools even show you an amortization schedule—fancy word for a chart that breaks down each payment into interest and principal. You’ll see how extra payments shrink that interest chunk fast.

Things to Watch Out For (Don’t Get Burned!)

Payin’ extra sounds awesome, but there’s a couple traps to dodge. I learned this the hard way, so lemme save you the headache.

- Prepayment Penalties: Some lenders ain’t cool with you payin’ off early—they charge a fee if you do. Check your loan agreement or call your lender to see if this applies. If there’s a penalty, weigh if the savings from payin’ extra still beat the fee.

- Don’t Starve Other Goals: If payin’ extra means you got no emergency fund or can’t pay credit card debt with crazy high interest (like 20%), hold off. Tackle the pricey debt first.

- Precomputed Interest Loans: Some car loans calculate interest upfront, so payin’ extra don’t save as much. Ask your lender how your interest works—simple interest is better for early payoff.

I once threw a bunch extra at my loan without checkin’, only to find out there was a small penalty. Still saved money overall, but I felt like a goof for not readin’ the fine print.

Different Strokes for Different Folks: Scenarios

Everybody’s situation is different, so let’s walk through a few scenarios to see what “extra” might look like for you. Pick the one closest to your vibe.

Scenario 1: Tight Budget, Small Extras

Say you’re makin’ ends meet, but you can squeeze out $25 a month extra. You got a $20,000 loan at 5% for 60 months. Addin’ that $25 might only shave off a couple months, but you could save around $150 in interest. Plus, it builds the habit of payin’ more. Start small, and if you get a raise, bump it up.

Scenario 2: Decent Income, Moderate Extras

You’re doin’ alright, got $100 extra to throw at a $30,000 loan at 6% with 50 months left. That $100 could cut your term by 5-6 months and save you close to $500 in interest. That’s a vacation right there!

Scenario 3: Ballin’ with Big Extras

Maybe you’re crushin’ it and can afford $300 extra each month on that same $30,000 loan. You might slash the term by over a year and save thousands on interest. Or, if you get a $5,000 bonus, dumpin’ it as a one-time payment could have a similar effect. Go big if you can!

Other Ways to Attack That Loan

Payin’ extra ain’t the only way to get ahead. Here’s a few more ideas I’ve tried or seen pals use:

- Round Up Payments: If your payment is $432, round it up to $500. That extra $68 adds up without feelin’ like a huge hit.

- Principal-Only Payments: Tell your lender the extra is for “principal only” so it don’t get applied to future interest. Some lenders need you to specify this.

- Refinance for Better Rates: If your interest rate is high, look into refinancin’ for a lower rate. Might save more than payin’ extra, especially if your credit’s improved.

- Side Hustle Cash: Got a side gig? Use that money just for extra payments. Feels less painful when it’s “bonus” cash.

I started roundin’ up my payments back in the day, and it was like a sneaky way to pay more without noticin’. Worked like a charm.

Makin’ a Plan That Sticks

Alright, now that you got the gist of how much extra to pay, let’s lock in a plan. Here’s what I’d do if I was in your shoes:

- Figure Your Extra: Based on your budget, decide on $25, $50, $100—whatever works. Use my table above as a guide.

- Set It and Forget It: Set up automatic payments with the extra included so you don’t gotta think about it each month.

- Check In Yearly: Every year, see if you can up the extra amount. Got a raise? Bonus? Throw it at the loan.

- Track Progress: Keep an eye on your balance droppin’. It’s motivatin’ as heck to see that number shrink!

- Celebrate Wins: When you shave off months or hit a milestone (like half paid), treat yo’self to somethin’ small. Keeps the vibes up.

I used to check my loan balance every few months, and seein’ it drop faster ‘cause of my extras made me feel like a financial wizard. You’ll get that rush too.

What If I Can’t Pay Extra Right Now?

If your budget’s tighter than a drum, don’t stress. There’s still stuff you can do:

- Pay On Time, Every Time: Avoid late fees and keep your credit solid. That’s step one.

- Cut Other Costs: Look for tiny savings—like cancelin’ a subscription—and redirect even $10 to the loan when possible.

- Wait for a Windfall: Tax refund or holiday bonus comin’? Plan to use a chunk for the loan instead of splurgin’.

- Refinance Later: If rates drop or your credit gets better, refinancin’ might lower your payment, freein’ up cash to pay extra down the line.

I’ve been broke before, and just focusin’ on on-time payments kept me sane till I could do more. You got this, even if it’s slow goin’.

The Emotional Side of Payin’ Extra

Lemme get real for a sec. Payin’ extra on your car loan ain’t just about numbers—it’s about feelin’ in control. Every extra dollar you pay is a middle finger to debt. It’s sayin’, “I’m the boss of my money, not you.” When I paid off my car a year early, I legit threw a lil’ party for myself. No more payments hangin’ over my head felt amazin’.

But don’t let it stress ya out either. If payin’ extra makes you anxious ‘cause you’re stretchin’ too thin, dial it back. Money’s s’posed to work for you, not the other way ‘round.

Wrappin’ It Up: Take Charge Today

So, how much extra should you pay on your car payment? Start with what you can—$50, $100, or more if you’re able. Even small amounts save you interest and get you done quicker. Check your budget, know your loan, and play with the numbers to see the impact. Watch out for penalties and balance it with other goals, but don’t overthink it. Just start.

We at [Your Company Name] are all about helpin’ folks like you take charge of finances, one step at a time. Got questions or wanna share how much extra you’re payin’? Drop a comment below—I’m all ears! And hey, if you found this helpful, share it with a buddy who’s got car loan blues. Let’s get everyone drivin’ debt-free sooner rather than later. Catch ya on the flip side!

How to use this calculator

By putting the following into our loan calculator, you can find out how to pay off your car loan early and how much you could save. To get started, enter the following:

- 1. Schedule for amortization: The amount of interest that is paid off on a loan over time. There is a payment made every month toward both the loan principal and the interest.

- 2. Annual percentage rate (APR): This number, which changes based on current auto loan rates, shows how much interest and fees you’ll pay over the life of your loan. a loan amount that you will have to pay back over the course of a year

- 3. The amount of money you borrow from a lender to buy your car is called the loan amount. A lot of the time, this amount is less for used cars.

- 4. Loan term: The amount of time you have to pay back your lender for the loan. When it comes to car loans, these terms usually range from 24 to 84 months.

- 5. Another name for a prepayment penalty is an early payment fee that lenders charge borrowers who pay off their loan early or make extra payments before the due date.

- 6. The principal balance is the amount of money you owe on the loan you took out to buy the car.

- 7. When you click “View Report,” you’ll see a summary of how much of your auto loan you’ve paid off and a list of your loan payments. You also have the option to print this report.

- Figure out how much your car loan will cost you in total, including interest and fees. Find out how much your car loan will cost you in total, including interest and fees.

- Figure out how long it will take you to pay off your loan with the monthly payment you’re making now. With that number in mind, you can start looking into different payment amounts and how much they might save you. Figure out how long it will take you to pay off your loan with the monthly payment you’re making now. With that number in mind, you can start looking into different payment amounts and how much they might save you.

- Change the amount of your payment in the calculator to see how faster you could pay off your car loan if you made bigger payments or more of them (for example, two payments a month instead of one). For reference, the average auto loan term is 68. 63 months for new vehicles and 67. 22 months for used. Change the amount of your payment in the calculator to see how faster you could pay off your car loan if you made bigger payments or more of them (for example, two payments a month instead of one). For reference, the average auto loan term is 68. 63 months for new vehicles and 67. 22 months for used.

- Once you know how much your loan costs now, you can use the calculator to see if reducing the length of your loan could lower your interest rates. Long loan terms could save you money each month, but they may cost you a lot more in interest over the course of the loan. Once you know how much your loan costs now, you can use the calculator to see if reducing the length of your loan could lower your interest rates. Long loan terms could save you money each month, but they may cost you a lot more in interest over the course of the loan.

- If you click “View Report” on the calculator, it will make a schedule of your current payments as well as a separate schedule of your accelerated auto loan payments. This report can help you compare your current plan for paying off your debts with other options that might save you money. If you click “View Report” on the calculator, it will make a schedule of your current payments as well as a separate schedule of your accelerated auto loan payments. This report can help you compare your current plan for paying off your debts with other options that might save you money.

How to make the most of this calculator

An auto loan early payoff calculator can help you:

- Determine the total cost of your loan.

- Find out how much you still owe on your car loan.

- Experiment with different terms and monthly payment amounts.

Imagine you took out a $35,000 auto loan for 60 months at 6. 70 percent interest. You have 48 months remaining on your loan. The table below illustrates the potential savings you could achieve by increasing your monthly payment by various amounts.

| Increased payment amount | Term is shortened by | Savings |

|---|---|---|

| $0 | 0 months | $0 |

| $50 | 3 months | $322.72 |

| $100 | 6 months | $598.03 |

| $150 | 9 months | $834.93 |

| $200 | 11 months | $1,042.08 |

Paying Off Car Loan Early | Principal vs Extra Payment Explained

FAQ

How much extra should you pay on a car loan?

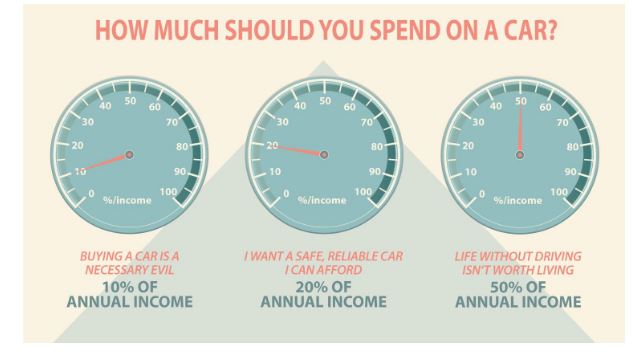

How much extra should you pay on car? Financial experts recommend spending no more than 10% of your monthly take-home pay on your car payment and no more than 15% to 20% on total car costs such as gas, insurance and maintenance as well as the payment. Should I pay a little extra on my car loan?.

Can you pay extra on a car loan?

In most cases, you can pay extra on your car loan. By paying more than the minimum, it can help you pay off your car loan faster Extra car payments may not automatically go to the loan principal. If you don’t tell your lender how to use them, they’ll probably be put toward interest first. How Does Extra Payment on Your Car Loan Work?

Should I pay extra on my car loan principal?

Paying extra on your auto loan principal won’t decrease your monthly payment, but there are other benefits. Paying on the principal reduces the loan balance faster, helps you pay off the loan sooner and saves you money. Should I pay extra on my car payment each month?.

What if you pay extra on a $20,000 auto loan?

Here is an example of how much you would pay off if you added $100 to your monthly payment on a $20,000 car loan with 36 months left on the term. That extra payment would help you pay off the loan seven months early, which would save you more than $200 in interest. What if you want to make a large one-time payment on your auto loan?.

What happens if I pay more than my monthly auto loan payment?

Most auto loans use simple interest, so the interest amount you pay monthly is based on the principal amount you still owe. Therefore, when you pay more than your required monthly auto loan payment, you’ll want to ensure the extra funds go toward paying the car loan principal.

How much does it cost to pay off a car loan?

Your current monthly payment is $377. If you want to pay off your loan seven months early, you’ll need to pay an extra $100 each month. This will save you over $200 in interest charges.

What happens if I pay an extra $100 a month on my car loan?

How much more should you pay on your car payment?

Many financial experts recommend spending no more than about 10% to 15% of your monthly take-home pay on an auto loan payment. Get auto loan offers to bring to a dealer with one of our top picks, myAutoloan.

What is the 50 30 20 rule for car payments?

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

How to pay off a 6 year car loan in 3 years?

- Refinance Your Car Loan.

- Make Biweekly Payments.

- Make Extra Lump-Sum Payments.

- Avoid or Cancel Add-On Expenses.

- Adjust Your Budget.