If youre like many people, you dont buy into the traditional definition of retirement. You may be planning an encore career or looking to maximize opportunities to travel. Hopefully, new adventures and new activities await you.

But remember, as you redefine your retirement, consider your retirement income plan, mapping it to a budget based on what you expect to spend—or can afford to spend—category by category throughout your retirement.

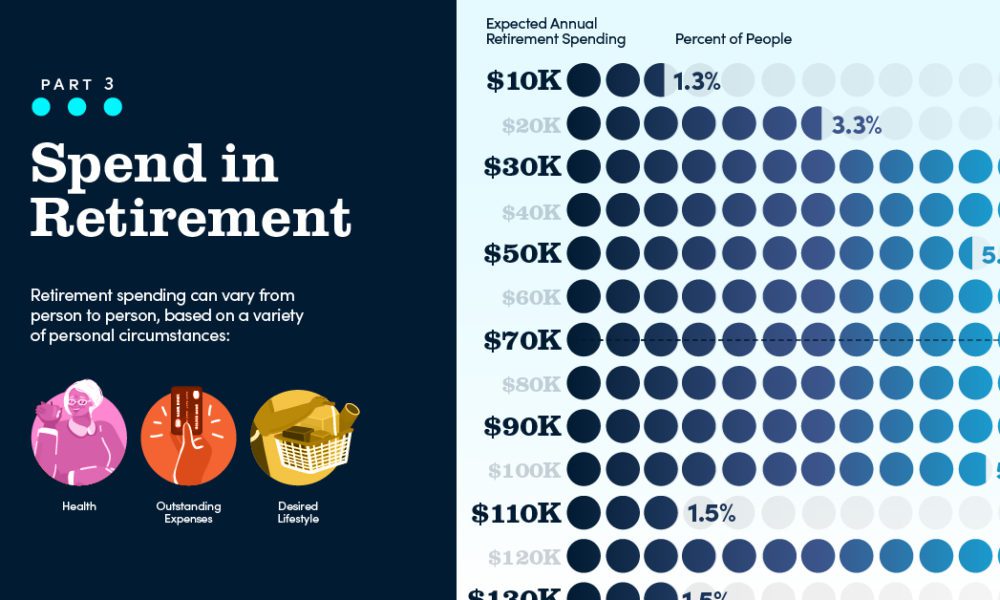

One of the biggest and most baffling questions youll likely face is determining what kind of a retirement lifestyle you can actually afford. Some of your expenses will go down, but others may actually go up.

How will you really know the extent of all these expenses before you enter retirement? The good news is this task gets easier the closer you get to retirement if youve already created a retirement budget and explored what your lifestyle will be like in retirement. Then you can turn your “guestimate” of retirement expenses into a detailed retirement income plan either on your own or with an advisor.

“When estimating the cost of retirement lifestyles, most people seek to maintain their standard of living, which generally peaks in your late 40s to mid-50s,” says Steve Feinschreiber, senior vice president of Financial Solutions at Fidelity. “Fortunately, many people who have saved adequately for retirement can fulfill their dreams because their overall expenses are generally reduced in retirement save one important category—health care.”

Are you approaching retirement and wondering how much of your nest egg should go toward housing? You’re not alone. Housing costs can make or break your retirement plans, and finding that sweet spot between comfort and financial security is crucial for your golden years.

As someone who’s helped many retirees navigate this decision, I’ve seen both successes and struggles. Let’s dive into what financial experts recommend and how to make the smartest housing decisions for your retirement.

The 30% Rule: Your Housing Budget Guideline

Financial experts consistently recommend that your total housing expenses should not exceed 30% of your overall retirement income. This isn’t just a random number – it’s a time-tested guideline that helps ensure you have enough money left for other essential expenses.

What does this 30% include? Everything related to your housing:

- Mortgage payments (if you still have them)

- Property taxes

- Homeowners insurance

- Maintenance and repairs

- HOA fees (if applicable)

- Utilities

For example, if your retirement income is $5,000 per month, your housing costs shouldn’t exceed $1,500 monthly. This leaves you with $3,500 for healthcare, food, transportation, leisure activities, and savings for unexpected expenses

Why Most Retirees Overspend on Housing

Here’s a surprising fact from finance experts: If you want a secure retirement, you should save about 12 to 15 percent of your income throughout your working years. But many people can’t achieve this because their mortgage consumes about 12 to 15 percent more of their monthly income than it should.

This creates a dangerous math problem for retirees. Every dollar overspent on housing is a dollar that can’t work for you elsewhere. And in retirement when income sources are more fixed this imbalance becomes even more problematic.

Practical Examples: What Housing Costs Look Like in Retirement

Let’s break this down with some real numbers

Example 1: If you’re living on a $30,000 annual retirement income, your housing expenses shouldn’t cost more than $9,000 per year, or $750 per month.

Example 2: For a couple with $60,000 annual retirement income, housing costs should stay under $18,000 yearly, or $1,500 monthly.

These numbers might seem tight, especially if you’re in a high-cost area. But remember – exceeding these limits could mean sacrificing other important aspects of your retirement lifestyle.

Factors That Should Influence Your Housing Budget

When deciding how much house you can afford in retirement, consider these critical factors:

1. Your Retirement Income Sources

Take stock of all income streams:

- Social Security benefits

- Pension payments

- 401(k) or IRA withdrawals

- Annuity income

- Part-time work income

- Rental property income

- Other investments

The more stable and guaranteed these income sources are, the more confident you can be in your housing budget.

2. Existing Debt Obligations

Outstanding debts will reduce your available income for housing:

- Credit card balances

- Car loans

- Medical debt

- Personal loans

- Ongoing financial support for family members

Ideally, you should aim to enter retirement with minimal debt or a clear plan to eliminate it quickly.

3. Lifestyle Preferences and Goals

Your retirement vision matters tremendously:

- Do you plan to travel extensively? (This might mean less spent on housing)

- Do you have expensive hobbies?

- How important is entertainment and dining out?

- Will you need to support adult children or grandchildren?

4. Healthcare Considerations

Healthcare costs tend to increase as we age:

- Medicare premiums and supplemental insurance

- Out-of-pocket medical expenses

- Potential long-term care needs

- Prescription medications

The average retiree spends a significant portion of their budget on healthcare, so leave room for these expenses to grow.

5. Location Factors

Where you live dramatically impacts housing costs:

- Property tax rates vary widely by region

- Maintenance costs differ by climate

- Utility expenses fluctuate by region

- Some states offer better tax advantages for retirees

Housing Options to Consider in Retirement

Staying in Your Current Home

Pros:

- Familiar surroundings and established community

- No moving costs

- Potential emotional benefits

- May be mortgage-free

Cons:

- Could be more house than you need

- Maintenance may become difficult

- May not be age-friendly

- Potentially high property taxes

Downsizing

Pros:

- Reduced maintenance

- Lower utility costs

- Potential to free up equity

- Possibly more age-appropriate layout

Cons:

- Moving costs and hassle

- Emotional adjustment

- Less space for family visits

- Market timing challenges

Renting

Pros:

- No maintenance responsibilities

- Flexibility to move

- No property taxes or insurance

- Predictable monthly costs

Cons:

- No equity building

- Rent can increase

- Limited ability to modify the space

- Potential instability

Independent Living Communities

Pros:

- Maintenance-free lifestyle

- Built-in social opportunities

- Amenities included

- Often offers continuum of care options

Cons:

- Can be expensive

- Monthly fees may increase

- May require significant upfront payment

- Less privacy than independent housing

The 4% Rule and How It Applies to Housing

You’ve probably heard of the 4% rule for retirement withdrawals – taking out 4% of your retirement savings annually to make your money last. This rule can also help you think about housing costs.

For example, if you have $500,000 in retirement savings, the 4% rule suggests you can withdraw about $20,000 annually for about 30 years. If housing should be no more than 30% of your income, that means spending no more than $6,000 per year on housing from your savings (plus whatever portion of Social Security or pension income you allocate).

Real Retirement Housing Numbers: What Retirees Actually Spend

According to the Bureau of Labor Statistics, the average household headed by someone 65 or older spends about $48,791 per year, or roughly $4,066 monthly. Of this, housing typically represents the largest expense category.

The average retired couple lives on about $624 a month for transportation expenses, which is less than the $895 that the average U.S. household spends. This illustrates how retirement spending differs from working-age spending.

Smart Strategies to Reduce Housing Costs in Retirement

1. Pay Off Your Mortgage Before Retiring

Eliminating your mortgage payment can dramatically reduce your monthly housing expenses. Consider making extra payments in your final working years to achieve this goal.

2. Rightsize Your Home

This doesn’t necessarily mean downsizing to something tiny. It means finding the right balance of space, maintenance, and cost for your retirement lifestyle.

3. Consider Geographic Arbitrage

Moving from a high-cost area to a lower-cost region can significantly stretch your retirement dollars. Many retirees find they can upgrade their lifestyle by relocating to areas with lower housing costs.

4. Explore Property Tax Relief Programs

Many states and localities offer property tax breaks for seniors. Research what’s available in your area or in places you’re considering for retirement.

5. Make Age-Friendly Modifications Early

Investing in accessibility improvements while you still have employment income can prevent costly emergency renovations later.

6. Consider House Sharing or Having a Roommate

This arrangement can cut housing costs substantially while providing companionship and security.

When It Makes Sense to Spend More on Housing in Retirement

Despite the 30% guideline, there are situations when allocating more toward housing might be justified:

- If your home serves multiple financial purposes (like a future inheritance for children)

- When your home provides income (through renting out a portion)

- If you’ve eliminated most other expenses

- When your home is central to your quality of life and happiness

- If you have substantial assets beyond your retirement accounts

Warning Signs You’re Overcommitted on Housing

Watch for these red flags that suggest your housing costs may be too high:

- You’re regularly dipping into savings for ordinary expenses

- You’re delaying needed home maintenance due to cost

- You feel anxious about housing costs frequently

- You’re sacrificing healthcare needs to pay for housing

- You’ve eliminated most discretionary spending

- You’re accumulating credit card debt for everyday expenses

Can You Retire with a Mortgage?

While conventional wisdom suggests paying off your mortgage before retirement, this isn’t always necessary or possible. The key question isn’t whether you have a mortgage, but whether your total housing costs fit within the 30% guideline.

Some retirees maintain mortgages because:

- Their interest rate is very low

- They prefer liquidity over having money tied up in home equity

- They benefit from mortgage interest tax deductions

- They’re investing the difference at a higher return rate

Looking at the Big Picture: Housing as Part of Your Retirement Plan

Your housing decision shouldn’t be made in isolation. It’s one piece of your overall retirement strategy. Work with a financial advisor to model different housing scenarios and their impact on your retirement security.

Remember that housing needs can change throughout retirement. What works at 65 may not be ideal at 85. Build flexibility into your planning, and periodically reassess whether your housing situation still meets your needs.

The Bottom Line: Finding Your Housing Sweet Spot

Finding the right balance for housing costs in retirement is deeply personal. While the 30% guideline provides a solid starting point, your specific circumstances might justify adjustments up or down.

The most important thing is making an intentional, informed decision rather than defaulting into housing costs that might undermine your financial security. By carefully considering your income, expenses, lifestyle goals, and housing options, you can create a retirement housing plan that supports both your financial needs and quality of life.

How your spending habits change in retirement

As people age, their spending patterns change, according to an analysis of Bureau of Labor Department data.2 On average, US households under age 55 spend almost $58,000 a year on a wide variety of expenses. Starting at age 55, spending tends to increase slightly, as some younger retirees travel or take on new pursuits. In the age range when most are retired at 65+, there is a significant drop in overall spending.

Source: Consumer Expenditure Survey data 2023, average US retiree total expenses by age.

The makeup of spending also changes. While spending on food, entertainment, and transportation remains relatively stable, spending on housing tends to go down and spending on health care goes up.

Expect to spend less on housing in retirement

Many retirees overestimate housing costs. In fact, average housing costs drop over time among retirees, as many downsize, move to cheaper parts of the country (or world), or find other creative ways to trim housing costs or pay off their mortgage (see chart).

Source: Consumer Expenditure Survey data 2023, average US retiree housing expenses by age.

“There are a number of housing decisions to consider as you transition from working to full-time retirement,” says Feinschreiber. “Work with your advisor to develop a housing strategy—with several different options— as you project where youll plan to live over the next 20–30 years. Whether you plan to downsize, relocate, or age in place—or consider such options as cohousing or living with one of your children–you can expect your overall housing cost to decline as you age.”

How To Know How Much House You Can Afford

FAQ

How much should you spend on a home?

When someone is working, my general rule of thumb is that a person should not spend more than 20% of their income on a home. For example, if your family income is $100,000, your total mortgage payments, including taxes and insurance, should not be over $20,000 per year, or $1,667 per month.

How much should your home payment be for a comfortable retirement?

This article will help guide you in determining how much your home payment should be for a comfortable retirement. When someone is working, my general rule of thumb is that a person should not spend more than 20% of their income on a home.

Can I spend more of my income on a home in retirement?

While working, you may see 30-40% of each paycheck eaten by taxes and savings. In retirement, you will probably see less than 15% of this same amount of income go to taxes, and of course, no savings. Therefore, you can spend more of your income in retirement on a home, but of course, there is a large catch.

How much money should a retiree spend in a year?

The traditional advice for retirees who need to make their money last for 30 years is to spend no more than 4% of their savings in the first year of retirement, and in subsequent years raise those withdrawals to keep pace with inflation. Copyright © 2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Can you afford a home with $110,000 in retirement income?

Let’s look at the couple above who has $110,000 in retirement income. Given the 25% rule of thumb, they can afford $27,500 per year on mortgage/rent or $2,291 per month. Living in Michigan, we are fortunate to have lower home prices than most parts of the country.

How much should you expect to earn in retirement?

Here is an example of a couple entering retirement and their anticipated income. This couple should expect $110,000 in income in retirement. Once you determine your retirement income, you can figure out how much home you can afford.

How much should a retired person spend on a house?

… your total housing expenses, including mortgage payments, property taxes, insurance, and maintenance, should not exceed 30% of your overall retirement income

What is the 7% rule for retirement?

How many Americans have $500,000 in retirement savings?

What is the best size house for a retiree?

In retirement, the goal isn’t to have more space—it’s to have the right space. Think of a home that’s easy to live in, manage, and enjoy. Ideal size range? For most retirees, a home between 1,500 to 2,200 square feet hits the sweet spot.