When you first get a credit card, your credit line (also called a credit limit) may not be as high as youd like. You might be able to ask for a higher credit limit after a while of having the new credit card.

It can be helpful to have a credit card with a high credit limit. You can buy big things with it without putting too much on your card. It also helps you keep your credit utilization ratio low, which is good for your credit score. But most credit cards have a low limit when you first get them. That being said, you may be wondering how often you can ask Discover to raise your credit limit.

What Factors Determine Your Initial Credit Limit?

When you first open a credit card. the issuer will determine your initial credit limit based on a few key factors

-

Credit score: Your credit score tells lenders how well you’ve paid back debts in the past. The higher your score, the more trustworthy you appear.

-

Income: Lenders want to know that you make enough money to make your monthly payments. Higher income often means a higher credit limit.

-

Existing debt – If you already have a lot of debt, you may get a lower credit limit. Lenders avoid overextending borrowers.

-

Credit history—People who apply for credit with little history are often given lower limits until they can prove they can pay them back.

-

Type of credit card – Premium travel rewards cards tend to have higher limits than basic cash back cards.

So if you start with a low limit, don’t take it personally. The lender is just being cautious until you build a relationship.

When to Request a Credit Line Increase

After responsibly using your card for 6 months or more, you can request a credit limit increase. Good times to ask include:

- You’ve never asked for an increase before

- Your credit score has improved significantly

- Your income has increased

- You now have a long credit history

Avoid asking if you’ve recently applied for new credit or your credit score has dropped.

How Often Can You Request an Increase from Discover?

Discover does not publish an official policy on how frequently you can request credit line increases But most issuers allow increases every 6 to 12 months for customers in good standing

Anecdotally, it seems Discover may allow increases as often as every 3 months for some borrowers. But you’ll have the best shot if you wait at least 6 months between requests. Discover wants to see that you’ve used your existing limit responsibly before approving more credit.

After being denied a request, wait even longer before asking again – maybe 9 to 12 months. Use that time to improve your financial profile

How to Request a Credit Line Increase from Discover

Requesting an increase from Discover is easy:

- Call 1-800-DISCOVER

- Log in online and go to Account Services > Credit Line Increase

- Open the Discover Mobile App and go to Services > Credit Line Increase

The process only takes a few minutes. Discover will review your account and let you know if you’ve been approved.

If denied, don’t take it personally. Focus on using your card responsibly, paying balances in full each month, and boosting your credit score. Then wait at least 6 months before politely asking again.

Weighing the Pros and Cons of a Higher Limit

A higher credit limit comes with both advantages and potential drawbacks:

Pros

- Make large purchases without maxing out your card

- Lower overall credit utilization

- More flexibility in emergencies

- Earn more rewards on spending

Cons

- Temptation to overspend

- Higher potential losses from fraud

- Slight ding to credit from hard inquiry

- Higher minimum payments

Evaluate your own spending habits and financial situation to decide if requesting an increase is right for you. And remember to spend responsibly no matter how high your limit goes.

Maintaining a Healthy Credit Profile

Here are a few tips for keeping your credit profile strong, which will help with increase requests:

-

Pay balances in full each month – This shows you reliably handle credit.

-

Keep credit utilization low – Try to use less than 30% of your total available credit.

-

Monitor your credit – Review reports regularly for errors or suspicious activity.

-

Limit hard inquiries – Each credit check can impact your score for a few months.

-

Have a mix of credit types – Credit cards, loans, mortgages, etc.

Good financial habits lead to higher credit limits and better loan terms over time. Be patient, focus on smart money management, and your available credit will gradually grow.

The Bottom Line

So how often can you request a credit line increase from Discover? There’s no set limit, but every 6 months is a good baseline. Just be sure to time your requests appropriately, use your card conscientiously, and have realistic expectations if denied. With responsible credit management, your limit should steadily rise.

When should you request a credit line increase?

People have many reasons for requesting a credit line increase. If you travel frequently, you can put flight and hotel purchases on your card to accrue extra miles or cash back rewards. If you have a lot of work expenses for which youre reimbursed, using a credit card will free up your available cash until you’re repaid.

Building a good credit history is partially about showing the credit issuer you can repay your credit card balance on time, every month. If your credit score has increased since you first got a credit card, you may be in a good position to request a credit limit increase.

Credit card companies look for a long history of good repayment behavior. If you have been using your card responsibly and repaying it consistently, you may be in a good position to ask for a higher credit limit.

Fortunately, if you apply for a credit line increase and don’t receive it, you’ll get a letter from the issuer describing the reason why.

Do you have a student credit card? If you demonstrate an on-time monthly payment history and show that you have extra income, then it might be a good time to ask for a credit limit increase. Note that some issuers might require your student card to be open and active for a certain number of months before you’re allowed to ask for an increase. Just call your credit card issuer to see if you can request a limit increase.

Especially if you get a new job with more pay. This allows you to maintain your credit history and makes you eligible for potential limit increases.

If you’re a cardmember with a traditional credit card account, there are other reasons you might easily qualify for a credit increase. Examples include a pay raise or a new higher-paying job. Having more income signals to the credit card issuer that you’ll be able to maintain your good repayment behavior, even if your spending increases.

How do you ask for a Discover credit line increase?

To reach a customer service rep who can help you request a credit line increase on your Discover Card, call 1-800-DISCOVER. You can always find our number on the back of your card.

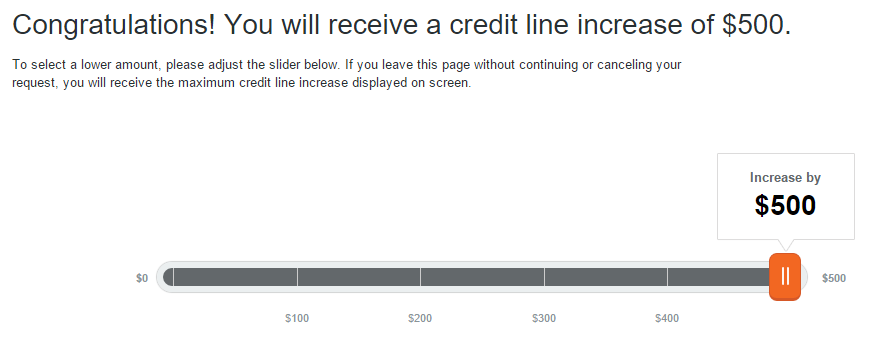

You can also request a credit limit increase online. To do so, select “Card Services” and then “Credit Line Increase” in the online Discover Account Center or “Services” and “Credit Line Increase” in the Discover Mobile App.

How To Get a Huge DISCOVER IT Credit Limit Increase

FAQ

How often can you get a Discover credit line increase?

There’s no specific timeframe Discover enforces between credit limit increase requests. However, they do consider factors like your credit history, on-time payments, and income when deciding on a request.

How to get $50,000 credit card limit?

To obtain a $50,000 credit card limit, you’ll generally need an excellent credit score (750 or higher), a high income (typically six figures), and a history of responsible credit card use.

How do I trigger an automatic credit limit increase?

…your chances of getting an automatic credit limit increase go up if you keep your credit utilization ratio low, pay your balances on time, and make enough money (Feb 24, 2023)

How often does your credit line increase?

Credit card issuers may increase credit limits either automatically or upon request. Automatic increases often happen based on changes in income or credit score, and may occur annually or more frequently.