A mortgage or loan with a low interest rate can save you a lot of money over the life of the loan. But because interest rates change all the time, it can be hard to tell if you’re really getting a good deal.

This article will go over in detail whether 2 75% is considered a good interest rate in 2023.

What Goes Into Determining a Good Interest Rate?

There are a few key factors that impact whether an interest rate is considered good or not

-

The Type of Loan – Interest rates vary significantly depending on if it’s a mortgage, auto loan, personal loan, student loan, etc. Each loan type has its own range for good rates.

-

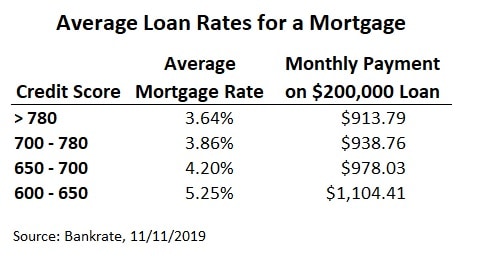

Credit Score—A better interest rate is possible if your credit score is high. Lenders offer better rates to borrowers deemed less risky.

-

Down Payment – For mortgages and auto loans, the size of your down payment also affects the interest rate. Bigger down payments lower the lender’s risk.

-

Market Conditions – Interest rates fluctuate based on factors like federal interest rate policies and competition among lenders.

-

Loan Term – Shorter loan terms often come with lower interest rates.

You can’t say for sure what interest rate is “good” without taking these things into account. Someone else’s “good rate” could be a different amount than yours.

How Does 2.75% Stack Up for Different Loan Types?

Let’s see how competitive 2.75% is for some of the most common loan types:

Mortgages

For a 30-year fixed-rate mortgage, 2.75% is an excellent rate in 2023. The average 30-year rate is currently around 7%. At the time this article was written, only borrowers with exceptional credit scores could expect to see 2.75%.

For 15-year mortgages, which carry higher rates, 2.75% is a steal. The average 15-year rate is above 7%, so this rate would require pristine credit.

Auto Loans

For a new auto loan, 2.75% is a very good rate in 2023 for borrowers with great credit, usually 740 or higher. The average auto loan rate currently hovers around 6%, so 2.75% gives major savings.

For a used car, 2.75% is competitive for buyers with credit scores in the 690-740 range. Used car loans have rates 1%-2% higher than new cars.

Personal Loans

A 2.75% rate on a personal loan is excellent in 2023. Borrowers with credit scores above 690 have the best shot at this rate. The current average rate on a 2-year personal loan is around 12%.

Anything under 8% is considered a good personal loan rate today. 2.75% requires tip-top credit and potentially taking other steps to lower rates like using collateral.

Student Loans

Student loan rates set by the federal government are fixed and don’t respond to market conditions. For 2022-23, undergrad federal student loan rates are 4.99% and graduate rates are 6.54%.

While 2.75% isn’t available for federal or private student loans right now, it would be an exceptionally low rate if offered. The average private student loan rate is currently 9-12%.

Should You Accept 2.75% If Offered?

If a lender approves you for a 2.75% interest rate on any type of loan in 2023, accepting is likely a very good move. Here are some pros of accepting:

-

Major interest savings – Even a small difference in rates can equal thousands in savings over the loan’s term. Just a 1% higher rate on a $300,000, 30-year mortgage costs nearly $30,000 more in interest.

-

Better cash flow – Lower monthly payments free up cash that can be used for other goals like retirement or college savings.

-

Opportunity to pay off faster – Lower rates make it more feasible to make extra payments and pay off your loan early.

However, there are a couple scenarios where accepting an ultra-low 2.75% rate may not be your best option:

-

You can only get it by paying discount points upfront – Sometimes lenders offer low rates if you pay more in origination fees. Run the math to see if it’s worth it long-term.

-

Your credit profile has improved significantly – If your credit score has increased by 75+ points recently, you may actually qualify for better terms elsewhere.

-

You plan to move or refinance very soon – The savings may not justify accepting a lower rate if you won’t keep the loan more than a couple years.

As long as the 2.75% loan fits your budget and timeline, it’s likely too good to pass up in 2023. Be sure to compare offers from multiple lenders though.

How to Get the Lowest Rate Possible

While 2.75% is highly competitive, here are some tips to potentially get even better rates:

-

Shop around – Compare offers from multiple lenders. Even small differences can save thousands.

-

Increase credit score – Making payments on time and lowering credit utilization can bump up your score.

-

Make a larger down payment – Putting 20% or more down on a mortgage or auto loan lowers rates substantially.

-

Shorten loan term – Opting for a 15-year mortgage, or 2-3 year auto or personal loan can mean a lower rate.

-

Pay discount points – Paying a fee upfront reduces the ongoing interest rate on a mortgage.

-

Use collateral – Backing a loan with an asset like a car or securities can qualify you for the lowest rates.

-

Enlist a cosigner – Adding a cosigner with excellent credit may increase your chances for the best rates.

The Bottom Line

While you can never predict exactly what mortgage rates or loan rates will do, locking in a low 2.75% interest rate in 2023 is likely a wise move for both savings and peace of mind.

Just be sure to compare lenders, run the numbers, and consider any fees or discounts associated with getting the rate. With smart decision making, you can maximize value and put yourself in an excellent financial position.

Current mortgage rates can be deceptive

Shopping around for a mortgage rate means applying with multiple lenders and getting personalized quotes. It means more than simply looking online and picking the lender with the lowest advertised rates.

Why? Because mortgage lenders tend to base their advertised rates on ‘ideal’ borrowers. They often include points that lower your mortgage interest rate but increase your upfront fees. Unless you have great credit, a significant down payment, and don’t mind paying extra closing costs, you probably won’t get those advertised rates.

The same applies to average rates. By definition, some borrowers will qualify for lower rates and some will get higher ones. What you’ll be offered will depend on your situation and personal finances.

How to find a good mortgage rate

A “good” mortgage rate is different for everyone.

In today’s market, a good mortgage interest rate can fall in the high-6% range, depending on several factors, such as the type of mortgage, loan term, and individual financial circumstances.

To understand what’s a good mortgage rate for you, get quotes from a few different lenders and compare them. This will show you the range of interest rates you’re eligible for and help you pick the cheapest lender for your situation.

In this article (Skip to…)

Bank of Canada Hold Interest Rate 2 75% April 2025

FAQ

Is 2.75% interest good?

A 2. 75% interest rate can generally be considered good, especially in the context of historical interest rates. Here are some things to think about: Type of Loan: For a mortgage, an interest rate below 3% is very good, especially when interest rates are going up.

Is 2.5 percent a good mortgage rate?

Mortgage Percentage Analysis 63. 3% of mortgage holders have a mortgage interest rate of between 2. 5% and 4%. This is the sweet spot where most Americans reside.

What is considered a good interest rate?

A “good” interest rate is relative and depends on the type of loan and the borrower’s creditworthiness. Generally, a lower interest rate is better, especially for loans like mortgages and auto loans. Rates below 2010 are often good for personal loans, and rates below 2015 can be good for credit cards.

What does 2.75 interest mean?

At the maximum 2. 75% annualized rate, you would earn around $27. 50 in interest annually (2. 75%*$1000), or around $2. 29 each month. Since interest is calculated daily and paid out monthly, you would receive around $2. 26 at the end of April: (30/365)*27. 50 = 2. 26.