Average auto loan interest rates can provide an idea of what APR to expect for your auto loan.

The products shown on this page are mostly or entirely from our advertising partners. They pay us when you click on one of their links and then do something on our site. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

When you’re getting ready to finance a new or used car, knowing the average car loan interest rate received by other recent car buyers is helpful. Having this information, especially if you have a credit score like mine, helps you know what rate to expect and how to properly compare loan offers.

The auto loan interest rate you receive is based on several factors — such as your income, credit history and credit score. Your credit score is one of the biggest factors in determining the rate you’ll get, because lenders use it to gauge how likely you are to repay the loan. Generally speaking, the higher your credit score, the lower your car loan interest rate is likely to be.

Also, the type of vehicle you buy affects your interest rate. For example, used car loan interest rates are usually higher than new car interest rates.

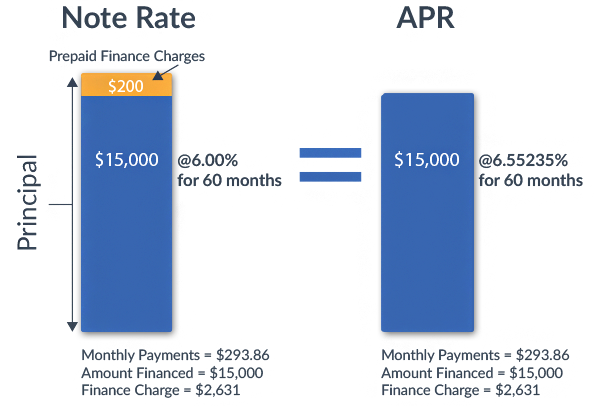

Car loan interest rates and annual percentage rates, or APRs, arent the same. Interest rate is the percentage you pay to borrow money. APR includes interest rate plus any fees charged by a lender. When comparing loan offers, make sure you are comparing the APR.

Getting a new or used car is an exciting experience. But financing the vehicle can be stressful, especially when you’re not sure what interest rate to expect. As you shop for an auto loan, one question you may ask is: Is 2.9% a good rate?

The interest rate has a big effect on the total cost of your loan, so it’s an important thing to think about when you’re choosing auto financing. This article will help you understand if 2.9% is a good rate and what factors go into figuring out your car loan APR.

What Does APR Mean on a Car Loan?

APR stands for annual percentage rate. It represents the actual yearly cost of borrowing money and includes the interest rate plus any fees or additional costs from the lender.

Take the case of a $25,000 auto loan with a 2% APR. If the interest rate is 9% and the lender charges a $100 origination fee, your APR would be a little higher than 30%. 9% to account for the fee.

Always compare APR when you shop and apply for loans, not just the interest rate. This gives you an accurate picture of the total cost.

What Is the Average Car Loan Interest Rate?

Interest rates on car loans can be quite different, ranging from about 3% to over 2020% for people with bad credit. Experian says the following were the average APRs in Q1 2022, broken down by credit score:

- Score 781-850: 5.18% (new), 6.82% (used)

- Score 661-780: 6.70% (new), 9.06% (used)

- Score 601-660: 9.83% (new), 13.74% (used)

- Score 501-600: 13.22% (new), 18.99% (used)

- Score 300-500: 15.81% (new), 21.58% (used)

In general, the highest credit scores (above 780) qualify for the lowest APRs on car loans, while subprime borrowers with scores below 600 pay the most

The average rate across all scores was around 6. 73% for new cars and 11. 87% for used cars in Q1 2022.

Is 2.9% a Good Interest Rate on a Car Loan?

Compared to current auto loan average rates, 2.9% is an excellent interest rate. It’s about half the average for borrowers with very good credit (scores 781-850). This means you’re getting a rate that’s well below what most people can expect to receive right now.

However, just because 2.9% is good compared to average doesn’t necessarily mean it’s the best rate you might qualify for. Interest rates can vary significantly between lenders.

For example, some banks or credit unions may offer 2.5% APR for top-tier borrowers while other lenders charge 3.5%. So it depends on your specific situation.

What Credit Score Do You Need for 2.9% APR Car Loan?

To get 2.9% APR or lower on a car loan, you generally need very good to exceptional credit. This typically means a FICO score of 720 or higher.

According to myFICO, people with scores in the following ranges can expect to receive APRs around 2.9%:

- 800-850: 1.98% – 2.98%

- 740-799: 2.45% – 3.45%

- 720-739: 2.65% – 3.65%

So while it’s possible to get 2.9% with a score in the low 700s, you stand the best chance with a score over 740. Some lenders may require 760+ for their lowest rates.

Other Factors Affecting Your Car Loan Rate

Beyond your credit score, several other aspects determine the interest rate you receive. These include:

- New or used car: New cars tend to get lower rates than used vehicles.

- Loan term: Shorter loans (3 years) have lower rates than longer loans (5-6 years).

- Your income: Higher incomes may qualify for lower rates.

- Make/model of vehicle: Luxury cars often have higher rates.

- Lender: Each lender uses different formulas, so shop around.

Getting pre-approved by one or multiple lenders before you even start looking for a car gives you an idea of what rate range to expect. Then once you find a car, you can negotiate the best deal since you already have financing lined up.

Should You Accept a Car Loan at 2.9% APR?

If you have the choice between 2.9% APR and a higher rate, 2.9% is likely the better option if you can comfortably afford the monthly payment. The lower interest rate saves you money over the life of the loan unless you plan to pay off the balance very quickly.

However, make sure to compare offers from other lenders and credit unions before signing. A local bank or credit union may beat 2.9% based on your situation. Pre-approval and rate shopping are your best tools for finding the lowest rate.

How to Get the Best Car Loan Rate Possible

Here are a few tips to ensure you get the lowest interest rate when financing a car:

-

Check your credit reports and score so you know where you stand. Dispute any errors.

-

Build your credit if needed by paying bills on time and lowering debt.

-

Get pre-approved with multiple lenders to compare rate offers.

-

Consider a shorter loan term as rates are lower (but monthly payment is higher).

-

Provide a larger down payment if possible to get better rates from most lenders.

-

Choose a used car over a new one if you want the lowest APR.

-

Compare offers carefully and negotiate if needed before accepting a loan.

The Bottom Line

A car loan interest rate of 2.9% APR is generally very good right now, especially for borrowers with excellent credit scores of 720 and higher. But always compare options from lenders and aim for the lowest rate possible for your situation. Pre-approval and rate shopping are the keys to saving money on auto loan financing.

Average car loan interest rates by credit score

Consumer credit reporting company Experian releases average auto loan interest rates in its quarterly Automotive Finance Market report. In the first quarter of 2025, the overall average auto loan interest rate was 6.73% for new cars and 11.87% for used cars.

Experian also provides average car loan APRs by credit score, based on the VantageScore credit scoring model.

|

Credit score |

Average APR, new car |

Average APR, used car |

|---|---|---|

|

Superprime: 781-850. |

5.18%. |

6.82%. |

|

Prime: 661-780. |

6.70%. |

9.06%. |

|

Nonprime: 601-660. |

9.83%. |

13.74%. |

|

Subprime: 501-600. |

13.22%. |

18.99%. |

|

Deep subprime: 300-500. |

15.81%. |

21.58%. |

|

Source: Experian Information Solutions, 1st quarter 2025. |

||

People with credit scores above 780 have the best shot of getting the lowest interest rates, with credit scores below 501 typically resulting in the highest interest rates.

How often do auto loan rates change?

When the Federal Reserve changes the federal funds rate, auto loan interest rates usually follow. Fed rate hikes that began in 2022 have pushed car loan interest rates to their highest level in years.

Find a good loan based on current rates

» Compare auto loan rates to find the best lender for you

Car Loan Interest Rates Explained (For Beginners)

FAQ

Is 9% a good APR for a car loan?

Car Loan APRs by Credit Score Excellent (750 – 850): 2. 96 percent for new, 3. 68 percent for used. Good (700 – 749): 4. 03 percent for new, 5. 53 percent for used. Fair (650 – 699): 6. 75 percent for new, 10. 33 percent for used. Poor (450 – 649): 12. 84 percent for new, 20. 43 percent for used.

Is 1.9 APR good for car?

In terms of cost, an interest rate of 1. 9% APR may not add much to your overall car purchase. On a $30,000 SUV, we estimate that a 5-year loan at 1. 9% APR would equate to $1,471 in money spent on interest alone. In contrast, a rate of 4% would equate to $3,150, while a loan at 6% would cost a little under $4,800.

How much is 2.9% APR for 72 months?

72 months at 2. 9% APR: 72 monthly payments of $15. 15 per thousand borrowed. 60 months at 2. 9% APR: 60 monthly payments of $17. 92 per thousand borrowed. 48 months at 2. 9% APR: 48 monthly payments of $22. 09 per thousand borrowed. 36 months at 2. 9% APR: 36 monthly payments of $29. 04 per thousand borrowed.

Is a 9.9 interest rate good?