In todays automotive market, with prices and rates on the rise, a 2. 9% APR is a good deal. But if this interest rate is good for you, it will depend on things like the market, your credit history, and what kind of manufacturer incentives are available at the moment for the car you want. With the average APR hovering around 10% these days, looking for a 2. 9% APR deal could save you money.

When shopping for a new vehicle securing the right auto financing can make a major difference in your total costs. Interest rates are a crucial factor in any car loan influencing your monthly payments and overall amount repaid. So when you see a 2.99% interest rate offered, is that considered a good deal for an auto loan? Let’s take a deeper look at current market rates and what determines whether this rate is ideal for your situation.

What Determines A Good Interest Rate?

When it comes to auto loans, there are a few main things that determine whether an interest rate is good or not:

-

Credit Score – The main factor impacting your rate. Those with higher credit scores get lower rates, as they pose less risk to lenders.

-

New vs. Used Car: Rates for new cars are usually lower than rates for used cars. This has to do with the chance that the value will drop over the loan term.

-

Loan Term – Shorter loan terms (36-60 months) mean lower rates versus longer ones (72-84 months). The longer the lender loans money, the higher the interest.

-

Market Conditions – When the economy weakens, rates tend to rise across lending. The stronger the economy, the better rates tend to be.

-

Down Payment: A bigger down payment lowers the amount that needs to be borrowed, which means that the interest rate is lower.

So while a 2.99% rate may seem good, whether it’s ideal for you depends on factors like your credit score, the loan length, market rates at the time, etc. Let’s look closer at current auto loan rates.

Average New & Used Car Loan Interest Rates

An Experian study found that the average interest rate on a new car loan in 2022 was 5. 16 percent, and 862 percent for used cars. It was very clear. The rate of 99% is well below both of these current averages for both new and used cars.

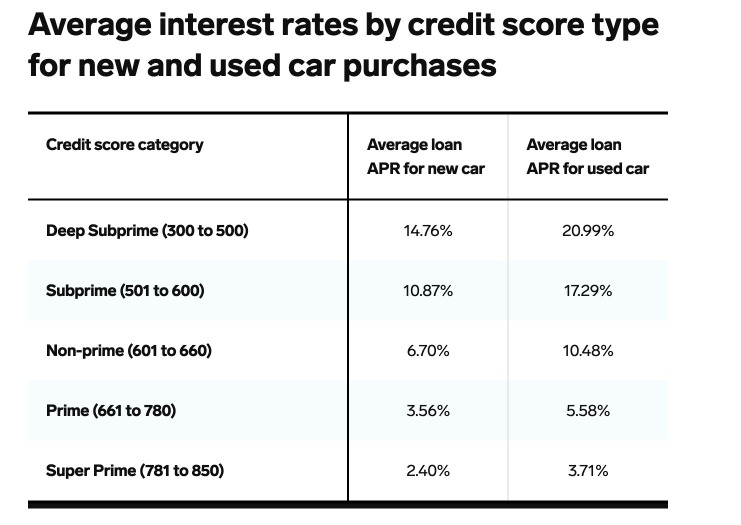

In general, here are the current average rates based on credit score:

- Excellent credit (781-850): 2.47% (new), 3.61% (used)

- Very Good (701-780): 3.51% (new), 5.38% (used)

- Fair (601-700): 6.07% (new), 9.8% (used)

- Poor (500-600): 9.41% (new), 15.96% (used)

As you can see, the 2.99% rate offered beats even the average for those with excellent credit. However, your personal credit score is still a major factor.

Is 2.99% A Good Rate For You?

While 2.99% is below current averages, that doesn’t guarantee it’s the best rate for your situation. Here are some factors to consider:

-

Credit Score – The higher your score, the better rate you can likely qualify for. Scores above 720 often get the best deals.

-

New vs. Used Car – Since used car loans have higher average rates, 2.99% is an especially good deal if your loan is for a used vehicle.

-

Loan Term – Make sure you’re comfortable with the loan length. Even at 2.99%, longer terms mean you pay more total interest.

-

Down Payment – A larger down payment allows you to borrow less, making 2.99% an even better deal. Putting 20% down or more is ideal.

-

Total Interest Paid – Do the math on total interest paid over the life of the loan to make sure it is affordable. Compare that to other rate offers.

If your credit score is very high, or you’re buying a new car, you may potentially find rates even lower than 2.99% to take advantage of. Be sure to compare offers from multiple lenders and negotiate for the best deal.

How To Get The Best Interest Rate On A Car Loan

While 2.99% would be considered a good rate by most standards, here are some tips to help ensure you get the lowest rate possible for your situation:

-

Compare offers from at least 3 lenders – Credit unions, banks, and online lenders. More quotes mean more negotiating power.

-

Get pre-approved – Being pre-approved shows dealers you’re a serious buyer and can help strengthen negotiating position.

-

Ask about manufacturer discounts – Many car brands offer special low-rate incentives that dealers can match.

-

Opt for shorter loan terms – Loans under 60 months tend to have the most favorable interest rates.

-

Make a larger down payment – Ideally 20% or more, as this allows you to borrow less and improves rates.

-

Boost your credit score – Making payments on time and lowering balances can help improve your rate.

-

Enlist a co-signer – If your credit is poor, a co-signer with better credit can help you qualify for the best interest rate.

The Bottom Line

Given current market conditions, a 2.99% interest rate is generally very favorable for an auto loan, beating average rates for both new and used cars. However, determining if it’s the right rate for you depends on factors like your credit score, the loan length, down payment, and the car itself.

Be sure to compare offers from multiple lenders, negotiate the best deal possible, and weigh the total interest paid before committing to any auto financing. With good credit and the right terms, rates under 2.99% are possible to find. Do your homework to make sure you get the lowest rate and most affordable financing before driving that new car home.

Do You Qualify for a Low APR?

While there can be lower interest rates like 0% APR which require stellar credit scores, you may still need above-average credit to qualify for 2. 9% APR. For example, according to a dealer incentive bulletin from Infinitis captive financing company, the full-size QX80 SUV has a 2. 9% APR financing deal for 60 months that requires a FICO score of over 720.

We recommend talking to your dealer about rate and loan term options for your unique situation. If you have bad credit, you may need to work with a dealer equipped to help customers with subprime credit. The best deals on new cars change every month, and the newest ones usually come out at the beginning of the month.

How Much Does 9% APR Cost?

On a $40,000 SUV, a 60-month (5-year) loan at 2. 9% would cost approximately $3,018 in interest. On a 72-month (6-year) loan, it would increase to $3,629. Weve even seen 84-month financing incentives that could translate to $4,245 in interest. The best deal for you may depend on your budget and comfort level when it comes to affordability.

Car Loan Interest Rates Explained (For Beginners)

FAQ

What is a good interest rate for a car?

A “good” interest rate for a car loan depends on your credit score and whether the vehicle is new or used. Rates below 5% are usually good for new cars, and rates below 7% are good for people with good credit on used cars.

How much is 2.9% APR for 72 months?

72 months at 2. 9% APR: 72 monthly payments of $15. 15 per thousand borrowed. 60 months at 2. 9% APR: 60 monthly payments of $17. 92 per thousand borrowed. 48 months at 2. 9% APR: 48 monthly payments of $22. 09 per thousand borrowed. 36 months at 2. 9% APR: 36 monthly payments of $29. 04 per thousand borrowed.

Is 1.9 interest rate good for a car loan?

In terms of cost, an interest rate of 1. 9% APR may not add much to your overall car purchase. On a $30,000 SUV, we estimate that a 5-year loan at 1. 9% APR would equate to $1,471 in money spent on interest alone. In contrast, a rate of 4% would equate to $3,150, while a loan at 6% would cost a little under $4,800.

How much is a $25,000 car loan for 72 months?

Extend your loan term For example, if you get a $25,000 loan with a 3. 5% interest rate for 48 months, your monthly payment will be $559, and you’ll pay a total of $1,827 in interest. If you extend the loan term to 72 months, it will reduce your monthly payment to $385, but you’ll pay $2,753 in interest.