People with credit scores between 300 and 850 have good credit. Scores between 670 and 739 are bad. Credit scores of 740 and above are very good while 800 and higher are excellent.

Credit scores between 300 and 850 are good, with a score in the mid to high 600s or higher being the best. A score in the high 700s or 800s is considered excellent. About a third of consumers have FICO® ScoresÎ that fall between 600 and 750âand an additional 48% have a higher score. In 2023, the average FICO® Score in the U. S. was 715.

Lenders use their own criteria for deciding whom to lend to and at what rates. But a higher credit score can generally help you qualify for a credit card or loan with a lower interest rate and better terms. The most common credit scores are the FICO® Score and the VantageScore® Credit Score. Their ranges are a little different, but their scoring factors are the same.

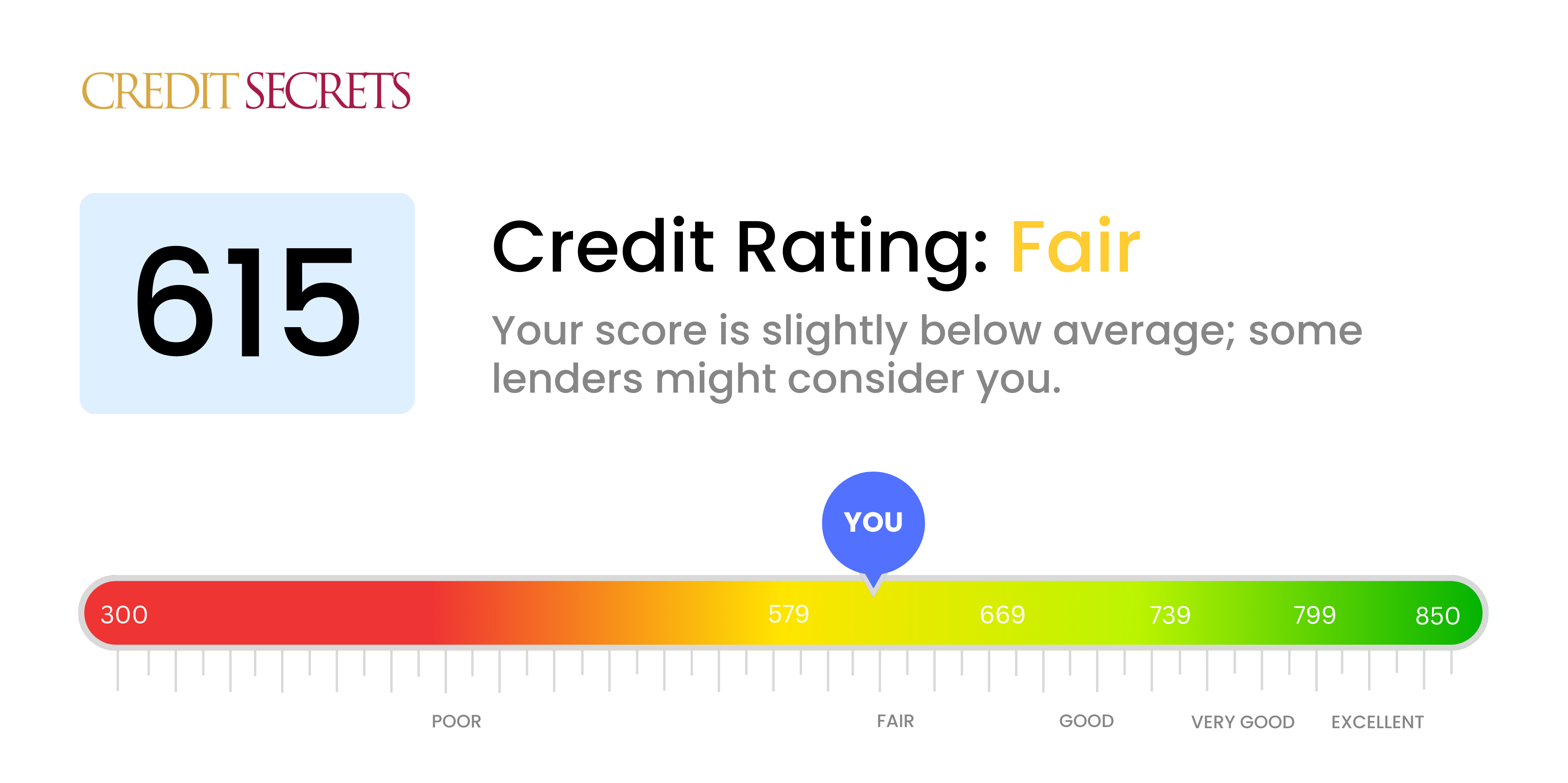

Your credit score is one of the most important numbers in your financial life It gives lenders an idea of how risky or reliable you are with credit If you have a credit score of 615, you may be wondering – is 615 a good credit score or a bad one?

The short answer is that a 615 credit score is considered fair or below average. It’s not terrible but it’s also not good. A score of 615 indicates you’ve had some issues with credit in the past. As a result you’ll likely have a harder time getting approved for loans and credit cards. You’ll also likely pay higher interest rates.

Even though a 615 credit score isn’t great, there are things you can do to make it better. You can raise your score if you put in some time and work.

What is a Good Credit Score?

A good credit score is generally 670 or higher. Excellent credit scores start at 740. Here’s a breakdown of the credit score ranges:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

You can see that a 615 credit score is in the good range. This is not a good enough score for lenders to give you the best rates and terms.

Just 17% of Americans have credit scores between 580-669. The average US credit score is 716. A 615 isn’t terrible, but it’s also not great compared to most other buyers.

Why a 615 Credit Score is Considered Fair

There are a few reasons a 615 credit score is considered fair rather than good:

1. Higher Risk of Delinquency

Data shows that consumers with scores between 580-669 are more likely to become seriously delinquent on credit obligations compared to those with higher scores.

About 21.8 percent of people with scores in this range are likely to go 90 days or more past due on their credit accounts. That’s a risk many lenders aren’t willing to take.

2. Limited Credit History

A short or limited credit history is common with fair credit scores. Things like a lack of accounts, high balances, and new accounts can bring scores down into the low 600s.

3. Negative Items

Late payments, collections accounts, and other derogatory marks often accompany credit scores in the low 600s. Just one 30-day late payment can drop your scores by 50-100 points.

Multiple late payments or collections can cause an even bigger drop. It takes time to rebuild credit after these negative items.

Credit Score Factors Affecting a 615 Score

Your credit scores are calculated based on information in your credit reports. Several factors likely contributed to a 615 score.

Payment History

This has the biggest impact, accounting for 35% of your FICO scores. Late payments can really drag down your scores.

95% of people with a 615 score have late payments on record. Even one 30-day late can seriously hurt.

Credit Utilization

This measures how much of your total credit limits you’re using. It accounts for 30% of your scores. High utilization lowers your scores.

People with 615 scores have an average utilization of 57%. Experts recommend keeping utilization below 30%.

Credit Age and Mix

These factors account for about 15% of your scores. Having new accounts and a lack of installment loans can lower your scores.

Hard Inquiries and New Accounts

Too many new accounts and credit checks in a short period can indicate higher risk and lower your scores temporarily.

Public Records

Bankruptcies, liens, and wage garnishment orders can devastate your scores if listed in your credit reports.

Is a 615 Credit Score Good Enough to Get Approved?

While it’s possible to get approved with a 615 credit score, it won’t be easy. You’ll likely face much higher interest rates and have fewer lenders willing to work with you.

Here’s a look at what you can expect when trying to get approved for credit with a 615 score:

-

Credit Cards – Most standard credit cards require good to excellent credit. Your best bets are secured cards or cards aimed at those rebuilding credit.

-

Personal Loans – Approval will be very difficult. You may need to look for a secured loan or find a co-signer to meet approval criteria.

-

Auto Loans – You can likely get approved but will pay higher interest rates. Shopping around is key to find the best rates.

-

Mortgages – Unlikely to qualify for a conventional mortgage. May need an FHA, VA, or USDA home loan.

While it’s not impossible to get approved with a 615 score, you won’t get ideal rates or terms. It’s wise to spend some time improving your credit before applying for new credit.

How to Improve a 615 Credit Score

The good news is that while a 615 isn’t a perfect score, it’s a great starting point for building better credit. Here are some tips to improve your 615 score:

-

Check credit reports – Review your reports for errors and dispute any you find. Mistakes could be dragging down your scores.

-

Pay on time – Your payment history has the biggest impact. Pay all bills on time, every time.

-

Lower balances – High utilization hurts your scores. Try to keep balances below 30% of credit limits.

-

Allow credit age to build – Avoid closing old, established accounts if possible. Length of history helps.

-

Limit hard inquiries – Too many credit checks in a short period can lower your scores. Only apply for what you need.

-

Use credit responsibly – Manage credit wisely to build positive history. Apply for new credit sparingly.

-

Be patient – Improving credit takes diligence and time. Stay focused on building good habits.

With effort and patience, you can absolutely boost your credit from the low 600s to the good credit range and above. Check your credit reports and scores, make a plan, and stick to credit-building fundamentals.

The Takeaway

While a 615 credit score is considered fair rather than good, it’s far from terrible. Millions of Americans have scores in the low 600s. The key is to view it as a starting point and take steps to boost your credit over time.

With diligent work, you can absolutely improve your 615 score and open the door to better loan terms in the future. Monitor your credit, focus on positive habits, and be patient. Your hard work will pay off with higher scores and more financial opportunities.

FICO’s Different Credit Scores

In 1989, FICO became the first company to create credit scoring models based on consumer credit reports. Although recent FICO® Score versions share a common name, such as FICO® Score 8, FICO creates different versions of the models for each credit bureau.

There are three general types of consumer FICO® Scores:

- ® Base Scores: These scores are made for all types of lenders and range from 300 to 850. The scores try to guess how likely it is that a person will not pay any kind of credit bill on time.

- Specialized FICO® Scores for Each Industry: FICO makes auto scores and bankcard scores just for auto lenders and card issuers. The goal of industry scores is to guess how likely it is that a customer will fall behind on a certain type of account. Scores range from 250 to 900.

- FICO® Scores that use different data: FICO has models, like the UltraFICO® and FICO XD scores, that can use different credit data. Both scores range from 300 to 850. The first group can look at linking information from deposit accounts, and the second group can find people by using non-traditional payment history from other databases, like your phone or utility bills.

FICO industry-specific scores are built on top of a base FICO® Score, and FICO periodically releases new suites of scores. The FICO® Score 10 Suite, for instance, has a base FICO® Score 10, a FICO® Score 10 T (which looks at trended data), and scores that are specific to different industries.

What Is a Good Credit Score to Buy a Car?

While there isnt a set minimum credit score to buy a car, a VantageScore credit score of 661 or higher could be a good score. Youll generally qualify for better auto loan terms as your score increases.

Auto lenders see low credit scores as a sign of risk, so someone with bad or fair credit will likely pay more in interest and may not be able to get as much of a loan. If you dont have a good score, try to improve your credit before you buy a car.

Learn more: Average Car Loan Interest Rates by Credit Score

What is a GOOD Credit Score in 2025? What’s the Average Credit Score Overall & By Age / Generation?

FAQ

Is 615 a good credit score?

If you have an 615 credit score, you are generally considered a subprime consumer, but it won’t necessarily prevent you from borrowing money. The average FICO credit score in the United States is 714 as of 2021, and scores within the 580-669 range are considered to be “fair” credit.

What is a 615 FICO ® score?

A 615 FICO ® Score is a 615-point score on the FICO ® credit scoring model. It is considered an average score and is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and fewer fees.

How to improve a credit score of 615?

To improve a credit score of 615, you could consider applying for a secured credit card and paying the bill on time every month. For example, you could also borrow a small amount with certain unsecured credit cards or a personal loan for damaged credit, but the interest rate is likely to be high.

What is the average APR on a 620-659 credit score?

With a score in the 620-659 credit score range, the average APR was 11. 76%. And with a score of 590-619, the average rate was 15. 92%. It’s also worth mentioning that interest rates can vary significantly among lenders, even for borrowers with the exact same credit score.

What should I do if my credit score is 600?

If your credit score is around 600, one of the first things you should do is lower how much credit you use and pay your bills on time every month.

What can I do with a 615 credit score?

A 615 credit score is generally considered fair, meaning it’s not terrible but not great either. You might be able to get some loans and credit cards with a 615 score, but the terms and interest rates might be worse than for someone with a higher score.

How to increase credit score from 615 to 700?

But generally speaking, here are some of the best ways to take your credit score into 700 territory. Pay on Time, Every Time. Pay Down Credit Card Balances. Avoid Unnecessary Debt. Dispute Inaccurate Credit Report Information. Avoid Closing Old Credit Cards.

Can I buy a house with a 615 credit score?

Yes, it is possible to buy a house with a 615 credit score, but it may come with some limitations and require specific loan options.

How bad is a credit score of 615?

You are in the group of people whose credit might be seen as Fair if your FICO® Score is 615. Your 615 FICO® Score is lower than the average U. S. credit score. 17% of all consumers have Scores in the Fair range (580-669).