According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time. 1 It can be an important part of building your financial confidence and security. 1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home. 1 You may also be able to access more competitive interest rates. 1.

There are two main credit bureaus in Canada: Equifax and TransUnion. 1 These are private companies that keep track of how you use your credit. 1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score. 1.

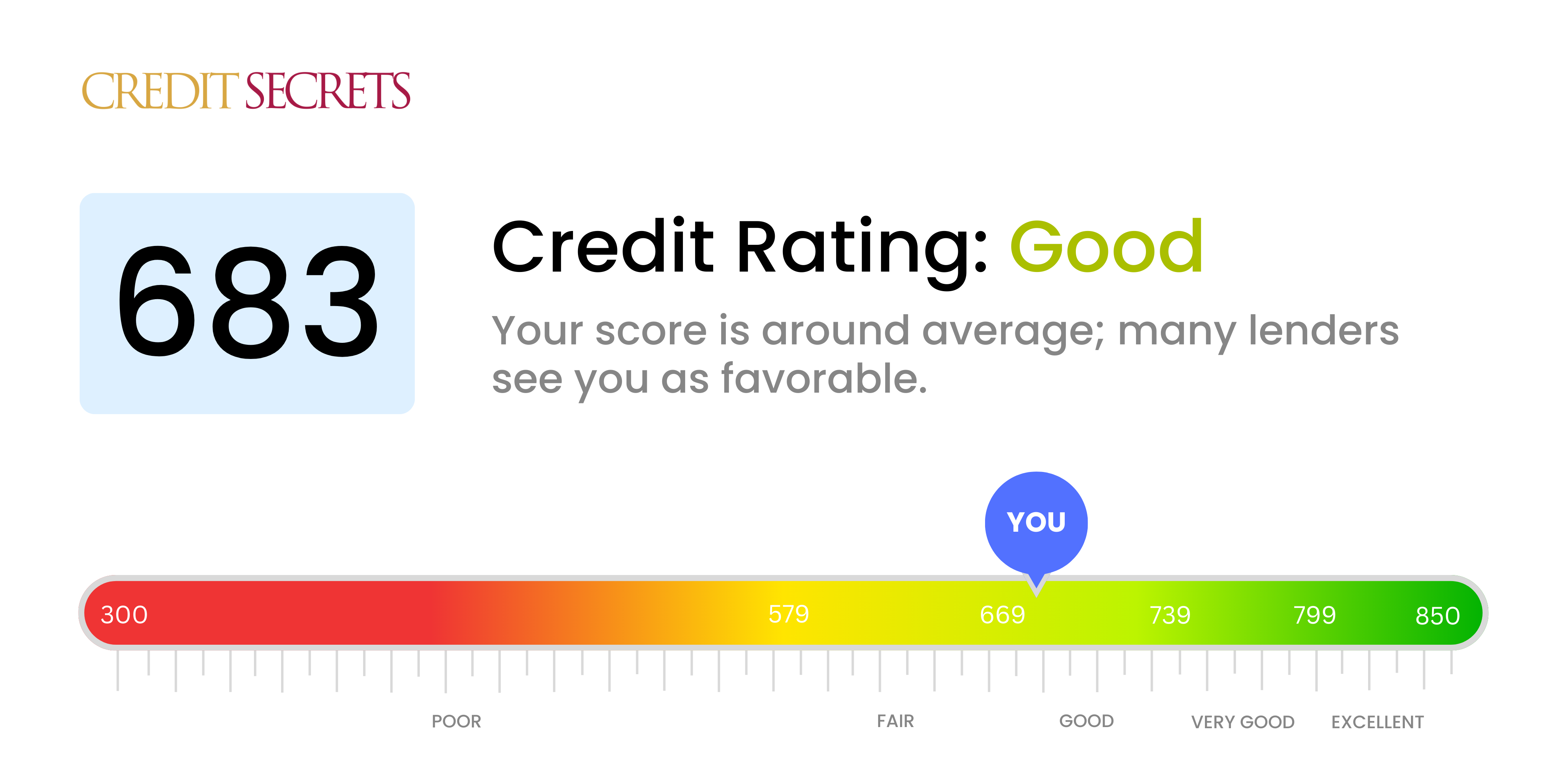

Hey there, folks! If you’re sittin’ there wonderin’, “Is 683 a good credit score?” then you’ve landed in the right spot. I’m gonna lay it out straight for ya—yes, a 683 credit score is considered good It ain’t the top of the heap, but it sure ain’t bad neither You’re in a decent place, and it opens up a fair amount of financial doors. But, there’s always room to climb higher and snag better deals. Stick with me, and we’ll dig into what this score means for your wallet, how it stacks up, and how you can push it even further.

At its core, your credit score is like a report card for how well you handle money—lenders use it to decide if they wanna trust ya with a loan or a credit card. A score of 683 puts you in the “Good” category, which means you’re likely to get approved for stuff, though maybe not at the absolute best rates Let’s unpack this step by step, so you can see the whole picture and figure out your next move

Where Does a 683 Credit Score Stand?

First off, let’s get a grip on what “good” actually means when it comes to credit scores. Most scoring models, like FICO and VantageScore, rank scores on a scale from 300 to 850. The higher ya go, the better you look to banks and lenders. Here’s how the ranges typically break down for FICO, which is the big dog in the credit world:

| Credit Score Range | Rating | Percentage of Population |

|---|---|---|

| 800 – 850 | Exceptional | 21% |

| 740 – 799 | Very Good | 25% |

| 670 – 739 | Good | 21% |

| 580 – 669 | Fair | 17% |

| 300 – 579 | Poor | 16% |

With a 683, you’re right in the middle of the “Good” range (670–739). That’s solid! About 21% of folks in the U. S. You’re just a little below the national average, which is somewhere between 714 and 718 points, if your score is in this range. “Good” in a different model called VantageScore ranges from 661 to 780, so you’re also good there. Finally, you’re not having a hard time, but you’re also not in the VIP club yet.

Now, why does this matter? ‘Cause lenders look at these ranges to decide if they’re gonna give you money and at what cost. A “Good” score like 683 tells ‘em you’re a pretty safe bet, but they might not roll out the red carpet with the lowest interest rates or the fanciest credit card perks That’s reserved for the “Very Good” or “Exceptional” crowd Still, you’ve got options, and we’ll get into those next.

What Can You Do with a 683 Credit Score?

Alright, let’s talk turkey. If you have a credit score of 683, you can make a lot of financial moves. However, it’s not all sunshine and rainbows. Here’s the lowdown on some common scenarios:

- Credit Cards: You’re in a good spot to get approved for most credit cards. Not the super elite ones with crazy rewards, mind ya, but definitely solid unsecured cards. Just make sure you pay on time every dang month and keep your balance under 30% of your limit. That’s a golden rule to keep your score from takin’ a hit.

- Personal Loans: Most lenders will give you a thumbs-up for a personal loan with a 683. The catch? Your interest rate might be a bit higher than someone rockin’ a 750 or above. Steer clear of them sketchy payday loans—they’re a trap that’ll mess up your finances worse than a bad hangover.

- Home Loans (Mortgages): Wanna buy a house? You’re likely above the minimum score needed for most conventional loans, which is around 620. With a 683, you can probably qualify, but don’t expect the lowest rates or the best terms. Some lenders might want a bigger down payment or charge more interest. If you can, bump that score up a bit before applyin’ to save some serious cash long-term.

- Auto Loans: Need a new ride? Most car lenders will work with a 683 score. Again, though, the interest rate might not be the cheapest. Your approval odds are decent, but they’ll also peek at stuff like your income and debt to see the full picture. Shop around for deals, and don’t settle for the first offer that comes your way.

I remember when I was hoverin’ around this score a few years back. I managed to snag a decent credit card and even financed a used car, but man, them interest rates stung a little. It wasn’t until I pushed my score up a notch that I started seein’ better offers. So, while 683 gets ya in the game, it don’t got you sittin’ in the front row.

Why Ain’t 683 the Best? The Limitations

Now, don’t get me wrong—683 is good, but it’s not great. There’s a reason to aim higher, and it mostly comes down to savin’ money. When your score is in the “Good” range, lenders see ya as reliable, but not their top pick. That means:

- Higher Interest Rates: Whether it’s a mortgage, car loan, or personal loan, you might pay more in interest compared to someone with a “Very Good” score (740-799). Over time, that extra percentage or two adds up to thousands of bucks. Ouch!

- Limited Premium Offers: Some of the best credit cards—the ones with killer cashback or travel perks—often want a higher score. You might miss out on the really sweet deals.

- Stricter Terms: For big loans like mortgages, lenders might ask for a larger down payment or tack on extra fees to cover their “risk.” It’s their way of playin’ it safe since your score ain’t in the top tier.

Think of it like this: a 683 score is like havin’ a decent car—it gets ya where you need to go, but it’s not a luxury ride with all the bells and whistles. If you wanna upgrade to that fancy model with better gas mileage (aka lower rates), you gotta put in some work on your credit.

What Goes Into a 683 Credit Score?

So, how’d ya end up with a 683 anyway? Credit scores ain’t just random numbers—they’re cooked up from a few key ingredients. Here’s the recipe, broken down simple-like:

- Payment History (35% of your score): This is the big one. If you pay your bills on time, your score gets a boost. A 683 usually means you’ve been pretty good about this, though maybe you’ve missed a payment or two in the past. Even one late payment can ding ya hard, so stay on top of it.

- Credit Utilization (30%): This is how much of your available credit you’re usin’. If you’ve got a credit card with a $10,000 limit and owe $4,000, that’s a 40% utilization rate. Experts say keep it under 30% to look better to lenders. A 683 might mean you’re a bit high here—pay down them balances!

- Length of Credit History (15%): The longer you’ve had credit, the better. If you’re newer to the game, your score might not be as high. With a 683, you might have a shorter history, or it’s just not super long yet. Time will help this one.

- Credit Mix (10%): Lenders like seein’ a variety of credit types—like a credit card and a car loan. It shows you can juggle different debts. If you’ve only got one kinda credit, that might keep your score from climbin’ higher.

- New Credit (10%): Applyin’ for a bunch of new accounts at once can spook lenders ‘cause it looks like you’re desperate for cash. A 683 might mean you’ve opened a few things recently, causin’ a small dip.

For many people with a 683, the score means they mostly have good habits, with maybe one or two weird ones, like a high card balance or a shorter track record. The good news is that you can change these things to make your number go up.

How to Boost Your 683 Credit Score to the Next Level

Alright, now that we’ve got the lay of the land, let’s talk about gettin’ that score from “Good” to “Great.” Movin’ up to the “Very Good” range (740-799) can save you a boatload on interest and open up better offers. Here’s some straight-up tips to make it happen:

- Pay Them Bills on Time, Every Time: I can’t stress this enough. Late payments are like kryptonite to your score. Set up reminders on your phone or auto-payments if ya gotta. One slip-up can haunt ya for months.

- Lower That Credit Utilization: Got high balances on your cards? Chip away at ‘em. Aim to use less than 30% of your total credit limit. If you can’t pay it off quick, at least get it down bit by bit. This shows lenders you’re not maxed out.

- Check Your Credit Report for Goofs: Sometimes, errors sneak onto your report—like a late payment that wasn’t really late. Grab your free report from the big three bureaus (you know who they are) and look for mistakes. Dispute anything that don’t look right.

- Mix Up Your Credit Types: If all you’ve got is credit cards, think about a small installment loan or somethin’ to show you can handle different debts. Don’t take on more than you can chew, though—only do this if it fits your budget.

- Become an Authorized User: Got a buddy or family member with awesome credit? Ask if you can piggyback on their account as an authorized user. Their good history gets added to your report, givin’ ya a quick boost. Just make sure they’re responsible, ‘cause their mess-ups can hurt ya too.

- Consider a Credit Builder Loan: These are neat little loans designed to help build credit. You make payments, and it gets reported to boost your score. It’s a low-risk way to show you’re good with money.

- Don’t Apply for Too Much at Once: Every time you apply for credit, it can knock your score down a few points temporarily. Space out them applications, and only go for what ya really need.

I’ve seen pals jump from scores like 683 to over 750 in a year or two just by nailin’ these basics. It takes patience, though—credit ain’t a quick fix. Stick with it, and you’ll see results.

Why Bother Improving Your Score?

You might be thinkin’, “Hey, 683 ain’t bad. Why mess with it?” Fair point, but here’s the deal: a higher score saves you money and stress. Picture this—on a 30-year mortgage, droppin’ your interest rate by just 1% ‘cause your score went up could save ya tens of thousands. Same with car loans or credit cards. Plus, a better score means less hassle gettin’ approved for stuff. It’s like upgradin’ from a clunky old phone to the latest model—everything just works smoother.

Back when I was stuck around this score, I didn’t think much of it until I saw a friend with a higher score get a way better deal on a car. That lit a fire under me to improve mine, and let me tell ya, it was worth the effort. You don’t gotta aim for a perfect 850—just gettin’ to 740 or so can make a huge diff.

Common Myths About Credit Scores Like 683

Before we wrap this up, let’s bust a couple myths I hear all the time about scores in this range. Folks got some wild ideas, so let’s set ‘em straight:

- Myth 1: A 683 Means You’re Average or Bad: Nah, not true. It’s considered “Good,” and you’re above a big chunk of the population. Sure, the average is a smidge higher, but you’re not in the danger zone by any stretch.

- Myth 2: You Can’t Get Good Loans with This Score: Wrong again. You can qualify for most loans and cards, just not always at the best rates. It’s more about shoppin’ around than bein’ shut out.

- Myth 3: Checkin’ Your Score Hurts It: Nope, checkin’ your own score is what’s called a “soft inquiry” and don’t do squat to your number. Only hard inquiries from lenders ding ya a little, and even then, it’s temporary.

Clearin’ up these misconceptions helps ya focus on what really matters—buildin’ better habits and not stressin’ over fake news.

Final Thoughts on Your 683 Credit Score

So, is 683 a good credit score? Heck yeah, it is! You’re in a solid spot, better than a lotta folks out there, and you’ve got access to plenty of financial tools. But, and this is a big but, it ain’t the peak. Pushin’ your score up even just a few dozen points can unlock lower rates, better terms, and less headache when dealin’ with lenders. Think of it as a stepping stone—you’ve climbed a good ways, now keep goin’ for that next level.

We’ve covered where 683 stands, what you can do with it, and how to make it better. Start with the easy wins like payin’ on time and cuttin’ down card balances. Over time, them small moves add up to big gains. Got questions or wanna share your own credit journey? Drop a comment below—I’m all ears. Let’s keep this money convo rollin’!

What’s a good credit score?

It depends on the scoring model used. In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it’s likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score.2 The credit score range is anywhere between 300 to 900.2 The higher your score, the better your credit rating.2

Your credit score helps lenders to assess your credit capacity. 1 The higher your score, the more likely you are to get approved for loans and credit. 1 It may also be checked when applying to rent a property or when applying for certain jobs. 1, though, and every person’s finances are unique. Your credit score will change over time based on your credit history and how much debt you have.

According to the Government of Canada, your credit history is a record of your debt repayments on credit cards, loans and lines of credit.1 Your credit history helps determine your credit score.1 That’s why it’s important to be smart about how you use and manage your credit.

How to check your credit score

The federal government says it’s important to check your credit score so you know where you stand financially. Both Equifax and TransUnion provide credit scores for a fee.

Check your credit score

You can check your credit score with the TransUnion CreditView® Dashboard in the TD app. Checking in the TD app will not affect your credit score in any way. Learn more.

How to increase your credit score

The Government of Canada states that your credit score will increase if you manage credit responsibly and decrease if you have trouble managing it.1

Here are some tips from the Government of Canada to help improve your credit score:

- Get a credit card and use it to buy things you would have bought anyway to build credit. 3. Getting a credit report from a credit bureau gives you access to and a look at your credit history. Equifax and TransUnion both let you get a free copy of your credit report once a year. This won’t hurt your credit score. You can order the report by phone, email and online. 4.

- To keep a good repayment history and raise your score, try to pay your bills on time and in full. 3. If you can’t pay the whole bill, try to make at least the minimum payment. 3. If you think you might not be able to pay your bill, call your lender. 3.

- Don’t apply for credit or switch credit cards too often. 3. Try not to have too much debt, and don’t let small balances add up. 3.

Also, here’s some advice: make the most of your credit card and don’t miss your payments. One way to help stay on top of your payments could be to set up pre-authorized payments from your bank account to your credit card.

Check out this video that breaks it down in simple terms:

How to maintain your credit score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above. 3 Add up all your credit limits and multiply the total by 35%. That’s the amount you should ideally try to avoid exceeding when borrowing money or using credit. 3.

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 That’s because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!.

- Here’s a video that shows you how to make and stick to a budget. This is a key step toward financial confidence.

- How to cut back on spending: Read our tips on how to cut back on spending to save money, even when times are tough.

- Check your credit score: The TransUnion CreditView® Dashboard in the TD app lets you check your credit score. There is no way that checking in the TD app will hurt your credit score. Get a free check of your credit score. Learn more .

- With the TD Debt Consolidation Calculator, you can quickly find your debt-freedom date and see how soon you can be debt-free. TD Debt Consolidation Calculator Calculate .

- Need a credit card? Our Credit Card Selector Tool can help you pick the right one. Looking for a credit card? Explore your options .

Is 683 A Good Credit Score? – CreditGuide360.com

FAQ

What can a 683 credit score get you?

With a 683 credit score, individuals will likely still have access to loans and other credit options, but they may face higher interest rates or more limited options compared to those with higher credit scores.

Is 700 a good credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. While credit scores range from 300 to 850, most people think that a score in the mid to high 600s or higher is good.

Is 683 a good credit score to buy a car?

Experian says that if your credit score is at least 661, you should be able to get a loan for a new car with an APR of about 6. 70% or better, or a used-car loan around 9. 06% or lower. Superprime: 781-850. 5. 18%. 6. 82%.

What credit score is considered good?

A good credit score typically falls within the range of 670 to 739. Scores in this range are generally considered acceptable or lower-risk by lenders.