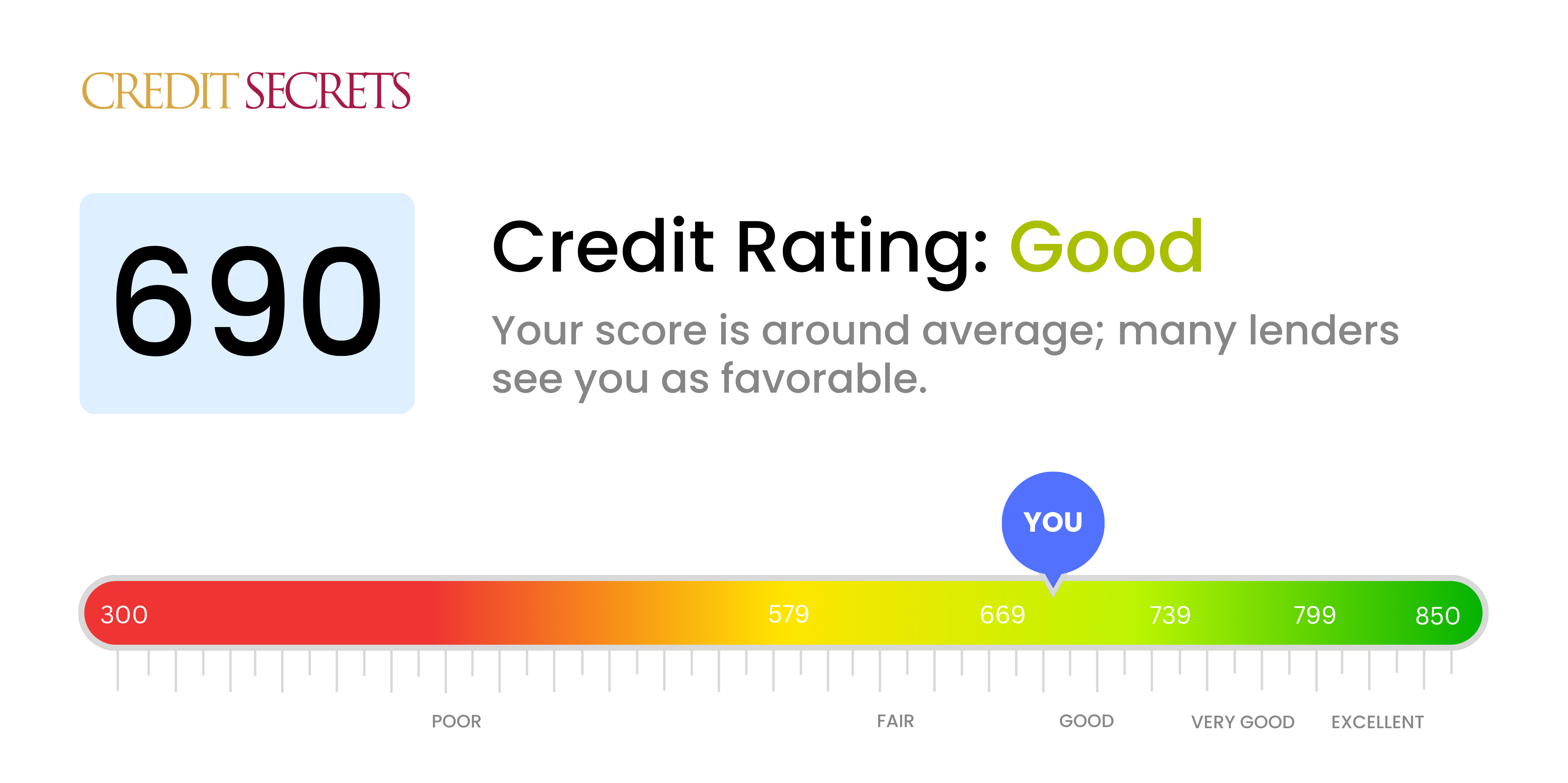

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U. S. FICO® ScoreÎ, 714, falls within the Good range. Lenders see people with good credit scores as “acceptable” borrowers and may offer them a range of credit products, though not always at the lowest interest rates.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

Buying a house is an exciting event in one’s life, but it also needs careful planning and thought when it comes to money. One of the most important things lenders look at when approving a mortgage is the borrower’s credit score. “Is 690 a good credit score to buy a house?” is an important question for people who want to buy a house.

What Does a 690 Credit Score Mean?

A 690 credit score falls in the “good” range. Experian says that this score is a little lower than the average credit score of 714. However, it still demonstrates responsible credit management.

Lenders view a 690 score as acceptable and low risk. Loans and mortgages can be given to people with this score, but the rates may not be the best.

690 Credit Score Range

Credit scores range from 300 to 850 Here is how a 690 score stacks up

- 300-579 – Poor

- 580-669 – Fair

- 670-739 – Good

- 740-799 – Very Good

- 800-850 – Exceptional

So a 690 puts a borrower in the higher end of the good range, fairly close to very good It shows a pattern of on-time payments and reasonable credit utilization. However, there may be some minor dings for late payments or high balances

What Credit Score Is Needed to Buy a House?

The minimum credit score needed to qualify for a mortgage is generally 620. However, the higher your score, the better mortgage terms you can receive.

Here are some common mortgage recommendations based on credit score:

- 760+ – Best rates and terms

- 700-759 – Good rates

- 660-699 – Average rates

- 620-659 – Higher rates, larger down payment

So while a 690 credit score meets the basic threshold to qualify for a mortgage, it won’t get you the lowest rates. To get the very best terms, you typically need a score of at least 760.

Can I Get a Mortgage with a 690 Credit Score?

The good news is that a 690 FICO score makes you eligible for most conventional mortgage programs. Lenders view this score as acceptable risk.

However, with a 690 score, you won’t qualify for top tier interest rates and terms. You’ll likely pay a slightly higher rate than borrowers with scores in the very good or exceptional ranges.

Lenders also look at your entire financial profile. The higher your score, the more flexibility you have with other factors like debt-to-income ratio.

Tips for Getting a Mortgage with a 690 Credit Score

If your goal is buying a house and your credit score is 690, here are some tips:

- Shop around with multiple lenders to compare rates and terms. Even small differences can make a big impact over the life of a mortgage.

- Make a larger down payment if possible. This shows lenders you’re financially committed. And it lowers your loan-to-value ratio.

- Pay down existing debts. Lower debt balances help compensate for a lower credit score.

- Add a co-signer with better credit, if available. This shifts some risk away from you as the primary borrower.

How to Improve Your Credit Score Before Buying a House

The higher your credit score, the better mortgage terms you can get. If you have time before buying a house, boosting your 690 score could save you thousands. Consider these tips:

- Pay all bills on time – payment history is 35% of your score.

- Pay down balances – amounts owed are 30% of your score.

- Limit credit inquiries – apply for new credit sparingly.

- Allow credit history to age – length of history is 15% of your score.

- Mix credit types – have installment loans and credit cards.

With diligent credit management, you can improve your 690 score to over 700 or even 750. This opens the door to the very best mortgage rates and terms.

The Bottom Line

A credit score of 690 is considered good. It meets the minimum requirement for most mortgage programs. However, this score will not get you the absolute lowest interest rates or best terms.

With a 690 credit score, focus on compensating factors like larger down payments and low debt. Shop multiple lenders. And if possible, give yourself time to boost your score over 700 before buying a home. This will ensure you get the most favorable mortgage rate and terms.

Staying the course with your Good credit history

Having a Good FICO® Score makes you pretty typical among American consumers. Thats certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range (740-799) or even the Exceptional range (800-850). Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreâand they arent good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default (go 90 days past due without a payment) on debt than those who pay promptly. If you have a history of making late payments (or missing them altogether), youll do your credit score a big solid by kicking that habit. More than one-third of your score (35%) is influenced by the presence (or absence) of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the cards spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | Spending limit | Utilization rate (%) | |

|---|---|---|---|

| MasterCard | $1,200 | $4,000 | 30% |

| VISA | $1,000 | $6,000 | 17% |

| American Express | $3,000 | $10,000 | 30% |

| Total | $5,200 | $20,000 | 26% |

Most experts agree that utilization rates in excess of 30%âon individual accounts and all accounts in totalâwill push credit scores downward. The closer you get to âmaxing outâ any cardsâthat is, moving their utilization rates toward 100%âthe more you hurt your credit score. Utilization is second only to making timely payments in terms of influence on your credit score; it contributes nearly one-third (30%) of your credit score.

Its old but its good. All other factors being the same, the longer your credit history, the higher your credit score likely will be. That doesnt help much if your recent credit history is bogged down by late payments or high utilization, and theres little you can do about it if youre a new borrower. But if you manage your credit carefully and keep up with your payments, your credit score will tend to increase over time. Age of credit history is responsible for as much as 15% of your credit score.

New credit activity typically has a short-term negative effect on your credit score. Any time you apply for new credit or take on additional debt, credit-scoring systems determine that you are greater risk of being able to pay your debts. Credit scores typically dip a bit when that happens, but rebound within a few months as long as you keep up with your bills. Because of this factor, its a good idea to “rest” six months or so between applications for new creditâand to avoid opening new accounts in the months before you plan to apply for a major loan such as a mortgage or an auto loan. New-credit activity can contribute up to 10% of your overall credit score.

A variety of credit accounts promotes credit-score improvements. The FICO® credit scoring system tends to favor individuals with multiple credit accounts, including both revolving credit (accounts such as credit cards that enable you to borrow against a spending limit and make payments of varying amounts each month) and installment loans (e.g., car loans, mortgages and student loans, with set monthly payments and fixed payback periods). Credit mix accounts for about 10% of your credit score.

Public records such as bankruptcies do not appear in every credit report, so these entries cannot be compared to other score influences in percentage terms. If one or more is listed on your credit report, it can outweigh all other factors and severely lower your credit score. For example, a bankruptcy can stay on your credit report for 10 years, and may shut you out of access to many types of credit for much or all of that time.

How to improve your 690 Credit Score

A FICO® Score of 690 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 690 FICO® Score is on the lower end of the Good range, youll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range (580 to 669).

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, youll receive information about ways you can boost your score, based on specific information in your credit file. Youll find some good general score-improvement tips here.

Do You Really Need A Credit Score To Buy A House?

FAQ

Is 690 a good credit score?

However, even with a 690 credit score, you still have opportunities to obtain decent credit cards or loans. It’s worth noting that making slight improvements to your credit can significantly expand your options and lead to substantial savings. Credit Rating: 690 is still considered a fair credit score.

Is a 690 FICO ® score good?

A 690 FICO ® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. To begin, getting your free credit report from Experian and looking at your credit score are both great ideas. This will help you figure out what factors have the most impact on your score.

Is 620 a good credit score to buy a house?

Most lenders set a 620 minimum benchmark for you to buy a house, though that’s not necessarily a “good” score to buy a house. There’s a few reasons the minimum score isn’t good for buying a house: The lower your credit score, the higher your payment. The higher your payment, the higher your debt-to-income (DTI) ratio.

What is a good credit score to buy a house?

A favorable credit score to buy a house is typically in the high 600s and 700s. Anything higher than that is considered “exceptional”, and helps borrowers get the very best mortgage rates. Certain loan types even allow you to buy a house with a credit score as low as 500.

Do you need a credit score to buy a house?

Your credit score is one of the most important factors when it comes to qualifying for a mortgage—and getting a good interest rate. But the credit score needed to buy a house depends on your lender, where you want to live, and how much you need to borrow. What Credit Score Is Needed To Buy a House?.

Can you get a student loan with a 690 credit score?

Student loans are some of the easiest loans to get with a 690 credit score, seeing as more than 60% of them are given to applicants with a credit score below 700. A new degree may also make it easier to repay the loan if it leads to more income. Note: Borrower percentages above reflect 2020 Equifax data.

What can I get with a 690 credit score?

If your credit score is 690 or lower, you may have fewer loan and credit card options. However, you may still be able to get loans or credit cards. Some lenders may require additional documentation or collateral, while others may offer higher interest rates or require a co-signer.

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? Credit scores as low as 500 and as high as 800 can all be used to buy a $250,000 house. Mar 19, 2025.

Can I get a house with a 690 credit score?

A 690 credit score puts you in a good position to qualify for a conventional loan, but lenders consider many other factors.Mar 10, 2025

What credit score is needed to buy a 300K house?

To buy a $300K house, you typically need a credit score of at least 580 for an FHA loan or 620 for a conventional loan.Apr 25, 2025