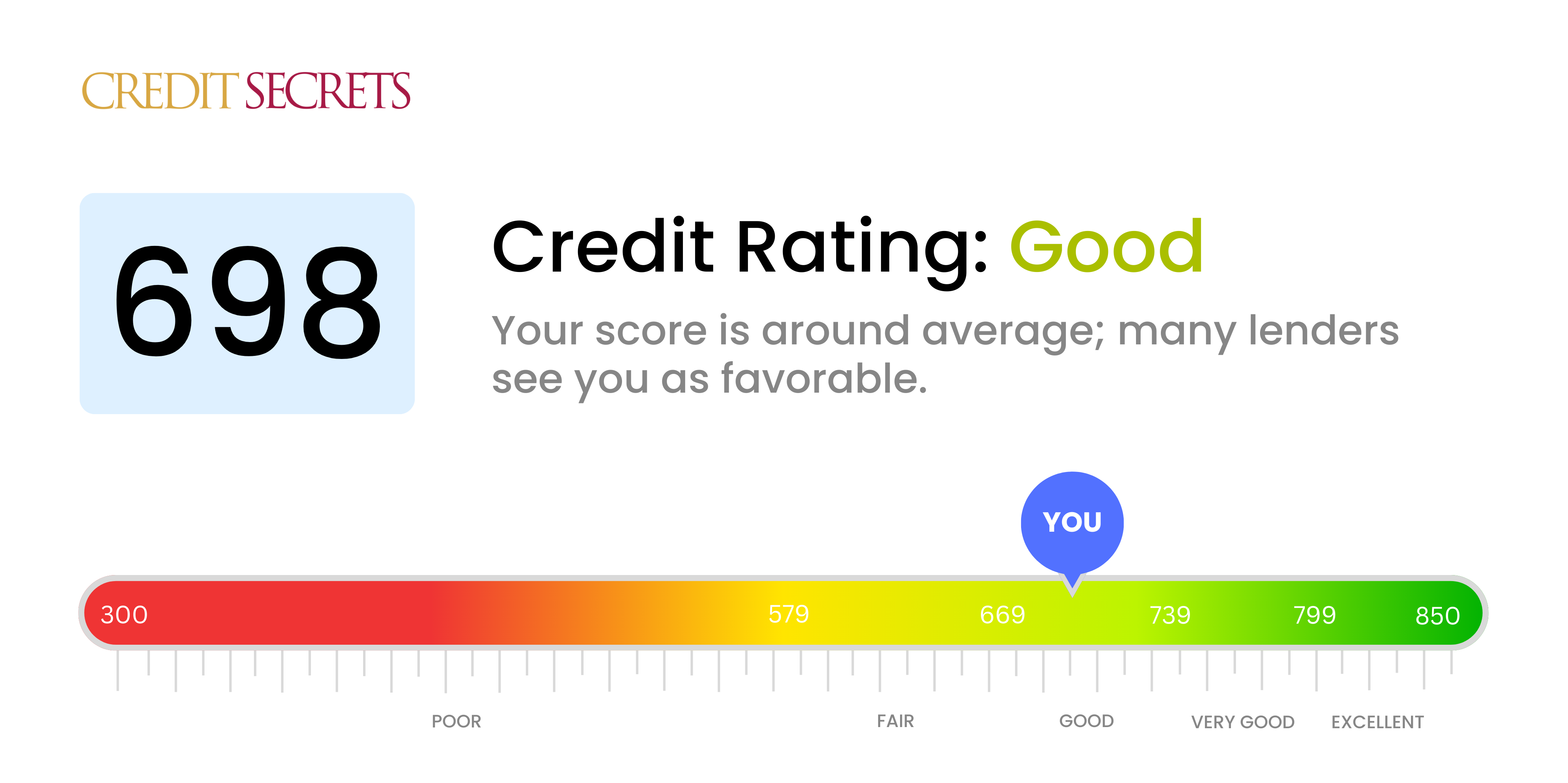

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent.

For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good. A score in the high 700s or 800s is considered excellent. About a third of consumers have FICO® ScoresÎ that fall between 600 and 750âand an additional 48% have a higher score. In 2023, the average FICO® Score in the U. S. was 715.

Lenders use their own criteria for deciding whom to lend to and at what rates. But if your credit score is higher, you may be able to get a credit card or loan with better terms and a lower interest rate. The two main types of credit scores, the FICO® Score and VantageScore® credit scores, vary slightly in their ranges but have similar scoring factors.

It can feel like a difficult puzzle to figure out your credit score. Different credit agencies use different numbers and ranges, which makes a lot of people wonder, “What does my score really mean?” For example, if you live in the UK and look at your Experian credit report and see a score of 698, you may be wondering, “Is 698 a good credit score in the UK?”

The short answer is yes, a credit score of 698 is usually seen as good in the UK. But to get the whole story, you need to know how credit scores work and what they mean to lenders. If you live in the UK and have a credit score of 698, this article will explain what that means and give you tips on how to get a perfect score.

Navigating UK Credit Scores

In the UK, the three major credit reference agencies (CRAs) that calculate credit scores are Experian, Equifax, and TransUnion. Each uses its own unique scoring model and range:

- Experian – Scores range from 0 to 999

- Equifax – Scores range from 0 to 700

- TransUnion – Scores range from 0 to 710

Even though the numbers are different, all three CRA models use scores like “poor,” “fair,” “good,” and “excellent” to judge a person’s creditworthiness.

Lenders mostly use Experian’s scoring model because it is the biggest CRA in the UK. Experian says that a credit score between 560 and 720 is “good.”

Understanding a 698 Experian Credit Score

So what does it mean if your Experian score is 698 specifically?

A 698 places you in the higher end of the “good” category. According to Experian data, this means your credit risk level is below average. You have a proven history of managing credit and paying bills on time.

Lenders will see you as a reliable borrower who is likely to repay debts responsibly. You have access to mainstream credit at decent interest rates from most lenders.

Benefits of Good Credit in the UK

A good credit score unlocks several financial advantages:

-

Better loan terms – Good credit means qualified borrowers can access larger loans and lower interest rates This saves thousands over the lifetime of a loan

-

Credit card perks – Issuers offer good credit customers higher limits, low rates, rewards programs, and sign-up bonuses.

-

Improved insurance rates – Good credit can lower premiums for home, auto, health, and life insurance.

-

Rental accommodations – Landlords often check credit to screen tenants. Good scores improve chances of approval and negotiating lower deposits.

-

Employment aid – Some employers check credit histories as part of background screening, though this practice is decreasing. Still, good credit looks responsible.

-

Financial freedom – With good credit, you can more easily finance big purchases and investments in your future.

How to Reach an Excellent Credit Score

While 698 is considered good credit, there are still benefits to reaching the UK’s “excellent” credit score range, between 720 and 959 with Experian. Here are tips to keep improving your score:

-

Check credit reports – Review your Experian, Equifax, and TransUnion reports annually for errors that could be lowering your scores. Dispute any inaccuracies found.

-

Pay bills on time – Payment history carries the most weight in credit calculations. Stay on top of due dates and deadlines.

-

Lower credit utilization – Keep balances below 30% of your credit limits on cards and lines of credit. High utilization drags down scores.

-

Curb hard inquiries – Each application for new credit temporarily dings scores by a few points. Only apply for what you need.

-

Build diverse credit – Have a mix of installment loan, mortgage, credit card, and service payment history. This demonstrates responsible usage across credit types.

-

Let length grow – The longer your accounts stay open in good standing, the more it bolsters your score. Keep old cards open.

Climbing into the “excellent” score range takes diligence, but it opens doors to the most favorable lending terms the UK has to offer. Even if your goal feels far away, be encouraged that 698 is a score many strive for. Pat yourself on the back for a job well done, then keep taking small steps to build your best financial future.

VantageScore’s Different Credit Scores

VantageScore creates a generic tri-bureau scoring model, meaning the score is designed for any type of lender. The same model can evaluate your credit reports from the three major consumer credit bureaus (Experian, TransUnion and Equifax).

VantageScore launched its first modelâthe VantageScore 1. 0, which is no longer offeredâin 2006. In 2017, it released VantageScore 4. 0 was the first credit score that used trended data, like how your balances or credit utilization rate change over time.

VantageScore announced its VantageScore 4plus⢠model in May 2024. This model is different from the others because it lets creditors ask customers if they want to link a bank account and share their banking information. If the person links an account, VantageScore 4plus; can consider the banking data and recalculate their score.

| VS 3.0 | VS 4.0 | VS 4plus |

|---|---|---|

| Only considers data from a credit report | X | X |

| Can consider additional data with your permission | X | |

| Considers trended data | X | X |

What Is a Good Credit Score to Buy a Car?

Of course, there is no set credit score needed to buy a car, but a VantageScore of 661 or higher might be good. Youll generally qualify for better auto loan terms as your score increases.

Auto lenders view low credit scores as a sign of risk, so an applicant with poor or fair credit will pay more in interest and might receive a lower loan limit. If you dont have a good score, try to improve your credit before you buy a car.

Learn more: Average Car Loan Interest Rates by Credit Score

What’s a good credit score? (UK)

FAQ

Is a 698 FICO ® score good?

A FICO® Score of 698 is Good, but if you can get it up to the Very Good range, you might be able to get better loan terms and lower interest rates. To begin, getting your free credit report from Experian and looking at your credit score are both great ideas. This will help you figure out what factors have the most impact on your score.

Is 698 a good credit score?

Credit Rating: 698 is still considered a fair credit score. Borrowing Options: Most borrowing options are available, but the terms may not be very attractive. For example, you should be able to qualify for unsecured credit cards and personal loans, but the interest rate may be fairly high.

What is a good credit score?

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U. S. FICO ® Score ☉, 714, falls within the Good range. Lenders view consumers with scores in the good range as “acceptable” borrowers, and may offer them a variety of credit products, though not necessarily at the lowest-available interest rates.

How much credit should I use?

A general rule of thumb is to use less than 30% of your credit at any one time, so that’s a good benchmark to aim for. For any number higher than that, lenders might think that your finances aren’t stable, even if that’s not the case.

What does a high credit score mean?

A higher credit score means your credit report contains information that shows you could be low risk, so you’re more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, you could be considered a reliable borrower. If you have a high credit score, your application is more likely to be accepted.

Can I buy a house with a 698 credit score?

A strong credit score could help you secure a lower mortgage rate. You generally need a credit score of at least 620 to qualify for a conventional mortgage, though every lender is different. It’s possible to qualify for an FHA loan, which is backed by the federal government, with a credit score as low as 500.

How long does it take to go from a 650 credit score to 700?

How good is a credit score of 698?

Quick Answer. For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

Has anyone gotten an 850 credit score?

Your 850 FICO® ScoreΘ falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.