When it comes to credit cards, “good” can mean a lot of things, but today, we’re talking credit limits. You know, the magical number that determines how much you can spend before your card gives you the cold shoulder. But what exactly is a good credit limit? Is it enough to cover a trip to Bora Bora or just a night out?.

Different people have different credit limits, but to keep your credit score healthy, it should be enough to cover your costs without going over 30% of your available credit. This means that your credit limit should be almost four times the most you plan to spend on the card (before you pay it off).

It can be both exciting and scary to get your first credit card. You are given a small piece of paper with some numbers on it and told that this is your credit limit. But what does that really mean? Is a $15,000 limit high or low?

As someone who’s been there, I totally get the confusion. When I opened my first card I had no idea how credit limits worked or why they mattered.

After making plenty of mistakes, I’ve learned a thing or two about ideal credit limits and how to make the most of yours. So let’s break it all down to see if a $15,000 credit limit is good for you

What Exactly Is A Credit Limit?

To put it simply, your credit limit is the most money that a lender will lend you. You can only spend a certain amount on your credit card before you have to pay off the balance.

Your credit limit is based on things like your income, debts, credit score, and credit history. The higher your limit, the more buying power you have.

But don’t let a high limit fool you – it’s not an invitation to rack up debt! No matter your limit, it’s wise to only charge what you can realistically pay off each month.

Is $15,000 Considered A High Limit?

In a word – yes! $15,000 is an above average credit limit.

According to Experian, the average credit limit in 2022 was $13,296. So a $15,000 initial limit is definitely on the higher end for most new cardholders.

As a rule of thumb:

- $1,000 – $5,000 is a low or moderate limit

- $5,000 – $10,000 is fairly high

- Above $10,000 is considered a very high limit

Of course, your perception of a “high” limit is subjective. But objectively speaking $15,000 is an excellent starting point.

What Does A $15,000 Limit Mean For Your Credit Score?

The higher your credit limit, the lower your credit utilization ratio will be – and that’s crucial for your score.

Your credit utilization is how much of your available credit you’re using. Experts recommend keeping this below 30%.

- For example:

- If your limit is $1,000 and you have a $500 balance, your utilization is 50%

- If your limit is $15,000 and you have a $500 balance, your utilization is only 3%

As you can see, a higher limit makes it easier to keep your utilization low. And the lower your utilization, the more it benefits your credit score.

So while a $15,000 limit won’t automatically boost your score, it gives you the flexibility to keep your utilization ideal for credit building.

How Does It Compare To Other Limits?

Here’s how a $15,000 credit limit stacks up:

-

It’s higher than what most new cardholders qualify for. Many starter cards have limits between $500 – $2000.

-

It’s an excellent limit for someone with good/excellent credit. Approval limits often increase to $5,000 – $15,000 for those with established credit.

-

It’s lower than the limits extended to people with pristine credit and high incomes. Limits of $20,000+ are reserved for elite credit holders.

-

It’s a fraction of the limits boasted by ultra-exclusive cards like the American Express Centurion “Black” Card, which starts at $100k.

While $15,000 is modest compared to the highest limits, it’s still considered high for the average person. Having this limit from the start can be a major asset.

Is It The Right Fit For You?

While a $15,000 credit limit sounds glamorous, more isn’t necessarily better when it comes to credit limits. A few key factors determine if it’s the right fit:

1. Your Income

Ideally your credit limit shouldn’t exceed your annual salary. Lenders want to see you have the means to manage high limits responsibly.

2. Your Credit Score

A higher credit score gives you better odds of qualifying for an initial $15,000 limit. Scores below 650 will have trouble getting approved.

3. Your Spending Habits

Ask yourself – will you be tempted to overspend with a $15,000 buffer? If you lack spending discipline, start lower.

4. Your Existing Debts

Too many recurring debts like loans and mortgages may discourage lenders from approving such a high limit.

5. Your Credit Card Needs

A limit of $15,000 or higher is ideal for financing large purchases or business expenses.

As long as it aligns with your financial situation, a $15,000 credit limit can be an amazing starting point on your credit journey.

Tips For Managing A $15,000 Limit

Here are some tips to leverage a $15k limit responsibly:

-

Make payments in full each month – avoid interest charges and credit damage by paying on time and in full.

-

Split big purchases into multiple payments – major purchases won’t wreck your utilization if you pay them down incrementally.

-

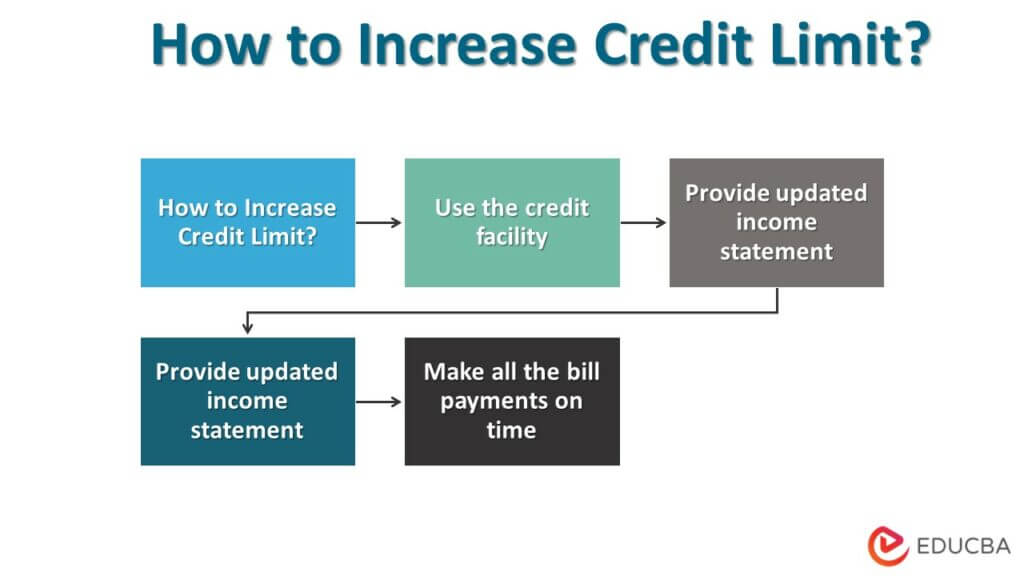

Ask for limit increases after 6 months – regular increases show lenders you can handle more credit.

-

Set spending alerts – get notified if your balance approaches 30% of your limit, signaling high utilization.

-

Pay down balances before the statement date – this keeps your reported utilization lower.

-

Have a budget – be realistic about what you can afford monthly to avoid overspending.

With smart strategies, there’s no reason a $15,000 limit can’t be a valuable asset on your financial journey.

Bottom Line

A $15,000 credit limit is excellent compared to average starter limits. It provides ample room to keep credit utilization low and build credit responsibly.

With financial prudence and healthy credit habits, such a high initial limit can give your credit score a real boost right out the gate.

Just be sure your income and spending levels align with handling a limit this large – don’t bite off more than you can chew! Start small if needed and work your way up.

But if you’ve got the green light for a $15k limit? Then congratulations, and spend wisely! With great credit comes great responsibility.

What should your credit limit be?

How do you figure out what your credit limit should be? It boils down to your financial habits and income. A good rule of thumb is to aim for a credit limit that’s about 20-30% of your annual income. For example, if you make $50,000 a year, a good credit limit might be around $10,000 to $15,000. This level not only gives you spending power but also keeps your credit utilization in check, which can help boost your credit score.

Finding the Sweet Spot

In the end, a good credit limit is all about balance. It should give you enough flexibility for larger purchases without tempting you to overspend. Remember, a high credit limit isn’t a green light to splurge; it’s a tool to manage your finances more effectively. Use it wisely and keep your spending in check.

Build Credit Fast No Credit Check? $15,000 Line of Credit

FAQ

Is $15000 a good credit limit?

It boils down to your financial habits and income. A good rule of thumb is to aim for a credit limit that’s between 30% and 40% of your yearly income. For example, if you make $50,000 a year, a good credit limit might be around $10,000 to $15,000.

Is $15000 in credit card debt a lot?

$15000 in credit card debt is not a lot, but it’s not at all ideal with your income.

What is considered a good credit limit?

If you’re just starting out, a good credit limit for your first card might be around $1,000. If you have built up a solid credit history, a steady income and a good credit score, your credit limit may increase to $5,000 or $10,000 or more — plenty of credit to ensure you can purchase big ticket items.

Can I get a credit card with a $15,000 limit?

… limit is considered to be $5,000 or more, and you will likely need good or excellent credit, along with a solid income, to get a limit of $15,000 or higherMay 8, 2025.