Most likely, one of the last things you want to think about when a family member dies is taking on their debt. But debt collectors could make this difficult situation even worse by contacting you. If youâre not sure how debt inheritance works or how to handle financial matters after a death in the family, this could add extra stress to the circumstances.

Letâs take a look at some information that can help you navigate dealing with inherited debt.

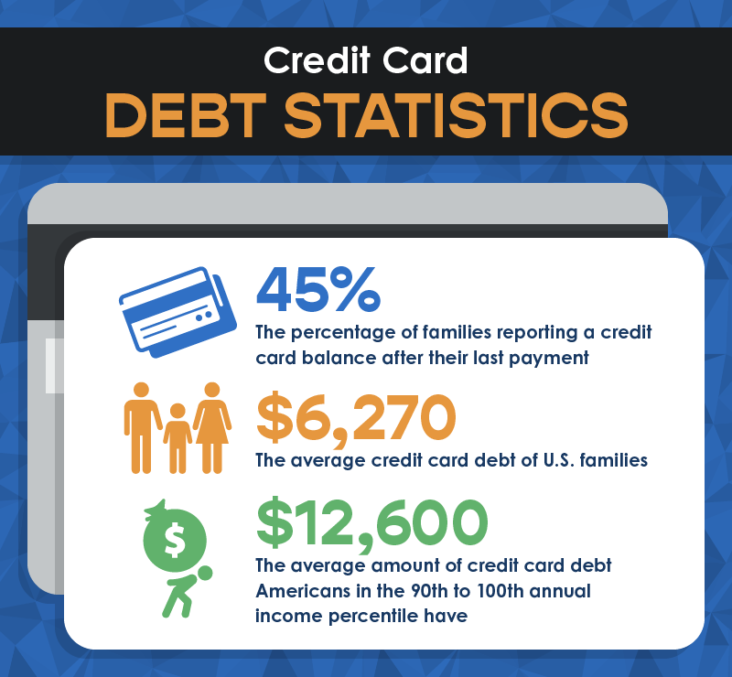

Credit card debt is getting worse in a lot of homes today. People who don’t pay off their credit card bills in full every month have an average balance of about $6,200. This can make things very expensive for their family after they die. How does credit card debt get paid off after you die? Does it get given to your family and friends?

The short answer is no, credit card debt is generally not inherited directly by your spouse or children. However, any outstanding debts still owed by you at the time of death do come out of your overall estate before any assets are distributed to beneficiaries

How Credit Card Debt is Handled After Death

Any credit card debt you have doesn’t just go away when you die. The credit card companies can still go after you for the debt, which needs to be taken care of by your estate.

An executor, typically the person designated in your will, is appointed to handle your estate. This involves assessing assets paying any debts or taxes owed and distributing whatever remains per the will’s instructions.

The executor will use assets within the estate to pay off credit card balances. If there is not enough money in the estate to fully cover all debts, credit card companies and other unsecured creditors will simply absorb the loss on whatever is unpaid.

Any joint account holders on credit cards with the deceased do become responsible for the debt. Authorized users are not liable for balances unless they continue charging to the account after being notified of the primary cardholder’s passing.

Credit Card Debt is Paid Before Beneficiaries Receive Inheritance

Members of the family should know that debts are paid off before any inheritance is given out. If you die with a $50,000 life insurance policy and $10,000 in credit card debt, the $10,000 debt is paid off first. Beneficiaries would receive the remaining $40,000.

Creditors can’t go after surviving spouses or other relatives directly to collect credit card debts that are higher than the value of the estate’s assets. In this case, though, the family and friends would also get nothing from the estate.

While family members don’t “inherit” the debt in a direct sense, owing substantial credit card balances can therefore impact inheritances.

Steps for Handling Credit Cards After a Death

When a cardholder passes away, here are some key steps their family and executor should take regarding outstanding credit card debt:

-

Obtain death certificates: Multiple official copies are needed to notify financial institutions, government agencies, etc.

-

Stop card use: Any authorized users should immediately cease charging anything else to cards of the deceased. The accounts are technically invalid after the death.

-

Notify issuers: Contact all credit card companies as soon as possible and provide a death certificate to close accounts. This prevents unauthorized use.

-

Review statements: Look for recurring charges, automatic debits, etc. that may need to be cancelled to avoid further charges.

-

Protect against ID theft: Request credit freezes and monitor reports to prevent fraudulent accounts being opened in the deceased’s name.

-

Pay from the estate: Use estate assets to pay any valid credit card debts up to the value within the estate. The executor submits claims.

-

Understand rights: Debt collectors may still contact survivors asking about unpaid balances. Know that relatives are not directly responsible.

Tips for Managing Credit Card Debt When End of Life Nears

No one likes thinking about their own demise, but managing financial affairs appropriately becomes especially important as one ages or faces health issues. Here are some tips regarding credit cards:

-

Downsize the number of open cards and consolidate balances to simplify matters. Close accounts no longer in use.

-

Communicate clearly with authorized users on expectations (e.g. whether they can continue using the card or not after you’re gone).

-

Make sure a trusted executor has documentation to easily access and close accounts upon death.

-

Set up automatic payments from a bank account to avoid missed credit card payments if ill or hospitalized.

-

Consider debt consolidation or balance transfer options to pay off large credit card balances over time.

-

Consult an estate planning attorney on strategies to handle debts and distribute assets efficiently.

-

Discreetly disclose debts and account details to heirs so they aren’t blindsided later during the estate settlement.

What About Leftover Credit Card Rewards?

Many credit card issuers will allow unused points, miles, and cash back rewards earned on an account to be redeemed by or transferred to heirs in some form upon the death of the primary cardholder. This is subject to the policies of each rewards program.

Requesting a payout or balance transfer of rewards is usually time-sensitive, such as within 1 year after the cardholder’s death. Documentation like a death certificate is typically required.

The best course of action is having beneficiaries properly designated with the issuer ahead of time so they can seamlessly access rewards later. An executor can also contact customer service about options.

Bottom Line

While credit card debt dies with you in a sense, it doesn’t disappear from your financial legacy entirely. Any outstanding balances still owed by you when you pass will be paid from your overall estate first before inheritance distribution.

Your credit card debt does not directly transfer as a burden to family members in most cases. But high balances can reduce what beneficiaries ultimately receive. Being prudent about debt management as you age, and communicating expectations clearly with heirs, helps ensure finances are orderly.

Home equity loans on inherited houses

Inheriting a family memberâs home after they die can result in financial liabilities. If the person who died had a mortgage or home equity loan, the person who gets the money could end up with their debt.

Tips for managing inherited debt

If someone leaves you debt, there are some things you can do to learn more about your rights and responsibilities. Letâs explore a few possibilities.

Can Credit Card Debt Be Inherited? Understanding the Inheritance of Debt

FAQ

Can debt be inherited?

Certain types of debt, such as individual credit card debt, can’t be inherited. However, shared debt will likely still need to be paid by a surviving debtholder. There are laws that protect family members from aggressive debt collectors who may use questionable methods to collect debts.

Are credit card debts inherited?

Credit card debts aren’t inherited by family members but paid for by your estate in a complex process. Does your credit card debt go away when you die? If so, you might want to talk to an estate planning lawyer about how to protect your assets after you die. Under certain circumstances, your family members could liable for your credit card debt after you die.

Can I inherit my credit card debt if I’m not a cosigner?

If you’re not in a community property state and you weren’t a cosigner or joint account holder, then you shouldn’t inherit their credit card debt. However, laws vary by state, so make sure to check the laws where you live or hire an attorney to help you understand your debt obligations.

What happens to credit card debt after a family member dies?

After a family member dies, relatives are sometimes left to deal with their credit card debt. When a deceased person leaves behind debt, like credit card bills, their estate pays off the balances. If there isn’t enough money to pay them and no one else co-signed for the debt, creditors may be out of luck.

What happens if a person inherits a debt?

Laws generally protect individuals from inheriting debt outright; creditors must present written claims to the estate within a specified period. If the estate lacks sufficient assets to pay all debts, creditors may choose to forgive the remaining amount. This means that not all debts will necessarily be collected.

Do credit card debts disappear when you die?

Unfortunately, credit card debts don’t disappear when you die. The debt is paid off via your estate’s assets, which includes everything you own – like your car, home, bank accounts and investments. The executor of your estate, the person who carries out your wishes, will use your assets to pay off your credit card debts.

Do you inherit your parents’ credit card debt?

Generally, no, you don’t inherit your parents’ credit card debt. When someone passes away, their debts are typically paid from their estate, which includes any assets they owned. If the estate has enough funds to cover the debts, they are paid off before any inheritance is distributed to heirs. If the estate doesn’t have enough money, the rest of the debt is often forgiven, and family members aren’t held responsible.

Does credit card debt transfer to heirs?

If the credit card was shared with a joint account holder or a cosigner, any lingering debts become their responsibility. The estate. If a sole cardholder has debt remaining on a card upon their death, the estate will be responsible for paying off that account from the remaining assets. The deceased’s spouse.

Do I have to pay my mom’s credit card debt if she dies?

Generally, you are not personally responsible for paying your mother’s credit card debt after she dies. Credit card debt is typically paid from the deceased’s estate, not directly from family members.

Can creditors come after children for parents’ debt?

Generally, no. But there are certain circumstances where children may have to pay off the debts left by their parents. A son or daughter will have to pay the debt of their mother or father, for example, if the childco-signed on a loan or is a joint account holder on a credit card.