You may feel confused about mortgage underwriting because you’ve heard it takes a long time and is hard to understand. But that shouldn’t give you cause to worry.

We’ll help you understand everything about mortgage underwriting, including how you can prepare to be ready for every step of the process.

Getting a mortgage to purchase a home can be an exciting yet challenging process. One of the most critical steps is going through mortgage underwriting, where the lender evaluates your financial profile to determine if you qualify for a loan. Many borrowers wonder – is mortgage underwriting difficult?

The underwriting process involves extensive verification of your finances, credit, and employment history. While it can seem daunting, being prepared and working closely with your lender can help streamline underwriting and improve your chances of approval.

What is Mortgage Underwriting?

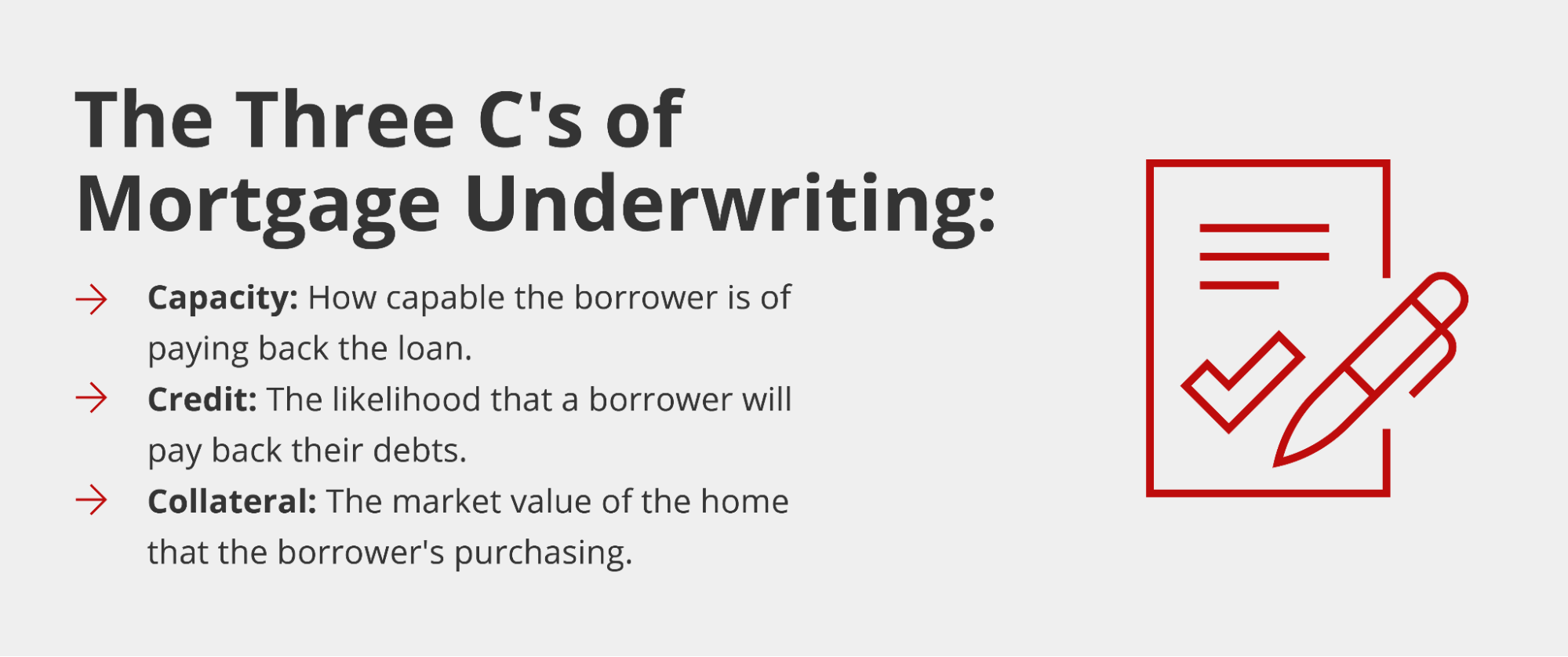

Mortgage underwriting is the process a lender uses to assess a loan application and decide whether to approve or deny the mortgage. The underwriter, who works for the lender, analyzes the borrower’s creditworthiness and the property that will serve as collateral for the loan.

The goal is to ensure the borrower has the capacity to repay the mortgage debt and that the property provides sufficient value to secure the loan Underwriters carefully evaluate the borrower’s

- Income and assets

- Credit history and credit score

- Existing debts and liabilities

- Employment history

They also review the appraised value of the home and may require additional documentation like bank statements, tax returns, or gift letters for large deposits.

Different lenders have different underwriting rules, but most of them are based on Fannie Mae, Freddie Mac, FHA, VA, or USDA standards.

Is Mortgage Underwriting Difficult?

The underwriting process can certainly feel overwhelming, especially for first-time homebuyers. Working through the documentation requirements and waiting for a decision creates anxiety for many borrowers.

Being ready and quick to respond, on the other hand, can make underwriting easier and speed up the closing process. Here are some tips:

Start preparing early

As soon as you begin considering purchasing a home, start putting key financial documents in order, such as:

- Tax returns for the past 2 years

- W-2s for the past 2 years

- Pay stubs covering the last 30-60 days

- Last 2 month’s bank statements

This will make it easy to submit a complete application.

Know lender requirements

Find out what the requirements are for getting the mortgage you want, whether it’s an FHA, conventional, VA, or other type. This helps you figure out if you need to take steps to raise your credit score, lower your debts, or save more for a down payment.

Get pre-approved

Complete the pre-approval process before house hunting. This gives you an estimate of your borrowing potential and surfaces any potential issues early.

Maintain your finances

Avoid new debts, credit inquiries, or large purchases during underwriting. Also continue making all payments on time. Any deterioration of your financial profile could jeopardize approval.

Communicate with your lender

Stay in close contact with your loan officer throughout underwriting. Respond quickly to any requests for additional documents to prevent delays. Keep them updated on any changes to your employment or credit.

Be patient

Underwriting often takes at least 2 weeks, sometimes longer. The process cannot be rushed. But staying organized and responsive helps minimize delays on your end.

Steps in the Mortgage Underwriting Process

While underwriting requirements vary across lenders, the process generally includes the following key steps:

Pre-approval – Provides an initial snapshot of your finances. Pre-approval is not a guarantee of final loan approval.

Verification – Underwriters verify your income, employment, assets, and debts. Additional documentation may be requested.

Appraisal – An appraiser estimates the market value of the home you wish to purchase.

Credit review – Your credit report and score are evaluated for any potential red flags.

DTI calculation: your total monthly debts are divided by your gross monthly income. Most lenders require DTI under 50%.

Decision – The underwriter will approve your loan, deny it, or request additional conditions be met before final approval.

Top Reasons Mortgage Loans are Denied

While most applicants successfully pass underwriting, approximately 8% of mortgage applications are denied according to data from HSH.com. Here are some top reasons underwriters reject loans:

-

Low credit score – Indicates potential difficulty repaying debts. Minimum scores vary by lender and loan type but often start around 620.

-

High DTI – Too much existing monthly debt compared to income. Most lenders cap DTI around 50%.

-

Limited down payment – Loan amount too high compared to home value. Conventional loans usually require at least 3%.

-

Employment history – Frequent job changes or gaps can signal instability. At least 2 years with current employer is often required.

-

Questionable deposits – Large deposits from uncertain sources can appear risky. Gift letters may be needed to explain.

-

Property issues – Major defects found during inspection or an appraised value lower than the purchase price.

-

Credit events – A history of missed payments, foreclosure, or bankruptcy can cause denials for a certain period of time.

Tips for Smooth Sailing Through Underwriting

While underwriting can seem intimidating, being proactive helps ensure the process goes smoothly and avoids denials. Consider these tips:

-

Check your credit – Review credit reports for errors, pay down balances, don’t apply for new credit prior to applying.

-

Save for a down payment – Larger down payments reduce risk for lenders. Shoot for at least 5-10% if possible.

-

Pay down high-rate debts – Reducing credit card balances lowers your DTI. Pay off collections and charge-offs if possible.

-

Start gathering documents – Tax returns, pay stubs, bank statements. Create a system to store financial records.

-

Choose lender carefully – Work with an experienced lender who can guide you through underwriting.

-

Maintain contact with lender – Respond promptly to any underwriter requests to avoid delays.

-

Be upfront about issues – Clearly explain any credit blemishes or employment gaps. Don’t hide anything.

The Final Verdict on Mortgage Underwriting

Underwriting causes stress for many homebuyers because it is a time-consuming process that picks through your financial history with a fine-tooth comb. While approval is never 100% guaranteed, being organized, patient, and transparent can help smooth the way.

Work closely with your lender and loan officer. Seek their guidance to ensure you submit a solid application. Maintain your good financial habits throughout the process. While underwriting requires effort, preparation and diligence reduces the difficulty significantly.

With a properly documented application and a little perseverance, you can make it through underwriting with your dream home waiting for you at the finish line. Don’t let the process intimidate you. Be ready to provide all required information accurately and honestly, and you’ll be unpacking boxes in your new house before you know it.

What can you expect out of the process?

Your home mortgage consultant will be with you from the start to help you through the underwriting process. After receiving and acknowledging your documents, you will be given a home loan processor who will help you finish the process.

Timeframe: The initial review generally takes about three business days to complete, but that timeframe could change depending on each borrower’s unique situation. During that time, if an appraisal is required, it will be ordered, and your underwriter will begin reviewing your documents. They will also work with the title company and verify your employment.

Extra paperwork: Your mortgage consultant or home loan processor will get back to you to talk about whether you need any extra paperwork. Their job is to keep the loan process moving toward the closing stage once they have all the documents they need to conditionally approve your loan.

Final steps: Once your loan is ready for closing (signing your final loan documents), your loan processor will walk you through the next steps of connecting you with a closing agent. Closing your loan in a timely manner is extremely important, so be mindful of providing requested items within 48 hours to keep the process moving and to avoid delays. Learn more about what is expected at closing.

Are you ready for the next step in your homebuying journey? Talk with your mortgage consultant if you have questions or concerns. You can also check out our Learning Center to help you make more confident decisions throughout the homebuying process.

What is mortgage underwriting? Mortgage underwriting is the process to assess whether you meet specific requirements for the loan you’ve requested. The process involves a thorough review of your credit, employment history, income, assets, and property details by a mortgage underwriter.

There are four key focuses to the underwriting process: credit, income, assets, and property.

- Credit: Underwriters will look at your credit history to see how to borrow money and pay it back in the past.

- Income and employment: To see if you can pay back the loan, underwriters look at your work history and proof of income.

- Assets: Your bank and investment accounts are part of your assets that underwriters look at to see if you have enough money for the down payment and closing costs.

- Property: Finally, if needed, underwriters will look over an appraisal of the property to see if the value of the property supports the loan amount and purchase price.

2 Big Reasons Home Loans Blow Up In Underwriting – [Underwriting Mortgage Process]

FAQ

How common is it to get denied during underwriting?

The denial rate for FHA loans in underwriting was 13. 6% in 2023. This is nearly double the denial rate for conventional mortgages for the same year. May 1, 2025.

Do underwriters look at spending habits?

What are the 4 C’s required for mortgage underwriting?

… are four core components — the four C’s — that lenders will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

How stressful is mortgage underwriting?

The underwriting process can indeed be stressful for many borrowers, particularly during home buying. Several factors contribute to this home buying stress: Extensive Documentation: Borrowers must provide various financial documents, including pay stubs, tax returns, bank statements, and more.