“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our content is written by professionals with a lot of experience and is edited by experts in the field to make sure it is fair, correct, and reliable.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo.

Hey there, family! If you’re wondering, “Should I make two payments on my car?” you’ve come to the right place. I get it—having to pay for someone else’s car can feel like a load of lead, especially if the lender makes you roll your eyes like a teen. You might have just gotten a job at McDonald’s and have some extra cash coming in. You want to get rid of that debt as soon as possible. We’re going to make this really easy to understand so you can decide if double up is a smart move or a total waste of money.

If you double up on your car payment, you pay twice as much each month, or at least add extra money to it whenever you can. The best part is that you could pay off that ride faster and save a lot of money on interest. But hold up—it ain’t always rainbows and butterflies. Things to keep an eye on include whether or not your lender will let you do this without charging you extra, and whether or not your budget can handle the hit. I’m going to tell you the pros and cons of this idea and how to make it work if you decide to go for it in this post. Let’s dive in!.

Why Doublin’ Up Can Be a Game-Changer

First off, let’s talk about why payin’ extra on your car loan might have you feelin’ like a financial wizard. When you double up or toss extra bucks at your loan, you’re usually chippin’ away at the principal—that’s the actual amount you borrowed, not the interest tacked on. Here’s why that’s a big deal:

- Save on Interest, Big Time: Most car loans work on somethin’ called simple interest. That means the interest you pay is based on how much principal you still owe. Pay more now, owe less later, and boom—you cut down the total interest you shell out over the loan’s life. If you’re early in your loan term (like, just a year into a 4-year deal), this can save you a fat stack of cash.

- Get Outta Debt Quicker: Say you owe $3,067 with 3 years left on a 4-year term. Doublin’ up could knock that down way faster—maybe even in a year or less, dependin’ on your payments. That’s freedom, my friend! No more monthly stress over that car bill.

- Avoid Bein’ Underwater: Ever heard of bein’ “upside-down” on a loan? That’s when your car’s worth less than what you owe. Sucks if you wanna sell or trade it in. Extra payments help you pay down the balance quicker than your car depreciates (loses value), keepin’ you in the clear.

- Free Up Cash Later: Once that loan’s gone, the money you were throwin’ at it can go elsewhere—like savin’ for a vacay, a new ride, or just buildin’ a cushion for rainy days.

Sounds sweet, right? I’ve been there, wantin’ to just be done with a loan that felt like it was draggin’ on forever. But before you start tossin’ every spare dime at your lender, we gotta look at the flip side

The Downsides—Why Doublin’ Up Ain’t Always Smart

Now, I ain’t gonna sugarcoat this. Doublin’ your car payment can backfire if you ain’t careful. Here’s the real talk on what could go wrong:

- Strains Your Budget: If you’re workin’ a job that’s payin’ the bills but not much more, doublin’ up might leave ya strapped. What if your car breaks down or you got a surprise medical bill? You don’t wanna be diggin’ into savings or—worse—runnin’ up credit card debt just to cover basics.

- Might Not Save You Nothin’: Some loans got what’s called precomputed interest. Fancy term, but it just means the interest is figured out upfront for the whole term, and payin’ extra won’t cut it down. You’d still pay off faster, but no savings on interest. Kinda a bummer, right?

- Prepayment Penalties: Some shady lenders—or even legit ones—charge fees if you pay off early. It’s like they’re punishin’ ya for bein’ responsible! These penalties could eat up any interest you’d save, so ya gotta check your loan terms.

- Less Cash for Other Goals: Doublin’ up means less money for stuff like buildin’ an emergency fund (super important, trust me), savin’ for a house, or payin’ off higher-interest debt like credit cards. If your card’s got a 20% interest rate and your car loan’s at 6%, you’re losin’ more money ignorin’ the card.

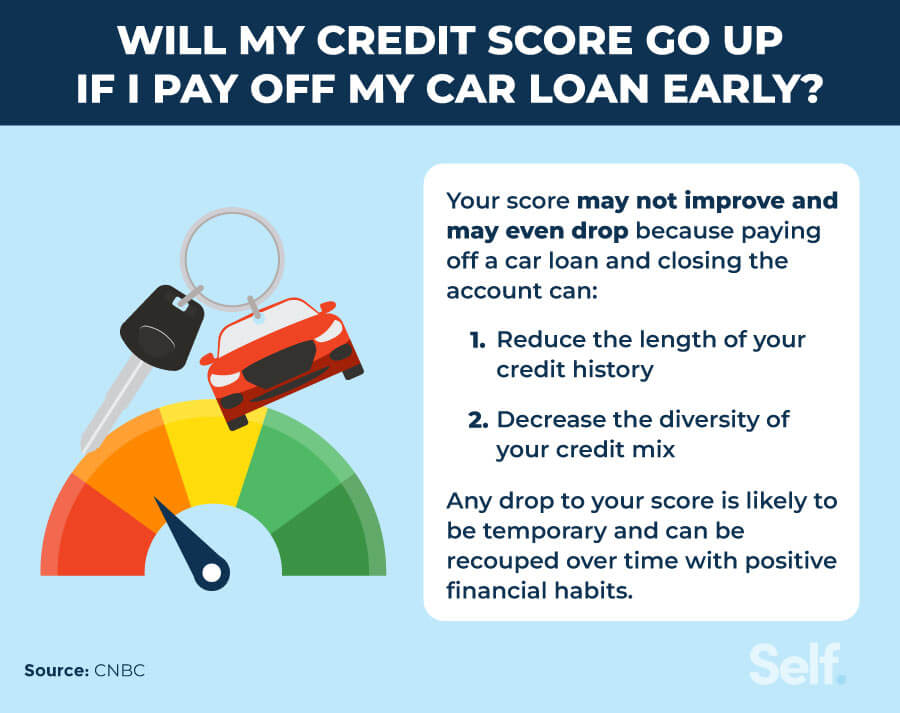

- Credit Score Could Dip: Weird, huh? Payin’ off a loan early can sometimes nudge your credit score down a bit. If this car loan is one of your only debts or your oldest account, closin’ it might mess with your credit mix or history length. Don’t sweat it too much—it usually bounces back quick if you keep other payments on track.

I remember when I thought about dumpin’ extra cash on a loan once but then realized I needed that money for somethin’ else urgent. Gotta weigh your options, ya know?

Things to Chew On Before You Double Up

So, should ya double up on that car payment or nah? It depends on a few key things. Grab a coffee (or a soda, whatever’s your jam), and let’s run through what you gotta consider:

- Can Your Budget Handle It?: Be real with yourself. Look at your income—whether it’s from flippin’ burgers or whatever—and your expenses. If doublin’ up means skippin’ meals or stressin’ every month, it ain’t worth it. Maybe start smaller, like addin’ $50 extra when you can.

- What’s Your Lender’s Deal?: Not all lenders play nice with extra payments. Some won’t let ya apply extra straight to the principal unless you jump through hoops—like fillin’ out forms or sendin’ a note with your payment. Others might hit ya with those prepayment penalties I mentioned. Call ‘em up or dig into your loan agreement to find out.

- Got Precomputed Interest?: If your loan’s got this, extra payments won’t save on interest. You’ll still pay it off faster, but decide if that’s worth tyin’ up your cash now.

- Other Debts Stealin’ Your Thunder?: Check the interest rates on any other debt ya got. Credit cards often run way higher than car loans—like 22% versus 6%. Payin’ off the higher-rate stuff first usually saves ya more in the long run.

- Bigger Fish to Fry?: Think about your goals. If you’re savin’ for a house down payment or need an emergency stash (aim for 3-6 months of expenses, by the way), that might trump doublin’ up on the car loan.

Here’s a lil’ table to help ya visualize the decision:

| Factor | Double Up? (Yes) | Double Up? (No) |

|---|---|---|

| Budget Room | Got extra cash after bills | Barely makin’ ends meet |

| Lender Rules | Allows extra payments, no penalties | Charges fees or restricts extra payments |

| Interest Type | Simple interest (saves on interest) | Precomputed (no interest savings) |

| Other Debt | No higher-interest debt | Credit cards or loans with higher rates |

| Financial Goals | Want debt gone ASAP | Savin’ for house, emergency fund, etc. |

This should give ya a quick snapshot of where ya stand. We ain’t done yet though—let’s talk how to do this right if you decide to go for it.

How to Double Up the Right Way

Alright, say you’ve thought it over and wanna double up on that car payment. Cool beans! But you gotta do it smart. Here’s the step-by-step to make sure it works in your favor:

- Check with Your Lender First: I know I said this already, but it’s worth hammerin’ home. Call or email your lender and ask if you can make extra payments and how to make sure they go to the principal, not just interest. Sometimes ya gotta check a box online or send a note sayin’ “apply to principal.” If they got penalties for early payoff, figure out if the savings outweigh the cost.

- Start Small If Needed: You don’t gotta go full double right away. If your monthly payment is, say, $150, try addin’ $50 or $75 extra when you can. Even small extras add up over time.

- Try Biweekly Payments: Here’s a neat trick—split your monthly payment in half and pay every two weeks. Over a year, that’s like makin’ an extra full payment without feelin’ the pinch as much. So if your payment’s $150, pay $75 biweekly. Boom, 13 payments a year instead of 12.

- Toss in Lump Sums When Possible: Got a tax refund, bonus, or some side hustle cash? Throw it at your loan as a one-time extra payment. Just make sure it’s goin’ to principal—check them statements after to confirm.

- Keep an Eye on Your Budget: Don’t let this extra payin’ mess with your day-to-day. Keep some cash aside for emergencies so you ain’t stuck if life throws a curveball.

- Track Your Progress: Watch your loan balance drop—it’s motivatin’ as heck! Most lenders got online portals where ya can see how much you owe. Celebrate the small wins when you hit milestones.

I’ve tried the biweekly thing before, and lemme tell ya, it feels sneaky-good to know you’re sneakin’ in that extra payment without really noticin’ the difference month to month.

What If Doublin’ Up Ain’t Your Thing?

After reading all of this, it’s okay if you decide, “Nah, I can’t swing it.” You can pay off that car loan in other ways that won’t break the bank:

- Refinance for a Lower Rate: If your interest rate’s high, look into refinancin’ with another lender for a better deal. Lower rate means less interest over time, even if you stick to regular payments. Just watch out for fees with this too.

- Stick to the Plan, But Save Elsewhere: Keep payin’ the minimum, but focus extra cash on buildin’ an emergency fund or payin’ off pricier debt. You’ll still get there, just slower.

- Sell or Trade If It’s a Lemon: If the car—or the lender—is drivin’ ya up the wall, consider sellin’ it if the value covers what ya owe. Or trade it in for somethin’ cheaper. Risky move, but sometimes it’s the only way to ditch a bad deal.

I’ve had buddies who refinanced and swore it was the best decision ever, savin’ hundreds in interest. Might be worth a peek if doublin’ up feels too heavy.

Real-Life Example—Let’s Crunch Some Numbers

Lemme paint a picture for ya. Say you owe $3,067 on your car, got 3 years (36 months) left, and your monthly payment is around $100 (rough guess with interest). Interest rate’s, let’s say, 6%—pretty standard for a used car. At this rate, you’re payin’ about $1,500 total in interest if ya stick to the schedule.

Now, if ya double up to $200 a month, you could pay it off in about 16 months instead of 36. Total interest drops to maybe $300-ish. That’s savin’ over a grand! But—if ya can only afford $150 a month, you’re still done in about 22 months, savin’ close to $800 in interest. See how even a lil’ extra helps?

Course, this is a ballpark. Your rate or balance might be different, so play with a loan calculator online to get your exact numbers. Point is, doublin’ up—or even just uppin’ it a bit—can shave off serious time and money.

How It Might Mess with Your Credit (But Don’t Panic)

I touched on this earlier, but let’s dig a tad deeper. Payin’ extra itself won’t hurt your credit score—makin’ on-time payments is what counts most. But if you pay off the whole loan early, a couple things might happen:

- Credit Mix Gets Less Diverse: If this car loan is your only “installment” debt (not a credit card, which is “revolving”), closin’ it might lower your score a smidge ‘cause your credit types ain’t varied no more.

- History Takes a Hit: If it’s one of your older accounts, closin’ it could shorten your credit history length, which is a factor in your score. Younger credit history = slight dip.

- Usually Temporary: Good news? If you keep payin’ other bills on time, any drop should fix itself in a few months. Plus, a paid-off loan stays on your report as a positive for up to 10 years.

If you’re plannin’ to apply for a big loan soon—like a mortgage—maybe hold off on payin’ it off early to avoid even a tiny score blip. Otherwise, it ain’t a huge worry for most folks.

Wrappin’ It Up—Should You Double Up or Not?

So, should I double up on my car payment—or should you? Here’s the bottom line from us at [Your Company Name or just “we”]: makin’ extra payments can be a dope way to pay off your loan faster and cut down on interest. You could save hundreds, maybe thousands, and get that debt monkey off your back sooner. But it ain’t for everyone. You gotta make sure your budget can take the hit, check if your lender’s cool with it (and won’t charge penalties), and decide if that money’s better spent on other stuff like high-interest debt or savin’ for emergencies.

If you’re sittin’ on $3,067 owed like some folks, with 3 years left, doublin’ up could have ya debt-free in half the time or less. But don’t rush in blind—talk to your lender, crunch your numbers, and see what fits your life. We’ve laid out the steps and tricks like biweekly payments to make it easier if ya go for it.

Got questions or wanna share how you tackled your car loan? Drop a comment below—I’m all ears! And hey, if this helped ya sort things out, share it with a buddy who’s in the same boat. Let’s keep hustlin’ toward that debt-free life together!

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate. com is an independent, advertising-supported publisher and comparison service. Sometimes we get paid to put sponsored products and services on our site or for you clicking on certain links on it. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. How and where products show up on this site can also be affected by things like our website’s rules and whether or not a product is available in your area or at the credit score range you choose. Bankrate does not include information about every financial or credit product or service, even though we try to offer a lot of them.

- A principal-only car payment is an extra payment that goes toward the principal of your car loan when there is no interest due.

- Extra payments may not always be added to the principal by the lender, so you may need to make a specific request.

- If you only pay the principal on your auto loan, you can save money and pay it off faster.

If it’s possible for your budget, making a principal-only payment on your car loan can be a good idea. Extra payments can help you build equity, save on loan interest and pay off your auto loan faster.

Make sure you allocate extra payments in a way that saves you the most money. If your lender doesn’t apply extra payments to your principal, you won’t benefit as much — but there is nothing wrong with getting ahead of your monthly payments.

Benefits of making extra principal payments

A smaller principal means less interest and a faster payoff date. Every payment that goes solely toward your principal also builds equity in your car, which reduces the risk of owing more than your car is worth — known as an upside-down car loan.

The most common financing option, simple interest auto loans, calculates interest as a percentage of the total principal you owe. As you reduce the principal amount owed, less interest will accrue.

Since the main benefit is saving money over the long term, you can use an early payoff calculator to see how additional monthly payments will reduce the total interest paid and the amount of time spent paying the loan.

Take a $42,000 auto loan with a 6.35 percent APR and a 60-month term. By paying even a little extra each month, you can save hundreds in interest and cut multiple months off of your loan term.

| Additional monthly principal-only payment | Total interest paid | Total cost-savings | Loan term reduction |

|---|---|---|---|

| $0 | $7,130 | $0 | 0 months |

| $50 | $6,638 | $492 | 4 months |

| $100 | $6,211 | $919 | 7 months |

It can. Early repayment may impact your credit mix, your payment history and your debt-to-income ratio before you decide to pay the loan off early.

How To Way To PAY OFF Your Car Loan in HALF the Time!

FAQ

Is it smart to make double car payments?

It helps you get closer to an early payoff date without significantly increasing your monthly loan payment. In order to save money doubling your monthly payment on your car loan is a great way. To maximize your savings, you’ll need to make two separate payments.

What happens if I pay an extra $100 on my car loan?

By making an extra $100 payment every month, you can lower your principal balance faster than with regular payments. This will shorten the length of your loan and lower your interest rates. How much time and money you save will depend on how much you borrow and how long your interest rate term is.

What happens if I double up on my car payment?

If you made two payments on your car, you can either ask for a refund or add the extra to next month’s payment. You can also use the extra payment to lower the principal on your loan.

Is it better to pay more on your car payment?

Refinancing — or just making extra payments — are the best ways to pay off your car loan faster. Even if it’s just a few extra dollars, you will reduce your debt and may cut a few months out of your loan.