What you consider a good credit card APR may depend on the national average rates and your individual creditworthiness. But, generally, an APR thatâs in the low teens or below is a good APR.

A good annual percentage rate (APR) for a credit card is a rate thats below the current average credit card interest rate. A lower rate means youll accrue less interest if you carry a balance on the card. With credit cards, “APR” and “interest rate” are used interchangeably since credit card APRs dont take fees into consideration (as is the case with other types of debt).

Understanding whether your credit card APR should be high or low can be confusing. This comprehensive guide will help you determine if your APR is favorable and provide strategies to get a better rate.

What is APR?

APR stands for annual percentage rate It represents the yearly cost of borrowing money on a credit card. If you carry a balance past your payment due date, the APR determines how much interest the card issuer can charge you

In general, it’s better for the cardholder if the APR is lower. But APRs aren’t always “good.” What’s “good” depends on your credit score, the type of card you have, and the economy as a whole.

How Credit Card APRs Are Determined

Several key factors go into determining your APR when you open a credit card:

-

The card’s interest rate range Many cards advertise APR ranges based on creditworthiness Your specific APR is pegged to where you fall within the range.

-

Your credit score and history: Better credit typically equals lower APRs. Lenders examine your credit report and FICO score to gauge risk.

-

Comparison of interest rates: If your card’s APR changes based on things like the prime rate, this is called a benchmark interest rate.

-

Transaction type: Purchases, balance transfers, and cash advances may have different APRs.

What is Considered a Good APR?

-

The national average APR is around 20%. So an APR below that benchmark can be considered good.

-

The better your credit, the lower the APR you can generally qualify for. An APR below 10% is excellent.

-

0% introductory APR offers provide an interest-free grace period for new purchases and balance transfers.

-

Rewards cards tend to have higher APRs than basic no-frills cards.

Should You Have a High or Low APR?

-

It doesn’t matter what your APR is if you always pay your bill in full. You won’t have to pay interest.

-

Low APR can save you money on interest if you sometimes carry a balance. High rates above 24% get very expensive.

-

Only consider high APR cards if you won’t carry a balance. The rewards aren’t worth it if you’ll pay interest.

How to Get a Good APR

-

Boost your credit – pay bills on time, lower utilization. Higher scores unlock better APRs.

-

Seek out introductory 0% APR offers on purchases or balance transfers.

-

Comparison shop at credit unions for low ongoing rates.

-

Ask your issuer to lower your rate – show you’re a responsible borrower.

The Bottom Line

Ideally, you want the lowest APR possible based on your credit profile and card type. But diligently paying your balance off monthly makes the APR irrelevant. Consider your spending habits and financial discipline before deciding between high and low APR cards.

What Is a Good Credit Card APR?

A good credit card APR is one thats below the national average credit card rate, which is 21.47% as of November 2024, according to Federal Reserve data.

Average rates go up and down, impacted in part by benchmarks correlated with the federal funds rate set by the Federal Reserve. As a result, the standard for whats considered a good credit card APR can change over time.

Pay Off Your Card Each Month

If you pay your statement balance in full each month before the due date, then your purchases wont accrue interest during the statement period or during the grace period, which lasts from the end of the statement period to the bills due date.

Some people incorrectly believe that carrying a balance can improve their credit score. While using your credit card is helpful, you dont need to carry a balance or pay any interest to benefit from using your card.

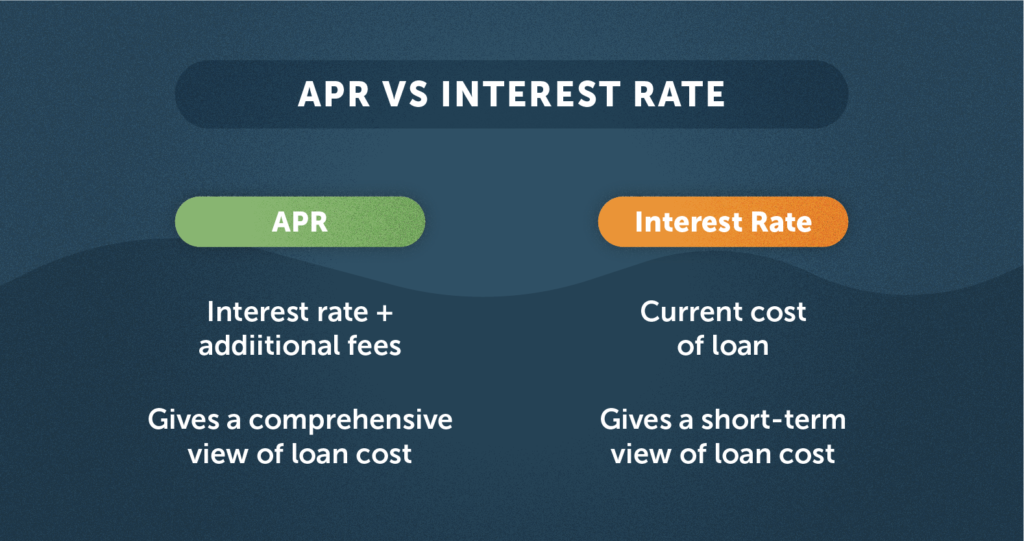

The difference between APR and Interest Rate

FAQ

Why is my Apr so high?

Even with good credit, your APR might be high due to factors like recent Federal Reserve rate increases, the type of card you have or changes in your credit utilization. The good news is you can often negotiate with your credit card company for a lower rate.

What is a good APR on a credit card?

The Federal Reserve tracks credit card interest rates, and an APR below the average would also be considered good. The best possible APR on a credit card is 0%, which you can get for an introductory period on many cards. In addition, if you pay your credit card in full every month, your APR doesn’t even matter, since you won’t get charged interest.

Will my credit card Apr be higher if my credit is bad?

Your credit card APR is probably going to be higher if your credit isn’t very good. You can get a good APR if you keep good credit habits, like paying your credit card bill on time every month and using your credit cards less than you borrow.

Is a 25% Apr high for a credit card?

Yes, a 25% APR is high for a credit card, as it is above the average APR for new credit card offers.

How do I qualify for lower APRs?

Maintaining a good credit score is key to qualifying for lower APRs. As a general rule, you should make all of your payments on time, keep your credit utilization low (ideally under 30%), and avoid applying for too many new credit cards at once. These habits show credit card companies you’re a responsible borrower.

Can a credit card have a low APR?

Credit cards with APRs below 10 percent are fairly rare but may be offered by some credit unions or local banks. It’s likely that your interest rate will be much higher than the average rate if you have fair or bad credit. As a result, the best approach is to pay.

Is it better to have a high or low APR?

Is 24% a high APR?

Yes, a 24% APR is high for a credit card.

Is 0% APR too good to be true?

No. 0% APR is too much of a risk (trap). Some cards, if you carry the balance the entire time, and are unable to pay, you’ll end up being charged all of the accrued interest for the entire 12/15/18 months you carried the balance. Even if that doesn’t apply to a given card, still not going to set myself up for failure.

Is 26.99 APR good for a credit card?