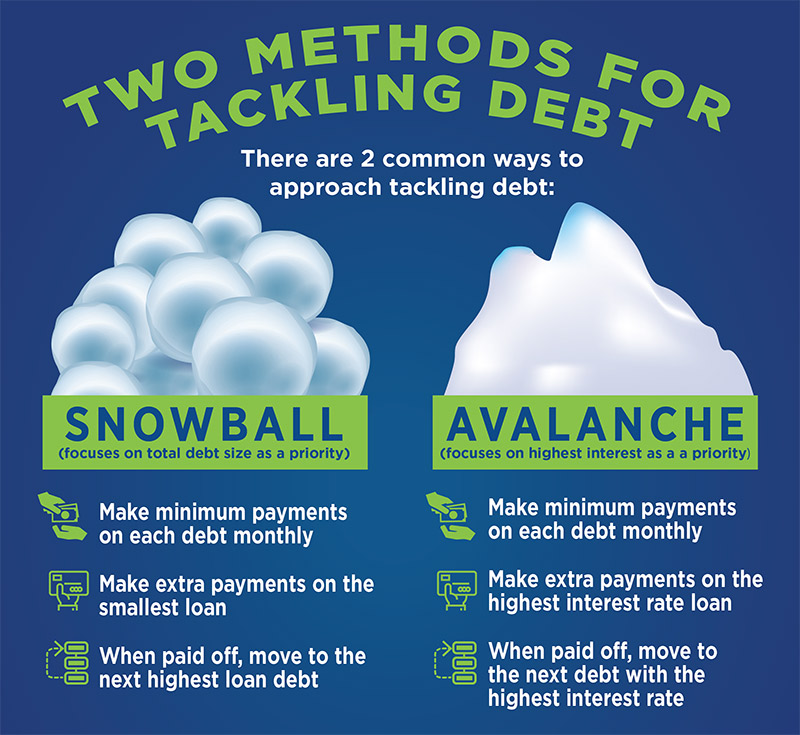

Trying to pay off your debt can seem overwhelming, but there are strategies that can help. Many people choose between two different ways to help them pay off their debt. Each has its own pros and cons. There is no right or wrong answer when it comes to which method is best because every person’s debt situation differs. Sometimes it might even be a combination of both methods. It is up to you to determine what motivates you and which process may be the best fit for your situation.

Hey, family! If you’re facing a mountain of debt and feel like it’s going to bury you, I feel you. Debt can be a real pain, keeping you up at night and stressing you out every time a bill comes in. But the good news is that there are good ways to pay off your debt that can help you slowly pay it off and finally breathe easy. We like to keep things real here at MoneyMoxie and give you the tools you need to take charge of your money. Now that we know what debt repayment strategies are, how they work, and which one could help you get out of debt, let’s talk about them.

What Are Debt Repayment Strategies, Anyway?

In simple terms, debt repayment strategies are game plans to pay off what you owe in a smart organized way. They ain’t just about throwin’ random cash at your bills and hopin’ for the best. Nah these methods help you prioritize which debts to tackle first, how much to pay, and where to find extra dough to speed things up. Whether it’s credit card balances, student loans, or that pesky car payment, a good strategy can save you money on interest, reduce stress, and get you outta debt faster than you thought possible.

Let’s break down the most popular and effective debt repayment strategies I’m gonna lay ‘em out clear and simple, so you can pick the one that vibes with your situation Ready? Let’s roll!

1. The Debt Snowball Method: Stack Up Them Quick Wins!

First up is the debt snowball method, and lemme tell ya, this one’s a fan fave for a reason. The idea is to focus on payin’ off your smallest debt first while makin’ minimum payments on everything else. Once that tiny debt is gone, you roll the money you were payin’ on it into the next smallest debt. It’s like a snowball rollin’ downhill—gets bigger and faster as you go!

- How It Works: List all your debts from smallest balance to largest. Pay minimums on all, but throw every extra penny at the smallest one. When it’s paid off, add that payment to the next smallest debt.

- Why It’s Awesome: You get quick wins, which feels freakin’ amazing. Payin’ off a small debt in a few months can give you the boost to keep goin’.

- Who It’s For: If you need motivation and wanna see progress ASAP, this is your jam. It’s less about savin’ on interest and more about feelin’ like a boss.

I remember when I owed a bunch of small amounts on my credit cards, like $500 here and $800 there. I finished the smallest one in just two months using the snowball method. It felt like winning the lottery to cross that off my list! It made me excited to move on to the next one.

2. The Debt Avalanche Method: Slash Them High-Interest Suckers!

Now, if you’re more about savin’ cash than quick wins, the debt avalanche method might be your style. This strategy focuses on payin’ off the debt with the highest interest rate first, while still coverin’ minimums on the rest. Once that pricey debt is gone, you roll the payment into the next highest interest debt.

- How It Works: List your debts from highest interest rate to lowest. Pay minimums on all, but dump extra cash on the one with the worst rate. After it’s paid, target the next highest rate.

- Why It’s Awesome: You save a ton on interest over time, ‘cause them high rates are what bleed you dry. It’s a slower burn on motivation but a smarter play for your wallet.

- Who It’s For: If you’ve got patience and wanna minimize costs, this is the way. Perfect if you’ve got big credit card balances with nasty APRs.

I had a buddy who swore by this. He had a credit card with a 22% interest rate that was killin’ him. By focusin’ on that first with the avalanche method, he saved hundreds in interest over a year. Takes grit, but it works!

3. Pay More Than the Minimum: Chip Away Like a Champ!

This ain’t exactly a fancy method, but it’s a solid habit to pair with any strategy. Payin’ more than the minimum on your debts—especially credit cards—means you’re hittin’ the principal harder and cuttin’ down on interest charges. Even an extra $20 or $50 a month can make a big diff.

- How It Works: Look at your budget and find any spare change. Put it toward one or more debts above the minimum payment. Be consistent, even if it’s small.

- Why It’s Awesome: Speeds up your payoff timeline and saves you money on interest. Works for any kinda debt—loans, cards, whatever.

- Who It’s For: Anyone who can squeeze a lil’ extra outta their budget. It’s a no-brainer to stack with snowball or avalanche.

I thought I was fine when I only paid the minimum on my cards. Then I saw that I wasn’t even touching the balance! When I added an extra $30 a month, the balance went down a lot faster. Small moves, big results.

4. Balance Transfer to a Lower-Interest Card: Dodge Them Interest Hits!

Are you stuck with credit card debt that has crazy high interest rates? A balance transfer could be the answer. On this page, you can move your balance to a credit card with a lower interest rate (sometimes even 0% for a promotional period). Less of your payment goes to interest and more goes to the debt itself.

- How It Works: Find a card with a low or 0% introductory APR on balance transfers. Move your high-interest balance over, but watch out for transfer fees (usually 3-5%). Pay it off before the promo ends.

- Why It’s Awesome: Cuts down interest costs big time, lettin’ you pay off the balance quicker. Can save you hundreds if timed right.

- Who It’s For: Folks with decent credit who can qualify for these cards and got a plan to pay it off fast. Ain’t for everyone if your score’s rough.

Just a heads up—check the fine print! Some cards jack up the rate after the intro period, and fees can sneak up on ya. I did this once and saved a bunch, but I had to hustle to pay it before the 0% ran out.

5. Debt Consolidation Loan: Simplify Your Mess!

If you’re jugglin’ a bunch of debts with different due dates and rates, a debt consolidation loan can be a lifesaver. This is where you take out one loan to pay off all your other debts, leavin’ you with just one payment to worry about, often at a lower interest rate.

- How It Works: Apply for a personal loan with a better rate than your current debts. Use it to pay off cards, loans, etc. Then just pay the new loan monthly.

- Why It’s Awesome: One payment, one due date—way less stress. Can lower your interest and make budgetin’ easier.

- Who It’s For: Good for peeps with multiple high-interest debts and a solid credit score to snag a good rate. Don’t do it if you’ll just rack up new debt, tho.

I’ve seen folks turn their chaos into clarity with this. Imagine swappin’ five credit card payments for one manageable bill. But you gotta stay disciplined—don’t go swipin’ them cards again!

6. Budget Like a Boss and Cut Them Expenses!

Ain’t no debt repayment strategy gonna work if you don’t know where your money’s goin’. Creatin’ a budget and cuttin’ back on unnecessary stuff frees up cash to throw at your debt. It’s about livin’ lean for a bit to win big later.

- How It Works: Track your income and expenses. Pick a budget style—like the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt). Cut stuff like daily coffee runs or extra subscriptions.

- Why It’s Awesome: Puts you in control of your cash. Even savin’ $20 a week adds up over months.

- Who It’s For: Everyone! If debt’s your enemy, budgetin’ is your shield. Works no matter your strategy.

I started trackin’ my spendin’ and realized I was droppin’ way too much on takeout. Cut that back, and suddenly I had an extra $100 a month for debt. Small sacrifices, y’all.

7. Boost Your Income with a Side Hustle: Hustle Hard!

Sometimes, cuttin’ expenses ain’t enough. You need more cash comin’ in to really attack that debt. That’s where a side hustle comes in—whether it’s a part-time gig, freelance work, or sellin’ stuff you don’t need.

- How It Works: Find somethin’ you can do on the side. Drive for a rideshare app, walk dogs, sell old clothes online. Put every dime from it toward debt.

- Why It’s Awesome: Extra income means faster payoff. Plus, it feels good to hustle for your freedom.

- Who It’s For: Anyone with time and energy to spare. If you’re maxed out, maybe skip this, but most of us can find a lil’ side gig.

I picked up some freelance writin’ gigs a while back. Wasn’t much, but the extra $200 a month went straight to my credit card. Felt like I was fightin’ back, ya know?

How to Pick the Right Strategy for You

Now that we’ve laid out these debt repayment strategies, you’re prob’ly wonderin’, “Which one do I pick?” Here’s the deal—it depends on your vibe and your numbers. Let’s break it down with a quick table to help ya decide.

| Strategy | Best For | Focus | Motivation Factor |

|---|---|---|---|

| Debt Snowball | Need quick wins to stay pumped | Smallest balance first | High (fast results) |

| Debt Avalanche | Wanna save on interest, got patience | Highest interest rate first | Medium (slower wins) |

| Pay More Than Minimum | Anyone with a lil’ extra cash | Any debt, just pay extra | Medium (steady progress) |

| Balance Transfer | Credit card debt, decent credit score | Lower interest rate | High (if you pay fast) |

| Debt Consolidation Loan | Multiple debts, good credit | Single payment, lower rate | Medium (simplifies life) |

| Budgeting/Cutting Expenses | Everyone, tight on cash | Free up money | Low (requires discipline) |

| Side Hustle | Can spare time, need more income | Extra cash for debt | High (feels empowering) |

Take a hard look at your debt load first. How much do you owe compared to what you make? If it’s a huge chunk of your income, somethin’ like consolidation or even debt relief might be worth a peek. If it’s manageable, start with snowball or avalanche. Also, think about what keeps you goin’—do you need fast results, or are you cool grindin’ it out to save every penny on interest?

Assessin’ Your Debt Load: Where You At?

Before divin’ into any strategy, you gotta know your startin’ point. Grab a pen, or heck, open a spreadsheet, and write down every debt you got. Credit cards, loans, medical bills—list the balance, interest rate, and minimum payment for each. Add it all up. Now compare that to your yearly income before taxes. If your debt is like 50% or more of your income, you might be in deep and need bigger moves like debt relief. If it’s less, DIY strategies can prob’ly get you there.

This step ain’t fun, I know. When I did it, seein’ that total number made my stomach drop. But facin’ it head-on is the only way to make a plan that sticks. You got this!

When Debt’s Too Much: Lookin’ at Debt Relief

Sometimes, no matter how hard you hustle, the debt just feels like a brick wall. If you can’t see yourself payin’ it off in five years, or if it’s half or more of your income, debt relief options might be the move. I’m talkin’ about stuff like debt management plans where a counselor helps negotiate lower rates, or even debt settlement where you try to pay less than you owe. Bankruptcy’s a last resort, but it’s there if you’re drownin’.

I ain’t gonna sugarcoat it—these options got risks and can hit your credit score. But if you’re losin’ sleep every night, it might be worth explorin’. Talk to a pro if you’re at this point. Ain’t no shame in gettin’ help.

Stayin’ Motivated: Keep Your Eye on the Prize

Payin’ off debt ain’t a sprint, it’s a marathon. You’re gonna have days where you wanna give up, trust me. I’ve been tempted to blow my extra cash on a new gadget instead of my loan. Here’s how to keep your head in the game:

- Celebrate Small Wins: Paid off a card? Treat yourself to a cheap coffee or somethin’. Reward the grind without breakin’ the bank.

- Track Your Progress: Use a chart or app to see them balances drop. Visuals help you stay hyped.

- Remember Why You Started: Wanna buy a house? Travel? Be stress-free? Keep that goal in your mind every time a bill comes.

We at MoneyMoxie believe in you. Debt’s a beast, but you’re stronger. Pick a strategy, tweak it as you go, and don’t stop ‘til you’re free.

Bonus Tips to Keep Debt from Creepin’ Back

Once you start makin’ progress, you don’t wanna slide back into the hole. Here’s a few tricks to stay debt-free:

- Build an Emergency Fund: Even $500 saved can keep you from swipin’ a card when life hits hard.

- Avoid New Debt: Cut up them credit cards if you gotta. Don’t borrow what you can’t pay back quick.

- Keep Budgetin’: Make it a habit, not a one-time thing. Know where every dollar goes.

I learned the hard way that debt creeps back if you ain’t careful. After payin’ off a big chunk, I got cocky and charged up a card again. Don’t be like me—stay sharp!

Let’s Wrap This Up: Start Today, Fam!

So, there ya have it—a full rundown on what debt repayment strategies are and how to make ‘em work for you. Whether you go with the snowball method for quick vibes, the avalanche to save on interest, or mix and match with budgetin’ and side hustles, the key is to start now. Don’t wait ‘til next month or next year. Pick one strategy that feels right, map out your debts, and take that first step today.

We’re rootin’ for ya at MoneyMoxie. Drop a comment if you’ve got a fave strategy or a story about crushin’ your debt. Let’s build this community of money warriors together! Get after it, and let’s make debt a thing of the past!

Esta página solo está disponible en inglés

Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

Trying to pay off your debt can seem overwhelming, but there are strategies that can help. There are generally two different approaches to take to help pay down your debt, and each method has its pros and cons. There is no right or wrong answer when it comes to which method is best because every person’s debt situation differs. Sometimes it might even be a combination of both methods. It is up to you to determine what motivates you and which process may be the best fit for your situation.

What to know about the snowball vs. the avalanche method

The “snowball method,” simply put, means paying off the smallest of all your loans as quickly as possible. When you pay off that debt, you move the money you were using to pay it to the next-smallest debt you owe. Ideally, this process would continue until all accounts are paid off. As you roll the money used from the smallest balance to the next on your list, the amount “snowballs” and gets larger and larger and the rate of the debt that is reduced is accelerated.

In contrast, the “avalanche method” focuses on paying the loan with the highest interest rate loans first. When you pay off the debt with the highest interest rate, you put the money toward the account with the next highest interest rate, and so on, until you are done. This is similar to the “snowball method.” By focusing on the loans that are the most expensive to carry in the long run, you should pay less over time as the higher interest loans are addressed first.

The “avalanche method” might save you some money, but if your principal is big, it might take a long time to pay off the debt with the highest interest rate. This can make you lose motivation and make it hard to stick to the plan. Paying off small debts quickly can feel rewarding. If you prefer to see progress quickly and work your way up, then the “snowball method” may be a better fit for your debt management goals.

Putting the different methods to work

To apply the “snowball method” or the “avalanche method” to your financial situation, get organized by following these steps:

“Snowball Method” |

“Avalanche Method” |

|

|---|---|---|

| 1. | Make a list. Organize any payment information, total amount owed, minimum monthly payments and due dates. | Make a list. Organize any payment information, total amount owed, minimum monthly payments and due dates. |

| 2. | Sort them out. Arrange your list of accounts from smallest to largest dollar amount owed. | Sort them out. Arrange your list of accounts from the highest interest rate to the lowest interest rate on each bill. |

| 3. | Budget beyond the minimum. Determine how much extra you can afford to put toward the monthly minimum payment for your smallest debt, after paying the minimum payments on all of your other outstanding debts. Remember, if you do not have enough for even the minimum on each of your debts, it can hurt your credit score. | Budget beyond the minimum. Determine how much extra you can afford to put toward the monthly minimum payment for your highest interest rate account, after paying the minimum payments on all of your other outstanding debts. Remember, if you do not have enough for even the minimum on each of your debts, it can hurt your credit score. |

| 4. | Roll over payments as you make progress: When you’ve paid off the smallest debt, take the money previously used — the monthly payment and the little extra you budgeted — and put it toward the next-smallest debt. | Roll over payments as you make progress: When you’ve paid off the account with the highest interest rate, take the money previously used — the monthly payment and the little extra you budgeted — and put it toward the next-highest interest rate account debt. |

Best Way to Pay Off Debt Fast (That Actually Works)

FAQ

What are the three debt repayment strategies?

The avalanche method helps you pay off your debts with the highest interest rates first, while the snowball method starts with your smallest debts and works its way up. Debt consolidation is another option to consider. Whichever repayment strategy you choose, it’s important to keep up with your other financial goals while working to become debt-free.

Which debt repayment strategy would be best?

Prioritizing debt by interest rate. This repayment strategy, sometimes called the avalanche method, prioritizes your debts from the highest interest rate to the lowest. First, you’ll pay off the debt with the highest interest rate, then the debt with the next highest interest rate, and so on.

How to pay off $30,000 in debt in 1 year?

The 6-step method that helped this 34-year-old pay off $30,000 of credit card debt in 1 yearStep 1: Survey the land. Step 2: Limit and leverage. Step 3: Automate your minimum payments. Step 4: Yes, you must pay extra and often. Step 5: Evaluate the plan often. Step 6: Ramp-up when you ‘re ready.

What is the best strategy for paying off excessive debt?

Set goals and commit to them so you can pay down your debt, rebuild your savings and gain control over your finances. Figure out how much you owe. Write down how much you owe to each creditor. Focus on one debt at a time. Put any extra money toward your debt. Embrace small savings.