Its an age-old question we receive, and to answer it requires that we start with the basics: What is the definition of a credit score, anyway?.

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report. Your payment history, the amount of debt you have and the length of your credit history are some of the factors that make up your credit scores.

There are many different credit scoring models, or ways of calculating credit scores. Possible lenders and creditors, like banks, credit card companies, and car dealerships, look at your credit score as one of the things they use to decide if they will give you credit, like a loan or credit card. Credit scores help creditors determine how likely you are to pay back money they lend.

Its important to remember that everyones financial and credit situation is different, and theres no credit score “magic number” that guarantees better loan rates and terms.

Hey there folks! If you’ve got a 689 credit score you’re prob’ly wondering, “What the heck can I actually get with this number?” Well, I’m here to break it down for ya, straight and simple. No fancy mumbo-jumbo, just the real deal on where you stand and what doors are open—or half-open—with a score like this. At 689, you’re sittin’ in a decent spot, not rock bottom but not exactly livin’ the high life either. Let’s dive into what this score means for your wallet and how you can snag some financial wins with it.

Where Does a 689 Credit Score Land Ya?

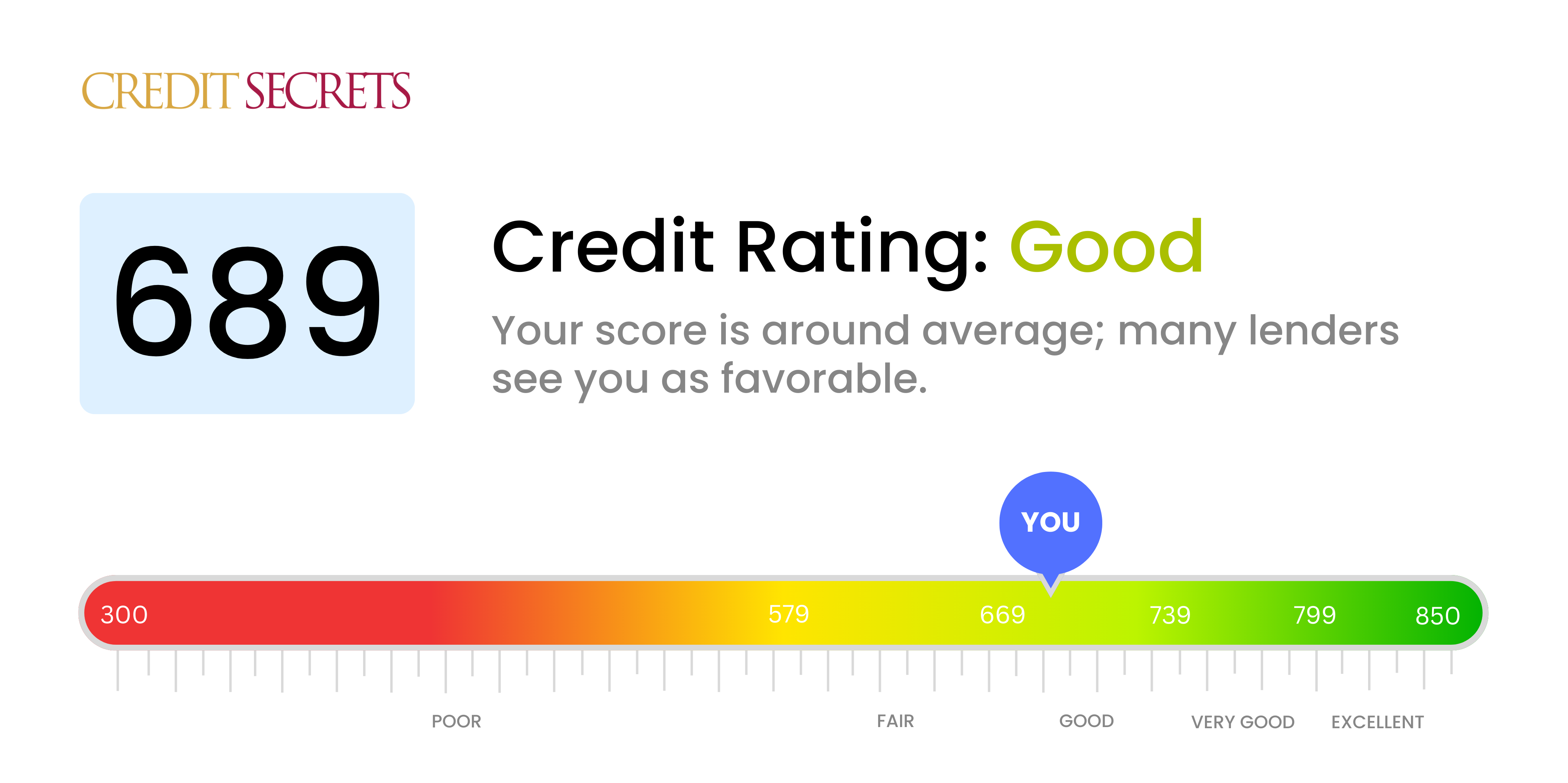

First, let’s talk about what 689 really means. Credit scores are like report cards that show how well you’ve managed to borrow money. They range from 300 to 850. These days, a 689 score can be called “fair” or even “good” depending on who is giving the score, such as the FICO or VantageScore folks. ” Here’s the general vibe:

- FICO Scale: Scores from 670 to 739 are often seen as “good,” so you’re in that zone, though barely. Lenders might give ya a nod, but they ain’t rollin’ out the red carpet.

- Other Models: Some say “good” starts at 700, so 689 gets slapped with a “fair” label. It’s like bein’ the kid who’s almost cool but not quite there.

Either way, with a 689, you’re not in the dumpster. You’ve got options, but they might come with some pesky strings attached, like higher interest rates or extra fees. Think of it as bein’ able to get into the party, but you’re stuck payin’ for overpriced drinks. Let’s see what kinda stuff you can actually grab with this score.

Credit Cards You Can Snag with a 689 Credit Score

Alright, let’s talk plastic. With a 689 credit score, you’re not stuck with just those secured cards that make ya put down a deposit. Nah, you can likely qualify for some unsecured credit cards—ones that don’t need cash upfront. Here’s what’s on the table:

- Basic Unsecured Cards: You can get approved for cards without an annual fee if you’re lucky. These ain’t fancy, but they get the job done for everyday spendin’.

- Rewards Cards (Kinda): Some cards with cash back or points might be in reach, though don’t expect huge bonuses. You might score a card that gives a little somethin’ back on gas or groceries, but the big travel rewards? Prob’ly outta reach for now.

- Store Cards: Retail cards for specific shops are often easier to get. Think like a card for your favorite department store—handy if you shop there a lot.

Just so you know, these cards may have interest rates that are much higher than what people with the best credit get. That APR can bite you in the behind if you have a balance. Credit limits may be low at first, but some companies raise them after a few months of on-time payments. So, be smart—don’t go over your limit, and pay off your debts quickly.

Auto Loans: Can You Drive Away with 689?

Dreamin’ of a new ride? Good news—with a 689 credit score you can prob’ly get an auto loan. Over 40% of car loans go to peeps with scores under 700, so you’re in the game. But there’s a catch (ain’t there always?). Check this out

- Higher Interest Rates: You won’t get the sweet, low APRs that folks with 750+ scores snag. Your rate might be a bit steep, meanin’ you pay more over time.

- Terms Ain’t the Best: Lenders might not give you the longest payback period or the most flexible deal. You’re still approved, just not on VIP terms.

Wanna make it better? Put down a bigger chunk upfront as a down payment. That cuts how much you gotta borrow and might even lower your rate a smidge. Also shop around—banks credit unions, and online lenders might have better offers than the dealership. And don’t sweat multiple applications too much; if you do ‘em within a couple weeks, they often count as just one hit to your score. So, go get that car, just be ready to pay a lil’ extra for now.

Mortgages: Buyin’ a House with a 689 Score

Now, let’s chat about the big one—buyin’ a home. Can you get a mortgage with a 689 credit score? Yup, it’s doable. About a quarter to a third of first-time mortgages go to borrowers with scores below 700, dependin’ on the year. But, like with cars, it ain’t all roses. Here’s the scoop:

- Conventional Loans: These might be tough to get with awesome terms. You could still qualify, but expect higher interest rates and maybe some extra fees.

- Government-Backed Options: Loans like FHA, VA, or USDA are often easier to snag for folks in your score range. They’re backed by the feds, so lenders take a chance even if your score ain’t perfect. Down payments can be smaller too, which is a win.

My advice? Shop around like crazy. Rates are very different depending on where you are and who you’re dealing with. Don’t send too many applications in a short amount of time, like 14 days. Too many inquiries will hurt your score. And if you can, try to raise your score before you apply—even a few points could save you a lot of money in interest over 30 years. We’ll talk more ‘bout improvin’ your score in a sec.

Personal Loans: Borrowin’ Cash with 689

Need some quick cash for a big purchase or to consolidate debt? Personal loans are prob’ly within reach with a 689 credit score, though it depends on the lender. Here’s what I’ve seen:

- Approval Odds: You might get approved, but it ain’t a sure thing for the best offers. Some lenders are cool with it, others want a higher score.

- Rates and Fees: Expect higher interest than someone with a “good” or “excellent” score. Plus, there might be upfront fees that jack up the cost.

- Purpose Matters: If it’s for debt consolidation, check if the new loan’s rate is actually lower than what you’re payin’ now—otherwise, it’s a waste. If it’s for somethin’ urgent, weigh if you can wait and improve your score first.

If you’re lookin’ at personal loans, compare options hard. Look at total cost, not just the monthly payment. And don’t just jump at the first offer—there’s usually a better deal if you dig a lil’. Me, I’d hold off on big borrowin’ unless it’s a must, ‘cause them rates can sting with a 689.

Student Loans: Fundin’ Your Education

Being able to get student loans is one of the easiest things to do if you want to go to school. A very large portion (over 20%) of these loans are given to people with credit scores below 700. Lenders know that a degree could help you make more money in the future, which makes it more likely that you will be able to pay back the loan. Still, keep an eye on:

- Interest Rates: They might not be the lowest, but they’re often manageable, especially with federal loans.

- Federal vs. Private: Federal loans don’t always check credit as hard, so they’re a safer bet. Private ones might approve ya but with tougher terms.

If you’re goin’ this route, max out federal options first before touchin’ private loans. And remember, borrow only what ya need—don’t saddle yourself with crazy debt just ‘cause you can.

What You’re Missin’ Out On with a 689 Score

Alright, let’s be real for a minute. A 689 credit score gets ya in the door, but you ain’t gettin’ the VIP treatment. Here’s what’s prob’ly outta reach or super hard to snag:

- 0% Intro APR Cards: Those sweet deals where you pay no interest for a year or so? Yeah, lenders usually save those for peeps with scores above 700, often way above.

- Top-Tier Rewards Cards: The cards with huge cash back or travel perks often want “good” to “excellent” credit—think 720 or higher.

- Rock-Bottom Loan Rates: Whether it’s a mortgage, auto, or personal loan, the best rates are reserved for higher scores. You’re payin’ more in interest than someone with a 750 or 800.

It’s a bummer, I know, but here’s the flip side—you’re so close to breakin’ into that next tier. A lil’ push, and you could be savin’ big bucks on interest and gettin’ better offers. Let’s talk about how to make that happen.

How to Boost Your 689 Credit Score to the Next Level

Now that we’ve covered what you can get, let’s chat about gettin’ more. Bumpin’ your score from 689 to, say, 700 or 720 can open up better deals and save ya a ton over time. Here’s my go-to tips for makin’ it happen (and yeah, I’ve been there, strugglin’ to inch up my own score):

- Pay On Time, Every Time: This is huge—missin’ payments tanks your score faster than anything. Set reminders, automate payments, do whatever it takes. Late payments stick around on your report for years, so don’t let ‘em happen.

- Lower That Credit Utilization: Keep your credit card balances under 30% of your limit. If you’ve got a $1,000 limit, don’t owe more than $300. Pay down debt or ask for a higher limit to make this easier. Trust me, this works wonders.

- Check Your Reports for Goofs: Errors on your credit report can drag ya down. Pull your free reports and look for stuff that ain’t right—like a late payment you didn’t make. Dispute anything fishy; it could boost your score quick.

- Don’t Open Too Many Accounts: Every new application can ding your score a bit. Space ‘em out, especially if you’re plannin’ a big loan soon. Give it six months or so between new credit.

- Mix Up Your Credit (Carefully): Havinn’ different types—like a card and a loan—can help. But don’t borrow just for the sake of it. If you’ve got a car loan or somethin’ already, that’s a start.

- Pay Off Collections: If you’ve got old debts in collections, settle ‘em. Once they’re at zero, some scorin’ models stop countin’ ‘em against ya.

- Give It Time, Man: Older credit history looks better. Don’t close old cards, even if you don’t use ‘em much. Keep ‘em open to boost the age of your accounts.

Stick with these habits, and you’ll see that 689 creep up. Even hittin’ 700 can make a difference, and pushin’ toward 740 or higher gets ya into “very good” territory. We’re talkin’ lower rates, better cards, the whole shebang.

What If You Get Turned Down?

Look, even with a 689, there’s a chance a lender says “nah.” It happens, and it stinks. But don’t just shrug and walk away—ask why. Lenders gotta tell ya the reason if you push for it. Maybe it’s somethin’ fixable, like a high debt load, or maybe they’re bein’ shady (which ain’t legal if it’s based on stuff like race or gender). Know your rights, and don’t be afraid to fight for ‘em.

If you’re denied, take it as a sign to tighten up. Use the tips above to build that score, and try again in a few months. I’ve been knocked back before, and it lit a fire under me to get my finances straight. You got this.

Real Talk: The Emotional Side of a 689 Score

Can I just say somethin’ personal here? Havin’ a credit score like 689 can mess with your head a bit. You’re not in the gutter, but you’re seein’ folks with higher scores gettin’ all the perks, and it’s frustratin’. I’ve felt that sting, wonderin’ if I’ll ever get to where I wanna be financially. But lemme tell ya, it’s a journey. Every on-time payment, every bit of debt you knock out, gets ya closer. Don’t beat yourself up—focus on the wins, even the small ones.

We’re all tryin’ to build a better future, right? A 689 ain’t the end of the road; it’s just a pit stop. Keep your eye on the prize—better rates, cooler cards, less stress when ya apply for stuff. You’re closer than ya think.

Wrappin’ It Up: Your 689 Credit Score Ain’t So Bad

So, what can you get with a 689 credit score? Plenty, actually. Unsecured credit cards, auto loans, mortgages, personal loans, and student loans are all in play, even if the terms ain’t the greatest. You’re not locked out, but you’re payin’ a premium ‘cause you’re not in that elite score range yet. Higher interest rates and limited access to top-tier rewards are the trade-offs, but it’s workable.

The real magic happens when ya take control. Use this score as a launchpad to build better habits—pay on time, keep debt low, check your reports. Before ya know it, you’ll be crossin’ into “good” or even “excellent” territory, and them lenders will be beggin’ to work with ya. I’m rootin’ for ya, and I know you’ve got the grit to make it happen.

Got questions or wanna share your own credit story? Drop a comment below. We’re all in this money game together, and I’d love to hear how you’re navigatin’ it. Let’s keep pushin’ forward, one point at a time!

What are credit score ranges and what is a good credit score?

Credit score ranges vary depending on the scoring model. Higher credit scores show that you have been good with money in the past, which may give potential lenders and creditors more confidence when they look at your credit request. Most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score People with credit scores in this range are thought to be low-risk borrowers. It might be easier for them to get a loan than for people with lower scores.

- These people have a very good credit score (740 to 799), which means they have a history of good credit behavior and may have an easier time getting more credit.

- 670 to 739: Good Credit Score Lenders usually think that people with credit scores of 670 or higher are good borrowers and don’t pose as much of a risk.

- 580 to 669: Fair Credit Score People in this range are often called “subprime” borrowers. Lenders might see them as a bigger risk, and it might be hard for them to get new credit.

- Credit Scores Between 300 and 579: Bad People in this range often have trouble getting new credit. In the event that your credit score is low, you’ll probably need to take steps to raise it before you can get any new credit.

Lenders use credit scores along with other types of information, like the information you give them on the credit application (like your income, how long you’ve lived in your current home, and any other bank accounts you may have), to decide whether to give you a loan. Different lenders have different criteria when it comes to granting credit. That means the credit scores they accept may vary depending on their criteria.

Score providers, such as the three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®—and companies like FICO® use different types of credit scoring models and may use different information to calculate credit scores. Therefore, credit scores may be different from each other. Not all creditors and lenders report to all credit score providers.

What is the average credit score?

As of January 2024 the average credit score in the United States was 701. While this is the average credit score, it falls in the Fair Range.

Is 689 Credit Score Good? – CreditGuide360.com

FAQ

Can I get a personal loan with a 689 credit score?

Most lenders will approve you for a personal loan with a 689 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” or “Excellent” credit. It’s best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

Is 689 a good credit score?

Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted. A 689 credit score is generally a fair score.

Will auto lenders lend to someone with a 689 credit score?

Most auto lenders will lend to someone with a 689 score. You will want to keep working to raise your credit score, though, to make sure you get the best interest rates. There are also several other factors that lenders consider when deciding whether to lend to you and at what interest rate.

What can I do with a 689 credit score?

A FICO® Score of 689 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

What kind of loan can I get with a 689 credit score?

Unsecured Personal Loans: These loans do not require collateral and are based solely on your creditworthiness. With a credit score of 689, you are more likely to qualify for unsecured personal loans with favorable terms.

Can I buy a house with a 689 credit score?

What Is a Realistic Credit Score to Buy a House? A realistic credit score range to buy a house generally falls between 620 and 700. Oct 28, 2024.

Can I get a car with a 689 credit score?

Quick Answer. No matter what your credit score is, you can get an auto loan. However, for the best terms and rates, most lenders want to see that you have a prime credit score of 661 or higher. There’s no minimum credit score required to get an auto loan.