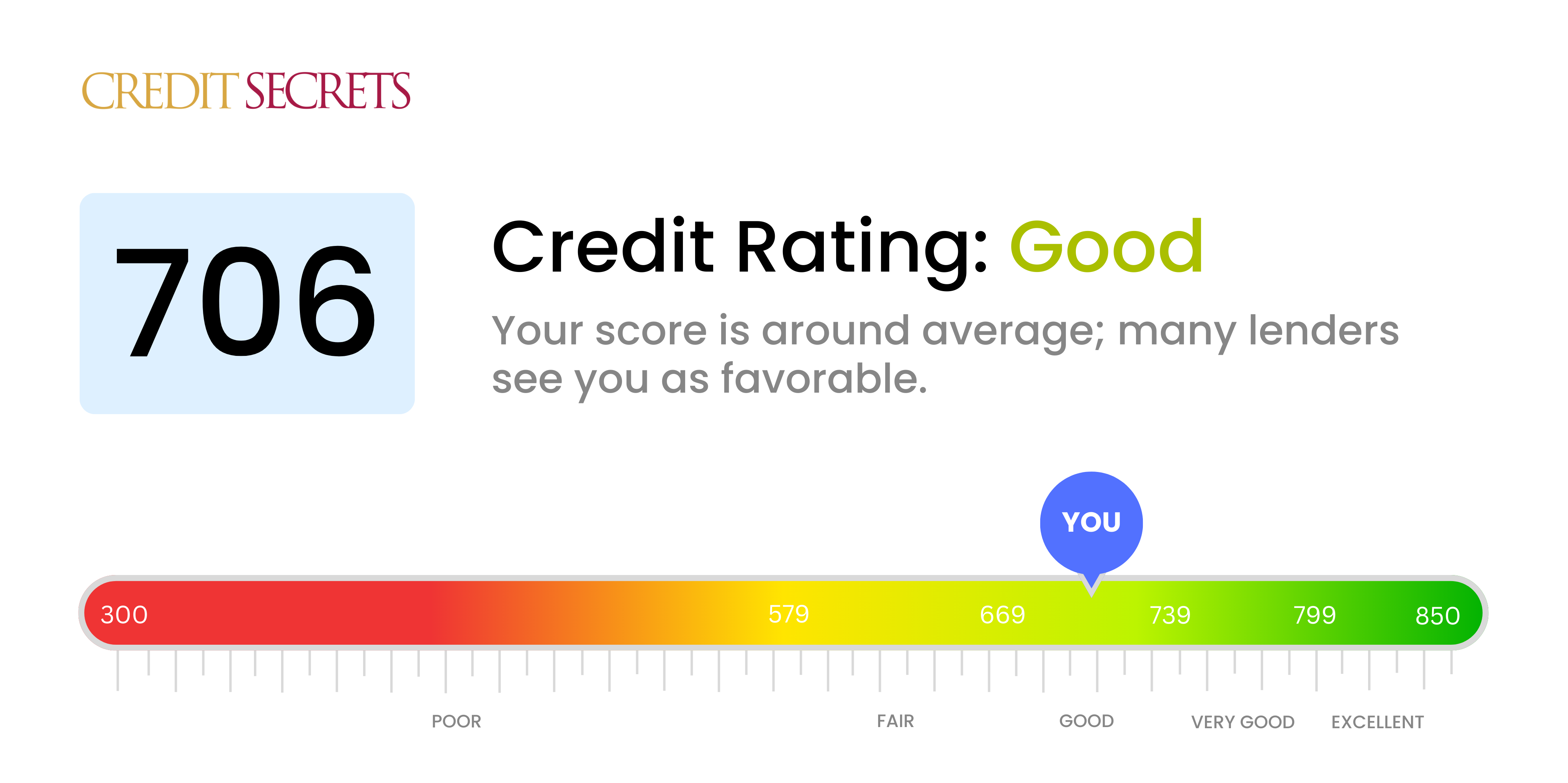

If your credit score is 706, you are right in the middle. At the end of 2021, Experian said that the average American consumer had a FICO Score of 714. A score between 670 and 739 is usually thought to be good.

Most lenders consider an 706 credit score to be an average credit score that shows you generally pay your bills on time. This article will go into more detail about what a 706 credit score means when you apply for loans and what you can do to raise it.

A FICO score of 706 puts you in the “good” credit range, which means you have pretty decent credit But what exactly does a credit score of 706 signify and how can you improve it? Let’s break it down.

An Overview of FICO Scores

First, it’s important to understand what FICO scores are. Fair Isaac Corporation, which is what FICO stands for, made the FICO credit scoring model. Lenders most often use this model to figure out how creditworthy someone is.

There are different credit ranges, with scores ranging from 300 to 850. The lower the score, the lower the credit risk is seen to be.

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

So with a score of 706, you’re in the good range. But what does it mean to be in the good range specifically?

The Significance of a 706 FICO Score

If your credit score is 706, it means that you have good credit that has been around for a while. You probably have a variety of types of credit, such as mortgages, credit cards, and auto loans. And you make payments on time for the most part.

Lenders see people with credit scores around 706 as a manageable credit risk. You should be able to get loans and credit cards with reasonable interest rates, but you might not get the lowest rates or the best rewards programs.

Having a score in the low 700s also means you’re doing well avoiding behaviors that tank scores. Like maxing out credit cards, missing payments, or having collections or bankruptcies listed.

That said, a 706 FICO is on the lower end of the good range. It puts you close to sliding into the fair range, which starts at 670. So you have to be careful not to let your credit slip.

Overall, a 706 credit score is decent. But there’s still room for improvement to get your score solidly into the very good or exceptional ranges.

How to Improve Your 706 Credit Score

Here are some tips for boosting your 706 credit score:

-

Lower credit utilization – This measures how much of your credit limits you’re using. Aim for less than 30% on individual cards and across all cards.

-

Pay bills on time – Payment history is the biggest factor affecting your scores. Set up autopay or reminders to avoid lateness.

-

Limit hard inquiries – Too many credit checks when applying for new credit can lower scores temporarily. Space out applications by 6 months.

-

Increase credit history length – In general, the longer your history, the better. Allow accounts to age rather than closing them.

-

Diversify credit mix – Having both installment loans and revolving accounts can help. But don’t take on unnecessary debt.

-

Dispute errors – Incorrect negative information dragging down your credit can be removed by disputing.

-

Practice good habits – Responsible credit use over time is key for ongoing score improvement.

With consistent effort, you can get your FICO score well over 700. A 706 is a good start, but boosting it further can mean better rates and opportunities. Monitor your progress over time as you work to improve your credit standing.

Can I get a credit card with an 706 credit score?

The short answer is yes. You should be able to get a standard (non-secured) credit card with a FICO Score in the realm of good credit scores. Having said that, there are a couple of big caveats.

For one thing, you aren’t likely to qualify for some of the best credit card offers in the market. To get the best rewards credit cards, balance transfer offers, and best 0% APR offers, lenders may want to see excellent credit, with scores significantly higher than yours. You also might not get as high of a credit limit as consumers with higher scores.

Second, your credit score is just one part of the credit card approval process. Lenders will also take your other debts and employment situation into consideration. In fact, it’s not uncommon for consumers in the elite credit tiers to get rejected because their other debts are a bit too high.

Can I get a personal loan with an 706 credit score?

You can get a personal loan with an 706 credit score, but not every lender may approve you. Some lenders require scores well into the 700s for consideration. However, depending on the lender, you may get a personal loan with rather competitive terms.

Upstart-powered personal loans are designed primarily for borrowers who may not have top-tier credit but are considered credit-worthy based on non-traditional variables, so you may want to consider checking your loan offers if you’re in the market.

This Is What Your FICO Score REALLY Means

FAQ

Is a FICO score of 706 good?

People with credit scores between 300 and 850 have good credit. Scores between 670 and 739 are bad. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

Is a FICO score the same as a credit score?

People often use “FICO score” and “credit score” to mean the same thing, but a FICO score is not the only type of credit score. Credit score is a broader term referring to any score that lenders use to assess credit risk.

Can I get a loan with a 706 credit score?

A credit score of 706 is good and shows that the borrower is responsible and knows how to handle credit and debt well. If you have a credit score of 706 or higher, you are likely to have access to a wide range of financial products and services, including personal loans with favorable terms and conditions.

Can I get a car with a 706 credit score?

There is no minimum credit score required to buy a car, but most lenders have minimum requirements for financing. Most borrowers need a FICO score of at least 661 to get a competitive rate on an auto loan.