The advice in this article is offered by the team independent of any bank or credit card issuer. This article may contain from our partners, and terms may apply to offers linked or accessed through this page. as of posting date, but offers mentioned may have expired. Bankrate logo.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

We at Bankrate look at the things that customers care about most: APR, rewards, welcome offers and bonuses, and the overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. We make sure everything we do is correct at all times so we can continue to be here for you every step of the way. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. We want to give readers information that is both correct and fair, and we have editorial standards in place to make sure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Hey there folks! Ever peeked at your credit card statement and saw a negative balance staring back at ya? That’s right a number with a little minus sign, like the bank owes you money instead of the other way around. Pretty sweet, huh? But what if you’re thinkin’ about closing that card while it’s still in the negative? Does the cash just vanish into thin air, or do ya gotta jump through hoops to get it back? Well, stick with me, ‘cause I’m gonna break down exactly what happens if you close a credit card with a negative balance. We’re diving deep into the nitty-gritty, so you don’t end up shortchanged or scratching your head.

First Things First: What’s a Negative Balance Anyway?

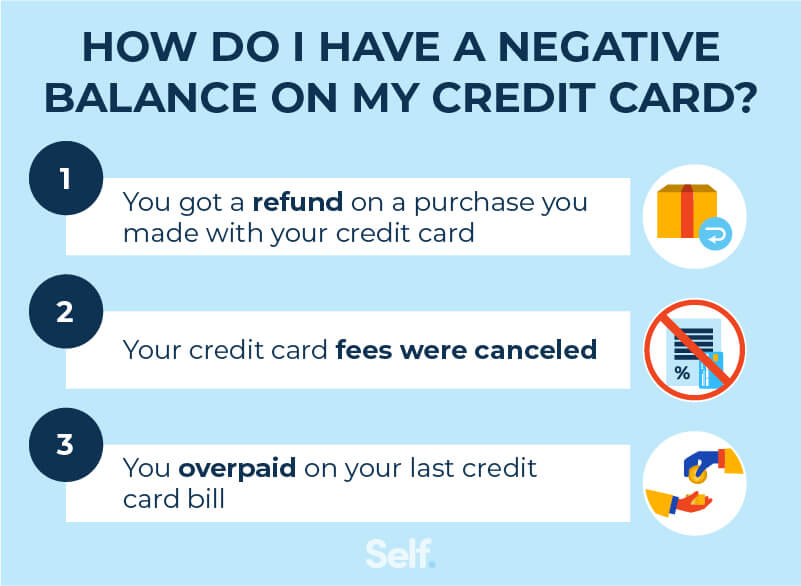

Before we get into the whole closing shebang, let’s make sure we’re on the same page. A negative balance on your credit card ain’t a bad thing—far from it! It means the card company owes you money. Yup, you heard that right. This can happen for a few reasons:

- Overpayment Mishap: Maybe you paid more than you owed on your bill. Coulda been a typo when you punched in the amount online, or you doubled up with a check and an auto-payment. Whoops!

- Refund from a Return: You bought somethin’, paid it off, then returned it. The store credits the money back to your card, and boom, you got a negative balance if the account was already at zero.

- Rewards or Credits: Some cards give ya bonuses or statement credits for certain purchases. If you’ve cleared your balance, that credit might push ya into negative territory.

That means the bank owes you $200 if your statement shows something like -$200. In a good place, but it gets a little harder if you want to close the account. Let’s unpack that next.

The Big Question: What Happens When You Close with a Negative Balance?

Alright, let’s cut to the chase. When you close a credit card account with a balance, the money doesn’t just go away. You can still own it, but you won’t be able to use the card because the account is closed. Here’s the deal in a nutshell:

- The Balance Stays Owed to You: Closing the card doesn’t mean the bank keeps your cash. That negative balance represents money they gotta give back, whether it’s $5 or $500.

- Refund Process Kicks In (Eventually): Most banks will issue a refund for that negative balance after closure, usually via a check or direct deposit to a linked account. But here’s the rub—they might not do it right away unless you nudge ‘em.

- Extra Steps Might Be Needed: If you don’t request the refund yourself, some banks just let it sit there for a while before sendin’ the money. And if your online access gets cut off post-closure, you’ll hafta call ‘em up to sort it out.

I’ve been in a spot like this once, where I overpaid a card by accident—thinkin’ I owed more than I did—and then wanted to ditch the card ‘cause of a pesky annual fee. I had to ring up the bank after closing it to make sure I got my $100 back. Took a couple weeks, but it showed up as a check in the mail. Point is, ya gotta stay on top of it.

How to Get Your Money Back After Closing

Now that ya know the money’s still yours let’s talk about how to actually get it in your pocket. There’s a few ways to handle a negative balance when closin’ a card, and I’m gonna lay ‘em out for ya.

- Request a Refund Pronto: Don’t wait for the bank to figure it out. Call the number on the back of your card or log into your account before closing to request a refund. You can usually pick between a check or a transfer to your bank account. Bigger balances, like over a grand, make this option super worth it, but even for smaller amounts, why not?

- Use It Up Before Closing: If the balance ain’t huge, just keep the card open a bit longer and make purchases to bring it back to zero or positive. Say you got a -$150 balance; buy some groceries or gas, and it’ll even out. Then close it without the hassle.

- Wait and See (Not My Fave): You could close the card and let the bank send the refund on their own timeline. But honestly, this can take ages, and I ain’t got the patience for that. Plus, if your account access is gone, trackin’ it down gets annoyin’.

I have a little advice for you: if you want to close the card with a negative balance, do it no more than two months after the last refund or overpayment. Some banks have rules about how long they have to keep it before they consider it “abandoned,” but most will get in touch with you at some point. Better safe than sorry, right?.

Does a Negative Balance Mess with Your Credit Score?

Here’s a question I get a lot: will that negative balance hurt my credit if I close the card? Short answer—nope, not directly. But closin’ any credit card can have ripple effects, so let’s break this down real simple.

- Negative Balance Itself? No Impact: Most credit scorin’ models treat a negative balance like a zero balance. It don’t hurt ya, and it don’t help neither. It’s just sittin’ there, neutral.

- Closing the Card? Possible Ding: Here’s where it gets dicey. Shuttin’ down a credit card account can mess with two big factors of your credit score:

- Length of Credit History: If this card’s one of your oldest, closing it shortens your average account age, which makes up about 15% of your FICO score. Ouch.

- Credit Utilization Ratio: This is a biggie—30% of your score. If you got balances on other cards, closin’ this one reduces your total available credit, makin’ your debt-to-credit ratio look worse. For example, if you owe $2,000 on other cards with a $10,000 limit total, closin’ a card with a $5,000 limit drops your total credit to $5,000, bumpin’ your utilization from 20% to 40%. Not great.

I learned this the hard way a few years back. Closed an old card thinkin’ I didn’t need it, only to see my score dip a bit ‘cause my utilization shot up. Had to hustle to pay down other balances to fix it. So if you’re closin’ a card with a negative balance think about your overall credit picture first. Maybe keep it open till you got other accounts in better shape.

What About Negative Reward Balances? Another Curveball!

Some of you may be wondering if that card comes with rewards points or cash back. Can those be messed up by a negative balance or the other way around? Get ready for something even stranger.

- Negative Reward Balances Happen: If you returned somethin’ big or got a refund after earnin’ rewards, the bank might deduct those points or cashback from your account. If you already spent the rewards, your balance could go negative—like owing points!

- Closing with Negative Rewards: This gets murky. Some banks don’t charge ya for a negative reward balance when you close, especially if it’s small. Others might hold off closin’ till it’s positive, or in rare cases, try to recover the value. I’ve heard of folks closin’ accounts with tiny negative reward balances and nothin’ bad happened, but it’s a gamble.

- Best Bet: Try to get your reward balance to zero or positive before closin’. Make a purchase to earn more points if ya can, or just wait it out. You don’t wanna risk a bank flaggin’ your account for “abuse” or somethin’ silly like that.

I remember a buddy of mine had a card with a negative point balance after a flight refund. He closed it anyway, and nothin’ came of it, but he was sweatin’ bullets for a while thinkin’ they’d bill him. Better to play it safe if you ask me.

Steps to Take Before Closing: A Handy Checklist

To make this whole thang easier, I put together a quick checklist. Follow these steps, and you’ll dodge most headaches when closin’ a card with a negative balance.

- Check the Exact Balance: Double-check how much is negative. Is it $10 or $1,000? That’ll decide your next move.

- Decide on Refund or Usage: Wanna use it up with purchases, or get a refund? Pick before you call to close.

- Contact the Bank Early: Ring ‘em up or chat online to confirm how they’ll handle the negative balance on closure. Ask about refund timelines.

- Clear Any Reward Issues: If you got a negative reward balance, see if ya can fix it first with a small purchase or by waitin’ for points to post.

- Consider Credit Impact: Look at your other cards. Will closin’ this one jack up your utilization or shorten your credit history? Maybe hold off if it will.

- Request Closure and Refund: Once you’re ready, officially close the account and request that refund if needed. Get confirmation in writin’ if ya can.

This checklist saved my bacon last time I ditched a card. Had a small negative balance, called ahead, and got a check mailed out a week after closin’. Smooth as butter.

A Quick Table: Pros and Cons of Closing with a Negative Balance

Let’s lay out the good and bad of this decision in a neat lil’ table. Sometimes seein’ it side by side helps ya think clearer.

| Pros | Cons |

|---|---|

| You get your money back eventually | Refund process can be slow and annoyin’ |

| Might avoid future annual fees | Gotta jump through hoops to request cash |

| Simplifies your wallet | Closures can hurt credit score indirectly |

Lookin’ at this, I’d say unless ya got a darn good reason to close—like dodgin’ a fat annual fee—maybe wait till the balance is sorted. But hey, your call!

Why You Might Wanna Keep the Card Open Instead

Speakin’ of reasons to wait, let’s chat about why keepin’ the card open might be smarter for a bit. I ain’t sayin’ never close it, just think twice.

- Emergency Credit Line: Even if ya don’t use it, an open card is a backup if somethin’ hits the fan. Once it’s closed, that line’s gone.

- Credit Score Protection: Like I mentioned, closin’ can ding your score by messin’ with history and utilization. Keepin’ it open avoids that hit.

- Use Up the Balance Easy: If the negative balance ain’t huge, just spend it down with everyday buys. No need to deal with refund nonsense.

I’ve kept a couple cards open over the years just for these reasons. One’s got a zero balance now, but it’s my oldest account, so it helps my credit age. Another I use for small stuff to keep it active. Works for me.

What If the Bank Drags Their Feet on the Refund?

Okay, let’s say ya closed the card, requested the refund for that negative balance, and… crickets. Weeks pass, no check, no deposit. What now? Don’t panic—I gotcha covered with some steps.

- Follow Up Quick: Call the bank again, pronto. Have your account number or any closure confirmation handy. Ask for a status update on the refund.

- Escalate if Needed: If they’re givin’ ya the runaround, ask for a supervisor. Be polite but firm—say ya know it’s your money and ya expect it back soon.

- Check Legal Rules: I ain’t a lawyer, but I’ve heard banks gotta refund negative balances over a certain amount—like a buck or two—within a reasonable time. Look up the rules or mention ya know ‘em if the bank’s stallin’.

Had to do this once myself. Bank said they “mailed the check” but it never showed. Took three calls and a lil’ pushin’, but they finally sent it. Persistence pays, my friends.

Real Talk: Personal Stories and Lessons Learned

Lemme share a bit more from my own mess-ups and wins with credit cards. Back in the day, I overpaid a card by like $300 ‘cause I misread the balance—thought I owed when I didn’t. Decided to close it ‘cause the interest rate was nuts, but didn’t think about the refund till after. Took me a month of callin’ to get that cash back, and I felt like a dummy for not askin’ upfront. Lesson learned: always sort the money part before pullin’ the plug.

Another time, a refund from a busted gadget pushed a card into negative right as I was thinkin’ of closin’ it. I waited, used the balance on some bills, and closed it clean at zero. Felt way smoother. So, if ya can, plan ahead—it saves ya grief.

Other Things to Watch Out For

There’s a few sneaky bits I ain’t covered yet that might trip ya up when closin’ a card with a negative balance. Keep an eye out for these:

- Account Access Cut-Off: Once the card’s closed, ya might lose online access to check the status of that refund. Write down important numbers or save statements before ya pull the trigger.

- Bank Policies Vary: Some banks are speedy with refunds; others act like they’re mailin’ it via carrier pigeon. Research or call to know what you’re dealin’ with.

- Small Balances Might Get Ignored: If it’s just a few bucks negative, a bank might not bother sendin’ a check unless ya ask. Don’t let even small change slip through the cracks—it’s yours!

I’ve had a bank once tell me a $3 negative balance “wasn’t worth processin’” till I pushed. Got my three bucks, dang it. Every penny counts when it’s mine.

Wrappin’ It Up: Should Ya Close or Nah?

So, what’s the final word on closin’ a credit card with a negative balance? Honestly, it’s doable, but it ain’t always the smartest move right off the bat. That negative balance is money the bank owes ya, and closin’ the account means ya gotta chase down a refund through a check or deposit. It won’t directly hurt your credit score, but closin’ any card can mess with your credit history length and utilization ratio, which might drop your score a notch. Plus, if ya got negative rewards tied to the card, that’s another wrinkle to iron out.

My advice? If the negative balance is small, use it up with purchases before closin’. If it’s big, request the refund before you close, or at least right after, and stay on the bank’s case till ya get it. And think hard about your credit situation—don’t close an old card or one with a big limit if ya got debt elsewhere. Keep that score healthy, ya know?

How closing a credit card with a balance impacts your credit score

While a credit card account that’s closed in good standing can stay on your credit reports for 10 years and help your credit score as a result, closed accounts with late payments or other negative marks can only stay on your credit reports for up to seven years. This factor may not impact your decision at all, but it’s worth knowing how long a closed account can impact your credit score either way.

Generally speaking, you should not close a credit card with a balance — or any credit card you’re not really using — if you want to keep your credit in good shape. This is because closing your card will impact these two major factors of your credit score:

- History of credit: The average length of your credit history makes up 15% of your FICO score. Closing accounts can hurt your score in the short term and even over time if you don’t have any other accounts with long histories.

- Credit utilization: Closing a credit card account can also change your credit utilization ratio, which shows how much debt you have compared to the total amount of credit you can use. This makes up 30% of your FICO score, so closing a card can have a big effect if you have a lot of debt because you will be using more of your available credit.

Pros and cons of closing a credit card with a balance

The best thing for you to do will depend on your personal finances, and that could mean closing a credit card, even if it could hurt your credit score. For instance, if you keep using a credit card to get into financial trouble and you’re desperate to break the cycle, closing a card with a balance may be the best step.

Before you move forward, consider the potential advantages and disadvantages of closing a credit card with a balance:

- You’d avoid paying an annual fee. If you close a credit card, you may not have to pay the annual fee, which you might not want to do if you’re not using the card enough.

- You can end the temptation to spend. When you close a credit card account, you can’t add any new balances to that card.

- You can simplify your financial life. If you close a credit card, you won’t be able to use it anymore and won’t have to make monthly payments on it. This can make your money situation easier.

- You can damage your credit score. When you close a credit card account, your credit utilization goes up and your credit history gets shorter. Both of these things can hurt your credit.

- You’d lose out on cardholder benefits. When you close a credit card account, you lose access to the benefits you had with it. These could have been consumer protections, free insurance, or travel benefits.

- You’d limit your credit options for emergencies. If you keep a card open, you can use it as a line of credit in case of an emergency. If you close it, you won’t be able to use it if you need to.

What A Negative Credit Card Balance Means

FAQ

What if I have a negative balance while closing a credit card?

If you have a negative balance while closing a credit card account, the card issuer should settle that by refunding the money before officially closing the account. However, you may find yourself with a negative balance if you get one last refund right before the account is officially closed.

What happens if a credit card rewards balance is negative?

They also decrease your rewards balance. Specifically, most credit card issuers deduct rewards for returns and refunds. If you already have a low rewards balance, these refunds can cause it to fall into the negative. Here’s what you need to know about negative reward balances on credit cards.

What does a negative credit card balance mean?

A negative credit card balance means your card issuer owes you money; it doesn’t affect your credit score. You could have a negative balance if you’ve overpaid your bill, received a refund, or redeemed credit card rewards as a statement credit. What happens if I accidentally paid too much to my credit card?.

What happens if a credit account has a negative balance?

Having a negative balance can make closing a credit account more cumbersome. Close a credit account with a negative balance. It’s not the worst thing that could happen, but you’ll have to take a few extra steps to get your money back and close the account for good.

Can a credit card issuer refund a negative balance?

According to the Truth in Lending Act, card issuers must refund any negative balance over $1 within a reasonable timeframe. But the process will go faster if you ask for a refund by hand through your online account or by calling the number on the back of your phone. What Do You Do With a Negative Balance on a Closed Credit Card Account?.

What happens if you close a credit card with a balance?

When you close a credit card with a balance, you’re essentially ending your relationship with the issuer. However, your responsibility to repay the outstanding debt doesn’t vanish. You’re still obligated to fulfill your financial commitment, regardless of the account’s closure Consequences of Closing a Credit Card with a Balance:

What happens if I have a negative balance on my closed credit card?

If a credit card account with a negative balance is closed, the issuer will typically refund the money before closing the account.

What happens if I close a credit card I owe money on?

Whenever you close your account and there is still a balance, you have to pay it off on time. The card company is allowed to charge interest on the amount you still owe. Your cardholder agreement may give you any other details on how to close your account.

Does closing a credit card negatively affect credit?

Is it better to close a credit card or let it go inactive?

Keeping an unused credit card open can benefit your credit score – as long as you follow good financial habits. If an unused credit card tempts you to unnecessarily spend or has an annual fee, you may be better off canceling the account.