If your credit card closed, heres why that might have happened and what to do next.

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

Has your credit card closed? Even those with good-to-great credit face hurdles at times, particularly if you forget about a card collecting proverbial dust in your wallet.

Credit card issuers can close your account due to whats known as “inactivity,” meaning you haven’t used the card in a certain amount of time — lets say a year or more — and the issuer now assumes you have no use for that account.

A canceled credit card might lower a good credit score for several reasons. Heres what you need to know about closed accounts.

Having a credit account closed by a creditor can be an unsettling experience You may see the ominous “closed by creditor” note on your credit report and wonder – what does this mean and how will it impact my finances?

Rest assured, an account closure is not necessarily catastrophic But it’s wise to understand the implications so you can take steps to protect your credit score and manage debts going forward

In this comprehensive guide, we’ll explore:

- Why creditors close accounts

- How account closures affect your credit

- Steps to take when your account is closed

- Rebuilding your credit after an account closure

Why Do Creditors Close Accounts?

There are a few common reasons why a creditor may decide to close your account:

-

Inactivity—If the account isn’t used for a long time and there aren’t any new charges or payments, the creditor may decide to close it.

-

Late payments—Late or missed payments that happen over and over again cause creditors to close accounts out of concern for delinquency

-

Exceeding the credit limit – Maxing out your credit limit and not paying it down can cause the account to be closed.

-

Fraud: Spending patterns that don’t seem right could be a sign of fraud, which would cause a creditor to freeze or close the account.

-

Your request – You can request an account closure if you wish. The creditor must honor the request.

-

Credit card issuer decision – The company may elect to close certain accounts due to internal policy changes.

How Closed Accounts Impact Your Credit Score

When an account is closed – either by you or the creditor – it can negatively influence your credit score in a few key ways:

-

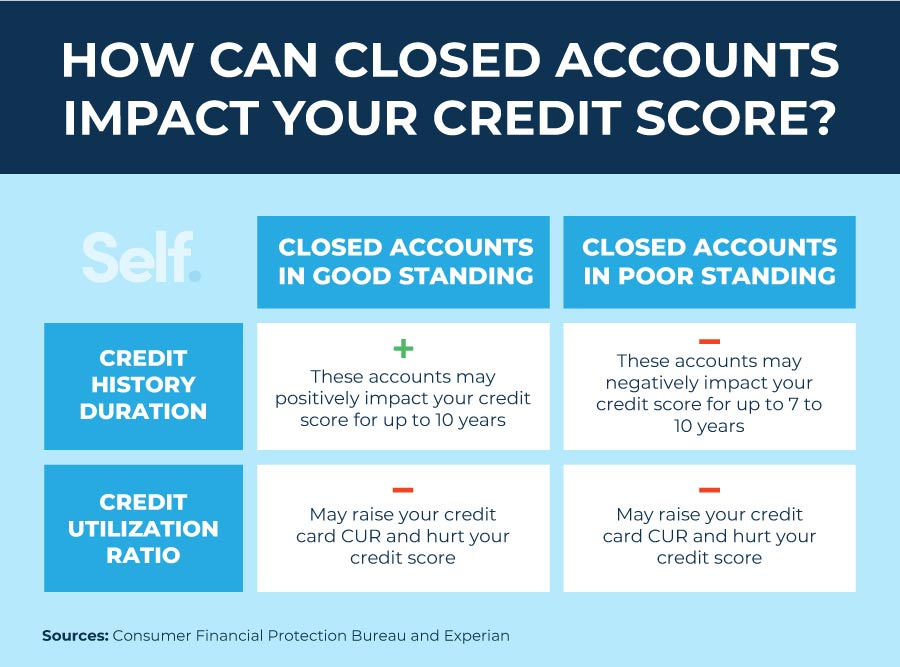

Credit utilization ratio: When you close an account, the amount of credit you have available goes down. This makes your credit utilization ratio go up because you still owe the same amount but have less cash on hand. Higher utilization hurts your score.

-

Credit mix – Eliminating an installment loan like a car loan or mortgage leaves only revolving credit, negatively impacting your credit mix.

-

Average age of accounts – Long-open accounts help your score. Closing the oldest account lowers your average account age.

-

Derogatory marks – If the account was closed due to delinquency, those missed payments stay on your report for 7 years.

The impact diminishes over time, but can be 50-100 points initially. Paying down balances helps minimize damage.

What To Do When Your Account is Closed

Learning that your account was closed can be upsetting. But staying calm and taking the right steps is key:

-

Pay off balances – Continue paying off any lingering debt to protect your credit score. Get current on payments.

-

Lower utilization – Reduce balances on other cards to bring down your overall utilization. This helps offset the drop in available credit.

-

Open new accounts – Applying for new credit responsibly, with low utilization, can aid your score.

-

Dispute errors – If the account was closed inaccurately, file disputes with credit bureaus.

-

Negotiate reopening – Ask the creditor if accounts closed from inactivity or credit limit issues can be reopened.

-

Build credit – Opening secured cards and becoming an authorized user helps establish positive history.

Rebuilding Your Credit after an Account Closure

Recovering from the credit score damage of a closed account takes consistent effort over time. Positive steps you can take include:

- Pay all current accounts on time each month

- Maintain low credit utilization across accounts

- Dispute and correct errors on your credit report

- Limit new credit applications to avoid too many hard inquiries

- Become an authorized user on a family member or friend’s account

- Open a secured credit card and use responsibly

- Include a mix of revolving (credit cards) and installment (car loan) accounts

- Monitor your credit report regularly to catch issues

- Allow time for the account closure’s impact to fade

With diligence and smart credit habits, your score can rebound even after a painful account closure. The damage diminishes gradually, and proper financial behaviors will build positive data that offsets the closure’s effects.

Key Takeaways

Having a credit account closed can be stressful and damaging to your credit initially. But the effects are not permanent with proper response. Keep these tips in mind:

- Creditors may close accounts for many reasons – don’t take it personally

- Closures can hurt your score through increased utilization, lower age, and derogatory marks

- Paying balances and reducing utilization helps minimize negative impacts

- Reopening closed accounts and rebuilding credit is possible over time

- Consistent smart credit behaviors will undo the damage and improve your score

Understanding why accounts get closed and how to respond puts you in control. With diligence, you can rebuild and strengthen your credit even after an account closure.

Why your credit card closed

There are several reasons why your card may have closed.

Your card is inactive.

If you havent used your card for several months, your credit card issuer might close your account for inactivity.

If you arent using the card, the issuer isnt making money from “swipe fees,” the fees it charges merchants when you make a purchase with your card. Try to make at least one purchase a month on each card to avoid this type of credit card closure.

If you don’t know how to make the most of your credit cards, learn how they work.

You havent paid your bill.

The credit card company wants you to make at least the minimum payment every month. However, paying off your balance in full is always better for your credit and to avoid fees.

Since you haven’t paid for 180 days, your card will be considered in default and is likely to be closed. You should avoid this at all costs because it will decimate your credit score. Your credit card company will probably sell your debt to a collections agency.

You make charges over your credit limit.

If you habitually exceed your credit limit, the issuer might conclude that youre a poor credit risk and close your account. This scenario is most likely with charge cards, such as the American Express Green, Gold and Platinum cards, which require you to pay your bill in full each month.

Other reasons your credit card may close.

If your credit score drops precipitously or the issuer discontinues the card, your account might also be closed.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Credit card company closed my account – What happens to my credit score?

FAQ

Do you still have to pay if a creditor closes your account?

Regardless of why your account was closed, you’ll need to pay any balance you owe. Understanding the proper steps to pay off a closed credit card account is crucial for maintaining your financial health and credit score.

Should I pay off closed accounts?

Yes, it’s generally a good idea to pay off closed accounts, even if they are no longer actively reporting to your credit.

Is it bad if a credit card company closes your account?

Is it good when a collection account is closed?

If the account was closed in good standing, it could help your credit score. But if it was closed with negative marks, it may continue to harm your score until it falls off, typically after seven years.