Being named both an executor and beneficiary of an estate can feel like wearing two hats at once. It’s actually more common than most people think yet it comes with unique challenges and responsibilities. If you’ve found yourself in this position—or are considering naming someone to serve in both roles—you need to understand how these dual responsibilities work together.

The Dual Role: Common but Complicated

Let’s be real – when someone passes away, they often name people closest to them as both executors and beneficiaries. Think about it: if a parent passes away, they might name their adult child as executor, who is also inheriting from the estate. Or a spouse might be named executor while also being entitled to a portion of the estate.

This arrangement makes perfect sense on a personal level. After all who better to handle your affairs than someone who

- Knew you well

- Understands your wishes

- Is familiar with family dynamics

- Already knows where important documents are kept

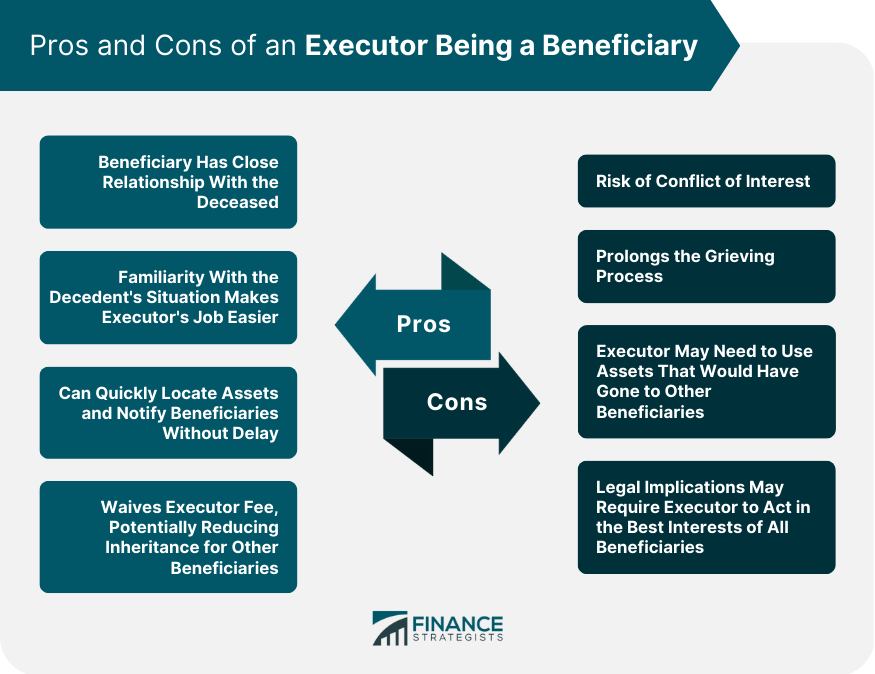

However, this seemingly logical setup creates a situation where one person must balance personal interests with legal responsibilities to all beneficiaries.

The Executor’s Fiduciary Duty

When you accept the role of executor, you’re taking on what’s called a “fiduciary duty” – basically the highest standard of care recognized by law. This means you must:

- Act solely in the best interests of the estate

- Prioritize the estate’s welfare above your personal gain

- Manage assets with prudence and diligence

- Protect estate assets

- Pay debts properly

- Distribute property according to the will’s terms

The tricky part? When you’re also inheriting from the same estate, these duties become especially sensitive. Your personal stake in the outcome requires strict impartiality and transparency in every action you take.

Potential Conflicts When You’re Both Executor and Beneficiary

Let’s explore some common situations where conflicts might arise:

1. Dealing with Grief While Managing Responsibilities

One of the biggest challenges isn’t even legal – it’s emotional. As someone close to the deceased, you’re grieving while simultaneously handling complex estate matters. This emotional burden can cloud judgment and make it tempting to take shortcuts (like hiring expensive lawyers to handle everything).

2. Property Sales and Purchases

If the estate needs to sell property to cover debts, but you grew up in that house and hoped to keep it, you’re facing a classic conflict. Your duty as executor requires getting the best price, which might conflict with your personal desire to acquire it affordably.

3. Asset Valuation

When valuing assets you’ll personally inherit, you must ensure valuations are accurate – not understated to reduce taxes or disadvantage other beneficiaries.

4. The Executor’s Fee Question

Executors are typically entitled to a fee (often around 5% of the estate’s value). However, when you’re also a beneficiary, taking this fee could reduce what other beneficiaries receive and potentially damage relationships. While legally permitted, many beneficiary-executors waive this fee to avoid conflicts.

5. Asset Distribution Timeline

As executor, you might be tempted to distribute assets to yourself before satisfying creditors or other beneficiaries. This would violate your fiduciary duty and could result in personal liability.

The Benefits of Serving in Both Roles

Despite these challenges, there are genuine advantages to this dual role:

- Intimate knowledge: You likely know the deceased’s wishes better than anyone else.

- Familiarity with assets: You probably know which items are family heirlooms and what they meant to the deceased.

- Existing relationships: You already know the other beneficiaries, making communication easier.

- Efficiency: Your personal knowledge can speed up the probate process.

How to Navigate Being Both Executor and Beneficiary

If you find yourself in this position, here are some practical steps to manage potential conflicts:

1. Communicate Openly with All Beneficiaries

This is absolutely critical! Regular updates prevent suspicion and misunderstandings. Explain your decisions clearly and provide context for your actions. Many executors get into trouble simply because they failed to keep others informed.

2. Help Beneficiaries Understand Your Role

Many beneficiaries don’t understand probate law, so some of your necessary tasks might look suspicious to them. Take time to explain your responsibilities as executor. The more beneficiaries understand about the process, the less likely they’ll question your actions.

3. Maintain Meticulous Records

Document everything – every expense, every decision, every transaction. Detailed record-keeping protects you and provides transparency to other beneficiaries.

4. Provide Clear Accountings

One of your most important duties is providing accurate accountings to beneficiaries. These should include:

- All estate-related transactions

- Changes in asset values

- Explanations for any unusual expenses

- Timeline for expected distributions

5. Consider Waiving the Executor Fee

If you’re receiving a substantial inheritance, consider waiving your executor fee to avoid appearing greedy. This gesture of goodwill can help maintain trust with other beneficiaries.

6. Seek Professional Help When Needed

Don’t hesitate to consult with estate attorneys, accountants, or other professionals. Their expertise can help you navigate complex situations and provide an objective perspective.

What Rights Do Other Beneficiaries Have?

If you’re serving as executor-beneficiary, understand that other beneficiaries have important rights:

- They have the right to be informed about the estate’s administration

- They can request a formal inventory of estate assets

- They’re entitled to detailed accounting of all transactions

- They can formally object to your actions through the probate court

- In cases of serious misconduct, they can petition for your removal

When Might an Executor Be Removed?

An executor won’t be removed simply for being a beneficiary, but could be for:

- Self-dealing or using estate assets for personal gain

- Mismanaging funds (like mixing estate money with personal accounts)

- Failing to follow the will’s terms or court orders

- Misappropriating or stealing estate assets

- Serious breaches of fiduciary duty

The removal process typically starts with an interested party filing a petition with the probate court, outlining specific misconduct allegations with supporting evidence.

What If You’re the Sole Beneficiary?

If you’re both executor and the only beneficiary (lucky you!), there’s generally less potential for conflict. However, you still must follow proper legal procedures – particularly regarding creditor claims and taxes. Certain duties, like keeping beneficiaries informed, obviously won’t apply to your situation since you’re the only beneficiary.

When to Consider Declining the Executor Role

Sometimes, the wisest choice is to step aside. Valid reasons to decline appointment include:

- You don’t have adequate time

- You live far from where the estate must be administered

- You want to avoid potential conflicts with family

- You doubt your ability to administer the estate fairly

- You feel overwhelmed by the responsibility

Remember, you don’t need to provide a reason for declining. The court will either appoint an alternate executor named in the will or choose an administrator.

Final Thoughts

Being both an executor and beneficiary isn’t inherently problematic – thousands of people successfully navigate these dual roles every year. The key is understanding your responsibilities, maintaining transparency, and always putting the estate’s interests first.

If you’re feeling overwhelmed by these responsibilities, don’t hesitate to seek professional guidance. Estate attorneys can help you navigate potential conflicts and ensure you’re fulfilling your duties properly.

Have you experienced being both an executor and beneficiary? What challenges did you face? I’d love to hear your experiences in the comments below!

Disclaimer: This article provides general information only and should not be considered legal advice. Every estate situation is unique, and laws vary by state. Consult with a qualified estate attorney for guidance specific to your circumstances.

AVOIDING PROBATE ALL TOGETHER

As we mentioned, the primary role of an executor is to shepherd your estate through the probate process, often with the aid of a qualified attorney. But there can be ways to avoid probate altogether. In many states, small estates do not need to go through the probate process, which can be slow, costly and public. You can set up certain accounts as “payable on death,” so that the assets will transfer directly to the stated beneficiary. And you might also consider creating a trust, which, unlike a will, is not subject to probate.

While the answer is yes, an executor of a will can be a beneficiary, there are several factors to consider before you make that decision. Estate planning can be a complicated matter, and if you have a complex estate, you probably should discuss your options with both your financial advisor and a qualified estate attorney. You should also discuss your decisions with your executor and the rest of your beneficiaries to try to alleviate any future misunderstandings. This gives the beneficiaries a chance to hear from you as to why you have made your decisions and it enables beneficiaries to ask any questions they may have.

Neither Edelman Financial Engines nor its affiliates offer tax or legal advice. Interested parties are strongly encouraged to seek advice from your qualified tax and/or legal professionals to help determine the best options for your particular circumstances.

ALTERNATIVES TO NAMING A BENEFICIARY

Keep in mind that some parties may choose to litigate, and that, in some cases, an executor might be sued. So it may make more sense to name someone who doesn’t have a beneficial interest in the estate as the executor. This could be a family friend or a relative outside the immediate family, or a professional, such as one from a trust department of a bank or other financial institution.

If you determine that your beneficiary lacks the knowledge to also serve as your executor, or if there is the possibility of conflicts with other beneficiaries, you may want to explore some alternatives. You might have a friend or nonbeneficiary family member act as your executor.

However, naming a nonbeneficiary as executor is not a silver bullet as this person might be just as inexperienced as the beneficiaries. Also, there are some beneficiaries who will argue with whomever is serving as executor, which might make a nonfamily member a better choice.

You might also consider hiring a third party such as a bank or trust company. But doing so raises its own issues. Not all such firms will offer these services, and those that do can charge hefty fees. Additionally, you want to make sure that you feel confident with the entity you’re naming to execute your estate plan.

What To Do If an Executor Is Not Communicating With Beneficiaries | RMO Lawyers

FAQ

Can an executor be a beneficiary of the same estate?

An executor simultaneously being a beneficiary of that same estate is more common than you may think.

What happens if an estate executor is a beneficiary?

An estate executor who’s also a beneficiary may find it more difficult to make the right choices for the estate. For example, an executor may need to sell a piece of property in order to cover any outstanding debt the estate might have.

Can a named beneficiary serve as an executor?

Named beneficiaries can serve as executor of an estate, but you may be better off choosing a third party or even an attorney to be your executor in certain circumstances. Who are my beneficiaries? Beneficiaries of a will are the people who receive your assets after you die, and they can pretty much be whomever you want.

Who is a beneficiary in a divorce?

In fact, it is common practice for the testator to nominate a beneficiary to the role of executor. For example, a parent often will appoint a surviving spouse or their eldest adult child as the executor. Typically, this close relative will be among the beneficiaries as well.

What happens if a person is named as an executor?

If you’ve been named as someone’s executor, their beneficiary or both, it’s important to know what to expect. Executors have the right to: Someone who’s named as an executor also has the right to decline the appointment. In terms of what rights beneficiaries have, they include the right to:

What if my beneficiary doesn’t serve as my executor?

If you determine that your beneficiary lacks the knowledge to also serve as your executor, or if there is the possibility of conflicts with other beneficiaries, you may want to explore some alternatives. You might have a friend or nonbeneficiary family member act as your executor.

Who has more power, a beneficiary or executor?

The root of a potential executor conflict of interest lies in the role itself. Since the executor has power over an estate, and beneficiaries stand to receive inheritances from the estate, it’s easy to see why beneficiaries may not be comfortable with the arrangement.

What happens when an executor is also a beneficiary?

By minimizing or forgoing executor fees, the beneficiary-executor can also retain more of their own inheritance, offering financial benefits, especially in cases where the executor has a close family relationship with the deceased or is dependent on the inheritance.

Can a person be both executor and beneficiary?

Can an executor of a will be a beneficiary? Yes, the executor of the estate also can be a beneficiary of the will, and often is. Many people will select one of their grown children to be their executor.

What is the conflict of interest between executor and beneficiary?

Conflict of interest

For example, when an executor favors a beneficiary concerning communication or distribution or when they own a business that could benefit from acquiring assets from the estate, perhaps they own a real estate company and decide to sell property from the estate to their company at discounted prices.