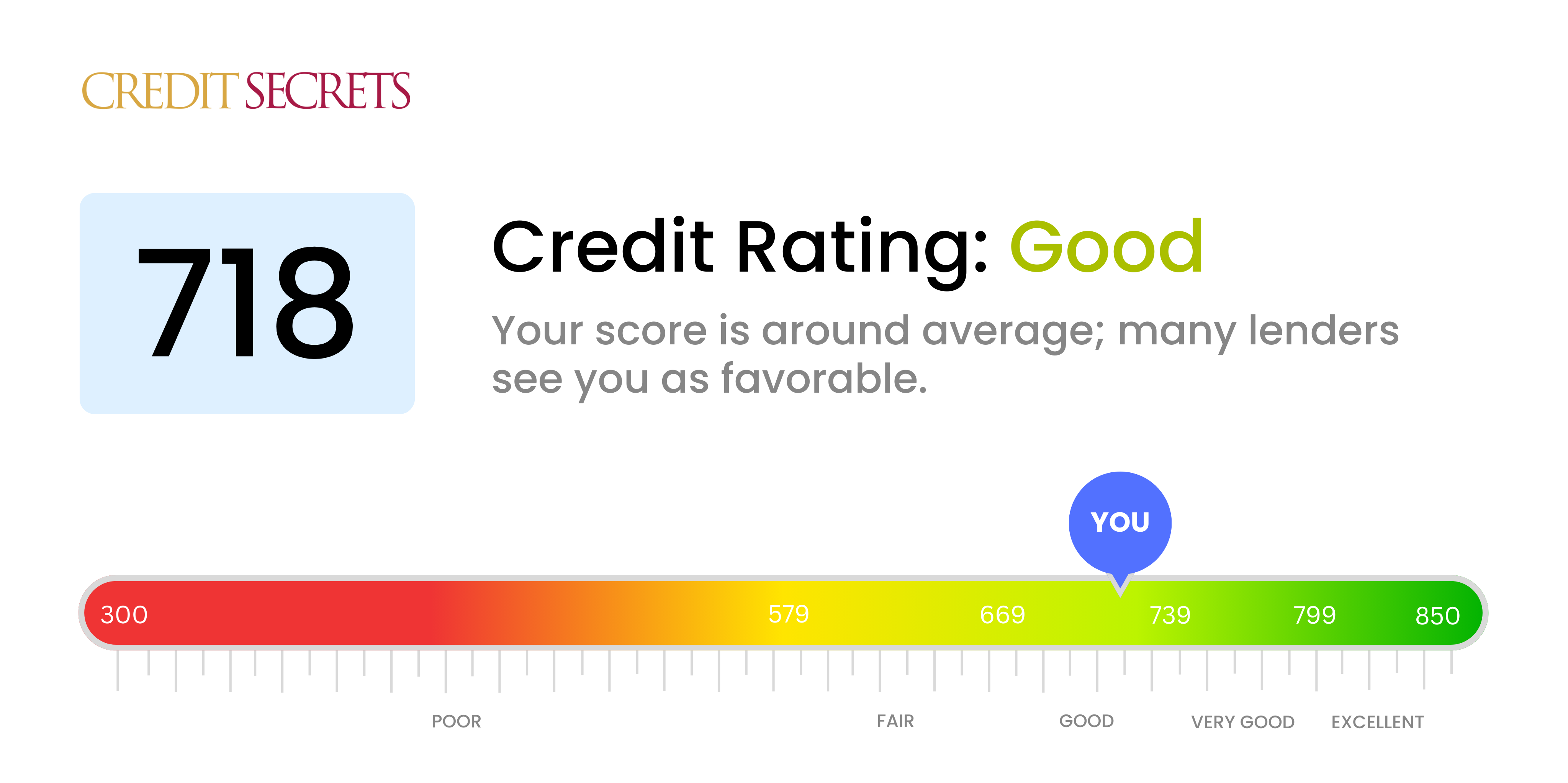

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U. S. FICO® ScoreÎ, 714, falls within the Good range. Lenders view consumers with scores in the good range as “acceptable” borrowers, and may offer them a variety of credit products, though not necessarily at the lowest-available interest rates.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

Your credit score plays a huge role in determining the interest rate you can qualify for when applying for a mortgage or other loan Specifically, a credit score of 718 is considered a “good” credit score by FICO, one of the leading credit scoring companies But what does that mean in terms of the interest rates you can expect to get approved for? Keep reading to learn more about what interest rates are typical for borrowers with credit scores around 718.

An Overview of 718 Credit Score

A credit score of 718 falls within the “good” credit range, which spans 670-739 on the FICO scoring model. Good credit is the middle tier, below “very good” (740-799) and “exceptional” (800-850), but above “fair” (580-669) and “poor” (300-579).

In terms of myFICO scores, 718 ranks at the 37th percentile, which means that 2063 of people have a lower score and 2037 of people have a higher score. So a 718 credit score is slightly above average.

With a good credit score, you’re considered an acceptable borrower by most lenders. You should qualify for competitive interest rates, though you may not get the rock bottom rates reserved for those with excellent credit scores above 740.

How Credit Scores Impact Mortgage Rates

When it comes to loans, the better your credit score, the lower the interest rate lenders will give you. The reason for this is that people with higher credit scores are less likely to default on their loans and are more likely to pay them back on time. The lowest rates go to borrowers with exceptional credit.

Still, a credit score of 718 is well within the range that most lenders will accept. You might not be able to lock in the lowest rates, but you should still be able to get competitive prices.

Here’s an overview of the typical interest rate ranges associated with various credit score tiers on a 30-year fixed-rate mortgage:

-

Exceptional credit (760-850): 3.25%-3.875%

-

Very good credit (700-759): 3.375%-4.25%

-

Good credit (640-699): 3.625%-4.875%

-

Fair credit (580-639): 4.375%-6.125%

-

Poor credit (500-579): 5.625%-7.125%

So with a 718 credit score, you can expect to see interest rate quotes somewhere around 3.625%-4.5% for a 30-year fixed mortgage in today’s market. The exact rate will depend on additional factors like your debt-to-income ratio, down payment amount, and type of mortgage loan.

Increasing your credit score, on the other hand, can help you get the best prices possible.

How to Get the Best Interest Rates with a 718 Credit Score

While a 718 credit score alone makes you eligible for decent mortgage rates, you may be able to do even better by taking these additional steps:

-

Shop around with multiple lenders. Get rate quotes from several different mortgage lenders and compare offers. Different lenders use varying loan criteria and pricing models. Shopping around ensures you don’t miss out on a great rate simply because that particular lender values your specific credit profile.

-

Work on improving your credit score. If you can boost your score into the 720s or higher, you may qualify for even better pricing. Paying down balances, disputing errors on your credit reports, or becoming an authorized user on someone else’s account are some ways to potentially give your score a quick boost.

-

Make a larger down payment if possible. The more you’re able to put down as a down payment, the less risk you present to the lender. A 20% down payment is ideal, but any extra you can put down could mean a lower rate.

-

Shorten your loan term. Opting for a 15-year mortgage instead of a 30-year loan may also score you a lower rate. The shorter term presents less risk to the lender so they reward you with better pricing.

-

Reduce your debt-to-income ratio. Lenders will look at your total monthly debt payments divided by your gross monthly income. Keeping this ratio below 36% makes you look like a reliable borrower able to handle mortgage payments comfortably. Paying down debts can help optimize this ratio.

Learn more about your credit score

A FICO® Score of 718 is Good, but if you can get it up to the Very Good range, you might be able to get better loan terms and lower interest rates. To begin, getting your free credit report from Experian and looking at your credit score are both great ideas. This will help you figure out what factors have the most impact on your score. Read more about score ranges and what a good credit score is.

How to keep on track with a Good credit score

Having a Good FICO® Score makes you pretty typical among American consumers. While that’s not a bad thing, you can raise your score to the Very Good (740–799) or even Exceptional (800–850) range with some time and work. Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreâand they arent good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default (go 90 days past due without a payment) on debt than those who pay promptly. If you have a history of making late payments (or missing them altogether), youll do your credit score a big solid by kicking that habit. More than one-third of your score (35%) is influenced by the presence (or absence) of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the cards spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | Spending limit | Utilization rate (%) | |

|---|---|---|---|

| MasterCard | $1,200 | $4,000 | 30% |

| VISA | $1,000 | $6,000 | 17% |

| American Express | $3,000 | $10,000 | 30% |

| Total | $5,200 | $20,000 | 26% |

Most experts agree that utilization rates in excess of 30%âon individual accounts and all accounts in totalâwill push credit scores downward. The closer you get to âmaxing outâ any cardsâthat is, moving their utilization rates toward 100%âthe more you hurt your credit score. Utilization is second only to making timely payments in terms of influence on your credit score; it contributes nearly one-third (30%) of your credit score.

Its old but its good. All other factors being the same, the longer your credit history, the higher your credit score likely will be. That doesnt help much if your recent credit history is bogged down by late payments or high utilization, and theres little you can do about it if youre a new borrower. But if you manage your credit carefully and keep up with your payments, your credit score will tend to increase over time. Age of credit history is responsible for as much as 15% of your credit score.

New credit activity typically has a short-term negative effect on your credit score. Any time you apply for new credit or take on additional debt, credit-scoring systems determine that you are greater risk of being able to pay your debts. Credit scores typically dip a bit when that happens, but rebound within a few months as long as you keep up with your bills. Because of this factor, its a good idea to “rest” six months or so between applications for new creditâand to avoid opening new accounts in the months before you plan to apply for a major loan such as a mortgage or an auto loan. New-credit activity can contribute up to 10% of your overall credit score.

A variety of credit accounts promotes credit-score improvements. The FICO® credit scoring system tends to favor individuals with multiple credit accounts, including both revolving credit (accounts such as credit cards that enable you to borrow against a spending limit and make payments of varying amounts each month) and installment loans (e.g., car loans, mortgages and student loans, with set monthly payments and fixed payback periods). Credit mix accounts for about 10% of your credit score.

Public records such as bankruptcies do not appear in every credit report, so these entries cannot be compared to other score influences in percentage terms. If one or more is listed on your credit report, it can outweigh all other factors and severely lower your credit score. For example, a bankruptcy can stay on your credit report for 10 years, and may shut you out of access to many types of credit for much or all of that time.

Is A 718 Credit Score Good? – CreditGuide360.com

FAQ

What kind of loan can I get with a 718 credit score?

If you have multiple debts with varying interest rates, a personal loan can be used to consolidate them into a single, more manageable monthly payment. If your credit score is 718 or higher, you can get a consolidation loan with a good interest rate. This will save you money on interest and make your finances easier.

Can I buy a house with a 718 credit score?

Indeed, a credit score of 718 is normally thought to be good and should let you buy a house.

What credit score is needed for a $40,000 auto loan?

Quick Answer. No matter what your credit score is, you can get an auto loan. However, for the best terms and rates, most lenders want to see that you have a prime credit score of 661 or higher.

What home interest rate can I get with a 750 credit score?

| FICO Score | Mortgage APR* | Monthly Payment* |

|---|---|---|

| 760-850 | 7.242% | $2,746 |

| 700-759 | 7.449% | $2,803 |

| 680-699 | 7.555% | $2,832 |

| 660-679 | 7.609% | $2,847 |