Your credit utilization rate is an influential factor in your credit scores. This ratio indicates how much of the available credit on your credit cards youre using at a given time. While some financial experts recommend keeping your utilization rate at 30% or below, there is no magic threshold.

In reality, you can never have too much available credit, and the more you have, the better it is for your credit score.

Being able to use a lot of credit on your credit cards is important for keeping your credit score high. But what exactly does “good” mean when it comes to available credit? This guide will tell you what available credit is, how much you should have, and how to handle it properly.

What is Available Credit?

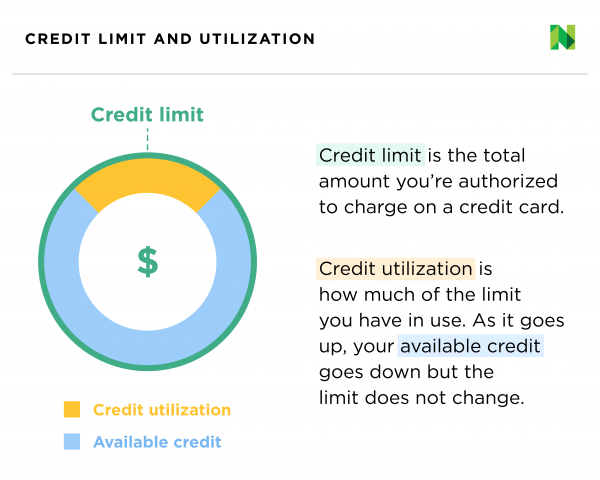

The amount of credit you can use on your credit cards and lines of credit is called your “available credit.” To figure it out, add up all of your credit card limits and then take away all of your current balances.

For example if you have

- Credit Card A with a $5,000 limit and $2,000 balance

- Credit Card B with a $3,000 limit and $0 balance

Your total available credit would be

- Credit Card A: $5,000 limit – $2,000 balance = $3,000 available credit

- Credit Card B: $3,000 limit – $0 balance = $3,000 available credit

Total available credit = $3,000 + $3,000 = $6,000

So in this example, you would have $6,000 in available credit between the two cards.

Why Available Credit Matters

The amount of available credit you have plays an important role in your credit scores in a couple of ways:

1. Credit Utilization Ratio

This number tells you how much credit you’re using compared to how much you have available. To find it, divide your total balances by the total amount of credit you have available.

For example, if you have $5,000 in balances and $10,000 in available credit, your utilization would be 50% ($5,000/$10,000).

Experts recommend keeping your utilization below 30%. The lower the ratio, the better it is for your credit score. Having a higher credit limit allows you to use more credit while maintaining a low utilization.

2. Credit History and Mix

Your score also takes into account how long you’ve had credit and what kinds of credit you have. Lenders will see that you’ve been good with a big line of credit over time if you have an old credit card with a high limit.

Additionally, having different types of credit like installment loans and revolving credit demonstrates you can manage diverse credit types. An ample credit limit contributes to this credit mix factor.

How Much Available Credit is Considered Good?

So how much available credit should you have to maintain strong credit? Here are some guidelines:

-

Aim for at least 2 times your monthly spending. If your monthly credit card spending is around $2,000, aim for $4,000 or more in available credit. This allows room for months with higher spending while keeping utilization low.

-

The more the better (within reason). There’s really no “too much” available credit when it comes to your credit score. Just don’t open more cards than you can responsibly manage.

-

At least $10,000 total. Most credit experts recommend having at least $10,000 in total available credit to show you can manage a sizable line.

-

Higher credit scores have more available credit. People with credit scores in the good to exceptional range (670+) tend to have significantly higher average available credit compared to those with lower scores.

While there are no hard rules on the ideal available credit amount, keeping the above guidelines in mind as you manage your credit cards can ensure your profile remains healthy.

How to Increase Your Available Credit

If your available credit seems lower than ideal, there are a couple ways to increase it:

Request a Credit Limit Increase

One option is to ask your existing credit card companies to raise your credit limit. They may approve an increase if you have a good payment history and your credit score has improved since opening the account.

A higher limit not only gives you more available credit but also shows lenders you can handle a larger line responsibly.

Open a New Credit Card

Applying for a new card from a different issuer is another way to add to your total available credit. This also helps diversify your credit mix.

When opening a new account, choose a card with benefits that match your spending. And make sure to consider the impacts of a hard credit inquiry when applying.

How to Manage a High Credit Limit

A high credit limit and ample available credit can certainly help your credit profile. But it also comes with responsibility to manage your accounts wisely. Here are some tips:

-

Use cards moderately. Don’t be tempted to overspend just because you have more available credit. Stick to your budget.

-

Pay in full each month. Pay off balances completely to avoid interest charges. Maintain low credit utilization.

-

Set payment reminders. With multiple cards, set up alerts or automatic payments to avoid missed payments and credit damage.

-

Check statements regularly. Closely monitor account activity to catch fraudulent charges early.

-

Limit card applications. Apply for new credit only when needed to avoid unnecessary hard inquiries.

-

Ask for limit decreases if needed. If you can’t manage multiple large credit lines responsibly, ask issuers to decrease the limits.

The Takeaway

Available credit is an important factor in your credit profile and having a generous amount can benefit your credit scores. Aim to have at least $10,000 in total available credit and a utilization under 30%.

Be sure to manage any increased credit limits responsibly by spending within your means, paying balances off in full each month, and closely monitoring account activity. Maintaining good financial habits will ensure ample available credit helps – not hurts – your credit.

What Is a Good Amount of Available Credit?

Credit scoring models consider your available credit for each individual credit card, as well as across all of your cards.

The 30% credit utilization rule of thumb can be an easy benchmark to help you make sure you dont use too much of your available credit. But for the benefit of your credit score and your overall financial health, its best to keep your utilization rate as low as possible.

To give you an idea of how people in different credit score ranges manage their credit cards, heres how much available credit each range has on average, according to Experian data:

| Credit Score Range | Available Credit |

|---|---|

| Very Poor (300-579) | 27% |

| Fair (580-669) | 49% |

| Good (670-739) | 67.4% |

| Very Good (740-799 | 87.6% |

| Exceptional (800-850) | 94.3% |

As you can see, even people with good credit tend to use more than 30% of their available credit, which shows that going beyond that threshold wont wreck your credit. But people with higher credit scores tend to use far less, showing that they can manage their credit well.

How to Use Credit Responsibly

Managing your credit utilization well is key to building excellent credit. Here are some steps you can take to keep your credit card balance low relative to your credit limits:

- Pay before the statement date. Credit card issuers report your account balance to the national credit reporting agencies once a month, typically on or close to the statement date. If you make a large payment before the current statement cycle closes, it will reduce the balance your credit card company reports to the credit bureaus.

- Make multiple payments throughout the month. If you have a low credit limit, try to make more than one payment throughout the month to maintain more available credit and drive down your utilization rate.

- Use credit cards sparingly. If you have trouble with overspending on your credit cards, that could make it challenging to maintain a lot of available credit. Its good to have at least something reported to the credit bureaus every month, but consider using your cards sparingly to avoid racking up a lot of debt.

How you handle all of your debts is also important in avoiding using too much of your available credit on your credit cards. Here are some other good credit habits to develop if you havent already:

- Always pay your bill on time.

- Make it a priority to pay down existing credit card debt if youre carrying a balance. Paying your bill in full each month when possible will go far to help your credit.

- Apply for credit only when you need it.

- Avoid applying for multiple credit accounts, especially credit cards, in a short period.

- Avoid closing old credit card accounts.

- Check your credit score regularly to keep track of how your actions impact your credit history.

What’s My Total Available Credit? Credit Limits Revealed!

FAQ

What is a good credit availability?

Most experts agree keeping your credit utilization below 30 percent of your available credit limits is a good idea, and keeping credit utilization below 10 percent can help your credit score the most. Apr 26, 2025.

How common is an 800 credit score?

An 800 credit score is considered exceptional and is relatively common, with FICO reporting that roughly 24% of Americans have scores in the 800-850 range.

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule is a credit card application restriction specifically used by Bank of America. It limits the number of new credit cards you can be approved for within certain timeframes.

How much is too much available credit?

Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain a good or excellent credit score.