How long youve had credit affects your score. But paying on time and not using a lot of your limit matter more.

The products shown on this page are mostly or entirely from our advertising partners. They pay us when you click on one of their links and then do something on our site. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

Whether you’ve had credit for six months or 20 years can make a difference in your credit scores.

A long track record without any major slip-ups suggests that your credit behavior will be similar in the future — and lenders and credit card issuers like that.

Credit scoring company VantageScore combines two things in its 3. 0 scoring model — how long you’ve been using credit and what types of credit you have — into a single factor and considers it “highly influential. It’s a little different for FICO credit scores, which take into account the length of your credit history and the mix of accounts that make up your score.

Hi there, family! Have you ever thought about why some people have credit scores that are as shiny as a new penny and others are stuck in the mud? Well, I’ll tell you a secret: “credit age.” “At MoneyMaverick, we like to break down hard money topics into small, manageable pieces. So, grab a coffee (or a soda—we won’t judge) and let’s talk about what a good credit age really means and how it can be your secret weapon to raise that score.

So, What Exactly Is Credit Age?

Let’s kick things off with the basics. Your credit age is just the average number of years that all of your credit accounts have been open. Credit score is like the silent ninja of your life; it works in the background to shape how lenders see you. This average takes into account all of your open loans, credit cards, and lines of credit. Banks and credit card companies like it when your average age is higher.

Here’s the deal when you first start out maybe with that shiny new credit card at 18 or 20 your credit age is gonna be super young—like, baby young. But as you keep accounts open and active over the years, that age creeps up. And trust me, lenders love seein’ a seasoned credit history. It tells ‘em, “Hey, this person’s been at this game for a while and ain’t messin’ up.”

Why Does Credit Age Matter So Much?

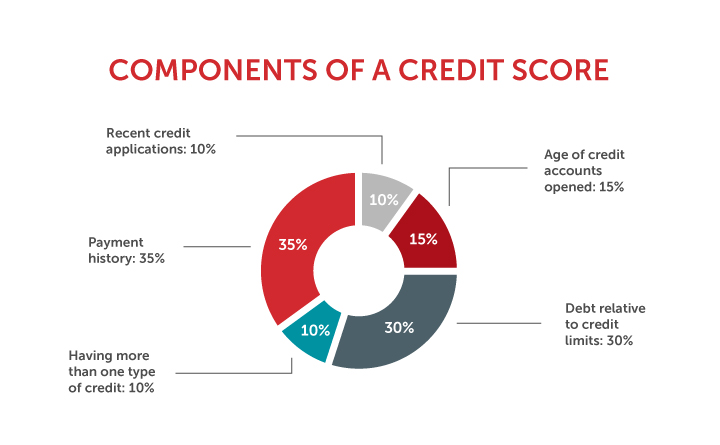

Now, you might be thinkin’, “Why should I care about how old my credit is?” Fair question! Here’s the scoop: credit age plays a big role in your overall credit score. If we’re talkin’ FICO scores (one of the big dogs in credit scorin’), the length of your credit history makes up about 15% of your total score. Another 10% comes from the mix of credit types you’ve got—like cards, loans, or mortgages. So, that’s a solid chunk of your score tied to how long you’ve been playin’ the credit game.

There’s another system called VantageScore that lumps credit age and credit mix together as a “highly influential” factor. Either way, whether it’s FICO or VantageScore, the message is clear: the longer you’ve had credit without major slip-ups, the more trustworthy you seem to lenders. It’s like havin’ a long resume—it shows you’ve got experience.

What’s Considered a “Good” Credit Age?

And now for the fun part: what’s a good credit age? Well, there isn’t a single answer. It depends on your life stage. For example, if you’re in your early 20s, a credit age of only a couple of years might be fine. But if you’re close to 40, you should try to have at least 10 years of credit history.

To get a better picture, let’s connect this to credit scores. People between the ages of 18 and 26 are said to have an average credit score of around 680. Between 27 and 42-year-olds, that number goes up a bit to between 680 and 690. If your score is in that range or higher for your age, you’re probably in good shape, and the fact that you have credit history probably helps you out. Most of the time, having more credit history means you’ve had more time to build a good credit history, which is good for your score.

Here’s a quick lil’ table to give you a rough idea of how credit age might look across different life stages:

| Age Group | Average Credit Age (Rough Estimate) | Average Score Range |

|---|---|---|

| 18-26 | 1-5 years | Around 680 |

| 27-42 | 5-15 years | 680-690 |

| 43-58 | 15-25 years | 690-720 |

| 59+ | 25+ years | 720+ |

Keep in mind, these are just ballpark figures. Your personal credit age being “good” depends on how it stacks up with your payment history and other factors. But generally, the longer, the better.

How Credit Age Fits Into the Bigger Picture

Before you go obsessin’ over your credit age, let’s put it in perspective. Yeah, it’s important, but it ain’t the whole story. There’s other stuff that weighs way heavier on your credit score. Lemme break it down for ya:

- Payment History (35% of FICO score): This is the big boss. Payin’ your bills on time, every time, is the single best thing you can do. Miss a payment, and your score takes a nosedive.

- Credit Utilization (30% of FICO score): This is how much of your available credit you’re usin’. Keep it under 30%—like, if you got a $1,000 limit, don’t owe more than $300. Less is even better.

- Length of Credit History (15%): That’s our buddy credit age. It matters, but not as much as the first two.

- Credit Mix (10%): Havín’ different types of credit—like a card and a car loan—helps a bit.

- New Credit (10%): Openin’ too many new accounts at once can spook lenders. Take it slow.

So, while credit age is a player in the game, it’s more like a supportive teammate than the star quarterback. Focus on payin’ on time and keepin’ your balances low, and the age thing will sorta take care of itself over time.

Can You Actually Improve Your Credit Age?

Now, you might be wonderin’, “Can I make my credit age better?” Well, sorta. You can’t speed up time (wish I could, tho!), but there’s a few tricks to help it along. Here’s what me and my team at MoneyMaverick suggest:

- Don’t Close Old Accounts: Even if you ain’t usin’ that first credit card from college no more, keep it open. Closín’ it shortens your credit history, and that’s a bummer for your age average.

- Become an Authorized User: If you got a parent or a buddy with a super old credit account in great standin’, ask if they can add ya as an authorized user. Their account’s history might give your credit age a lil’ boost. Just make sure they’re responsible—any mess-ups on their end could hurt ya.

- Be Patient: Real talk—credit age grows naturally as you keep accounts open. Just hang tight and don’t do nothin’ crazy like closin’ accounts for no reason.

One thing to watch out for: openin’ a bunch of new accounts at once can drag your average age down, since new accounts got zero history. So, if you’re applyin’ for a new card or loan, space ‘em out a bit.

A Lil’ Story From Yours Truly

Lemme share a quick tale. Back when I was just startin’ out, me and my buddy was clueless about credit. We thought havin’ a credit card was just for emergencies or splurgin’ on pizza. I closed my first card after a year ‘cause I didn’t wanna “deal with it.” Big mistake! My credit age took a hit, and it took years to build back up. If I’d known then what I know now, I woulda kept that sucker open and just let it chill in my wallet. Learn from my goof, y’all—don’t ditch those old accounts.

Common Myths About Credit Age (Let’s Bust ‘Em!)

There’s a lotta nonsense floatin’ around about credit age, and I’m here to set the record straight. Check out these myths and the real deal:

- Myth #1: Credit age is the most important thing for your score.

Nah, fam. Like I said earlier, payment history and how much credit you’re usin’ matter way more. Credit age is just one piece of the puzzle. - Myth #2: You can’t get a good score if you’re young.

Not true! Even with a short credit age, you can rock a solid score by payin’ on time and keepin’ balances low. It’s tougher to hit super high numbers like 800, but “good” is totally doable. - Myth #3: Closín’ an old account don’t hurt ya.

Wrong-o! Closín’ old accounts can shrink your credit history and lower that average age. Keep ‘em open unless there’s a crazy fee or somethin’.

How to Check Your Own Credit Age

Curious about where you stand? It’s pretty easy to figure out your credit age, tho you might need to do a lil’ math. Here’s how we do it at MoneyMaverick:

- Pull Your Credit Report: Get a free report from one of the big credit bureaus (there’s three of ‘em, ya know). It’ll list all your accounts and when they were opened.

- List the Ages: For each account, note how long it’s been open. If a card was opened in 2018 and it’s 2023, that’s 5 years.

- Find the Average: Add up the ages of all accounts and divide by the number of accounts. That’s your credit age.

- Check Your Score: See how your score compares to averages for your age group. If it’s in the 680-690 range or higher, you’re likely golden.

Don’t stress if your credit age seems low. Remember, it’s just one factor, and time will naturally bump it up as long as you play your cards right.

Tips to Build a Stellar Credit History (Beyond Just Age)

Since credit age works hand-in-hand with other stuff, let’s talk about buildin’ a rock-solid credit profile. I’ve been down this road, and these tips have saved my bacon more than once:

- Pay On Time, Every Time: I can’t stress this enough. Set up auto-payments if you gotta. Late payments are like kryptonite to your score.

- Keep Balances Low: Don’t max out your cards. Aim to use less than 30% of your limit. Got a $2,000 limit? Keep the balance under $600.

- Mix It Up (Slowly): Over time, havin’ different kinds of credit—like a card, a car loan, or a mortgage—can help. But don’t rush to open new stuff just for variety.

- Check Your Report: Peek at your credit report now and then to catch errors. Wrong info can drag ya down, and disputin’ it is free.

- Avoid Too Many Applications: Each time you apply for credit, it can ding your score a lil’. Only apply when you really need somethin’.

Stick to these habits, and your credit age will grow into a nice, mature number without you even tryin’ too hard.

What If Your Credit Age Is Low? Don’t Panic!

If you’re just startin’ out or had to close accounts for whatever reason, a low credit age don’t mean you’re doomed. Focus on what you can control. Pay every bill on time, keep your credit use low, and avoid openin’ a ton of new accounts. Over the months and years, your credit age will climb, and so will your score.

One sneaky move I’ve seen work is gettin’ added as an authorized user on someone else’s old account, like I mentioned before. My cousin did this with his mom’s credit card—she’s had it forever—and it gave his credit age a nice lil’ nudge. Just make sure the main account holder is solid with their payments, or it could backfire.

Wrappin’ It Up: Your Credit Age Journey

So, there ya have it, peeps! A “good” credit age ain’t just a magic number—it’s about how long you’ve been in the credit game compared to your life stage, and how you’ve managed it. Whether you’ve got a couple years or a couple decades of credit history, the real key is keepin’ accounts open, payin’ on time, and usin’ credit smartly. At MoneyMaverick, we’re rootin’ for ya to build that score into somethin’ you can brag about.

Got a credit age story or a question? Drop it in the comments below. I’m all ears! And hey, stick around our blog for more no-nonsense tips on makin’ your money work for you. Let’s keep this financial journey rollin’ together!

Length of credit history vs. credit age

Rod Griffin is the senior director of public education and advocacy for Experian, one of the three major credit bureaus. He says that “length of credit history” refers to how long an account has been reported open.

Griffin says, “In general, the longer an account has been open and used, the better it is for the credit score.” “That’s particularly true for an account with a positive payment history that has no delinquency. ”.

The credit scoring algorithms calculate the average of how long all your accounts have been open. That average age of accounts is your “credit age. ”.

When you’re young, it’s almost impossible to get a score above 800 because you won’t have much credit history.

What is a GOOD Credit Score in 2025? What’s the Average Credit Score Overall & By Age / Generation?

FAQ

How much does credit age affect your credit score?

Your credit age accounts for 15% of your credit score. Apply for credit early, and keep your accounts open as long as you can. Length or age of credit history is how long you’ve had credit lines in your name. It accounts for about 15% of your credit score, and there’s not much you can do except be patient to help this factor improve.

What does credit age mean?

Credit age measures the length of your credit history. That is, how long you’ve had different kinds of credit, such as: For personal credit accounts, credit age is the number of years they’ve been open. What Is a Thin Credit File? Is 700 a Good Credit Score?.

What is a good credit score if you’re young?

That average age of accounts is your “credit age. ” It’s all but impossible to get a score higher than 800 if you’re young, because your credit age likely will be low. Your credit score is affected by your credit age, but you can’t change that. All you can do is keep your credit accounts open and don’t close credit cards suddenly.

What percentage of credit score is based on age?

When it comes to credit scores, the importance of credit age depends on the scoring model. Credit-scoring company FICO® says credit age accounts for 15% of its credit scores. VantageScore® says it accounts for 20%-21% of its latest credit scores. Join the millions using CreditWise from Capital One. What is length of credit history?.

What is the average age of credit?

This is just the average age of all of your accounts, based on the same “date opened” field. Let’s say you have two accounts that are 3 years old and 5 years old. The average age of your credit is 4 years. Because items can age off your credit report, credit age can change.

Is there a perfect credit age?

Broadly speaking, the longer you’ve had an account open the better. But there’s no perfect credit age. Improving your length of credit can take time. If you’re trying to establish credit, secured credit cards and credit-builder loans are two options. Becoming an authorized user is another.

What is a good credit age average?

Is 3 years of credit history good?

Building a good length of credit history takes time, and while 3 years and 10 months is a solid start, most lenders consider 5 to 8 years as the “good” range for credit history. Anything above 8 years typically falls into the “excellent” category.

What credit should a 25 year old have?

As of my last update, the average credit score for individuals aged 20 to 25 typically falls in the range of 630 to 680. This range can vary based on factors like geographic location, economic conditions, and individual financial behavior. Young adults often have shorter credit histories, which can impact their scores.

Can a 20 year old have a 700 credit score?

While someone who is 20 years old probably has a relatively short credit history, it is possible to have a score of 700.Jan 9, 2025