Your credit score is one of the most important things that South African lenders use to decide how much credit you can get. If you have good credit, you can get loans with lower interest rates, the best credit cards, rent a house or apartment, and even get your dream job. What, then, does a good credit score mean in South Africa in the year 2021?

Understanding Credit Scores in South Africa

In South Africa, credit scores range between 300 and 850. The scores are calculated by credit bureaus using the information in your credit report. This includes your payment history, amounts owed, length of credit history, credit mix, and new credit applications.

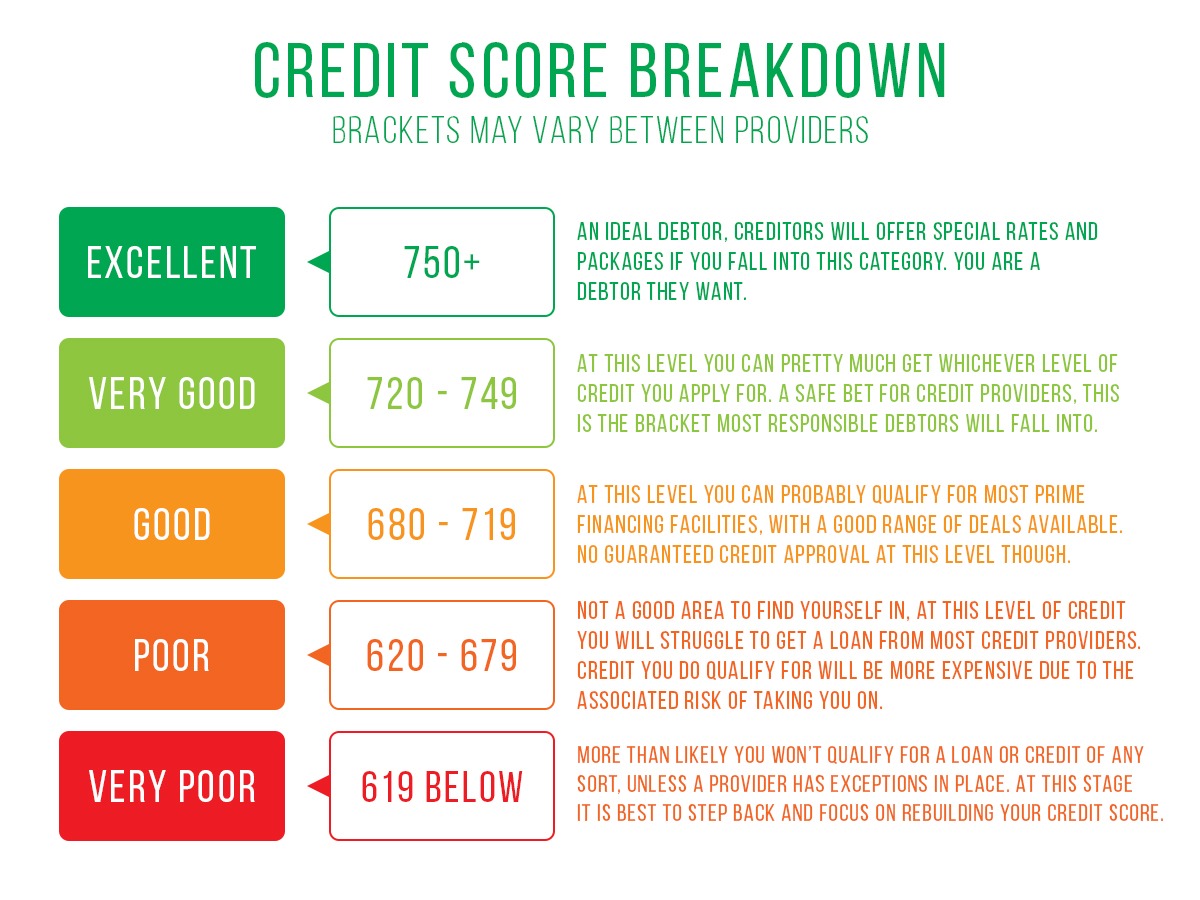

The Consumer Credit Index (CCI), which was made by TransUnion, is the credit score model most often used in South Africa. This is how TransUnion says the credit scores should be understood:

- 300-559: Very poor

- 560-601: Poor

- 602-662: Average

- 663-725: Good

- 726-785: Very good

- 786-850: Exceptional

According to TransUnion, a good credit score in South Africa is between 663 and 725. The higher your score, the better. A score above 700 is considered excellent.

What Determines Your Credit Score?

Many factors go into calculating your credit score. The main ones include:

-

Your payment history (35% of your score) shows how well you pay your bills and loans on time. Late or missed payments can really hurt your score.

-

Credit utilization (30%): The ratio of your current debts to your total available credit limit. Using more than 30% of your limit can hurt your score.

-

Credit history length (15%): How long you’ve had access to credit. A longer history reflects better on your score.

-

Credit mix (10%): The variety of credit accounts you have, such as credit cards, retail accounts, instalment loans, mortgage, etc.

-

New credit (10%): How many new accounts you’ve opened recently and how many credit inquiries are on your report. Too many can lower your score.

As you can see, responsible credit usage like paying your bills on time, keeping balances low, and having a mix of credit accounts will help boost your score.

Tips to Improve Your Credit Score

If your score is not yet in the good or excellent range, here are some tips to improve it:

-

Pay all your bills on time. Set up reminders if needed. Payment history has the biggest impact on your score.

-

Keep balances below 30% of the credit limit. Pay off debt aggressively and avoid maxing out cards.

-

Don’t close old credit accounts. Keeping them open preserves the length of your credit history.

-

Limit new credit applications. Too many can negatively affect your score. Only apply for what you need.

-

Correct errors on your credit report. Dispute any inaccurate or incomplete information with the credit bureaus.

-

Consider being an authorized user on someone else’s account to build up your history.

-

Don’t miss a loan repayment. Set up debit orders so you don’t accidentally skip an instalment.

-

Give it time. Building an excellent credit score doesn’t happen overnight. Be patient and consistent.

The Benefits of a Good Credit Score

Achieving and maintaining a good credit score above 650 comes with many advantages:

-

Better loan terms and lower interest rates, saving you money.

-

Higher credit card and loan limits approved for you.

-

Ability to rent a house without large deposits.

-

Increased chances of loan and credit applications getting approved.

-

Potential employers may view you as financially responsible.

-

Indicator of your financial trustworthiness as a business partner or tenant.

So take the time to monitor and build your credit score. Having a good score unlocks better financial opportunities for you. Be a responsible borrower, limit new debts, and make payments on time. Aim for a score between 663 and 725 to put yourself in a strong financial position in South Africa.

Figure 2: Account Management Score Migration, 2016 to 2017

Examining how key credit characteristics shifted between 2017 and 2018 highlights some of the drivers in the 14-point decrease in the average Account Management score. The increase in the delinquency, utilisation and enquires are all factors that have contributed to the decrease in the average Account Management score.

Figure 1: Account Origination Score Migration and Drivers

In 12 months, the average score for this group of consumers dropped by 9 points overall and by 11 points for the Thin File[1] population. Looking at some key characteristics that factor into the score calculation, we can start to understand why:

- The delinquency levels have significantly increased for this population, with fewer never-delinquent consumers and a 34% increase in 3-cycle (90 days) delinquency.

- A considerably higher proportion of Retail accounts opened by these consumers went delinquent within the 12-month analysis period.

This shift towards a more risky profile among borrowers who were recently granted credit highlights the importance of careful risk monitoring of this population. Regular review of monitoring reports helps lenders identify if a tranche of business is shifting risk and merits proactive risk management.

Risk shifts such as this show why it’s even more important for lenders to leverage robust account management tools to ensure they maintain a healthy portfolio.

Credit scores fully explained in South Africa

FAQ

What is the average credit score in South Africa?

Around 600 is considered to be an average credit score in South Africa. So, being in the 600 range is neither deemed good nor bad. In fact, you can celebrate if you’re in this range. It means your credit score is getting better, and you can even get it to an excellent level.

Can you buy a house with a 750 credit score?

The Quick Answer. A 750 credit score is excellent! It puts you in a fantastic position to qualify for the best mortgage rates and loan programs available. Lenders will see you as a very reliable borrower if your credit score is 750, which can help you a lot when you’re buying a home.

What credit score is needed for a loan in South Africa?

What Credit Score Do You Need to Buy a House? In South Africa, the minimum credit score to qualify for a home loan is typically around 600.

Is 660 a good credit score in South Africa?

The numbers matter. A good credit score in South Africa is between 650 and 669, while an excellent credit score is above 670.