Hey there, dreamer! Ever pictured yourself unlockin’ the door to your very own home, but thought, “Nah, I ain’t got the cash or the credit for that”? Well, lemme tell ya, the FHA Loan Program might just be the key you’ve been lookin’ for If the idea of owning a place feels outta reach, stick with me We’re gonna dive deep into what this program is, how it works, and why it could be your ticket to hangin’ up that “Home Sweet Home” sign.

The FHA Loan Program is basically a mortgage deal backed by the government that helps regular people like you and me buy homes, even if our credit or finances aren’t great. It has been around since 1934 and is all about making homeownership less of a dream and more of a “heck yeah, I can do this” chance. Let’s get right to the point and explain everything so you know what’s going on.

What Exactly Is the FHA Loan Program?

Alright, let’s start with the basics The FHA Loan Program is run by the Federal Housing Administration (that’s what FHA stands for), and it’s a part of the bigger US. Department of Housing crew. Here’s the deal they don’t actually lend you the money. Nope, instead, they insure the loan. That means if you can’t pay it back, the FHA’s got the lender’s back, which makes banks and lenders way more willing to say “yes” to people who might not qualify for a regular ol’ mortgage.

Why’s this a big deal for us? ‘Cause it opens the door wide for first-time buyers, folks with not-so-hot credit, or anyone who can’t scrape together a huge down payment We’re talkin’ down payments as low as 3.5% if your credit ain’t too shabby Compare that to the 20% some traditional loans want, and you see why this program’s a game-changer.

Here’s a quick snapshot of what makes FHA loans stand out:

- Low Down Payments: Sometimes just 3.5% of the home’s price.

- Easier Credit Rules: You don’t need a perfect score to get in the game.

- Government Backup: Lenders take a chance on ya ‘cause the FHA insures the loan.

- Options Galore: Whether you’re buyin’, fixin’ up, or even tappin’ home equity as a senior, there’s likely an FHA loan for ya.

Before things get too exciting, there’s always a catch. To cover that government protection, you have to pay something called mortgage insurance premiums, both up front and every year. But we’ll get into that later. For now, just know that the FHA Loan Program is like a friend who helps you out when the bank might have said “no way.” ”.

How Does an FHA Loan Work?

Let’s talk about how this thing really works. You still borrow money from a private lender when you get an FHA loan. This could be a bank or a mortgage company. The FHA, on the other hand, is like a co-signer who promises to help you out if things go wrong. Lenders don’t have to be as strict about “you gotta be perfect” rules when they have that safety net.

Here’s how it plays out, step by step:

- You Apply: Find a lender who offers FHA loans (most do), and throw in your application.

- Lender Checks Ya Out: They look at your credit, income, debts—all that fun stuff.

- FHA Backs It: If approved, the FHA insures the loan, so the lender feels safe.

- You Pay Extra for Insurance: You’ll fork over an upfront fee (usually 1.75% of the loan) and monthly insurance payments to keep that protection goin’.

- Get Your Home: Once it’s all set, you close the deal, pay your down payment, and snag those house keys.

The terms of an FHA loan ain’t much different from other mortgages. You can pick a fixed rate (stays the same forever) or an adjustable one (changes over time), and choose a 15-year or 30-year payback plan. Rates? They’re often a smidge lower than regular loans—think around 6.6% for a 30-year FHA versus 6.8% for conventional, dependin’ on the day.

One thing to remember, though: this loan’s gotta be for your main place to live. No fancy vacation homes or rental properties here. It’s for a primary residence, whether it’s a single-family house, a duplex, or even a mobile home in some cases.

Who Can Get an FHA Loan? The Requirements

Now, you’re probably wonderin’, “Do I even qualify for this sweet deal?” Good news is, the bar ain’t set sky-high like with some loans. But there are rules to play by. Let’s lay ‘em out so you can see where you stand.

Credit Score

Anybody can get an FHA loan, even if they have bad credit. Here’s the breakdown:

- 580 or Higher: You’re golden for a 3.5% down payment.

- 500 to 579: Still possible, but you gotta put down 10%.

- Below 500: Sorry, pal, you’re outta luck unless you boost that score first.

Some lenders might wanna see a higher score than the minimum, so shop around if yours is on the edge.

Down Payment

Like I said, it’s low—3.5% if your credit’s decent, 10% if it’s a bit shaky. So, for a $200,000 house, that’s $7,000 or $20,000 upfront. Way better than the $40,000 a regular loan might demand, right? Plus, there’s programs out there—state or local ones—that might help cover this cost if you’re strapped for cash.

Debt-to-Income Ratio (DTI)

This fancy term just means how much of your money goes to bills versus what ya bring in. For FHA loans:

- No more than 31% of your income should go to mortgage payments.

- No more than 43% should go to all debts combined (think car loans, credit cards, etc.).

Some lenders might bend a bit if you’ve got a big down payment or other strengths, but that’s the general rule.

Property Rules

The home you’re buyin’ has to pass muster. A HUD-approved appraiser checks it out to make sure it’s safe and sound. We’re talkin’:

- Structurally solid (no crumblin’ walls).

- Workin’ heat, plumbin’, and electric.

- Decent drainage and ventilation.

If the place is a fixer-upper, there’s a special FHA loan for that, which we’ll chat about soon.

Loan Limits

You can’t borrow a gazillion bucks. The amount depends on where you live—higher in pricey areas, lower in cheaper ones. For a single-family home, it ranges from about $524,000 to over $1.2 million in high-cost spots. Check your local limit before fallin’ in love with a mansion.

Mortgage Insurance

This ain’t optional. You pay:

- Upfront MIP: 1.75% of the loan amount, usually at closin’.

- Annual MIP: Between 0.15% and 0.75% of the loan, paid monthly. Depends on your down payment and loan size.

If you put down less than 10%, you’re stuck payin’ this insurance for the whole loan term. Put down more, and you might ditch it after 11 years.

Here’s a quick table to sum up the must-haves:

| Requirement | Details |

|---|---|

| Credit Score | 580+ for 3.5% down, 500-579 for 10% down |

| Down Payment | 3.5% or 10%, based on credit |

| DTI Ratio | 31% for housing, 43% total debt |

| Property Standards | Must meet HUD safety/health rules |

| Loan Limits | $524K to $1.2M, varies by location |

| Mortgage Insurance | Upfront 1.75%, annual 0.15%-0.75% |

If you’re noddin’ along thinkin’, “I might got this,” then keep readin’. We’ve got more to unpack.

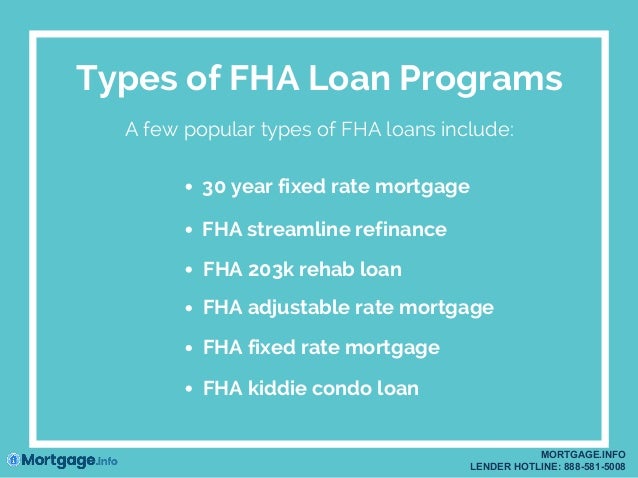

Types of FHA Loans: Somethin’ for Everyone

One size don’t fit all, and the FHA knows it. They’ve got a handful of loan types for different situations. Whether you’re buyin’ your first crib or fixin’ up a dump, there’s likely an option. Let’s run through ‘em.

- Basic Home Mortgage (203b): This is the go-to for most folks. Use it to buy or refinance a home—1 to 4 units. It’s the standard deal for first-timers or anyone wantin’ a straightforward mortgage.

- Rehabilitation Loan (203k): Got your eye on a place that needs some love? This covers the purchase price and repair costs. There’s a Standard version for big renos and a Limited one for smaller fixes. Perfect if you’re handy or wanna turn a rough spot into a gem.

- Disaster Victim Loan (203h): If a big disaster—like a hurricane or flood—wiped out your home, this helps you rebuild or buy anew with no down payment. Gotta be in a presidentially declared disaster zone, though.

- Home Equity Conversion Mortgage (HECM): This one’s for the older crowd—62 and up. It’s a reverse mortgage, meanin’ you can turn your home equity into cash without sellin’. Great for retirement income, but watch out for the risks (we’ll touch on that later).

- Energy-Efficient Mortgage (EEM): Wanna go green? This helps buy an energy-savvy home or upgrade yours with stuff like solar panels or better insulation. Save on bills while savin’ the planet.

- Graduated Payment Mortgage (245a): Not super common, but it’s for folks expectin’ their income to grow. Payments start low and creep up over time. Risky if your plans don’t pan out, so tread careful.

Each of these got its own quirks and perks. If you’re unsure which fits, talk to a lender. They can steer ya right based on your story.

Why Choose an FHA Loan? The Good Stuff

Now, let’s chat about why me and you might wanna jump on this bandwagon. The FHA Loan Program ain’t just hype—it’s got real benefits that can make homeownin’ happen sooner than you’d think.

- Lower Down Payment: I can’t stress this enough. Droppin’ just 3.5% means you don’t gotta save for a decade to buy. That’s huge for us regular folks.

- Credit Flexibility: Got a few bumps on your credit report? No biggie. FHA’s cool with scores way below what traditional loans want. It’s like givin’ you a second chance.

- Higher Debt Allowance: If you’ve got student loans or other debts, FHA’s more forgivin’ on that debt-to-income ratio. Some lenders let it slide higher than 43% if you’ve got other strengths.

- Start Buildin’ Equity: Ownin’ a home ain’t just about a roof—it’s about buildin’ wealth over time. FHA gets you in the game early.

- Seller Help: Sellers, builders, or even lenders can cover up to 6% of your closin’ costs. That’s less cash you gotta cough up at the end.

I’ve seen buddies who thought they’d never own a place snag a home thanks to these perks. It’s like the FHA’s sayin’, “We believe in ya, even if the big banks don’t.”

The Flip Side: What’s the Catch?

Ain’t nothin’ perfect, and FHA loans got their downsides too. I wanna be straight with ya so you don’t get blindsided.

- Mortgage Insurance Costs: That MIP I mentioned? It adds up. Upfront fee plus monthly payments can make your loan pricier over time compared to a regular mortgage where you might cancel insurance later.

- Loan Limits: If you’re dreamin’ of a mega-expensive pad in a ritzy area, FHA might not cover it. You’re capped based on where you’re buyin’.

- Property Standards: The home’s gotta pass an FHA appraisal. If it’s a total wreck, you might need that 203k loan or look elsewhere.

- Long-Term Insurance: Put down less than 10%, and you’re payin’ MIP for the whole loan term. That’s a long commitment. Only way out is payin’ off, sellin’, or refinancin’ to a different loan.

Weigh these against the upsides. If your credit’s decent (like 620 or up), a conventional loan might save ya money long-term ‘cause you can ditch insurance once you’ve got enough equity. But if you’re itchin’ to buy now and your score or savings ain’t there, FHA’s still a solid bet.

Is an FHA Loan Right for You?

Here’s where we get personal. Should you go for it? Lemme break it down with a few scenarios to see if this fits your life.

- You’re a First-Timer with Okay Credit: If your score’s around 580 and you’ve saved a lil’ bit, FHA’s your jam. Low down payment gets you in quick.

- You’ve Got Debt but Steady Income: If bills are high but you’ve got a solid job, that higher DTI allowance might work in your favor.

- You’re Eyein’ a Fixer-Upper: Love a challenge? That 203k loan could let ya buy cheap and renovate into somethin’ slicker than a whistle.

- You’re Older and Need Cash: Over 62? Own your home? The reverse mortgage option could help with retirement, but be careful—fees and risks are real.

On the flip side, if your credit’s strong (620+) and you can swing a slightly bigger down payment, check conventional loans. You might avoid lifelong insurance costs. Or if you’re military, a VA loan could be better. Point is, FHA ain’t the only path, but it’s a darn good one for many of us.

How to Apply for an FHA Loan: Let’s Get Movin’

Ready to roll? Applyin’ ain’t rocket science, but it takes some prep. Here’s how we do it, step by step.

- Check Your Stats: Look at your credit score (free reports online) and figure your DTI. Make sure you’re in the ballpark—580+ score, under 43% debt load.

- Save for Down Payment: Even 3.5% needs savin’. For a $250,000 home, that’s $8,750. Look into local help programs if you’re short.

- Find a Lender: Not every bank does FHA loans, but tons do. Search for “FHA-approved lenders” near ya or online. Compare rates—they vary.

- Gather Your Stuff: You’ll need:

- Last two years of tax returns.

- Recent pay stubs (last two usually).

- Bank statements showin’ savings.

- ID like a driver’s license.

- Apply: Fill out the lender’s forms. They’ll run a credit check and crunch numbers.

- Get Appraised: Once pre-approved, pick a home and get that FHA appraisal done. Gotta meet those safety standards.

- Close the Deal: Sign a mountain of papers, pay your down payment and upfront insurance, and boom—keys are yours.

Pro tip: Talk to a housing counselor if you’re feelin’ lost. They’re like free guides to walk ya through. You can find one through HUD-approved lists or hotlines.

Tips to Boost Your Chances

Wanna make sure you get that “yes” from a lender? Here’s some tricks I’ve picked up:

- Fix Your Credit a Lil’: Pay down small debts or fix errors on your report before applyin’. Even jumpin’ from 570 to 580 saves you on down payment.

- Cut Debt Where Ya Can: Lower that DTI by payin’ off a credit card or two. Less debt, better odds.

- Save Extra: Even if it’s just 3.5%, havin’ a bit more shows lenders you’re serious.

- Shop Around: Don’t settle for the first lender. Rates and fees differ. Get quotes from a few.

- Ask for Help: If down payment’s a struggle, check state or local programs. Some give grants or loans you don’t gotta repay right away.

We’ve all been there, scrapin’ by, but a lil’ effort can tip the scales.

FHA vs. Other Loans: How It Stacks Up

Wonderin’ how FHA compares to other options? Let’s do a quick face-off.

- FHA vs. Conventional: Conventional loans need better credit (usually 620+) and often bigger down payments (3-20%). But, you can cancel mortgage insurance after buildin’ equity. FHA’s easier to get, but insurance sticks longer.

- FHA vs. VA: VA loans are for military folks—vets, active duty, or spouses. Zero down payment, no insurance fees. If you qualify, VA’s often better. FHA’s open to everyone, though.

- FHA vs. USDA: USDA loans are for rural areas, low-to-moderate income buyers. No down payment, but location’s limited. FHA works anywhere, urban or not.

Depends on your sitch. FHA’s strength is accessibility—anyone can apply if they meet the basics.

Common Questions We All Got

Got Qs? I’ve got As. Here’s some stuff folks always ask me about FHA loans.

- How long does approval take? Usually 30-60 days, dependin’ on your lender and how fast you get docs in. Quicker if you’re organized.

- Can I use FHA for a condo? Yup, if the condo complex meets FHA rules. Check with your lender.

- What if I can’t pay the loan? FHA insurance protects the lender, but you still lose the home to foreclosure. Talk to your lender early if you’re strugglin’—they might rework terms.

- Is there an income limit? Nope, FHA don’t care how much ya make, just that your debt ratios line up.

Still got more? Hit up a lender or counselor. They’ve got the deets for your specific case.

Real Talk: My Take on FHA Loans

Look, I ain’t gonna sugarcoat it—buyin’ a home is a big freakin’ deal, and FHA loans ain’t a magic wand. But for a lotta us, it’s the boost we need. I’ve watched friends go from rentin’ forever to ownin’ a lil’ slice of the American dream, all ‘cause this program cut ‘em some slack on credit and cash. Yeah, the insurance fees suck a bit, but weigh that against livin’ in your space, paintin’ walls whatever crazy color ya want, and buildin’ somethin’ for the future.

If you’re sittin’ there thinkin’, “Maybe this is my shot,” then don’t just sit there. Check your credit, crunch some numbers, and talk to a lender. Me and you, we deserve a place to call ours, and the FHA Loan Program might just be the way to make it happen. So, what’re ya waitin’ for? Let’s get those home huntin’ boots on and make some moves!

Advantages and Disadvantages of FHA Loans

FHA loans are often the best source of a mortgage for borrowers who are unable to obtain financing through private lenders. They might be able to get an FHA loan even if they have bad credit, a lot of debt, or a high debt-to-income (DTI) ratio.

However, because FHA borrowers are often riskier, FHA loans usually come with somewhat higher interest rates and require borrowers to pay mortgage insurance premiums both upfront and monthly. FHA loans can only be used for your primary residence and come with borrowing limits.

- Available to borrowers with lower credit scores

- Smaller down payments

- Federally backed

- Requires insurance paid both upfront and monthly

- Cannot be used for second homes or investment properties

- Higher interest rates

- Not all properties qualify

Sufficient Income

Meanwhile, your back-end ratio, which consists of your mortgage payment and all other monthly consumer debts, should be less than 43% of your gross income.

| FHA Loans vs. Conventional Loans | ||

|---|---|---|

| FHA LOAN | CONVENTIONAL LOAN | |

| Minimum Credit Score | 500 | Typically 620; can vary by lender |

| Minimum Down Payment | 3.5% with a credit score of 580+ and 10% for a credit score of 500 to 579 | 3% to 20% |

| Loan Terms | 15 to 30 years | 8 to 30 years |

| Mortgage Insurance Requirements | Upfront MIP + annual MIP for either 11 years or the life of the loan, depending on LTV and length of the loan | None with a down payment of at least 20% or after the loan is paid down to 78% LTV |

| Mortgage Insurance Premiums | Upfront: 1.75% of the loan + annual: 0.15% to 0.75%, paid monthly | PMI: 0.2% to 2% of the loan amount per year |

| Down Payment Gifts | 100% of the down payment can be a gift | Some or all of the down payment can be a gift depending on the lender |

| Down Payment Assistance Programs | Yes | No |