It’s the retirement savings conundrum: choosing which account type youll use to save for your future. If you’re weighing whether to pick an IRA vs. a 401(k), you have 2 strong choices. (But spoiler alert: The answer may be both!)

Here’s what you need to know about the similarities and differences between 401(k)s and IRAs—plus tips to help you decide where to focus your savings.

Let’s face it – not everyone has access to a 401(k) plan. Even if you do, you might be wondering if there are better options out there for growing your retirement nest egg. As someone who’s spent years helping folks navigate the confusing world of retirement planning, I can tell ya that 401(k)s are great, but they’re definitely not the only game in town!

According to recent data, only about 81% of full-time workers have access to a 401(k) or similar employer-sponsored plan That leaves millions of Americans needing alternatives The good news? There are plenty of powerful options that might actually work better for your specific situation.

Why Look Beyond a 401(k)?

Before diving into alternatives. let’s quickly review why you might want options beyond a 401(k)

- Your employer doesn’t offer one

- Limited investment choices in your current plan

- High fees eating into your returns

- You’re self-employed or a small business owner

- You’ve already maxed out your 401(k) contributions

- You want more control over your investments

Top 8 Alternatives to a 401(k)

1. Traditional IRA

An IRA is better if your top priority is investment selection, and you don’t want your retirement plan tied to an employer. Since you can use both accounts, it could be worth splitting your funds between each to get the best of both worlds. A financial advisor can help you make this decision.

Traditional IRAs work similarly to 401(k)s in that they offer tax-deferred growth. Your contributions might be tax-deductible depending on your income and whether you have access to a workplace retirement plan.

Key Benefits:

- Wide range of investment options (way more than most 401(k)s)

- Not tied to your employer

- Tax-deferred growth

- Potentially tax-deductible contributions

Limitations

- Lower contribution limits ($7,000 in 2024/2025 vs. $23,000/$23,500 for 401(k)s)

- Income limits may restrict deductibility

- Required Minimum Distributions (RMDs) starting at age 73

2. Roth IRA

I absolutely love Roth IRAs for many of my clients! Unlike traditional retirement accounts, Roth contributions are made with after-tax dollars, but qualified withdrawals in retirement are completely tax-free.

Key Benefits:

- Tax-free growth and withdrawals in retirement

- No Required Minimum Distributions

- Can withdraw contributions (not earnings) penalty-free anytime

- Great for those expecting to be in higher tax brackets later

Limitations:

- Income limits for direct contributions

- Same contribution limits as Traditional IRA ($7,000 in 2024/2025)

- No immediate tax deduction

For high earners who exceed income limits, the “Backdoor Roth IRA” strategy (contributing to a traditional IRA then converting to Roth) remains a viable workaround in 2025.

3. Health Savings Account (HSA)

This might be the most underrated retirement account out there! While primarily designed for healthcare expenses, HSAs offer triple tax advantages that make them excellent retirement savings vehicles.

Key Benefits:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

- After age 65, can withdraw for non-medical purposes (paying only regular income tax)

- No “use it or lose it” rule

Limitations:

- Must have a qualifying high-deductible health plan

- Lower contribution limits ($4,300 for individuals/$8,550 for families in 2025)

4. SEP IRA

If you’re self-employed or run a small business, a Simplified Employee Pension (SEP) IRA might be your new best friend.

Key Benefits:

- Much higher contribution limits (up to 25% of compensation or $70,000 in 2025)

- Easy to set up and maintain

- Flexible annual contributions

- Same investment options as traditional IRAs

Limitations:

- Only employers can contribute

- If you have employees, you must contribute equally (percentage-wise)

- Interferes with Backdoor Roth IRA strategy if you have balances

5. Solo 401(k)

For self-employed individuals with no employees (except maybe a spouse), the Solo 401(k) offers incredible savings potential.

Key Benefits:

- Massive contribution limits (up to $70,000 in 2025)

- Contribute as both employer AND employee

- Can include Roth options in many plans

- Potential for loans from your account

Limitations:

- More complex administration than SEP IRAs

- Not available if you have employees other than a spouse

- Annual filing requirements once assets exceed $250,000

6. SIMPLE IRA

Another option for small business owners is the Savings Incentive Match Plan for Employees (SIMPLE) IRA.

Key Benefits:

- Higher contribution limits than traditional IRAs ($16,500 in 2025)

- Employer matching component

- Easier administration than 401(k) plans

- Good for businesses with under 100 employees

Limitations:

- Lower contribution limits than SEP IRAs or Solo 401(k)s

- Mandatory employer contributions

- Early withdrawal penalties can be higher than other plans

7. Taxable Brokerage Account

Don’t overlook the simple power of a regular investment account! While it lacks the tax advantages of retirement accounts, it offers unmatched flexibility.

Key Benefits:

- No contribution limits

- No withdrawal restrictions or penalties

- Complete investment flexibility

- Preferential tax rates on long-term capital gains

- Can harvest tax losses

Limitations:

- No tax deduction for contributions

- Dividends and capital gains are taxable

- No tax-deferred growth

8. Real Estate Investments

Many of my clients have built substantial retirement wealth through real estate investments, either directly or through REITs (Real Estate Investment Trusts).

Key Benefits:

- Potential for income and appreciation

- Tax advantages through depreciation

- Inflation hedge

- Diversification from stock market

Limitations:

- Requires significant capital or leverage

- Less liquid than financial assets

- Can be management-intensive

- Market volatility and risk

Combining Strategies for Maximum Benefit

In my experience, the most successful retirement savers don’t limit themselves to just one account type. They strategically use multiple vehicles to maximize tax benefits and flexibility.

Here’s a simple hierarchy I often recommend:

- First, contribute enough to your employer 401(k) to get any matching funds (that’s free money!)

- Next, max out an HSA if eligible (triple tax benefits!)

- Then, max out a Roth IRA (directly or via backdoor)

- After that, return to maxing out your 401(k)

- Finally, use taxable accounts, real estate, or other alternatives

Special Considerations for High-Income Earners

If you’re a high-income professional like a physician or executive, you face unique challenges with retirement accounts due to income limitations. Here are some strategies that work particularly well:

- Backdoor Roth IRA: Contribute to a traditional IRA then immediately convert to Roth

- Mega Backdoor Roth: If your employer plan allows after-tax contributions with in-plan Roth conversions

- HSA as a stealth IRA: Maximize contributions, invest aggressively, pay medical costs out-of-pocket, and save receipts for tax-free withdrawals later

What If You Have Both W-2 and Self-Employment Income?

I see this situation frequently with clients who have side hustles or consulting gigs. It creates unique opportunities for retirement savings:

- You can contribute to BOTH your employer’s 401(k) and a Solo 401(k) for your self-employment income

- The employee contribution limit ($23,500 in 2025) applies across all plans combined

- But you can still make employer contributions to your Solo 401(k) based on your self-employment profits

Approaching Your Employer About Retirement Plans

If your employer doesn’t offer a retirement plan, consider these approaches:

- Educate them on the tax benefits for the business

- Highlight how it helps with employee retention

- Suggest starting with a SIMPLE IRA, which is easier to administer than a 401(k)

- Propose carving out some of your compensation as 1099 income so you can fund your own retirement plan

FAQs About 401(k) Alternatives

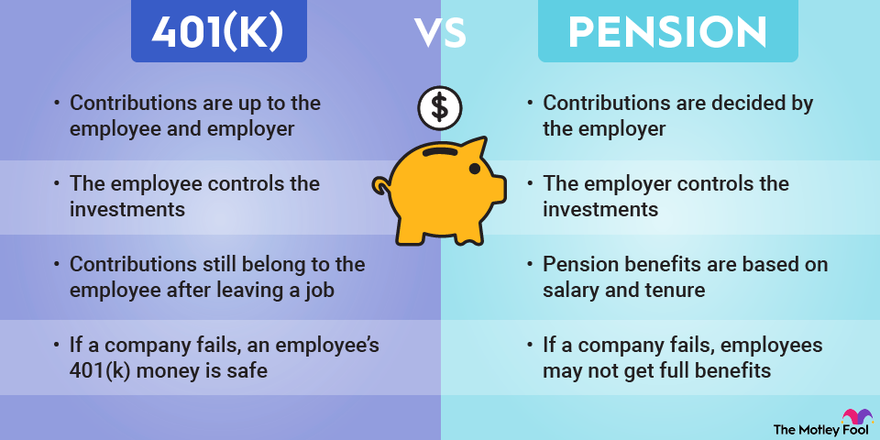

Is a pension better than a 401(k)?

A pension can be better for those seeking stable, guaranteed income throughout retirement with less personal investment management. However, pensions are becoming rare, and 401(k)s offer more control and portability between employers.

Is a Roth IRA better than a 401(k)?

Roth IRAs offer tax-free withdrawals in retirement and more investment flexibility, making them potentially better for those expecting higher future tax brackets. However, 401(k)s have much higher contribution limits and often include employer matching.

Where is the safest place to put retirement money?

The safest options include fixed annuities, CDs, treasury securities, and money market accounts. However, safety often comes with lower returns, so a balanced approach based on your time horizon and risk tolerance is usually best.

Can HSAs really be used for retirement?

Absolutely! After age 65, HSA funds can be withdrawn for any purpose (paying only regular income tax), making them function like a traditional IRA. But they’re even better because withdrawals for qualified medical expenses remain completely tax-free.

Conclusion

While a 401(k) is a valuable retirement savings tool, it’s certainly not the only option—and depending on your situation, it might not even be the best one for you. By understanding these alternatives, you can build a retirement strategy tailored to your unique needs, goals, and circumstances.

Remember that the best retirement plan usually combines multiple account types to maximize tax advantages, investment options, and flexibility. Consider working with a financial advisor who can help you navigate these choices and create a comprehensive retirement strategy.

What retirement accounts are you currently using? Have you explored any of these alternatives? I’d love to hear about your experiences in the comments below!

What is an IRA?

An IRA is a retirement savings option available to anyone with earned income (or whose spouse has earned income). You fund it with contributions directly from your bank account.

What is a 401(k)?

A 401(k) is an employer-sponsored retirement savings plan that allows you to make contributions through salary deferrals (aka money automatically deducted from your paycheck).