According to data compiled by TransUnion, the average credit card debt for Americans was an estimated $6,329 through the second quarter of 2024. This was an increase of about 6% from the roughly $5,090 average credit card balance Americans had at the same time in 2023.

But what does that number mean exactly? And if your household debt is near—or even above—the average credit card debt in the United States, what steps can you take to start paying it down?.

Credit card debt is becoming more of a problem for many American families. It’s easy to get into a lot of credit card debt because credit is easy to get and people like to spend money. But how much credit card debt does the average American household have? Let’s look at some key statistics about credit card debt in US households.

The Average Credit Card Debt in America

According to a 2022 report from Experian, the average credit card debt per American household is $8,590 This number has been steadily rising over the past decade Back in 2012, the average credit card debt per household was around $7,000.

That’s a rise of more than $1,500 in credit card debt for every household in just 10 years. That’s a worrying trend that shows how much many families depend on their credit cards.

Breaking Down Credit Card Debt by Income Level

It’s also useful to break down average credit card debt levels by income brackets. This gives a clearer picture of how credit card debt correlates with earnings.

- Households earning less than $15,000 per year have an average credit card debt of $3,551

- For households earning $15,000 to $24,999, the average is $4,959

- Households earning $25,000 to $34,999 carry an average credit card debt of $6,386

- In the $35,000 to $49,999 income bracket, the average is $7,752

- For households earning $50,000 to $74,999, the average jumps up to $10,727

- Households earning $75,000 or more have an average credit card debt of $11,611

As you can see, average credit card debt tends to rise steadily along with income levels. But even among higher earning households, high levels of credit card debt can quickly become unmanageable.

Factors Driving Increased Credit Card Debt

There are a few key factors that help explain why credit card debt has increased so much in recent years:

-

Quick and easy credit card approval: Banks and lenders have made it very simple to get multiple credit cards, even if you have bad credit. This increased access facilitates higher debt levels.

-

American culture encourages people to spend money instead of saving it through advertising and peer pressure. It is very easy to get credit, which leads many families to spend more than they can afford.

-

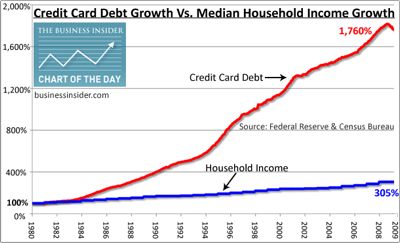

Stagnant wages: Despite a strong economy, wage growth has lagged in many industries. When earnings don’t keep pace with the cost of living, credit cards become a crutch for consumers.

-

Emergency expenses: Medical bills, home repairs, car troubles – unexpected expenses often wind up on credit cards, leading to ballooning balances.

The Risks of Excessive Credit Card Debt

Carrying high levels of credit card debt over time comes with considerable risks. These include:

-

High interest costs: With credit card interest rates hovering around 16-22%, debt can quickly snowball. This makes balances even harder to pay off.

-

Lower credit scores: Maxed out cards and high balances can cause credit scores to plummet. This makes accessing credit more expensive.

-

Strain on mental health: The stress of unmanageable debt takes a toll on wellbeing and relationships.

-

Bankruptcy: In worst case scenarios, excessive credit card debt can force borrowers to declare bankruptcy to discharge balances.

Tips for Paying Down Credit Card Debt

If you’re currently struggling with high credit card balances, here are some tips for paying them down:

- Make a budget to free up cash flow for paying extra on balances each month

- Prioritize paying off cards with the highest interest rates first

- Consider consolidating multiple balances to a lower rate card or personal loan

- Look for ways to earn extra income that can be put toward debt

- Avoid using cards until balances are under control

- Consider seeking credit counseling if you are overwhelmed

The key is staying disciplined and focused on steadily paying down balances over time. This will help you get out of debt and back on solid financial footing.

The Bottom Line

Credit card debt levels per American household now exceed $8,500 on average. With banks issuing cards freely and many households struggling with stagnant wages, it’s easy to see why balances have ballooned over the past decade. But excessive credit card debt comes with considerable financial risks. The key is staying vigilant about not overspending and paying off balances as quickly as possible. With focus and discipline, high credit card debt can be overcome.

States with the highest average credit card debt

- Alaska: $7,863

- District of Columbia: $7,548

- New Jersey: $7,401

- Connecticut: $7,381

- Maryland: $7,282

- Texas: $7,211

- Florida: $7,112

- Hawaii: $7,107

- Virginia: $7,002

- Colorado: $6,996

States with the lowest average credit card debt

- Arkansas: $5,667

- Vermont: $5,638

- Maine: $5,614

- South Dakota: $5,524

- Indiana: $5,502

- Mississippi: $5,415

- West Virginia: $5,348

- Kentucky: $5,304

- Wisconsin: $5,242

- Iowa: $5,227

I’m $60,000 In Credit Card Debt, Is This The Best Way To Get Out?

FAQ

What is the average household credit card debt?

What is the average number of credit card held by card holders?

Over 800 million credit cards are currently in circulation in the United States [1] The average American holds 3. 9% of people have credit cards in their wallet (or digital wallet) [2]. Credit cards make up about 31% of all payments made in the United States [3].

What is the average number of credit cards per household?

The question is: How many credit cards should you have? In reality, there’s no right answer to this question. According to an Experian consumer credit review, Americans have an average of 3. 84 credit cards per person. While that may seem like too many for some, others may consider it not enough.

What is the average amount of credit card debt American households have accumulated?

| Debt type | Average balance (2023 ) | Average balance (2024) |

|---|---|---|

| HELOCs | $42,139 | $45,157 |

| Auto loan | $23,792 | $24,297 |

| Credit card debt | $6,501 | $6,730 |

| Student loan debt | $38,787 | $35,208 |