A credit limit is the maximum amount of credit a lender authorizes a borrower to use on a credit card or line of credit. If the borrower goes over the credit limit, they could face fines, fees, or even having their credit cards and lines of credit taken away.

Keep reading to learn how credit limits work, how they are set and what may happen if you exceed your credit cardâs limit.

Capital One offers a wide range of credit cards to consumers, including cards for people with excellent credit as well as those rebuilding their credit. While Capital One doesn’t publicly share the minimum and maximum credit limits for its cards, data points from cardholders over the years give us a good idea of the general credit limit ranges you can expect from different Capital One cards.

This guide will tell you everything you need to know about credit limits, how Capital One decides them, the average credit limits for popular Capital One cards, and how to get the highest credit limit possible with Capital One.

How Capital One Determines Your Credit Limit

When you apply for a Capital One credit card the bank will review your credit report and application information to make a decision. One of the key pieces of any credit card approval is determining what credit limit to give you.

Here are some of the main factors Capital One considers when setting your initial credit limit:

-

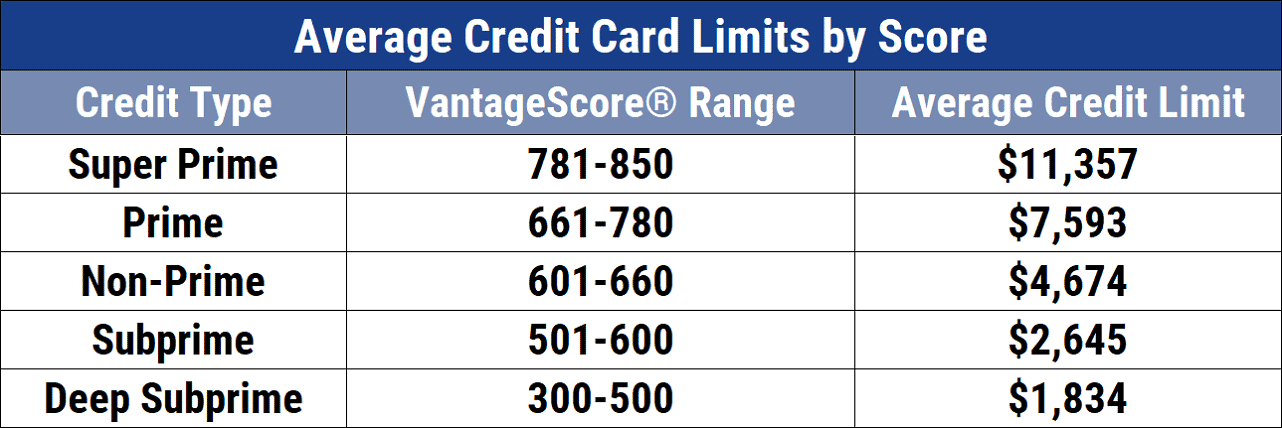

Your credit scores – Applicants with excellent credit scores in the 720 to 850 range will qualify for the highest limits, while poor scores under 620 will get lower limits.

-

Your income – Your reported income level will impact Capital One’s view of your ability to manage credit responsibly. High earners can get higher limits.

-

How much credit you already have: If you have high limits on other credit cards, Capital One may give you a similarly high limit.

-

Your credit history length—People who have had credit for a long time and have a good track record tend to get higher limits than people who are new to credit.

-

Your Capital One relationship – Existing Capital One customers in good standing may get higher limit offers than new customers.

-

The card itself—Premium travel rewards cards usually have higher limits than regular cash back cards

Once you are approved and have been using your card for a few months, Capital One will continue to re-evaluate your credit limit based on your usage and payment patterns. Responsible use could prompt automatic credit limit increases, while riskier behavior may lead to decreases.

Typical Credit Limits for Popular Capital One Cards

Capital One does not publish set credit limit ranges for their cards. However, based on consumer reports over the years, we can generalize the limits cardholders tend to see with different Capital One products:

-

Capital One Platinum Credit Card – This card is aimed at average credit, and limits range from $300 to $1,000 for most cardholders.

-

Capital One QuicksilverOne Cash Rewards Credit Card – Also for average credit, reported limits go from around $500 up to $1,500.

-

Capital One SavorOne Cash Rewards Credit Card – This rewards card for good credit sees limits between $1,000 to $5,000 commonly.

-

Capital One VentureOne Rewards Credit Card – As a step down from Venture, limits run from $1,000 to $10,000 based on creditworthiness.

-

Capital One Venture Rewards Credit Card – For excellent credit, approved limits span from $5,000 up to $20,000 with this premium travel card.

-

Capital One Venture X Rewards Credit Card – As Capital One’s top travel card, credit limits range from $10,000 up to $30,000.

Of course, these are just rough guidelines, not guarantees. The actual limit you receive will depend on Capital One’s review of your individual credit profile. Approved limits can end up lower or higher than the typical ranges.

Tips to Get the Highest Possible Limit with Capital One

While credit limits are ultimately at the bank’s discretion, there are some steps you can take to potentially get a higher limit when applying or asking for an increase:

-

Improve your credit scores – Reach scores of 700+ before applying for the best chance at upper limit tiers.

-

Lower your credit utilization – Keep balances low relative to limits on all cards to maximize your chances.

-

Ask for a review after 6 months – Capital One may approve increases after seeing 6 months of on-time payments.

-

Provide updated income info – An income boost could lead Capital One to increase your limit upon request.

-

Consider a secured card – Secured cards let you provide a refundable deposit for a higher initial limit.

-

Open a Capital One savings account – Having a banking relationship may help strengthen your case for a higher limit.

-

Apply for a premium rewards card – Venture and Venture X come with higher average starting limits than basic cards.

With responsible use and good credit, you may be able to get a credit limit well above the average ranges over time. However, Capital One also reserves the right to lower limits based on changes in their assessment of your creditworthiness or risk profile. Maintaining strong credit is key to keep your limit from going down.

The Highest Possible Capital One Credit Limit Is $30,000+

Based on reports from cardholders with pristine credit histories, Capital One’s highest credit limit currently seems to be around $30,000. Individuals with excellent scores, very high incomes, and established Capital One relationships may see limits reaching this upper ceiling.

The most common reports of Capital One approving $30,000 limits come from their Venture X card, which is their premium travel rewards card aimed at big spenders. However, a small number of consumers with exceptional profiles have reported $30,000+ limits with cards like Venture and Savor as well.

Realistically, limits above $20,000 with Capital One are mainly reserved for exceptionally qualified applicants who tick all the right boxes. Most everyday cardholders see maximum limits in the range of $10,000 to $15,000. But responsible use over many years could potentially get you to Capital One’s highest limits.

The Takeaway – Build Your Credit to Reach the Highest Limits

While the top end of Capital One’s credit limit spectrum reaches into the $30,000 zone, far fewer consumers see those lofty numbers compared to more modest limits. To maximize your chances of being approved for one of Capital One’s highest possible credit limits, the key is building and maintaining exceptional credit.

Focus on keeping your credit utilization low, making payments on time every month, and pursuing the most premium rewards cards that match your spending profile. With careful credit management over time, you can potentially end up among the select approvals who hit Capital One’s credit limit ceiling.

- What is the highest credit limit for capital one?

The highest credit limit Capital One offers on its credit cards seems to be around $30,000 or more in some cases for cardholders with exceptional credit histories. However, most consumers will have credit limits between $1,000 to $15,000 depending on the card and their creditworthiness. Premium travel rewards cards like Venture and Venture X tend to come with higher average limits.

- What factors determine your credit limit with Capital One?

Capital One considers factors like your credit scores, income, existing credit limits, credit history length, banking relationship, and the specific card you apply for when determining your credit limit. Excellent credit and high income increase chances for higher limits.

- What are the typical credit limits for popular Capital One cards?

Some example ranges:

Platinum – $300 to $1,000

QuicksilverOne – $500 to $1,500

SavorOne – $1,000 to $5,000

VentureOne – $1,000 to $10,000

Venture – $5,000 to $20,000

Venture X – $10,000 to $30,000

- How can you get the highest possible credit limit from Capital One?

Tips to maximize your chances include improving credit scores, lowering utilization, asking for a review after 6 months, providing updated income, getting a secured card, opening a savings account, and applying for a premium travel rewards card.

- What’s the highest credit limit Capital One will approve?

Based on limited data points, Capital One’s maximum credit limit seems to be around $30,000+ in exceptional cases. To qualify for the highest limits, you need nearly perfect credit and will likely need to be approved for Venture X or a similar premium card.

Whatâs the difference? Credit limit vs. available credit

While related, credit limits and available credit are not the same thing:

- Credit limit is the most money that a lender will let a borrower borrow.

- Available credit is the amount of credit you still have on your credit card or line of credit that you can use.

Purchases and other transactions, such as cash advances, reduce your available credit. And so will any credit card interest and fees youâre charged. But those things donât change your credit limit.

What happens if you go over your credit limit?

Going over your credit limit may result in declined transactions, fees or higher interest rates. Nevertheless, lenders can only charge over-the-limit fees if you participate in their over-limit coverage program. However, they may approve or decline transactions that exceed your credit limitâregardless of your enrollment status.

So, even if you are not enrolled, an over-the-limit charge may still be approvedâbut the lender cannot impose an over-the-limit fee. If you have opted into an over-the-limit coverage program, lenders can charge one fee per billing cycle and no more than three fees for the same transaction.

Contact your credit card company if youâre unsure of your program enrollment.

Capital One cardholders are never charged over-the-limit fees. View important rates and disclosures. Eligible cardholders may be able to exceed their credit limits, and if your account has access, you can use the Confirm Purchasing Power tool to check whether an over-limit purchase may be approved. You can also disable the ability to spend over your credit limit in your over-limit preferences.

What’s the highest credit limit for Capital One

FAQ

What is the maximum credit limit for Capital One?

Capital One credit card limits are not set at a specific maximum amount for all cards. Instead, they are individualized and can vary depending on the card, your credit history, income, and other financial factors.

Is $20,000 a high credit limit?

Yes, $20,000 is a high credit card limit. A credit card limit of $5,000 or more is usually considered high. To get a limit of $20,000 or more, you will probably need good or excellent credit and a steady income.

How to get $50,000 credit card limit?

To achieve a $50,000 credit card limit, focus on building a strong credit profile, demonstrating responsible credit behavior, and potentially increasing your income.

What credit card has a $100,000 limit?

The credit card that gives you the highest available credit is the Chase Sapphire Preferred® Card because it reportedly offers a maximum credit limit of $100,000. Chase Sapphire Preferred reserves its maximum credit limit for the highest-income individuals with good credit or better, though.