Credit scores are three-digit numbers designed to represent how likely you are to repay a lender on time.

Credit scores are one thing that potential lenders and creditors look at when they decide if they want to give you new credit. Lenders may also use your credit scores to set the interest rates and other terms for any credit they offer.

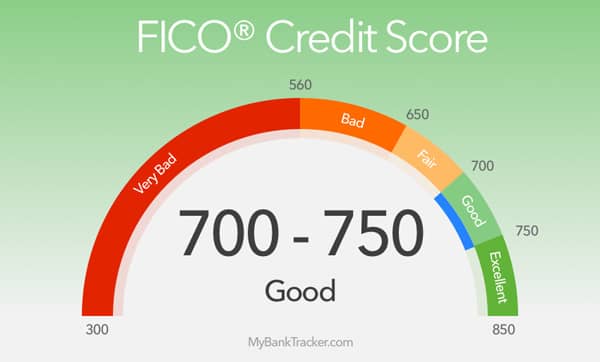

What is the highest credit score vs. a good or fair credit score? Credit scores typically range from 300 to 850. Scores in that range can usually be put into one of five groups: poor, fair, good, very good, and excellent.

If you want to get loans, credit cards, mortgages, or other types of credit, having a high credit score can really help. But what exactly is a top-tier score, and how can you get to that coveted level? In this detailed guide, we’ll talk about what top-tier credit is, what its benefits are, and most importantly, how to get there.

What is Meant by Top Tier Credit Score?

In simple terms, a top tier credit score falls within the highest credit score range. This generally includes scores of 740 and above in most scoring models.

The most widely used credit scoring models are

- FICO Score – Ranges from 300 to 850

- VantageScore – Ranges from 300 to 850

FICO says that credit scores between 740 and 799 are “very good,” and scores between 800 and 850 are “exceptional.” With VantageScore, 740+ is regarded as “prime”.

So in both models, 740 marks the start of top tier territory. However, some lenders set the bar even higher for their top tier – for instance, 760 or 780+. So there’s no definitive cutoff, but aiming for 740+ will put you in the running.

The higher your score, the better your chances of landing the very best rates and terms from lenders. And every extra point counts when you’re applying for major loans.

Why Top Tier Credit Matters

Aiming for top tier credit is about much more than bragging rights There are real, measurable financial advantages to hitting these elevated score levels

Here are some of the key benefits of top tier credit scores:

-

Lower interest rates – The higher your credit score, the lower the interest rate you’ll be offered on credit cards, auto loans, mortgages and other financing. Even a small rate reduction can add up to huge savings over the lifetime of a loan.

-

Larger loan amounts—Lenders are willing to give bigger loans to people with good credit who are less of a risk. This gives you more purchasing power.

-

Better terms – Top tier applicants can qualify for things like shorter loan lengths, lower down payments, smaller deposits, and waived fees. All of this makes borrowing more affordable.

-

Special offers – Credit card companies reserve their most attractive reward programs, introductory APR deals, and statement credits for their prime borrowers.

-

Improved job prospects – Some employers check credit reports as part of background screening. Solid credit can work in your favor.

-

Better chances of getting approved—If your credit score is in the top tier, you have a better chance of getting loans and credit cards. Lenders want to lend to low-risk applicants.

So it’s easy to see why maximizing your credit score is so worthwhile. Those extra points unlock the very best borrowing conditions.

What Impacts Your Credit Tier?

Your credit tier ranking depends on the information contained in your credit reports at the three major bureaus – Equifax, Experian and TransUnion. Here are the main factors that influence your score:

-

Payment history – Whether you pay your bills on time, along with any late payments, collections, defaults, or bankruptcies. This holds the most scoring weight.

-

Credit utilization – The ratio of credit you’re using compared to your limits. Lower is better.

-

Credit history – The length of your credit history and mix of credit types (e.g. credit cards, installment loans, mortgages).

-

New credit – How much new credit activity you have, including new accounts opened and credit inquiries.

-

Credit mix – Whether you have experience managing different types of credit, not just credit cards.

The most important criteria is consistently paying all your bills on time. One late payment can knock many points off your score. You should also aim to keep credit utilization low – under 30% is good, under 10% is better.

How to Reach Top Tier Credit Score Status

If your credit score isn’t quite where you want it yet, with some diligence and smart financial habits, it’s possible to reach that top tier.

Here are some tips for boosting your credit score:

-

Review your credit reports and dispute any errors – mistakes can drag down your score, so get them corrected.

-

Pay all bills on time, every time – set up autopay if needed, and calendar payment due dates.

-

Keep credit card balances low – pay off cards in full each month when possible, or at least the minimum.

-

Limit new credit applications – apply for new credit only when you need it to avoid too many “hard” inquiries.

-

Ask for credit line increases – higher limits help keep utilization low as your balances grow.

-

Become an authorized user – get added to a family member or partner’s old account to build history.

-

Monitor your credit – check your scores regularly so you can address issues quickly.

-

Practice good money management – budget, save, and spend within your means.

The most vital habit is paying all bills on time, but combining multiple responsible credit behaviors can get you over the top tier threshold. Be patient, as it takes time to increase scores substantially. But sticking to positive financial habits will get you there!

Maintaining Excellent Credit Over the Long-Term

Reaching top tier credit score status is an accomplishment to be proud of. But staying there requires ongoing effort and diligence. Here are some tips for maintaining excellent credit year after year:

-

Continue paying all bills on time without fail. Even one 30-day late can drop your scores.

-

Keep credit card balances under 10% of your limit. Don’t let spending creep up over time.

-

Be prudent about applying for new credit. Space out applications by 6 months to a year.

-

Monitor your credit reports and scores. Don’t let inaccurate information go unnoticed.

-

Contact lenders if you anticipate making a late payment. See if they’ll waive fees.

-

Ask for periodic credit line increases to keep pace with spending.

-

Consider setting up automatic payments to avoid ever missing due dates.

-

Create reminders to pay down balances before the next statement cuts to keep utilization low.

-

Avoid closing old credit accounts as the history helps your scores. However, you can stop using them.

-

Be cautious about co-signing loans or lending your credit cards to others. Their behavior could affect your credit.

-

Maintain healthy financial habits like budgeting, saving for emergencies, and contributing to retirement accounts.

Good personal finance habits go hand-in-hand with excellent credit. By continuing to manage credit wisely and monitoring your reports diligently, your top tier score can withstand the test of time.

The Takeaway

A top tier credit score is a score of 740 or higher, which unlocks the very best interest rates and loan terms from lenders. Excellent credit saves you money and provides flexibility in financing everything from cars to homes. Paying bills responsibly, limiting credit applications, keeping card balances low, monitoring your credit, and practicing sound money management are the keys to reaching and staying in top tier territory. With diligence and patience, a high score is an achievable goal that offers lifelong rewards.

What is a good credit score?

There is no “magic number” that will make it certain that you get a loan or that the interest rates and terms are better. However, in many popular scoring models, borrowers need a minimum score of 670 for their credit to be considered “good. ”.

Overall, the higher your credit score is, the more likely you are to appeal to lenders. Higher credit scores indicate that a borrower has demonstrated responsible credit behavior in the past. So, they also often receive more favorable terms and interest rates from lenders.

Credit score ranges—what are they?

Theres more than one credit scoring model available and more than one range of scores. However, most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score People with credit scores in this range are thought to be low-risk borrowers. It might be easier for them to get a loan than for people with lower credit scores.

- These people have a very good credit score (740 to 799), which means they have a history of good credit behavior and may have an easier time getting more credit.

- 670 to 739: Good Credit Score Lenders usually think that people with credit scores of 670 or higher are good borrowers and don’t pose as much of a risk.

- 580 to 669: Fair Credit Score People in this range are often called “subprime” borrowers. Lenders might see them as a bigger risk, and it might be hard for them to get new credit.

- Credit Scores Between 300 and 579: Bad People in this range often have trouble getting new credit. In the event that your credit score is low, you’ll probably need to take steps to raise it before you can get any new credit.

How to RAISE Your Credit Score Quickly (Guaranteed!)

FAQ

What is considered top tier credit score?

FICO ScoreVery poor: 300 to 579. Fair: 580 to 669. Good: 670 to 739. Very good: 740 to 799. Excellent: 800 to 850.

Has anyone got a 900 credit score?

A 900 credit score is typically only possible when auto lenders or credit card issuers use the older industry-specific FICO® Bankcard Score model. Mar 28, 2025.

What is top tier credit?

What are the 5 levels of credit scores?

The five levels of credit scores, based on FICO scores, are: Poor, Fair, Good, Very Good, and Exceptional.