Credit scores operate on a scale of 300 to 850. The better your credit score, the easier (and cheaper) it is to borrow money. While a bad credit score can hamper your borrowing efforts, having no credit can shut you out entirely.

Some of the most important money choices you’ll ever make, like buying a house or car, depend on your credit score. Even an apartment rental application can hinge on your credit score. Yet a TransUnion survey found that 45 million American consumers are considered credit underserved or unserved.

Heres everything you need to know about credit invisibility, who it affects, and how to become credit visible.

Having a credit score is an important part of financial life in America. Your credit score can impact your ability to get approved for loans, credit cards, mortgages, rental applications, utilities, and even jobs or insurance rates So what percentage of Americans don’t have a credit score? Let’s take a look at the data.

How Credit Scores Work

First, it’s helpful to understand what exactly a credit score is. Your credit score is a number ranging from 300-850 that is calculated based on information in your credit report This includes factors like

- Payment history – Do you pay your bills on time?

- Credit utilization – How much of your available credit are you using?

- Length of credit history – How long have you had credit accounts?

- Credit mix – Do you have different types of credit like credit cards, loans, etc?

- New credit applications – How many new accounts have you opened recently?

Banks, lenders, and credit card companies use your credit score to evaluate how risky it is to lend money to you. The higher your score, the lower the risk.

Even though a lot of companies make credit scores, FICO scores and VantageScores are two of the most common ones.

Americans With No Credit Score

So what percentage of Americans have no credit score at all?

According to data from the FDIC National Survey of Unbanked and Underbanked Households in 2023, approximately 15.7% of U.S. households had no mainstream credit. This means around 15.7% of Americans likely have no credit score from the major credit bureaus.

Additional data from TransUnion found that in 2024, around 12.1% of Americans had credit scores in the poor range (300-579). Many lenders consider consumers with scores in this range to be “unscoreable”.

So combining those two statistics, we can estimate that around 27.8% of Americans have no credit score or a score too low to be usable.

Almost 30% is a significant portion of the population without an established credit history and score.

Breakdown by Demographics

Not having a credit score doesn’t affect everyone the same way. Here is a breakdown by age, income level, and race:

-

Age: Younger adults are more likely to have no credit score. 33% of Americans ages 18-25 have no score, compared to only 11% of those over age 65. Building credit takes time.

-

Income: Lower income households are nearly 3 times as likely to lack a credit score. 31% of households earning under $15k annually have no score versus just 11% of those over $75k.

-

Race: It’s more likely for black and Hispanic Americans to not have credit. It is estimated that about 30% of Black households and 27% of Hispanic households do not have a credit score.

-

Unbanked status: 78% of Americans without a bank account (unbanked) also have no credit score. Having a banking relationship can help build credit.

So younger, lower-income, Black and Hispanic, and unbanked Americans are most likely to be credit invisible and not have a usable credit score from the major credit bureaus.

Why No Credit Score Matters

Not having a credit score can make aspects of financial life much more difficult. Without an established score, it’s nearly impossible to get approved for mainstream loans or credit cards at affordable rates.

Specifically, lack of a credit score can lead to issues like:

- Higher interest rates or denials for loans/credit cards

- Inability to finance larger purchases like a house or car

- Potential extra fees for utilities and cell phone plans

- Difficulty finding an apartment if landlords require credit checks

- Higher insurance rates if companies can’t evaluate credit risk

Those without credit scores often have to depend on alternative financial services like payday loans or secured credit cards that come with high fees and interest rates.

So while not having a credit score doesn’t completely prevent you from getting credit, it certainly makes it much harder and more expensive.

Building Credit From No Score

The good news is there are ways to start building credit even if you’re starting from scratch with no score:

-

Get a secured credit card. These cards require a deposit that you can get back, and they are easier to get approved for. Use it responsibly.

-

Become an authorized user on someone else’s credit card – Their history will start to apply to you.

-

Take out a credit-builder loan – Small loans where the payments are reported.

-

Use payroll deduction services like Rent Reporters that report rent payments to credit bureaus.

-

Open a checking/savings account – Having a banking relationship can help.

Building credit takes consistency and patience over time. Checking your credit reports frequently and tracking your progress is key. Within 6 months or so of responsible credit usage, you can get your first official scores.

The Bottom Line

About 27.8% of Americans have either no credit score or a score too low to qualify for most credit products. This percentage is much higher among younger, lower-income, and minority populations. Having no established credit history can make financial milestones like getting approved for credit cards, loans, and mortgages much more difficult. But the good news is with diligence, it is possible to build credit from scratch by using secured cards, credit builder loans, authorized user status, and other tools. Monitoring your credit reports and scores from the major bureaus provides visibility into your progress.

Steps to overcome credit invisibility

To get credit, one must already have a credit history, but to gain that credit history, one must already have credit. To break this catch-22 and become credit-visible, you need to find a way to get your foot in the door.

Who does credit invisibility affect?

According to research conducted by consulting firm Oliver Wyman, 19% of Americans are credit invisible. A disproportionate number of credit-invisible consumers are Black or Hispanic; theyre 1.8 times more likely to not have a credit score. Oliver Wymans research shows that 26% of Hispanic consumers and 28% of Black consumers are credit invisible or unscorable, compared to 16% of White and Asian consumers.

While people who are credit invisible have no credit information, people with unscorable credit have some credit history but not enough to assign that information a credit score.

Even Black and Hispanic consumers with credit scores are still 1. 9 times more likely to have a subprime credit score. Compared to 2020% of white consumers and 2011% of Asian consumers, %2040% of Black consumers and %2029% of Hispanic consumers have subprime credit.

Credit invisibility is also prevalent among immigrants as they generally arrive in the U. S. with an empty credit file, regardless of their credit status in their country of origin. Younger consumers also face similar issues, turning 18 without a credit profile. According to a FICO survey, 29% of Gen Z consumers dont have a credit score or dont know if they have one.

Additionally, while credit score calculations arent necessarily tied to your income, the two are correlated. Oliver Wyman found that 30% of consumers in low-income neighborhoods are credit invisible, and 16% of them are unscorable. In comparison, 4% of consumers in high-income neighborhoods are credit invisible, and 5% of those consumers are unscorable.

Elena Botella, who wrote “Delinquent: Inside America’s Debt Machine,” says that credit invisibility can also happen to older people whose credit file has been damaged because they haven’t used credit in a long time. Additionally, some simply have no interest in obtaining debt of any kind. As a result, they remain unseen in the eyes of the credit bureaus.

How to RAISE Your Credit Score Quickly (Guaranteed!)

FAQ

How many Americans have no credit score?

What happened? It’s a problem that’s more common than you might think: At least 26 million Americans don’t have credit scores. Mar 20, 2025.

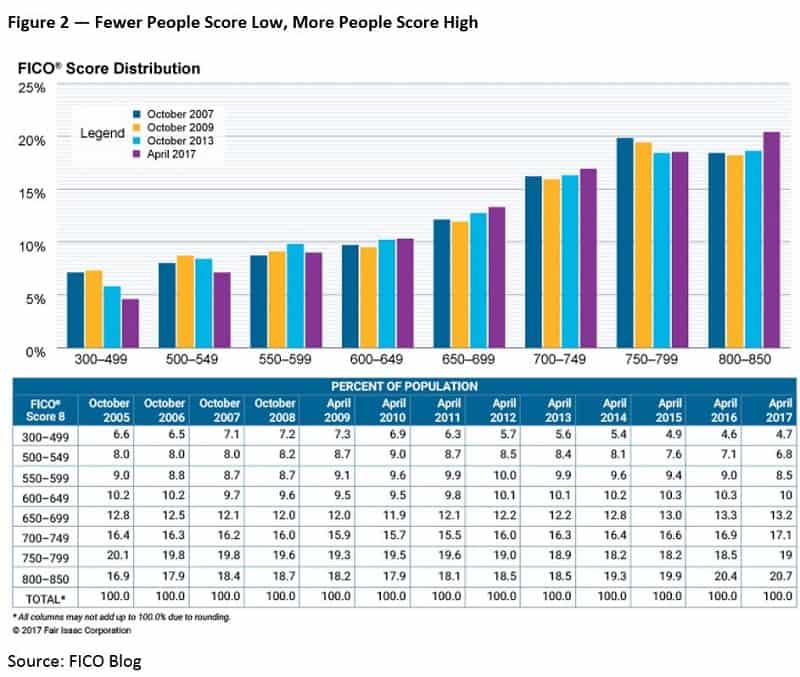

How many Americans have an 800 credit score?

According to The Motley Fool, about 22.4 percent of Americans have a FICO credit score of 800 or higher, which is considered “exceptional.”

How many Americans have a 700 credit score?

| FICO® Score Range | Percent Within Range |

|---|---|

| 650-699 | 11% |

| 700-749 | 16% |

| 750-799 | 24% |

| 800-850 | 24% |

How many people in the US are credit invisible?

Approximately 11 percent of Americans are deemed credit invisible, making it difficult to get access to affordable credit and to build wealth.