Using no more than 30% of your credit limits is a guideline — and using less is better for your score.

The products shown on this page are mostly or entirely from our advertising partners. They pay us when you click on one of their links and then do something on our site. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

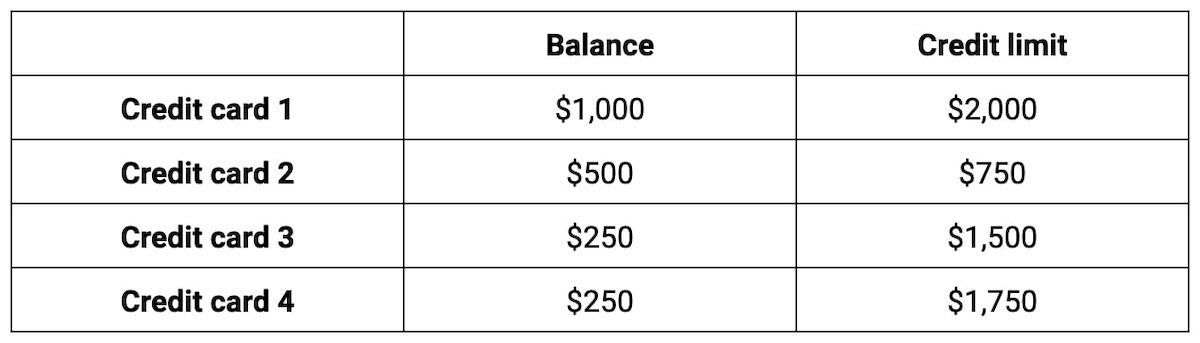

Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain a good or excellent credit score.

If you want to improve your credit score, you should pay attention to how much credit you use. The 30% rule is a good starting point, but remember that using even less is better for your score.

Keeping up with what percentage of your credit limits youre using is easier than you may think. You can set up alerts with your credit card issuers to track your balances. Or sign up for a free credit score that displays utilization rates.

Hey there friend! If you’re wonderin’ what percentage should you keep your credit card balance at, I gotcha covered. Straight up the golden rule in the credit world is to keep your balance under 30% of your total credit limit. Got a card with a $1,000 limit? Don’t let that balance creep past $300. But wait—there’s more to it than just a number. Stick with me, and I’ll break down why this matters, how it messes with your credit score, and some real-deal tips to keep your finances lookin’ sharp.

Why 30%? The Magic Number for Your Credit Score

Because of this, why is everyone so excited about 30%? It’s not just something that was pulled out of thin air. It’s linked to something called your credit utilization ratio, which is just a fancy word for how much of your available credit you’re using. Credit bureaus see that you might be in over your head if you’re close to or at the limit on your cards. Keep it below 70%, and you’ll show that you can handle credit like a pro.

Here’s the kicker this ratio makes up a big chunk of your credit score We’re talkin’ about 30% of your FICO score and around 20% of your VantageScore That’s huge! Mess this up, and your score takes a nosedive. Keep it low, and you’re golden. I’ve seen folks stressin’ hard over a dropped score just ‘cause they didn’t know this little trick. Don’t let that be you.

- Under 30% = Good vibes: You’re in the safe zone, likely keepin’ your score nice and high.

- Over 30% = Trouble brewin’: Starts to hurt your score, makin’ lenders think you’re risky.

- Way over, like 80-90% = Yikes: Major damage. Looks like you’re drownin’ in debt, even if ya ain’t.

How Does This Credit Utilization Thing Work?

Let’s keep it real simple. Your credit utilization ratio is just your balance divided by your credit limit turned into a percentage. Say you got two cards—one with a $2,000 limit and a $400 balance, another with a $1000 limit and a $200 balance. Total balance is $600, total limit is $3,000. That’s 600 divided by 3,000, which is 20%. Boom, you’re under 30%, and that’s a win.

But here’s where it gets sneaky. This ain’t just about one card—it’s all your cards together. And sometimes, it’s even per card in some scoring models. Plus, if you got a high balance reported to the bureaus right before you pay it off, it can still ding ya. Timin’ matters, fam.

When I got my first credit card, I thought, “Hey, I’ll just use it for everything and pay it off later!” That was a big mistake. My balance went up to about 80% of the limit, and my score dropped faster than a hot potato. Learned my lesson quick after that one, ha!.

What Happens If Ya Go Over 30%?

Alright, let’s say you slip up and your balance hits 40% or more. It ain’t the end of the world, but it’s gonna sting a bit. Here’s what’s up:

- Score takes a hit: Like I said, utilization is a big deal for your credit score. Go over 30%, and you might see a drop of a few points—or more if you’re way over.

- Lenders get nervous: High balances make it look like you’re relyin’ too much on credit. Banks might think twice about givin’ ya a loan or another card.

- Interest piles up: If you’re carryin’ a balance month to month, them interest charges ain’t playin’. It gets pricey, fast.

Good news though? This kinda damage don’t last forever. Your credit score can go back up as soon as the payment is made and reported to the credit bureaus. It happened to me too. I had a bad month and my balance went up, but I paid it off quickly and my score went back up right away.

Is 0% the Goal? Not Quite, Fam

Now, you might be thinkin’, “Alright, I’ll just keep my balance at 0%. Problem solved!” Not so fast. Here’s a weird lil’ twist—havin’ a 0% utilization can actually be less ideal than a tiny bit of usage. Crazy, right? Word on the street is that usin’ just 1% of your limit might look better to scoring models. It shows you’re usin’ credit responsibly without overdoin’ it.

What’s that about? Credit scores tell lenders if you’ll be able to pay back your loans. You can’t show that you’re good at managing your credit if you don’t use your cards. A tiny balance, paid on time, proves you got this. Don’t worry about a small balance; just keep it from getting too high.

How to Keep Your Balance in Check Like a Boss

Alright, now that we know the target—under 30%, maybe even closer to 1%—how do ya actually do it? I’ve got some tricks up my sleeve that’ve helped me keep my credit game strong. Try these out:

- Pay early, pay often: Don’t wait for the due date. If you use your card, toss some cash at it mid-month to keep that balance low. I do this all the time—makes me feel in control.

- Set up alerts, yo: Most card companies let ya set alerts for when your balance hits a certain amount. Set it at, say, 25% of your limit, so you know when to chill on spendin’.

- Use multiple cards smartly: If you got more than one card, spread out your purchases so no single card gets too high. Just watch the total utilization across all of ‘em.

- Ask for a higher limit: If your balance keeps creepin’ up, call your card company and ask for a bigger limit. Bigger limit means lower percentage, even if your balance stays the same. Worked for me once!

- Budget like ya mean it: Track what you’re spendin’. If you know you only got $200 to spend on a $1,000 limit card, stick to it. Old-school, but it works.

I ain’t gonna lie, it takes a lil’ discipline. There was a time I overspent on some dumb stuff—thinkin’ I’d “figure it out later”—and had to scramble to pay it down. Lesson learned: keep an eye on it from the jump.

A Quick Look at Utilization Ranges and Score Impact

Wanna see how different percentages might mess with your score? Check this lil’ table I whipped up. It’s a rough guide, but it gives ya the gist of things.

| Utilization Range | Impact on Credit Score | What It Means for Ya |

|---|---|---|

| 0-1% | Best possible | Shows responsible use, max score potential. |

| 1-10% | Excellent | Still awesome, minimal risk to score. |

| 10-30% | Good | Safe zone, minor impact if any. |

| 30-50% | Fair | Noticeable drop, lenders might worry. |

| 50-70% | Poor | Big hit to score, looks risky. |

| 70%+ | Very Poor | Major damage, red flags everywhere. |

Seein’ this laid out helped me wrap my head around why keepin’ it low is such a big deal. Aim for that sweet spot under 30%, and you’re settin’ yourself up for success.

How Do Ya Even Track This Percentage?

Wonderin’ how to keep tabs on your utilization? It ain’t as hard as it sounds. Most credit card apps or websites show your current balance and limit right there on the dashboard. Do the quick math—balance divided by limit, times 100—and ya got your percentage.

Another dope trick is signin’ up for a free credit score service. Some of ‘em break down your utilization rate for ya, so you don’t gotta calculate nothin’. I started doin’ this a while back, and it’s like havin’ a lil’ financial buddy nudgin’ me to stay on track. Plus, you can see how your score changes week to week based on your balances.

If you’re old-school, just jot down your limits and check your statements. Whatever works, just make sure you’re peekin’ at it regular-like. Ain’t no point in guessin’ when the info’s right there.

What If You’re Already Over 30%? Don’t Panic!

Hey, if you’re readin’ this and your balance is sittin’ way over 30%, don’t sweat it too hard. We’ve all been there—life happens, bills stack up. Here’s how to get back on track:

- Pay down the highest balance first: Focus on the card that’s got the biggest percentage used. Knock that down under 30% ASAP.

- Stop usin’ the card for a bit: Put a pause on new purchases till ya get that balance in check. Use cash or debit instead.

- Make extra payments: If ya can, throw extra money at it before the statement closes. Lower balance reported means less damage.

- Talk to your card folks: If you’re strugglin’, sometimes they can work with ya on a payment plan or lower interest for a bit.

I had a buddy who got stuck with a balance at like 60% after a big emergency expense. He freaked out, but paid it down over a couple months by cuttin’ back on extras and makin’ double payments. His score popped right back up. It’s fixable, trust me.

Busting Some Credit Card Balance Myths

There’s a lotta nonsense floatin’ around about credit card balances, and I wanna clear the air. Here’s a few myths I’ve heard, and the real deal:

- Myth: Carryin’ a balance builds credit better. Nah, fam. You don’t gotta carry a balance to build credit. Payin’ on time is what matters, not keepin’ debt.

- Myth: Utilization don’t matter if ya pay on time. Wrong again. Even if ya pay every bill on the dot, a high balance can hurt your score till it’s reported lower.

- Myth: Only one card’s balance counts. Nope, it’s all your cards together. One maxed-out card can drag down the whole picture.

I used to think carryin’ a small balance was “good” for my credit. Turns out, I was just payin’ interest for no reason. Don’t fall for that trap!

Why Keepin’ Your Balance Low Ain’t Just About Scores

Sure, we’ve talked a ton about credit scores, but there’s more to keepin’ your balance low than just a number. It’s about peace of mind, too. High balances mean high interest if ya don’t pay it off each month. That’s money down the drain that coulda been spent on somethin’ fun—or saved for a rainy day.

Plus, keepin’ it low means you’ve got room to breathe if an emergency hits. If your card’s already near the limit, what ya gonna do when the car breaks down or ya need a quick flight? I’ve made it a habit to keep my balances way under just for that reason—life’s unpredictable, ya know?

It also looks good when ya apply for stuff. Wanna rent an apartment, buy a car, or get a mortgage? Them folks check your credit, and a low utilization shows you’re not stretched thin. I felt real proud applyin’ for a loan once with a solid score, all ‘cause I kept my cards in check.

Final Thoughts on Your Credit Card Balance Game

So, to wrap this up, when it comes to what percentage should you keep your credit card balance, aim for under 30% of your limit. Better yet, get it as low as ya can—closer to 1% if possible. It’s all about that credit utilization ratio, which plays a massive role in your credit score. Go over, and ya risk a drop; stay under, and you’re buildin’ a strong financial rep.

Use tricks like payin’ early, settin’ alerts, and trackin’ your percentage to stay on top. If you’re over the limit now, no biggie—just focus on payin’ it down quick. And remember, it ain’t just about the score—it’s about keepin’ stress low and havin’ options when ya need ‘em.

I’ve had my ups and downs with credit cards, but learnin’ this 30% rule changed the game for me. Stick with it, and I bet you’ll see your financial life get a whole lot smoother. Got questions or wanna share your own tips? Drop ‘em below—I’m all ears! Let’s keep this money convo goin’.

Is 0% credit utilization bad?

In general, using as little of your credit card limits as possible is better for your scores. So logic would suggest that paying off your credit cards early so that a zero balance is reported to the credit bureaus would produce the highest scores. But using 1% of your credit limits may help your credit scores even more than 0% usage.

Credit scoring systems are designed to predict how likely you are to repay borrowed money. The two biggest credit factors — accounting for about two-thirds of your scores — are paying on time and the amount you owe.

If you want to get as many points as possible from credit utilization, you should aim low, just above zero. A credit expert named John Ulzheimer says that data has shown that 1% credit utilization predicts slightly less risk than 20%, and scoring models reflect this.

Tommy Lee, a senior director at FICO, one of the two most popular credit scores, says this about it: “Low utilization means you are using credit responsibly.” ”.

How much of my credit card should I use?

Keeping your credit utilization at no more than 30% can help protect your credit. If your credit card has a $1,000 limit, that means you’ll want to have a maximum balance of $300.

Why the 30% rule? It’s likely because the recommendation to keep your credit utilization low invariably prompts the question, “How low?” Having a number gives you an upper limit when thinking about how much to spend on your credit cards.

The 30% answer finds backing from the credit bureau Experian: “The 30% level is not a target, but rather is a maximum limit. Exceeding that level will have significantly negative impact on credit scores,” says Rod Griffin, Experian’s senior director of public education and advocacy. “The lower a person’s utilization rate, the better from a scoring standpoint.”

What Percentage Should You Keep Your Credit Card Balance? – CreditGuide360.com

FAQ

How much of a balance should I keep on my credit card?

A general rule of thumb is to keep your credit utilization ratio below 30%. And if you really want to be an overachiever, aim for 10%. According to Experian, people who keep their credit utilization under 10% for each of their cards also tend to have exceptional credit scores (a FICO® Score☉ of 800 or higher).

What is the 30% rule for credit cards?

The 30% rule for credit cards says that to improve your credit score, you should keep your credit utilization ratio (the amount you owe divided by your total credit limit) at 30% or less.

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule is a credit card application restriction specifically used by Bank of America. It limits the number of new credit cards you can be approved for within certain timeframes.

What is the 15 3 rule on credit cards?

When it comes to managing your credit cards, the “15/3 rule” means making two payments during a billing cycle. This could help your credit score. At least half of the balance is paid off in the first payment, which is made 15 days before the due date. The rest of the balance, plus any new charges, is paid 3 days before the due date.