Saving for retirement is often overwhelming, especially when you need to prepare for potentially high costs of living in your later years. Reasonable financial goals might feel out of reach, and itâs difficult to know where to start or how much to save. Luckily, understanding what you can expect and knowing how to proactively optimize your retirement finances go a long way.

Learn what the average retirement income is in the U.S. and how to plan for the most successful financial future.

Thinking about retirement can be kinda scary, right? I’ve been researching this topic for weeks and the big question on everyone’s mind seems to be “How much monthly income will I actually need when I stop working?” It’s not exactly a one-size-fits-all answer, which makes planning even trickier.

According to financial experts, a good retirement income is generally about 75% to 85% of your pre-tax income from your last working year. But what does that actually mean in real dollars? Let’s break it down in simple terms so you can figure out if your retirement savings are on track.

The Reality of Retirement Income in America

Before we dive into the numbers, let’s look at what retirement income looks like for average Americans today:

- The median income for individuals aged 65 and older was $29,740 (as of 2022)

- Households led by someone 65+ had a median income of $73,100

- Men aged 65+ had a median income of $37,430

- Women aged 65+ had a median income of $24,630

These numbers show a pretty big gender gap, with women typically having about $12,800 less in annual retirement income than men. This highlights why planning is super important, especially for women who may need their savings to stretch further.

How Much Monthly Income Do Retirees Actually Need?

Most financial planners use the 75-85% rule mentioned above. Let’s see what this looks like in practice:

| Pre-Retirement Annual Income | Monthly Retirement Need (75-85%) |

|---|---|

| $60,000 | $3,750 – $4,250 |

| $80,000 | $5,000 – $5,667 |

| $100,000 | $6,250 – $7,083 |

| $120,000 | $7,500 – $8,500 |

In real-world terms the average retiree in America spends around $5000 per month on living expenses, healthcare, and some leisure activities. But obviously, your personal situation might look different depending on

- Where you live (huge factor!)

- Your health status

- Your desired lifestyle

- Whether your mortgage is paid off

- If you’re supporting family members

The Average Monthly Retirement Income vs. Reality

Let’s get real about what most Americans are actually working with:

- Average retirement income in 2025: approximately $60,000 per year ($5,000 monthly)

- Median retirement income: closer to $47,000 annually ($3,900 monthly)

- Married couples: average around $100,000 annually ($8,300 monthly)

BUT… here’s where things get interesting. According to a 2022 survey, most retirees between ages 62 and 75 spend less than $4,000 a month:

- 15% of retirees spend less than $1,000 monthly

- 33% spend between $1,000-$1,999

- 20% spend between $2,000-$2,999

- 13% spend between $3,000-$3,999

- Only 18% spend more than $4,000 monthly

So about 68% of retirees are spending less than $3,000 per month. That’s quite different from the “ideal” numbers we calculated earlier!

Where Retirement Income Actually Comes From

When I talk to my recently-retired neighbors, most of them have multiple income sources. Here’s how typical retirement income breaks down for Americans aged 65+:

- Social Security: 83% of retirees receive this (average payment in 2025: $1,976 monthly)

- Assets (stocks, bonds, real estate): 69%

- Pension and retirement accounts: 30%

- Earnings from work: 23%

- Veterans benefits: 4%

- Public assistance: 2.5%

Social Security is clearly the backbone of retirement for most Americans, but it’s usually not enough on its own. The average Social Security check covers less than half of what most retirees need.

Location Matters More Than You Think!

One thing that’s blown my mind while researching this topic is how much location impacts retirement income needs. Check out these differences in average annual retirement incomes by state:

- District of Columbia: $43,080 (highest)

- Alaska: $36,023

- Maryland: $35,732

- Virginia: $35,306

- California: $34,737

Compared to the lowest state, Indiana, at just $20,542 annually! That’s a difference of over $22,000 per year just based on where you live. So a “good” retirement income in Mississippi might be totally inadequate in Massachusetts.

5 Ways to Boost Your Retirement Income

If you’re worried your retirement savings won’t provide enough monthly income, here are some strategies I’ve found that can help:

1. Maximize Social Security Benefits

Waiting until age 70 to claim Social Security can increase your benefit by about 8% per year beyond your full retirement age. This could mean hundreds of dollars more each month for the rest of your life.

2. Consider Annuities

Annuities are insurance products that can provide guaranteed income streams. They’re kinda like creating your own pension! Different types include:

- Fixed annuities (stable, predictable payments)

- Variable annuities (payments tied to market performance)

- Indexed annuities (combination of safety and growth potential)

3. Maximize Retirement Account Contributions

For 2025, contribution limits are:

- 401(k): $23,500 ($31,000 if you’re 50+)

- Extra catch-up for ages 60-63: additional $11,250

- IRA: $7,000 ($8,000 if you’re 50+)

4. Explore Housing Options

A paid-off home reduces monthly expenses, but some retirees might benefit from:

- Downsizing to reduce property taxes and maintenance

- Relocating to a lower-cost area

- Considering a reverse mortgage (if you’re 62+) to convert home equity into income

5. Part-Time Work

Even a small amount of income from part-time work can significantly reduce how much you need to withdraw from retirement accounts. Plus, it keeps you active and engaged!

The 4% Rule and Monthly Income

You’ve probably heard of the 4% rule – the idea that you can withdraw 4% of your retirement savings annually with minimal risk of running out of money. Let’s see what this translates to in monthly income:

| Retirement Savings | Annual Income (4% Rule) | Monthly Income |

|---|---|---|

| $500,000 | $20,000 | $1,667 |

| $750,000 | $30,000 | $2,500 |

| $1,000,000 | $40,000 | $3,333 |

| $1,500,000 | $60,000 | $5,000 |

| $2,000,000 | $80,000 | $6,667 |

As you can see, even with $1 million saved (which is more than most Americans have), the monthly income is around $3,333 – probably not enough for many retirees without Social Security or other income sources.

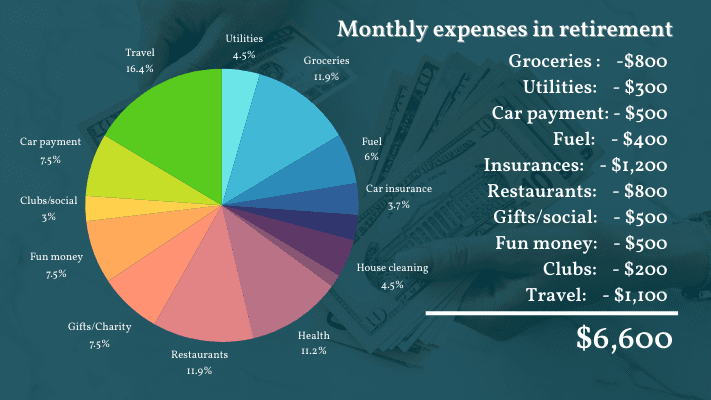

Sample Monthly Retirement Budget

To help you visualize what retirement expenses might look like, here’s a sample monthly budget for a retired couple:

- Housing (mortgage/rent, property taxes, insurance): $1,500

- Utilities (electric, water, gas, internet, phone): $500

- Healthcare (Medicare premiums, supplemental insurance, out-of-pocket): $800

- Food (groceries and dining out): $700

- Transportation (car payment, gas, maintenance, insurance): $400

- Travel/Entertainment: $500

- Miscellaneous (clothing, gifts, etc.): $300

- Emergency fund contributions: $300

- Total: $5,000

This budget doesn’t include income taxes, which will vary depending on your income sources and location.

Don’t Forget About Inflation!

One thing many retirement calculators ignore is the impact of inflation. Even with moderate 3% annual inflation, the purchasing power of your money will be cut in half in about 24 years. This means what seems like a comfortable income today might not be enough in your later retirement years.

This is why I always recommend building in some cushion to your retirement income plans. It’s better to have a little extra than not enough!

Final Thoughts: What’s REALLY a “Good” Monthly Retirement Income?

After diving deep into this research, I’ve come to realize there’s no magic number that defines a “good” monthly retirement income. It truly depends on your unique situation, goals, and lifestyle.

However, based on the data, here’s my take:

- Minimum comfortable retirement income: $3,000-$4,000 monthly for individuals ($36,000-$48,000 annually)

- Moderate comfortable retirement income: $5,000-$7,000 monthly for couples ($60,000-$84,000 annually)

- Very comfortable retirement income: $8,000+ monthly ($96,000+ annually)

Remember, these are just guidelines. The most important thing is understanding YOUR specific needs and developing a plan to meet them.

What monthly income are you aiming for in retirement? Do you feel like you’re on track? I’d love to hear your thoughts and experiences in the comments below!

Resources to Help You Plan

If you’re still figuring out your retirement income needs, check out these helpful tools:

- Social Security calculator on SSA.gov

- Retirement calculators from major financial institutions

- Meeting with a certified financial planner who specializes in retirement

The sooner you start planning, the more options you’ll have to create the retirement lifestyle you want. Good luck!

Diversify your income sources

Combining earnings from Social Security, pensions, savings, and annuities creates a more stable income stream that weathers economic conditions well. You can also supplement your retirement income by exploring part-time work or freelance opportunities that match your interests and skills. Another option is investing in real estate or rental properties to provide a steady income stream.

Review your retirement plan

Establish a practice of reviewing your retirement strategy at least once a year. Make sure youâre taking full advantage of any employer retirement matches, tax-advantaged accounts like 401(k)s, and catch-up contributions if youâre over 50.

What is a Good Monthly Income in Retirement?

FAQ

What is a good monthly retirement income for a couple?

My analysis of household averages estimates that a good monthly retirement income for a couple is $6,318.25. Social Security covers about $3,571.88 per month, on average, requiring couples to generate an additional $2,746.37 of retirement income per month or about $33,000 per year.

What is a good monthly retirement income?

Previously, she was a financial analyst and director of finance at public and private companies. Tina’s work has appeared in a variety of local and national media outlets. A good monthly retirement income is typically 80% of pre-retirement income; advisors often suggest a range between 70% and a more conservative 90%.

How much does a retiree make a year?

Retirement income varies considerably based on region. In some states, you might receive generous retirement incomes, while in others, you can expect payments below the annual national average of $27,617. For instance, the District of Columbia has the highest average retirement income at $43,080 per year.

How much money can you retire on a month?

Financial experts are quick to point out that there are no hard and fast rules when it comes to retirement. “You can have a great retirement on $5,000 a month, and you can have a great retirement on $50,000 a month,” says Joe Conroy, financial advisor and owner of Harford Retirement Planners in Bel Air, Maryland.

How much money should I have in my retirement account?

It’s a good idea to have two years’ worth of income on hand in an account that is liquid and accessible, where the funds can be withdrawn without penalty or significant taxes should you need them. One more consideration as you think about your retirement income is to plan for the legacy you want to leave.

What is the average retirement income?

What’s the average retirement income? According to the Administration for Community Living’s 2023 Profile of Older Americans, the median income for individuals aged 65 and older in 2022 was $29,740. Households led by individuals in this age group had a median income of $73,100.

Is $10,000 a month a good retirement income?

Yes, $10000 a month is a very comfortable retirement income for most people. It totals $120000 a year, which can cover living expenses, healthcare, travel, and hobbies, depending on your location and lifestyle. Managing it well with budgeting and investments can help it last throughout retirement.

Is $3,000 a month a good retirement income?

You can retire comfortably on $3,000 a month in retirement income by choosing to retire in a place with a cost of living that matches your financial resources. Housing cost is the key factor. It’s both the largest component of a retiree’s budget and it’s the household cost that varies the most according to geography.

How much do most retirees live on a month?

Key Takeaways. The average retired household spends around $5,000 per month, with housing, healthcare, and food being the largest expense categories. With a median 401(k) balance of $210,724, retirees relying on the 4% withdrawal rule and Social Security benefits often face a shortfall in covering monthly costs.

Can you live on $4 000 a month in retirement?

In summary, $4000 a month can be a reasonable amount for retirement for some individuals, particularly in lower-cost areas or with additional income sources. However, it’s essential to assess your specific financial situation and future needs to determine if it’s sufficient for you.