When many would-be homeowners imagine what being a homeowner is like, they imagine closing on their loan and making monthly mortgage payments that never change. Everything just settles into a pleasant and predictable pattern.

Many homeowners assume, at least in the short term, that their housing costs will remain fairly steady. But if a homeowner’s monthly mortgage payments go up without warning, they may feel caught off guard and have to rush to change their budgets.

If you’re a homeowner with a mortgage, you may have noticed your mortgage balance going up unexpectedly at times. An increase in your mortgage balance can be confusing and concerning. This comprehensive guide will explain the most common reasons why your mortgage balance may rise, and provide tips on how to avoid or minimize balance increases.

What is Mortgage Balance?

Your mortgage balance refers to the amount left that you still owe on your home loan. It’s the remaining principal that you need to pay back to your lender, plus any interest that accumulates Your monthly mortgage payments go towards reducing your balance over the life of the loan until it’s fully paid off.

Common Reasons for Mortgage Balance Increases

There are several scenarios that can lead to your mortgage balance going up instead of down:

1. You have an adjustable rate mortgage

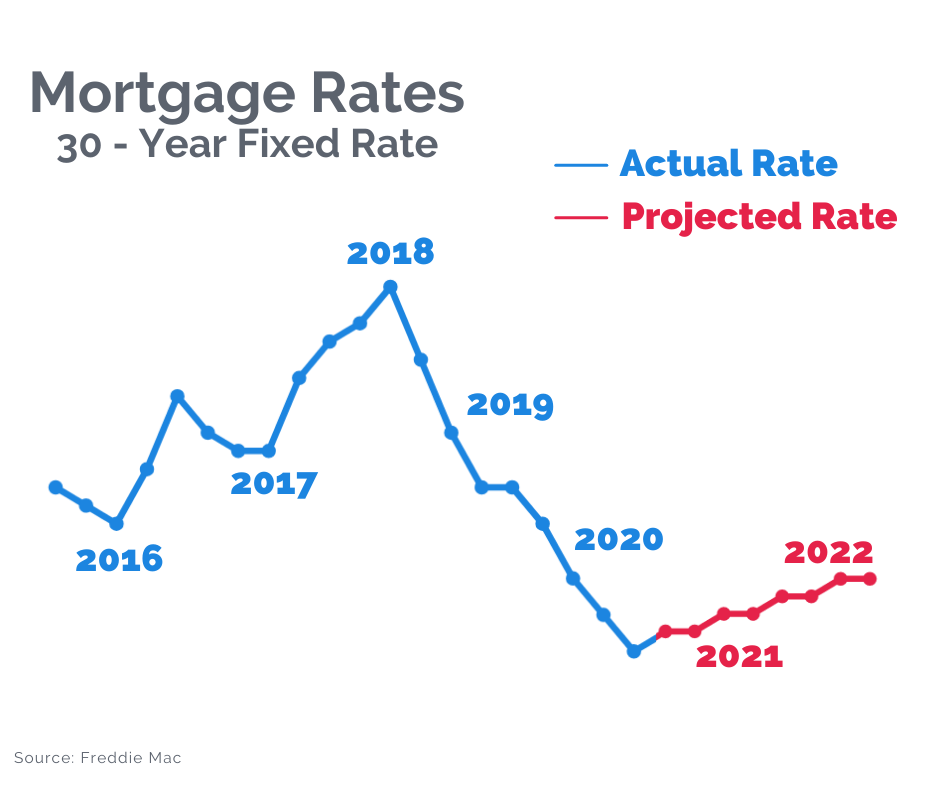

Interest rates on adjustable rate mortgages (ARMs) change over time. After an initial period of a fixed rate, the interest rate changes on a regular basis based on market indexes. If you’re not paying enough to cover the higher interest costs, rate hikes will make your loan balance go up. This is very likely to happen if you have an ARM with capped payment increases.

2. You paid extra towards principal previously

When you make additional principal payments, you reduce your loan balance faster and pay off your mortgage early. However, if you later stop making those extra payments, more of your monthly payment will go towards interest costs instead of principal. This causes your balance to increase again.

3. You incurred late fees

If you’re late on your mortgage payments, late fees will be added to your balance. If you are late on too many payments, the fees that add up can really hurt your finances over time.

4. Your escrow account was short

If your property taxes or homeowners insurance increased, it can cause a shortage in your escrow account. The shortage gets added to your balance so your servicer can pay those bills until the escrow catches up.

5. You used a forbearance or modification

Forbearance temporarily reduces or suspends your mortgage payments, while modifications permanently change the terms to make it more affordable. Both can increase your balance either during the process or when resuming normal payments afterwards.

6. Your mortgage servicer made a mistake

Sometimes servicers make errors calculating payments or crediting accounts, leading to inappropriate balance increases. This is rare but can occur.

How to Minimize Mortgage Balance Increases

While some balance fluctuations are inevitable, you can take steps to avoid unnecessary increases:

-

Opt for fixed-rate mortgages when possible to prevent rate-related jumps.

-

Make consistent extra principal payments if you want to pay off your mortgage faster.

-

Watch for escrow notices indicating shortages and consider paying those upfront.

-

Be prudent when using forbearances or modifications and understand how they impact your balance.

-

Review statements frequently and contact your servicer if you see suspicious changes.

-

Consider automatically drafting extra payments each month to pay ahead.

-

Refinance if interest rate drops provide enough savings to offset closing costs.

What to Do if Your Balance Increases

If you notice your mortgage balance rising, here are some tips:

-

Review your loan terms and statements to understand what’s causing it.

-

Contact your servicer to discuss the increase and get clarification.

-

Consider if refinancing makes sense to avoid further increases.

-

Pay down the balance faster by budgeting more towards extra principal payments.

-

For significant hardship-driven increases, ask about workout options.

-

Submit written complaints if you believe servicer errors are inflating your balance.

-

Seek help from housing counselors if you continue struggling with balance increases.

The Takeaway

It’s normal for mortgage balances to change a bit over the course of a loan. But jumps or fast increases that you didn’t expect can throw off your finances. Balance growth can be limited by keeping an eye on your loan often, knowing what sets off the process, and being proactive. You can manage your mortgage well and stay on track to paying it off if you do it right.

New fees were charged

The answer to why your payment changed could be that your lender added new servicing fees to your monthly bill. To confirm, check your monthly mortgage statement for any unfamiliar fees. Also, consider talking to your lender to see if you can remove any new fees.

Can my mortgage payment go up?

It’s true. Your mortgage payment can go up – even with a fixed-rate mortgage. In fact, your monthly mortgage payment can fluctuate several times over the term of the loan.

If your monthly payment has changed, you should first find out why. Here are the top reasons mortgage payments change:

Property taxes going up or down can cause a mortgage payment change. Most people pay their property taxes (and homeowners insurance) through an escrow account. With an escrow account, the cost of your property taxes is spread out in equal payments over a year, so you don’t have to pay your entire tax bill in one shot.

If a tax increase causes a shortfall in your account, your lender will cover the difference until your next escrow review. Your monthly payment will go up to make up for the shortfall after the review, and your lender will raise the tax estimate to make sure there is enough future coverage. Your mortgage servicer conducts an escrow analysis once a year, which may not coincide with your property tax evaluation.

The good news is that your tax payments will only change under certain circumstances.

Occasionally, your mortgage payment may go up or down due to a property value reassessment. The frequency of property reappraisals can differ by location. It may happen once a year, every 2 years or only when a house changes owners.

The loss of property tax exemptions can also drive your mortgage payment up. Some states and municipalities require you to reapply for your exemptions every year.

If you received a tax bill estimate from the previous homeowner and it looks different from your tax bill, they likely qualified for exemptions that you don’t, and vice versa. Exemptions are based on an owner’s qualifications.

Contact your local tax office with questions about exemptions or changes to your taxes.

If you have a mortgage, you’re required to have homeowners insurance. It protects you and your lender against damage to your house. Your lender may secure a policy if you don’t have a current policy or its expired.

If your lender sources the insurance, it may be more expensive than shopping around for your own policy and cause your mortgage payment to increase.

If you change your home insurance policies, your escrow account may go down, and your lender has to make up the difference. Another reason you may not have enough in your escrow account to cover your payment is if your premium suddenly increases.

Why Your Fixed Rate Mortgage Payment May Skyrocket: Escrow Shortages Explained

FAQ

Why does my monthly mortgage payment increase?

You should always contact your mortgage servicer — that’s the company you pay your monthly mortgage payment to — with questions about your specific loan, but here are some possible reasons your required payment might increase. If you have an adjustable-rate mortgage (ARM), your monthly payment can increase when the interest rate increases.

Why does my mortgage payment fluctuate?

In fact, your monthly mortgage payment can fluctuate several times over the term of the loan. If your monthly payment has changed, you should first find out why. If your property taxes go up or down, these are the main reasons why your mortgage payment might change:

What changes affect my monthly mortgage payment?

Your monthly mortgage payment usually includes principal, interest, taxes, and insurance (PITI). Changes to any of these parts can affect how much you pay each month. Here’s what you need to know about these increases. Changes in your escrow account top the list of reasons why your payment might change.

What causes a mortgage payment to change?

As just noted, a mortgage payment can change for multiple reasons. Let’s explore some of them momentarily. Most of the time, your mortgage payment will go up because your property taxes or homeowners insurance costs have gone up. These funds are traditionally held in an escrow account connected with your mortgage payment.

Will my mortgage payment change if my interest rate goes up?

If your mortgage payment includes homeowners insurance, property taxes, homeowners association dues or other homeownership costs, changes in these components will be reflected in your monthly payment. The monthly payment on an adjustable-rate mortgage can increase if the loan’s interest rate goes up.

Will my monthly mortgage payment increase if my interest rate is fixed?

Monthly mortgage payments can increase even if your interest rate is fixed. If your mortgage payment includes homeowners insurance, property taxes, homeowners association dues or other homeownership costs, changes in these components will be reflected in your monthly payment.

Why has my mortgage balance increased?

There are various reasons why your mortgage balance may increase. For example, you may have had a payment holiday, used some of your historic overpayments, or missed some of your monthly payments.

Why did my mortgage loan amount go up?

Common reasons for a monthly mortgage payment to change include: You have an escrow account to pay for property taxes or homeowners insurance premiums, and your property taxes or homeowners insurance premiums changed. Check your monthly mortgage statement.

Why would mortgage rates increase?

Supply and demand: When demand for mortgages is high, lenders tend to raise interest rates. This is because they have only so much capital to lend in the form of home loans. Conversely, when demand for mortgages is low, lenders tend to slash interest rates to attract borrowers.

How can I stop my mortgage from increasing?

Common loan modification options that can help reduce your monthly payments include lowering the interest rate, extending the repayment period, reducing the principal (though forgiven debt may be taxable) and converting an adjustable-rate mortgage to a fixed-rate one for more financial stability.